US helium reserve sale driving urgency to develop new supply

The sale of the US helium stockpile has wrought a greater sense of urgency to increase supplies of the rare gas.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Selling the US helium stockpiles have negatively impacted on global supplies of the rare gas

Diminishing supplies have led to a strengthening call to increase supply of helium

ASX listed companies are at the forefront in exploring for and developing new supplies

While Australia debates the merits of building a critical mineral strategic reserve to limit the impact of US tariffs, the hue and cry resulting from the recent sale of the US federal helium stockpile might provide a clue.

In June 2024, the US Bureau of Land Management completed the sale of its Federal Helium System to Messer America – a subsidiary of privately-owned German industrial gas giant Messer – as required by Congress under the Helium Stewardship Act of 2013.

While widely seen as marking a win for privatisation, the move has seen more recent criticism with the US House Committee on Oversight and Government Reform claiming that Messer has ties to the Chinese Community Party.

In a letter, the committee said the National Aeronautics and Space Administration had also raised concern about the sale, citing national security and supply chain shortages while private stakeholders in the medical, scientific, and helium industries also warned the sale presented a “significant risk of disruption to the helium supply chain”.

Ironically for the Republican dominated committee, the sale of US government helium assets dates back to 1996 when Republicans were enthusiastic about cutting government spending and the feeling was that blimps – the most visible use of helium – had little to do with national security.

This led to the passing of the Helium Privatization Act later that year and the sales of helium stockpiles started several years later.

However, this sale, which used a price formula with no ties to the market, came just as demand for helium started increasing due to growing production of computer chips (semiconductors).

This effectively resulted in the stockpiles being sold cheaply, allowing major industrial gas companies to make big margins off helium sales.

Demand has only risen since as helium is used for a range of high-tech applications including manufacturing semiconductors, solar panels, optic fibres and cooling superconducting magnets in MRI scanning machines.

Messer sale impact

So just what impact does the sale of the Federal Helium System have?

Blue Star Helium (ASX:BNL) non-executive director Gregg Peters told Stockhead the FHS’ primary function was inventory.

“For the period it was the world's largest supplier, it served as a buffer, a flywheel of sorts masking supply disruption at other sources, and the causes,” he said.

“Being federally owned, it was generally accepted as a fair system of allocating product among organisations with needs. Most notably was its impact on market pricing, artificially suppressing it.

“The privatisation does not change its importance as one of the world's most strategic structures for long term storage.

“It does however limit the accessibility by other entities to those who negotiate commercial relationships with Messer.

“As the Reserve has been in a state of declining production output, the impact on global supply remains negative, more or less to specific organisations based on their relationship with Messer.”

Peters adds the combination of less volume and fewer source location will consistently drive the pricing for helium up.

“’Displacement’ is the term for product that is not proximate to buyers, fewer source locations increase seller costs to move it to market. Less product on always increasing demand drives pricing up on the buyer side of the equation.”

This has led to increased urgency from the US to increase helium supply, which Peters said was true each time the world fell into another inevitable cycle of product shortage.

Delivering new helium

Given the falling supply and strong demand, there are a growing number of companies – including those listed on the ASX – that have mobilised to find and develop new sources of the rare gas.

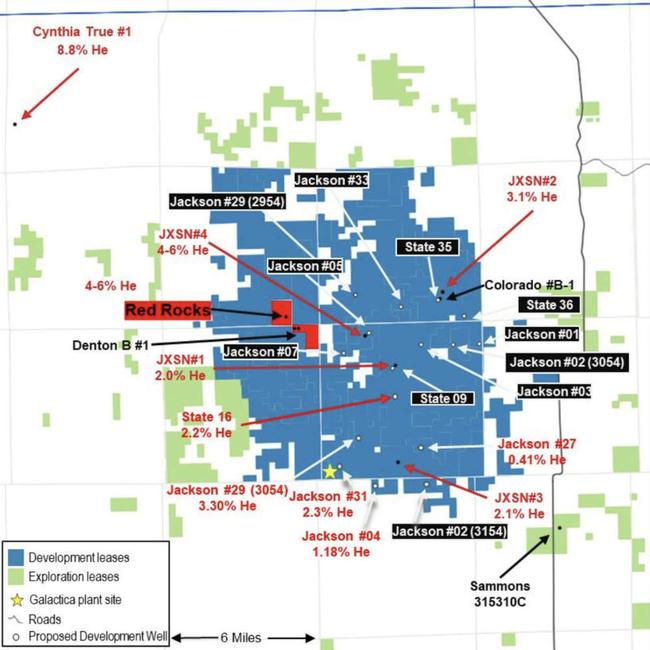

Over in the US, Blue Star has been going great guns progressing its Galactica helium development drilling program with five wells completed to date.

To date, two of the wells are projected to be capable of producing gas at stabilised rates rates of between 350,000 and 450,000 cubic feet of gas to optimise production.

Helium concentrations have been in line with expectations, topping up at 3.3% in Jackson-29, which also boats the high rates of production.

Most of the wells also had high levels of carbon dioxide, which is valuable in its own right in the food and beverage sector.

The company has received approval for a Major Facilities Permit from the Board of County Commissioners in Las Animas County for the construction of the Pinon Canyon plant that will process helium and CO2 from its wells in the county, starting with those at the Galactica project.

It also holds an option to acquire the discovery wells at the Great Plains Field.

This field includes the Bubba State-3 well that has flowed gas at a sustained rate of 740,000cfd from the target Keyes formation.

Gas analysis has confirmed the previously tested helium content of ~2.01%.

“We drilled the State 16 well mid 2024 which is capable of production and have just finished a five well campaign with all wells finding gas and being capable of completion for production,” managing director Trent Spry told Stockhead.

“We have decided to add one additional well to the current drilling campaign based on the new well data we have acquired which will be the sixth well in the farm-in agreement with Helium One Global.”

Also operating in the US is HyTerra Limited (ASX:HYT), which while focused primarily on natural hydrogen, has recognised that its Nemaha project in Kansas is also prospective for helium.

This belief has now being supported by its maiden well – Sue Duroche-3 – returning hydrogen concentrations up to 96.1% along with elevated helium within mud samples.

While the exact helium concentrations are unknown, samples have been sent to independent laboratories for verification and quantification.

The rig has moved to drill the Blythe 13-20 well.

Looking further afield, Noble Helium (ASX:NHE) is currently reviewing its overall position before making a final decision on where and when to carry out drilling at its flagship North Rukwa project within Tanzania’s Rukwa Basin.

This includes the extensive body of geophysical and drilling data it has accrued since its maiden 2023 drill program of two wells that pointed to the presence of a prolific helium system.

The Mbelele wells intersected multiple reservoir zones filled with helium-rich fluids interpreted as at or very close to fully saturated with air-corrected 2-3% helium in exsolved gas.

NHS notes that subject to further geochemical analysis, fluids containing hydrogen (and helium) can be traced back to a unique suite of basement rocks in the centre of the North Rukwa Rift Basin which are known to produce hydrogen when exposed to hot fluid.

Widespread helium and hydrogen-rich fluid migration has been noted up to 20km from these basement rocks along multiple pathways toward shallower sedimentary traps, where gas phase helium can naturally form.

It also means the hydrogen serves to guide the company where to look for primary, gas-phase helium, allowing it to focus its next drilling campaign on areas with the greatest potential for gas phase primary helium.

At Stockhead, we tell it like it is. While Blue Star Helium and HyTerra are Stockhead advertisers, they did not sponsor this article.

Originally published as US helium reserve sale driving urgency to develop new supply