Resources Top 5: Condor takes off on multi-billion barrel prospective resource

Condor has soared on the back of a multi-billion barrel prospective resource in the Tumbes TEA offshore northern Peru.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

A multi-billion barrel prospective resource has been estimated for the Tumbes TEA offshore Peru

Scandium has been added to a list of critical minerals hosted at RareX's Cummins Range project

Antipa has reclaimed full control of the 1520km2 Paterson project which surrounds its 2.3Moz Minyari Dome deposit

Your standout small cap resources stocks for Wednesday, April 9, 2025.

Condor Energy (ASX:CND)

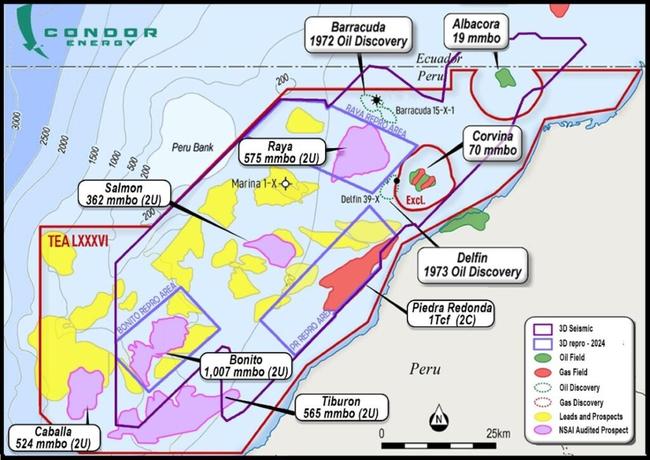

Taking off on the back of a multi-billion barrel prospective resource in the Tumbes Technical Evaluation Area LXXXVI (TEA) offshore northern Peru was Condor Energy, reaching 3c for a 30% increase on its previous close on volume of 45 million.

The independent combined best estimate gross unrisked 2U prospective resource across Bonito, Raya, Salmon, Caballa and Tiburon prospects is 3 billion barrels of oil prospective resources (100% gross unrisked) with 2.4 billion barrels net to Condor.

Bonita, the largest prospect, has a Best Estimate (2U) of 1bn barrels of oil prospective resource.

Prepared by international resource consultancy Netherland Sewell & Associates Inc., the majority of the resources are within Lower Miocene Zorritos Formation, a proven reservoir in the Tumbes Basin.

The world-class multi-billion barrel exploration potential builds on Condor’s substantial discovered gas field at Piedra Redonda (1 Tcf 2C).

“The independent resource estimate from Netherland Sewell & Associates Inc. (NSAI) validates our strong belief in the world-class potential of our acreage in the Tumbes Basin,” managing director Serge Hayon said.

“With a best estimate of 3 billion barrels of oil across five high-potential prospects, from our 20+ leads/prospects inventory, Condor has built and rapidly matured a high-quality and material exploration portfolio with significant scale and running room.

“Our Tumbes TEA combination of multiple, giant, stacked oil exploration prospects and the existing gas discovery of 1 Tcf in Piedra Redonda with near-term monetisation options provides massive upside for both oil exploration and gas development.

“This marks a major step forward in our exploration efforts, and we are now focused on progressing our farm-out process to secure a partner for exploration drilling at the earliest opportunity to unlock the full value of this exciting asset.”

The farm-out process is underway with multiple parties in the data room.

The Tumbes Basin is a proven hydrocarbon province with existing oil and gas discoveries and production within the basin.

Condor’s offshore TEA area covers an underexplored deepwater extension of this petroleum system, with Oligo-Miocene Heath Formation source rocks, Lower Miocene Zorritos Formation reservoirs and thick regional seals including the Cardalitos Formation

Seismic and well control confirm effective migration pathways and structural traps across the basin margin.

The area remains undrilled in the majority of CND’s TEA area, offering large structural closures with significant volume potential.

RareX (ASX:REE)

Scandium has been added to the growing list of critical minerals present at the Cummins Range project of RareX in WA’s Kimberley region.

The extremely rare and lightly traded metal, which commands a high price likely to be pushed further owing to the escalating tariff war, adds to the rare earths, gallium and phosphate identified at the project.

And the scandium discovered by RareX is not to be sneezed at with “extraordinary values” of up to 2330g/t. The results comprise:

- 60m at 320g/t Sc2O3, including 8m at 824g/t Sc2O3 and 3m at 1131g/t Sc2O3; and

- 53m at 482g/t Sc2O3, including 30m at 744g/t Sc2O3 and 3m at 1021g/t Sc2O3.

A mineral resource estimate for Cummins Range from January 2024 totals 524.3Mt at 4.6% phosphate, 3120ppm total rare earth oxides and yttrium, 190ppm heavy rare earths, 70g/t scandium oxide as well as neodymium, praseodymium and a small amount of thorium/uranium.

That clocks in at 38,250t scandium oxide, with 6980t in the higher confidence indicated resource category and Cummins Range stands as the largest deposit of scandium in not just the country, but the western world.

The scandium news comes hot on the heels of news Cummins Range contained some of the highest grade hits of gallium ever found in Australia, prompting a review of the historic drill core at the project.

“Scandium at Cummins Range contains values up to 2330g/t, making it clear that Cummins Range is evolving into something far more significant than originally considered – a large-scale, long-life and geopolitically significant critical minerals asset,” REE managing director James Durrant said.

“With gallium and phosphate already defined on top of the rare earths, and now scandium emerging at globally competitive grades, this project should be recognised as one of the most strategically valuable critical minerals systems in the country.”

Scandium's magic lies in its ability to enhance aluminium alloys, making them lighter and stronger, important for space tech. It's also used in solid oxide fuel cells, which account for 36% of demand, thanks to its role in stabilising zirconium for better efficiency at lower temperatures.

Investors responded positively in the morning with shares up by 9.53% to 2.3c but eased back in the afternoon, finishing 0.1c lower than the previous close.

RareX said work to date was proving very valuable and this along with a number of other advantages had positioned Cummins Range very favourably.

Advantages include the Tanami road being sealed by Mains Roads WA; the Port of Wyndham given port of first entry designation by the Feds; RareX's land option at the port and infrastructure sharing agreement for boat loading; completion of enviro baselines; and imminent Native Title agreement.

“With rapid geopolitical shifts occurring almost daily, it is clearly the right environment to profile assets like Cummins Range for what they are: multi-critical-mineral projects in stable jurisdictions, with de-risked pathways to production,” Durrant said.

“With the US actively seeking secure supply of critical inputs, China continuing to restrict exports and the Australian Government now advancing a bipartisan strategic reserve, the imperative to bring forward independent, large-scale supply is clear.”

Antipa Minerals (ASX:AZY)

Antipa has climbed 7% to 41.7c on reclaiming full control of the 1520km2 Paterson project which fully surrounds its 2.3Moz Minyari Dome in WA’s red hot Paterson region.

This follows IGO’s decision to pull out of a farm-in agreement that it had entered into with the company in July 2020.

While the decision precludes further investment from the larger miner, Antipa Minerals (ASX:AZY) is taking it as an opportunity to consolidate its holdings in the Paterson into a hefty 4060km2 package.

The company will also benefit from the $15m worth of investment that IGO had put into copper-focused exploration in the project.

“Antipa’s foresight in recognising the regional opportunity within the Paterson, combined with our early-mover actions, has delivered a significant advantage that is beginning to reveal itself,” managing director Roger Mason said.

“The full retention of this project is a fantastic result for Antipa, delivering a twofold benefit: first, the tenement package completely surrounds our flagship Minyari Dome Project, further enhancing any future standalone development and second, while exploration has been focused on copper discoveries several years, we have long recognised multiple gold-dominant opportunities on this ground which we are excited to now be able to properly interrogate.”

Magnetic Resources (ASX:MAU)

Testwork at the Lady Julie North 4 (LJN4) gold project has delivered plenty of encouragement for Magnetic Resources including a 97.5% recovery rate from a composite in a deeper section of the deposit’s underground resource.

The latest tests show a considerable increase over the potential recovery achieved with conventional gravity/leach of 88%, by adding two stage flotation and regrinding to 20µm.

The company said the 97.5% recovery in the deep altered ultramafic showed the increasing potential resource sizes within the central and northern high-grade core zones that were still open at depth.

That could increase the forecast annual production rate of 104,000oz.

The company has also boosted project economics by optimising the float/grind stage of processing, highlighting that a smaller grind mill may be needed then originally envisaged, translating to reduced capex and opex.

When weighted by the relative contribution to the project mill feed, the average recovery for the project remains above 92%.

“Another set of very pleasing results yet again reinforcing the value inherent in the project,” managing director George Sakalidis said.

“The exceptional 97.5% recovery in the deep ultramafic is very positive given the recent results showing potential increasing resource sizes within the central and northern high grade core zones that are still open at depth.

“The gains in recovery at a time of strengthening gold price, vindicates the speedy approach taken to adopt and incorporate new ideas when a benefit is visualised.

“This work provides the confidence needed to complete the process plant design/costing incorporating the optimised flotation/fine grind solution.”

LJN4 hosts a recently upgraded resource of 23.6Mt grading 2.04g/t for ~1.55Moz of gold and is the primary deposit at Lady Julie project that has an overall resource of 28.11Mt at 1.93g/t for 1.75Moz.

Lady Julie is expected to produce at an annual rate of 104,000oz for eight years from an open pit to generate total EBITDA of $1.49bn using a $3200/oz gold price.

Shares were as much as 4% higher to $1.41.

Nordic Resources (ASX:NNL)

(Up on no news)

Nordic Resources was riding at the top of a wave early in the day with shares up as much as 23.66% to 11.5c before a trading halt ended the momentum.

The halt was recommended by the company as it prepares a response to an ASX price query.

In a statement, the company said as well as the response there was “possibly, an announcement regarding a potential material project acquisition”.

NNL’s flagship Pulju project in northern Finland has nickel-copper-cobalt prospectivity and the company has full exploration rights over 12km of continuous strike within the mapped mineralised ultramafic unit.

There are a number of targets it plans to drill test away from the Hotinvaara deposit in the south and the company is in discussions with potential strategic partners.

A 2023 resource estimate for the Hotinvaara disseminated nickel sulphide deposit comprises 18mt grading 0.21% Ni, 0.01% Co and 53ppm Cu for 862,800 tonnes of contained Ni, 40,000t of contained Co and 22,100t of contained Cu.

Metallurgical results demonstrated that a clean 18% nickel concentrate with payable cobalt can be produced from the Hotinvaara mineralisation, with 62% recovery achieved in a first-pass test program.

Pulju is in the Central Lapland Greenstone Belt 50km north of Kittilä and with access to world-class infrastructure, grid power, a national highway and an international airport. Finland is also home to Western Europe’s only nickel sulphide smelters.

The project is a district scale nickel-copper-cobalt exploration and development opportunity within a progressive mining district in Europe.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While RareX, Antipa Minerals and Magnetic Resources are Stockhead advertisers, they did not sponsor this article.

Originally published as Resources Top 5: Condor takes off on multi-billion barrel prospective resource