Resources Top 5: Koonenberry glows as gold holds firm above $3200

Koonenberry Gold has lifted 30pc on broad, high-grade results from the second diamond hole at Sunnyside prospect.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

A 172.9m intersection has been returned from the second diamond hole at Sunnyside prospect

Kingsgate Consolidated appears set to grow its gold bounty at Thai project

Elixir Energy prepares path to development of the Grandis project

Your standout small cap resources stocks for Monday, April 14, 2025.

Koonenberry Gold (ASX:KNB)

With spot gold holding firm above US$3200/oz, having traded up to $3246.80 (A$5130) in the past 24 hours, gold stocks are generally moving ahead on any positive news they generate with Koonenberry Gold (ASX:KNB) among the beneficiaries.

After releasing broad, strong results from diamond drilling at the Enmore project in northeast NSW, KNB hit a new two-year high of 6.9c, an increase of 30% on the previous close with more than 72 million shares changing hands.

Investors have welcomed results from the second diamond hole at Sunnyside prospect which returned a 172.9m intersection grading 2.07g/t gold from 171 metres within which was 25m at 5.23g/t from 195m and this in turn included 5m at 11.09g/t from 213m.

This equates to a 357.9 gram metre interval, surpassing the 297.5 gram metre interval in the first Sunnyside diamond drill hole.

The second hole also returned 76m at 1.17g/t gold from 22m and the new results highlight the potential of the system to host broad intervals of relatively shallow gold mineralisation, as well as high-grade gold zones at depth.

“We thought the results announced for our first drill hole were exciting, but this 25m step-out hole has turned out to be even better showing an apparent 35m vertical continuity on this section,” KNB managing director Dan Power said.

“In addition, we have extended the depth of mineralisation from 240m to 275m vertically from surface which remains open at depth and along strike.

“As reported previously, samples from holes 25ENDD003 and 004, are at the lab and we now anticipate reporting on these in late April-early May respectively.

“Both holes intersected zones of visible gold as well as alteration and veining consistent with that observed in holes 001 and 002 associated with the broader zones of mineralisation.”

Results from the diamond drilling will be used to design follow-up diamond drilling to test the continuity of mineralisation at Sunnyside in multiple directions, including along the 125m x 550m prospective structural corridor, while results from a soil program will be used to plan drilling at other prospects in the district.

Enhancing the credentials of the Enmore project is its location in the New England Fold Belt which, despite having an endowment of more than 35Moz of gold, remains relatively unexplored.

This belt is home to several large deposits including the Ravenswood mine (8Moz gold), Mt Morgan mine (7.7Moz gold, 360,000t copper) and Cracow mine (2.5Moz gold) and Enmore is only about 20km from the Hillgrove gold-antimony mine (1.7Moz gold).

Kingsgate Consolidated (ASX:KCN)

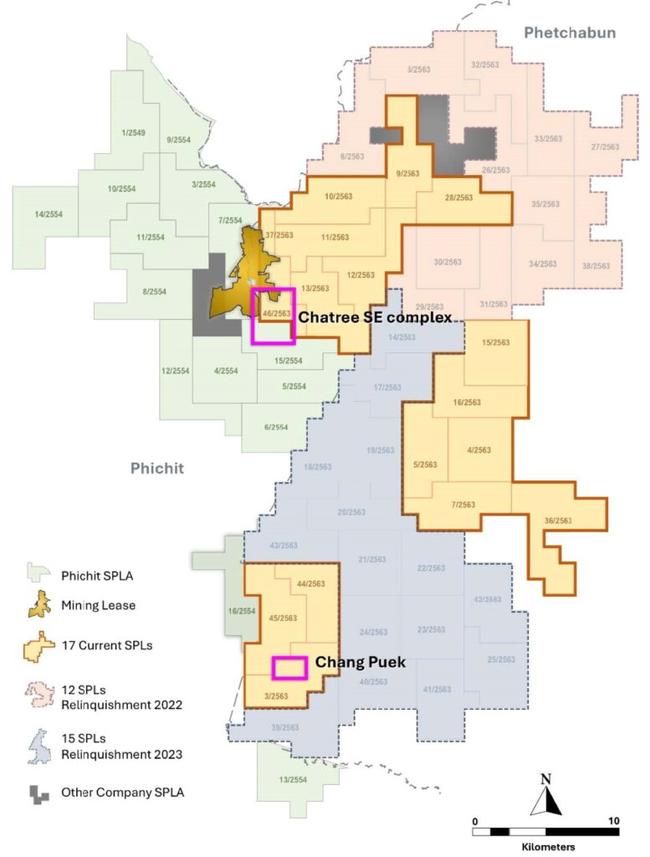

$372m capped Thai gold producer Kingsgate Consolidated has enhanced the future at its Chatree Gold Mine in central Thailand by confirming gold and silver continuity at prospects to the south of its operations with shares as much as 5.5% higher to $1.635.

Reverse circulation (RC) and diamond drilling programs have been focused on assessing exploration targets and characterising mineralised zones within the Chatree South-East Complex.

The company has completed 67% of its planned 2025 drilling in the South-East Complex with further gold results to inform an inaugural resource estimate for this area later this year while exploration drilling has focused on testing the Southern and Middle zones of the Chang Puek Prospect further to the south.

Six drill rigs are conducting exploration drilling, with a total of 38 RC holes for 5,158m from three RC rigs, and five diamond holes for 726m from three diamond rigs completed between February 16 and March 31, 2025.

Southern Zone results are:

- 14.2m at 2.05 g/t Au and 41.53g/t Ag from 39m; and

- 11m at 3.34g/t Au and 128.52 g/t Ag from 43m, 7m at 1.73 g/t Au, 24.04 g/t Ag from

- 74-81m and 6m at 0.91 g/t Au and 8.03 g/t Ag from 115m.

Middle Zone results include:

- 5m at 3.60g/t Au from 122m and 10m at 2.33g/t Au from 137m;

- 2m at 2.99 g/t Au and 1,140 g/t Ag from 57m, 37m at 2.90 g/t Au and 23.6 g/t Ag from 78m and 13m at 0.56 g/t Au from 137m; and

- 7m at 1.55 g/t Au and 7.43 g/t Ag from 71m, 7m at 1.76 g/t Au from 195m, 3m at 1.87 g/t Au from 206m and 10m at 0.99 g/t Au from 227m.

The Chatree Gold Mine is a world-class gold producing asset, with 1.8 million ounces of gold and 10 million ounces of silver produced between 2001 and 2016.

Following a successful restart in 2023, Kingsgate is now focused on an aggressive regional exploration program and continuing to ramp up operations at Chatree to produce 80,000-90,000 ounces of gold in FY25.

During the December quarter there was a 150% increase in ore mined at Chatree and it was the third consecutive quarter of gold production growth. Gold production increased 13.4% to 17,936 ounces with 128,037 ounces of silver produced.

In early February 2025, the company marked the one hundredth gold pour to occur at the Chatree Gold Mine since the restart in March 2023.

January 2025 saw a continued uplift in head grade to an average of 0.57 g/t gold, up from 0.51 g/t gold for the December 2024 quarter.

In the company’s December quarterly report, Kingsgate managing director and CEO Jamie Gibson said it was a solid quarter for Chatree marked by the third consecutive quarter of gold production growth and an impressive 150% increase in ore mined compared with the September quarter.

“I'm incredibly proud of the Chatree team who have been working hard to ramp up operations efficiently and safely."

KCN also has the Nueva Esperanza Development Project in Chile, where road repair works and a fixed-wing topographic survey have been completed and geochemical sampling is underway.

Elixir Energy (ASX:EXR)

With the energy sector trading higher and leaders Woodside Energy (up 1.04%), Santos (up 2%) and Yancoal (up 2.15%) doing well, a number of the sector’s smaller players have performed strongly, including Elixir Energy, which has been up to 45% higher at 2.9c.

Elixir is preparing the path to development of the Grandis project in Queensland’s Taroom Trough, which is expected to help ease gas shortages across Australia’s east coast.

To assist in paving the path, the company has appointed Stuart Nicholls as new CEO and managing director replacing Neil Young, who is retiring.

After dedicating more than a decade to developing the coal seam gas Nomgon Project in Mongolia and taking Elixir to its position of having a dominant place in the infrastructure rich, multiTcf discovered resource base in the Taroom Trough at a time of looming domestic gas shortfalls, Young has decided to transfer his responsibilities.

Young, who will remain engaged by EXR as an advisor for at least three months to ensure a smooth transition, said: “Although such things are always poignant, I’m confident the time is right for me to move on from Elixir to new pastures.

“I’m very proud of our team’s achievements in assembling the company’s current Taroom Trough focused asset base – whose multi-Tcf resource base is fantastically placed to help meet Australia’s and the world’s need for gas for many decades to come.

“ I’m also very pleased to be passing the baton onto a leader of Stuart’s great energies, talent and enthusiasm – I know of no one better qualified to deliver our next stages of growth and value realisation.”

Nicholls is a nationally recognised leader in Australia’s energy sector with a proven track record of turning around businesses and leading innovative, high-impact projects. He is well-known to the industry having a well-earned reputation of being able to profitably develop early stage assets thereby exponentially adding shareholder value. As CEO and MD of Strike Energy, he led the company from a small exploration business to becoming an ASX200 listed entity, delivering multi-million-dollar revenues and groundbreaking achievements in the gas and energy industries.

His experience also includes management roles within Shell in exploration, commercial, strategy after his time in military leadership positions.

Grand Gulf Energy (ASX:GGE)

Making a move to establish a position offshore Namibia, one of the world's most exciting oil & gas exploration frontiers, is Grand Gulf Energy, which has risen fourfold to 0.4c

The company has entered into a binding option agreement to acquire 100% of Wrangel Pty Ltd, an applicant for a 70% working interest in a Petroleum Exploration Licence over Block 2312 in the Walvis Basin, offshore Namibia, with consideration payable only upon grant.

This area has emerged as a global oil exploration hotspot, with more than 11 billion barrels discovered to date in recent high-profile discoveries and seven offshore wells scheduled for drilling this year.

Among the super-majors active are Shell, Chevron, TotalEnergies and GALP.

The groundbreaking Graff-1 oil well drilled offshore Namibia by Shell in 2022 catapulted Namibia to the forefront of global oil exploration. Shortly after, TotalEnergies reported an even larger multi-billion barrel discovery with their Venus-1 well and GALP followed in 2023 with the Mopane-1X oil and condensate discovery.

All these discoveries have now been appraised and tested.

By early 2025, after drilling 17 exploration wells and six appraisal wells, the overall success rate in the Orange Basin since 2022, is greater than 80%.

Block 2312 is south of Chevron-operated PEL 82 awarded in February 2025 and spans about 16,800km2 in water depths of 1,400m to 2,000m and consideration is payable by GGE only upon grant.

The block includes 6,100km2 of 3D seismic and 4,700 line km of 2D seismic and the previous operator reported a mean prospective resource of 1.1 billion barrels of oil.

Havoc Services, led by oil and gas veteran Dr Alan Stein, has been engaged as technical advisor with a track record including discovering in excess of 2 billion barrels of oil equivalent and more than US$1 billion in capital raised.

The application is in partnership with Namibian-based oil and gas company TSE Oil and Gas (20% WI) and the state-owned National Petroleum Corporation of Namibia (10% WI).

Energy World Corporation (ASX:EWC)

(Up on no news)

ASX-listed junior Energy World Corporation (ASX:EWC), which is primarily engaged in the production and sale of power, and the development of LNG projects, has made a strong move to a daily high of 2.2c, a lift of 57.14% on the previous close.

The company’s strategy is to become a leader of modular LNG developments and the operator of a vertically integrated clean energy supply chain delivering power, natural gas and LNG throughout the Asia Pacific.

EWC intends to selectively develop new power generation capacity fuelled by LNG and natural gas in locations where the ability to satisfy increasing local demand is restricted by the limited fuel supply and generation capacity currently in place.

The company has operations in three core countries - the Philippines, Indonesia and Australia.

On Pagbilao Island in Quezon province of the Philippines, EWC is developing the country’s first-ever LNG Hub terminal and a 650 MW combined cycle gas-fired power plant.

In November 2018 the Pagbilao Power Project was certified as an Energy Project of National Significance by the Philippines Department of Energy.

EWC’s focus in Indonesia is on South Sulawesi province where it has a 50% interest in the Sengkang gas field, has 90% of the 315MW Sengkang Power Plant power by the gas field and 100% of the Sengkang LNG Plant, which has a design capacity of 2 mtpa and consists of four modular 500,000 tpa trains, an import/export terminal and jetty facilities.

It intends to complete construction of 500,000 tonnes of capacity initially, and then roll out additional modules until all four modules are in commercial operation.

In Australia, the company has ownership interests in various gas fields, is developing a 56,000tpa LNG liquefaction plant, and in Alice Springs an 8MW power plant and an LNG plant, both of which are on care and maintenance.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Koonenberry Gold is a Stockhead advertiser, it did not sponsor this article.

Originally published as Resources Top 5: Koonenberry glows as gold holds firm above $3200