Seven days in February will shake global markets

How investors react to interest rate decisions and inflation data in the first week of February will determine market dynamics for the rest of the year.

Terry McCrann

Don't miss out on the headlines from Terry McCrann. Followed categories will be added to My News.

OK. It’s not quite ‘Ten Days That Shook the World’, but the first seven days of February will essentially set up the investment dynamics for the year ahead.

Between the first day of the month and Tuesday February 7, we’ll get the Fed’s first interest rate decision for the year – surfacing early Thursday morning on the second our time – our December quarter CPI number and our own Reserve Bank’s first rate decision for the year.

The decisions are effectively two hands clapping for investments across the spectrum.

The Fed’s rate is the absolute pivot for global share markets, including of course our entirely derivative local market; along with global bond and currency markets.

The RBA’s official rate is the absolute pivot for home loan rates – and, theoretically, bank deposit rates as well, but not so ‘urgently’ when rates are going up – and so the property market.

It’s not just what the duo do, or even what they say about rates going forward; absolutely critical as both those things are.

It’s also how investors and essentially, obviously, Wall St, react.

That plays straight into investment dynamics and outcomes; the continual never-pausing ‘two-step’ dance between the Fed and Wall St. Right now, and indeed, for some weeks, Wall St has been betting on a Fed ‘pivot’; that it would essentially declare success on the inflation front and at least stop hiking if not move immediately to rate cuts.

The Dow has leapt nearly 20 per cent since its end-September low-point; including a 5 per cent recovery from a pre-Christmas mini-slump.

Our own market as a consequence is up nearly 15 per cent since end-September and 6 per cent so far this year. The Wall St optimism was both dented and boosted by the last Fed rate decision in mid-December. And it’s now gone pretty positive on the latest US inflation number.

The mid-December decision delivered only a 50 point rate hike, after all the successive 75 point hikes.

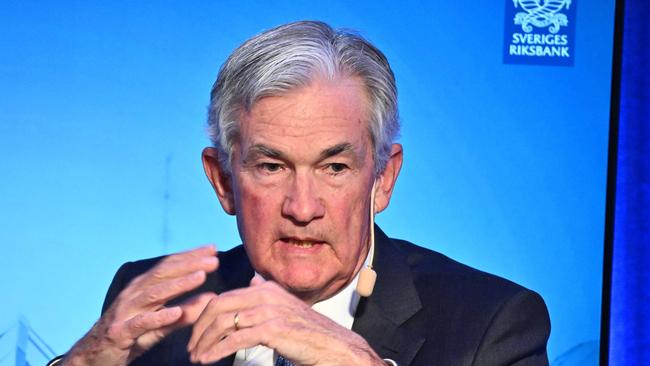

But it came with continued tough-talking from Fed head Jerome Powell and rate ‘guidance’ pointing to further rate hikes into 2023.

The CPI data showed US inflation for the month of December actually going – if only marginally - 0.1 per cent negative. That was largely thanks to plunging oil and petrol prices. Take out food and energy and ‘underlying’’ US inflation was still positive, at 0.3 per cent or 3.6 per cent annualised for the month.

As I have been trying for some months now to explain, the annual figures contain a lot of history. Over the last six months, overall US inflation has all-but evaporated. It’s added to just 1 per cent for the half year or 2 per cent annualised.

Subject to ‘events’ over the next two weeks, two options will be on the table at the Fed meeting: 25 points or 50. Those ‘events’ could add a third – zero.

We’ll explore these – and the likely Wall St reaction – and indeed pre-action – in coming columns.

Downunder, there will similarly be two options on the table at the RBA meeting: 25 points or a pause.

As I explained before Christmas, RBA Governor Philip Lowe will be desperately hoping to be able to deliver his first pause since last April.

As I also explained, it all turns on the December quarter CPI.

It comes out the week before the meeting –both ‘ interestingly’ and market-dynamically less than 24 hours in real time before the Fed decision.

As I also explained before Christmas, wishes are one thing, but depending on the CPI number Governor Lowe might have to consider going back to a 50 point hike.

We’ll also explore all this in coming columns.

As for my opening reference: those that know, will know; those that don’t, can always Google.