Traders’ Diary: Everything you need to get ready for the week ahead

Local markets ended last week about 0.7% higher, led by strong gains for the materials and energy stocks. US CPI and local home loan data are among this week’s highlights.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

What grabbed the headlines last week?

After falling again on Friday, local shares made the first week of the new financial year a positive one, adding more than 0.7%.

Resources-aligned stocks led the gains, and that was all she wrote, with seven of the market’s 11 sectors lower.

After a big dip on Monday and Tuesday it was ultimately a positive week for equity markets, here and in the States.

July, of course, is seasonally the strongest month of the trading calendar.

The S&P/ASX200 closed lower Friday, dropping 9.50 points or 0.12% to 7,822.30

The ASX Small Ordinaries (XSO) index ended last week ahead by 0.64%, while the ASX Emerging Companies (XEC) index soared by 2.6%.

Over the past five sessions, seven of the 11 ASX major sectors made gains. Energy stocks added an impressive 4.07%, thanks in no small part to coal stocks which surged after Anglo American's Grosvenor mine in Queensland was shut due to a fire.

ASX Sectors last week

Metals markets on Monday

Local copper stocks are due a win.

Dr Cu's looking ready to roll. The metal added almost 3% late last week, testing fresh five-week highs.

Gold rallied almost $US30 last week, taking it within 2.5% of its all time high.

The greater part of the ASX's gold stocks are yet to respond, languishing well below their 2024 highs.

And among the commodities to make moves last week, silver – friend of gold – lurched higher to be sitting pretty at the near 11-year highs seen late May.

Silver prices are looking punchy as China considers fresh stimulus targets this month at the key Third Plenum policy meet this month. The Chinese Communist Party’s top ranks are gathering in Beijing for the major policy meet – with everything economic on the cards and nothing off the table.

And as a key ingredient for manufacturing solar cells, silver demand should be supported by Beijing's love for all things solar, underscored by the recent reveal of the world’s largest solar farm straddling the deserts of Xinjiang.

Precious metals have also enjoyed the new-old talk of an interest rate cutting cycle starting sometime around September.

What is known as the Third Plenum gathers about 400 government bigwigs, military chiefs, provincial bosses and academics in Beijing to steer the political and economic course.

But investors this year have low expectations for the kind of Big Bang reforms that would revive market sentiment.

A slew of official readouts, articles and state media editorials over the past weeks suggest, instead, a reinforcement of President Xi Jinping’s long-term goals of doing as little as possible.

And the Aussie dollar did well last week against the greenback, rising above 67 US cents for the first time in six months.

Not the ASX

European stocks ended mixed after the UK election, which went to script and left the Tories in tatters.

France is at the polls for a second Sunday at the time of writing.

All eyes are on Jordan Bardella, the French far-right's 28-yr-old firebrand, who may well become the youngest prime minister in French history by the time you're pouring your morning brew.

After rural and regional French voters propelled Bardella and leader Marine Le Pen’s National Rally to a strong lead in the first round of snap legislative elections, Bardella is seeking an absolute majority in the decisive second round that would hand the anti-immigration nationalists a stunning win.

Bardella is part of a TikTok generation of young and annoyed Frenchies who signed up under Marine Le Pen, but wouldn’t have under her more bluntly racist and digitally challenged father.

Wall Street closed at fresh record highs on Friday in New York boosted by a June US jobless rate that hit its highest level since late 2021.

That good-bad news smothered US Treasury yields and added to bets on a September US Fed rate cut.

US markets are currently pricing in two rate cuts by Christmas, with the first coming in September, according to the CME FedWatch Tool.

The S&P500 logged a fourth positive week from the last five, gaining 1.2%. The tech-heavy index jumped 2.4%, and the Dow Jones ticked higher by 0.3%.

And despite Nvidia correcting 16% from its June high, US indices rallied strongly into the close after the Independence Day break as investors looked past an economic slowdown to focus on looming rate cuts.

The 4.1% jobless rate read sent bond yields lower across the curve, prompting those aforementioned rate cut hopes.

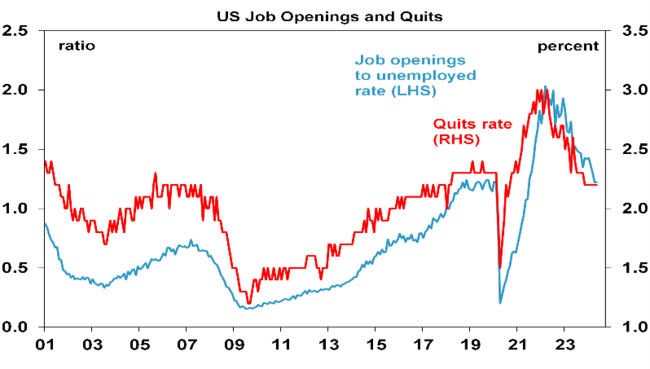

Also on Friday, US Non-farm payrolls increased by 206,000 in June, with job growth in the previous two months revised down by a total of 111,000.

After a dismal year-to-date, EV maker Tesla closed on Friday at $252, a decent 27% gain, Monday to Friday.

Elon's automaker rolled out a bunch of Q2 vehicle deliveries last week which wowed forlorn shareholders and easily topped Wall Street estimates.

Elsewhere, Meta surged 6% and Alphabet added 2.5%. US Consumer stocks also did well on Friday, with Walmart up 2.6% and Costco rising 2.7%.

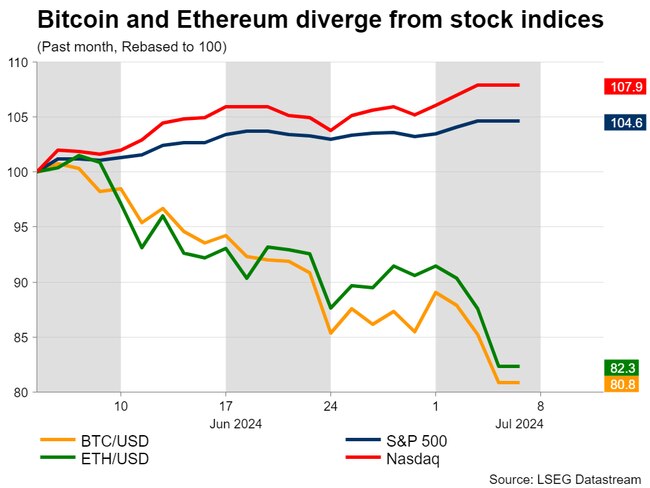

In cryptocurrency, Bitcoin had dropped to its lowest levels since February. BTC was trading for $US54,290, or $A80,700 on Australian exchanges, down seven per cent in 24 hours.

Bitcoin has been on a slippery slope in the past four sessions, dropping from $63,220 to a fresh four-month low of US$53,520 on Friday.

This weakness has spilled over to the broader crypto space, with Ethereum losing 18% in the same period, while a lot of the altcoins experienced even bigger losses.

The week ahead

The flow is slow this week.

We've got the Bureau of Numbers lobbing some new housing lending data on Wednesday. CBA reckons (based on the bank's internal lending data), we'll see a rise in the flow of housing lending of circa 3.5%.

There's the June edition of the CommBank household spending insights report on Thursday. As well as updates on consumer sentiment and business conditions this week thanks to the Westpac‑Melbourne Institute and NAB.

Local markets will be looking out for some market moving labour force data... a few weeks away on July 18. Outside of that, there's nothing really which screams here comes the monetary policy messaging.

Pretty quiet offshore too.

The June US CPI and PPI data is due on Thursday night, Sydney time. That's the biggie.

Elsewhere, interest rate decisions will be announced in Kiwiland, South Korea, and Malaysia.

There's inflation reads in Mexico, China, Brazil, India, and Russia.

India will also release key industrial production figures. Germany will do the trade balance.

In the UK, it'll be May GDP, goods trade balance, industrial production, and the BRC retail sales monitor.

China will release its inflation rate, PPI, new Yuan loans, and trade balance data.

The Economic Calendar

Monday July 8 – Friday July 12

MONDAY

Japan Current Account (May)

Australia Home Loans (May)

Germany Trade (May)

Canada Average Hourly Wages (Jun)

United States Consumer Inflation Expectations (Jun)

UK KPMG/REC Report on Jobs (Jun)

TUESDAY

Australia Westpac, NAB Confidence Indices (Jun)

Taiwan Trade (Jun)

Mexico Inflation (Jun)

Mexico Consumer Confidence (Jun)

United States Fed Powell Testimony

S&P Global Investment Manager Index (Jul)

WEDNESDAY

South Korea Unemployment Rate (Jun)

Japan PPI (Jun)

China (Mainland) CPI, PPI (Jun)

RBNZ Interest Rate Decision

Turkey Industrial Production (May)

Italy Industrial Production (May)

Brazil Inflation (Jun)

United States Wholesale Inventories (May)

S&P Global Business Outlook (Jun)

THURSDAY

Japan Machinery Orders (May)

South Korea BoK Interest Rate Decision

China (Mainland) M2, New Yuan Loans, Loan Growth (Jun)

Germany Inflation (Jun, final)

UK monthly GDP, incl. Manufacturing, Services

and Construction Output (May)

Brazil Retail Sales (May)

United States CPI (Jun)

United States Monthly Budget Statement (Jun)

FRIDAY

Singapore GDP (Q2, adv.)

Japan Industrial Production (May, final)

France Inflation (Jun, final)

India Industrial Production (May)

India Inflation (Jun)

Mexico Industrial Production (May)

United States PPI (Jun)

United UoM Sentiment (Jul, prelim)

Brazil Business Confidence (Jul)

Global GEP Supply Chain Volatility Index (Jun)

Originally published as Traders’ Diary: Everything you need to get ready for the week ahead