Telstra’s $3bn splurge to fix network

TELSTRA has lured hundreds of thousands of extra customers to its mobile network in the past year despite its succession of highly publicised outages.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

TELSTRA has lured hundreds of thousands of extra customers to its mobile network in the past year despite its succession of highly publicised outages.

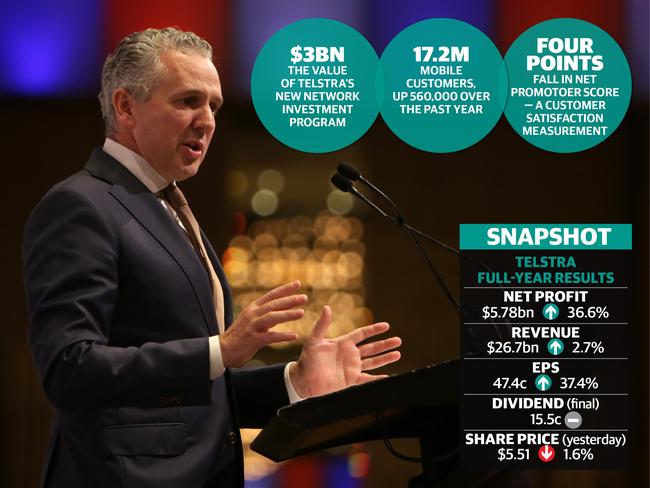

And the telecommunications group, Australia’s biggest, says it will now invest $3 billion to bolster the much-derided network.

In an attempt to repair the group’s reputation following the run of network failures, Telstra chief Andy Penn yesterday unveiled plans for the three-year investment spree.

It will be the biggest capital investment program at Telstra since the reign of Sol Trujilo last decade.

The revelation came as the telco posted a full-year net profit of $5.8 billion — up 36 per cent on the previous year, fuelled by the sale of a major stake in Chinese online car sales business Autohome.

Telstra also declared an unchanged final dividend of 15.5c, taking its total payout for the year to 31c, up 0.5c on the previous year following a small increase at the first-half results.

The group also yesterday revealed further details of a share buyback that will deliver up to $1.5 billion to investors.

It will be made up of a $1.25 billion off-market buyback, with more information to be announced on September 2, and a $250 million on-market buyback.

Under the $3 billion investment program, Telstra will prepare for next-generation 5G services.

Mr Penn said the investment was about ensuring the carrier kept its market dominance.

“Telstra has a history of making investments ahead of the curve to create differentiation,” he said.

The company would not disclose full details of the program, he said, to maintain its “strategic advantage in a heavily competitive environment”.

While Telstra’s bottom line ballooned on the sale of the Autohome stake, revenue was up only 1.5 per cent at $25.9 billion over the year to June.

On average, revenue for each user fell among customers of mobile and fixed broadband services.

And the group’s earnings before interest, tax, depreciation and amortisation slipped 0.6 per cent to $10.5 billion.

Its net promoter score — a measure of customer satisfaction — fell four points after the series of outages in the past six months.

But despite concerns about a possible customer exodus following the network failures, Telstra’s mobile customer base grew by 560,000 to 17.2 million in the year to June.

Nearest rival Optus has 9.33 million and third-placed Vodafone Hutchison Australia has 5.44 million.

Telstra’s mobile revenue grew 1.3 per cent to more than $10 billion. The telco also added 235,000 fixed broadband users.

The slow death of the landline telephone continued, albeit at a slower rate, with fixed line revenue falling $309 million to $3.4 billion.

Australian households and businesses now have 5.7 million landlines, down from 6 million a year earlier.

The telco added 235,000 fixed data services as the rollout of the National Broadband Network continued, with NBN connections climbing to about 500,000.

Telstra revealed more than 1.1 million customers had signed up to its national wi-fi hotspot network Telstra Air.

Despite pulling out of talks earlier this year about a joint venture to build a mobile network in the Philippines, Mr Penn denied the group was walking away from Asia.

But he said there appeared to be no suitable opportunities for a retail presence there at the moment.

Telstra shares closed down 1.6 per cent yesterday at $5.51.

Originally published as Telstra’s $3bn splurge to fix network