Ten of the biggest events that dominated business headlines in 2018

From big-ticket deals to trade stoushes and a furore in the finance sector, it was a year rich with drama in the world of business. We look back at 10 of the biggest events.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

From big-ticket deals to trade stoushes and a furore in the finance sector, it was a year rich with drama in the world of business.

We look back at 10 of the biggest events.

LEW’S PAY ASSAULT ON MYER

Famous for playing a long game in matters of business strategy, billionaire retail entrepreneur Solomon Lew lived up to his reputation in his battle with Myer directors.

Mr Lew ratcheted up his attack on the chain and, although he failed to win his bid to oust the board, has vowed to take his campaign to the “next level” this year.

MYER COPS SECOND PAY STRIKE, SPARED BOARDROOM SPILL

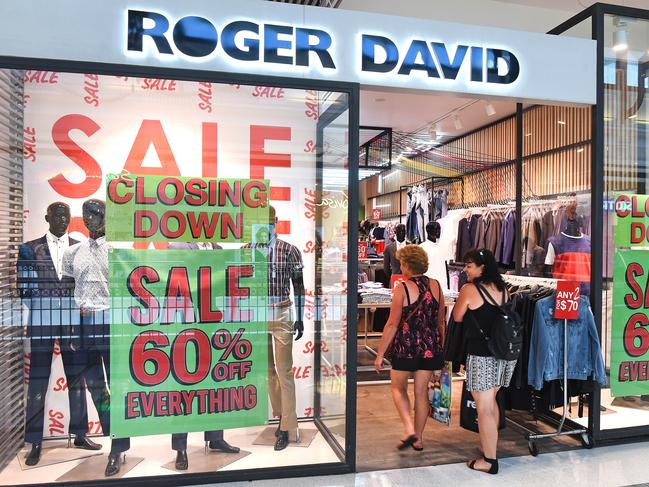

AUSTRALIAN MEN’S RETAILER ROGER DAVID TO CLOSE WITHIN WEEKS

Myer’s biggest shareholder, with a stake of almost 11 per cent, Mr Lew’s listed company, Premier Investments, inflicted a blow late in November.

At the department store group’s annual meeting, Premier encouraged shareholders to reject the executive remuneration report and to vote against the election of two directors.

Shareholders delivered a 43 per cent “no” vote against the pay report — well ahead of the 25 per cent threshold for a “strike” under corporate law.

It was the second successive year Myer has suffered a pay strike, meaning shareholders could then vote for a spill of the board. The spill vote, however, fell short of the required 50 per cent mark.

Myer chair Garry Hounsell described the campaign waged by Mr Lew as “vindictive” and destabilising.

In September, Myer reported a full-year net loss of $486 million — its deepest loss in almost a decade.

Earlier in the year, South Africa’s Woolworths Holdings, which is not related to its Australian namesake, wrote $700 million off the value of David Jones, having paid $2.1 billion for the chain four years ago.

CHAIN REACTION

The malaise in the retail sector wasn’t limited to department stores.

Wrestling with declining sales, high rents, fierce competition and the continuing impact of internet commerce, a string of prominent Australian retail chains — and some interlopers — hit the wall.

The 75-year-old men’s fashion house Roger David collapsed, saying it could no longer compete with multinational retailers and online shopping.

German-based clothing chain Esprit bowed out of the Australian market, closing 67 stores, as did US brands Gap and door-to-door cosmetics retailer Avon.

Fashion label Metalicus entered voluntary administration and online custom footwear seller Shoes of Prey shut up shop. So too did Toys ‘R’ Us, in August, after its US parent collapsed.

Other retailers to wind up, shrink dramatically or be restructured included the Maggie T, Diana Ferrari, Mountain Designs and Laura Ashley brands.

Foodies also witnessed a series of on-again, off-again attempts to salvage struggling chains.

Among them was chocolate specialist Max Brenner, while Zumbo Patisserie volunteered itself to the company doctor and continues to trade, and Doughnut Time also closed but was relaunched by a new owner.

INKING A BIG BUYOUT

Almost 180 years after it was founded, Fairfax Media was swallowed last month by free-to-air TV heavyweight Nine Entertainment.

At the publisher’s annual meeting in November, shareholders supported the buyout — touted as a $4.2 billion “merger” when it was announced in July — with a “yes” vote of more than 80 per cent.

The deal was consummated on December 7, but only after a dose of last-minute drama befitting of a TV soap opera as Antony Catalano, the former head of Fairfax-controlled property portal Domain, tried unsuccessfully to block the takeover.

NINE-FAIRFAX MERGER: SHAREHOLDERS AT FAIRFAX VOTE FOR MERGER

When the deal was unveiled, Nine and Fairfax said it would deliver $50 million in savings through the merger of some administration and support operations.

Nine’s shareholders have 51.1 per cent of the new company, which includes the broadcaster’s flagship free-to-air television network, digital businesses such as Domain and streaming operations Stan and 9Now, and Fairfax mastheads.

It also includes Fairfax’s majority stake in Macquarie Media, owner of radio stations including 3AW and 2GB.

Nine chief Hugh Marks has continued in that post at the combined company, while former federal treasurer Peter Costello, Nine’s chair, will also continue to lead the board.

POWER TO THE PEOPLE

The energy sector was again front and centre amid continuing angst in Canberra over the electoral impact of high power prices.

But it was a major deal — or more specifically, a move by the federal government to thwart it — that took the business world by surprise.

Treasurer Josh Frydenberg announced in November the government was blocking a proposed $13 billion buyout of gas pipeline owner APA by a consortium led by Hong Kong’s CK Infrastructure, formally called Cheung Kong Infrastructure.

The deal, Mr Frydenberg said, was not in the national interest and would have resulted in a single, foreign group having sole ownership and control of Australia’s most significant gas distributor.

APA controls 15,000km, or 56 per cent, of the national gas pipeline transmission system, including 74 per cent in Victoria and New South Wales.

In the broader energy market, petrol retailing and refinery owner Viva Energy made headlines in July when it floated on the Australian Securities Exchange.

The company was previously controlled by Swiss-based Vitol, which bought a suit of assets here from Royal Dutch Shell earlier this decade.

At an issue price of $2.50 a share, Viva’s listing valued the group at almost $5 billion.

Shares in the company have since struggled and are now fetching $1.80.

A CALL TO ARMS

It is the merger that promises to redraw the rules of engagement in our telecommunications industry — and the competition watchdog is baring its teeth.

In late August, TPG Telecom and Vodafone Hutchinson Australia announced plans for a $15 billion marriage.

It would bring together Vodafone’s mobile network, the third biggest in Australia, and TPG’s extensive fixed-line operations and under-development mobile network.

The Australian Competition and Consumer Commission has raised red flags. It is concerned the deal will result in higher mobile phone prices for consumers and may be a disincentive for TPG to be as price-competitive as it has been.

The ACCC is taking submissions on the plan and is due to make a final decision late in March.

ACCC: TPG-VODAFONE MERGER MAY RAISE PRICES

Telstra was also in the spotlight this year as it announced plans to hive its infrastructure operations into a separate, $11 billion wholly owned company.

Telstra InfraCo will include its fixed-line infrastructure, data centres, non-mobile fibre, copper exchanges, poles, ducts and pipes, but exclude mobile assets, including spectrum.

Shares in the telco hit their lowest level in more than seven years following the announcement, fuelled by growing concerns about the impact of the national broadband network on Telstra’s growth outlook. They have recovered little ground since.

OFF TO THE MARKET

For the first time in more than a decade, grocery heavyweight Coles became a listed company in its own right after it was spun out of parent group Wesfarmers.

The Perth-based parent company had owned Coles and its stable of brands, including discount department store chains Kmart and Target, along with stationery retailer Officeworks, since 2007 after succeeding in a buyout tilt.

That deal had positioned Wesfarmers, which already owned hardware chain Bunnings, as one of Australia’s biggest retailers.

Under new chief Rob Scott, 104-year-old Wesfarmers — a company with a long history of transforming itself — now believed the time was ripe to exit the grocery market.

It spun off Coles in a $20 billion demerger, albeit while keeping a 15 per cent stake in the chain and a half stake in loyalty program Flybuys. Shareholders were given one Coles share for every Wesfarmers share they owned. Coles shares were listed on the ASX on November 21, hitting the board at a price of $12.49 and closing that day at $12.75. They have since lost ground, closing yesterday at $11.74. The demerger came in a seismic year for Wesfarmers: the group abandoned its Bunnings rollout in the UK after Brits failed to embrace the brand.

HOLE IN THE WALL

Already mired in scandal as the financial services royal commission rolled through town, the Commonwealth Bank in June set an unenviable record: copping the biggest fine in Australian corporate history.

The CBA agreed to pay $700 million plus legal costs to end proceedings brought by the anti-money-laundering regulator, the Australian Transaction Reports and Analysis Centre.

The bank admitted to breaching anti-money-laundering and counter-terrorism-financing laws more than 53,000 times by failing to quickly report potentially suspicious transactions carried out at its so-called smart ATMs.

A flaw in the software for the ATMs, which accept deposits, allowed transactions worth $10,000 or more to go unreported. Former chief executive Ian Narev had left the group soon after the scandal emerged the previous year.

The bank also acknowledged in June that it had failed to properly monitor transactions on more than 778,000 accounts over three years.

Mr Narev’s successor, Matt Comyn, said the settlement with Austrac brought “certainty to one of the most significant issues we have faced”.

“While not deliberate, we fully appreciate the seriousness of the mistakes we made,” Mr Comyn said in a statement.

“Our agreement today is a clear acknowledgment of our failures and is an important step towards moving the bank forward.

“On behalf of Commonwealth Bank, I apologise to the community for letting them down.”

UNDER HOUSE ARREST

After years racing ahead, the property market in Australia’s biggest cities finally hit the brakes — then crunched into reverse.

It came as a series of potholes emerged in what many investors had come to regard as the easy road to riches.

Regulators, concerned at the prospect a housing bubble was emerging, had put caps on the amount banks could lend out for investment property.

Banks, shouldering rising costs for funds borrowed from overseas, broadly lifted home loan rates even as the Reserve Bank kept the cash rate on hold at an all-time low of 1.5 per cent.

And then the banking royal commission turned the spotlight on the lack of scrutiny banks were applying to home loan applications — raising fears many people had been given loans they would struggle to repay. The federal Opposition, with its vow to introduce new limits on tax breaks for property investors, was getting traction in the polls.

And economists warned households were increasingly vulnerable as wages continued to grow at a trifling rate while utility costs surged.

Finally, the market yielded. Nationally, house prices fell about 4 per cent across the year, but the falls were steeper in the biggest cities.

In Melbourne, property prices fell about 6 per cent, while in Sydney, the drop was a steeper 8 per cent — the biggest fall in that city in 35 years.

TRUMP VERSUS CHINA

It was the year US president Donald Trump trained his sights on America’s biggest trading partner, China, sending a shudder through markets.

Mr Trump flexed his muscle, announcing a hefty swag of taxes on imports from a string of countries — but focused in particular on Asia’s biggest economy.

The tariffs, he said, would help end a disparity in terms of trade that favoured China and also marked a response to the theft of intellectual property.

Economists warned they would have unwelcome repercussions for global trade, with knock-on effects for countries including Australia.

In a game of tit-for-tat, Mr Trump announced or flagged some tariffs, only for China to follow suit.

Counting tariffs announced, flagged, or threatened, the total value of imports to the US from China that would be caught in the net quickly eclipsed $US250 billion.

Among the goods to be hit with import taxes were steel and aluminium, impacting European Union countries, Canada and Mexico.

Australia received an exemption.

China has appealed to the World Trade Organisation, calling for an inquiry into a potential breach of international trade rules.

There is some hope of a ceasefire: Mr Trump said in a tweet overnight Sunday that he and Chinese counterpart Xi Jinping had made “big progress” in a conversation about trade — but markets will surely remain sceptical until both countries provide a more formal update.

AMP IN COVER-UP SCANDAL

A witness collapsed in the box. Senior executives and regulators were hauled over the coals. Careers were killed off.

And some of our biggest companies now owe hundreds of millions of dollars to customers they wronged.

It was the year of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

Though commissioner Kenneth Hayne is yet to release his final report, the impact of the inquiry cannot be overstated or underestimated.

Many suspect Mr Hayne’s report, due on February 1, will lead to sweeping changes in the rules that govern how financial institutions deal with their customers.

The inquiry also made a star of lead counsel assisting Rowena Orr, QC, who over the course of the 68 days of hearings, helped elicit evidence from 134 witnesses and helped tender almost 400 witness statements. More than 6500 exhibits were presented.

Among the revelations, it emerged a succession of Australia’s biggest and longest-running financial companies had been charging fees for services they never provided.

AMP, the CBA and National Australia Bank all charged fees to dead people.

After details emerged of AMPs lacklustre approach to informing regulators about an unfolding scandal, its chair, chief and counsel all departed.

NAB lost rising executive Andrew Hagger after his second appearance. The chief and chair of wealth manager IOOF are now the target of action by regulators to stop them running super funds.

In his interim report in September, Mr Hayne delivered a no-holds barred assessment of what had gone wrong with Australia’s finance companies, citing greed and weak regulation as key problems.

Expect more of the same, and then some, on February 1.