Lunch Wrap: ASX walks tightrope; lawsuit number two looms for Paladin

The ASX has been wobbling about as Trump’s tariff saga roared back to life. Meanwhile HealthCo REIT rallied on Healthscope rent deal.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Trump tariffs back on, but ASX inches higher

HealthCo soars on Healthscope rent deal

Paladin sued again, Viva dips, NRW wins Rio job

The ASX opened Friday on a mood swing, with the ASX 200 Index bouncing between gains and losses before inching higher by 0.1% by about 1pm, AEST.

Investors had gone to bed hoping Trump’s global tariff campaign had been buried for good, but woke up to find it very much still kicking.

Just yesterday, markets were cheering a US trade court decision that slapped down a big chunk of Trump’s tariff agenda.

The court ruled that the president had overstepped his authority under the International Emergency Economic Powers Act (IEEPA) by slapping tariffs on dozens of nations.

Judges made it clear: it wasn’t about whether tariffs were smart or dumb, the law just didn’t back him.

But before markets could even finish the victory lap, a higher court threw the brakes on the celebration. The US Court of Appeals stepped in with a temporary stay, meaning Trump’s tariffs are still alive, at least for now.

Trump’s trade adviser Peter Navarro declared the tariffs are “alive, well, healthy,” while White House press secretary Karoline Leavitt warned the Supreme Court may need to step in to protect presidential powers.

Despite the chaos and a string of flashing red lights from the US economy - which includes data showing US GDP shrinking by 0.2% in Q1 - Wall Street still managed to close in the green last night.

Bond yields fell, though, as traders started betting on Fed rate cuts.

Meanwhile in a private White House chat, Trump met with Fed chair Jerome Powell and reportedly urged him to cut interest rates. Powell apparently reminded the president that decisions would depend on data, not tweets.

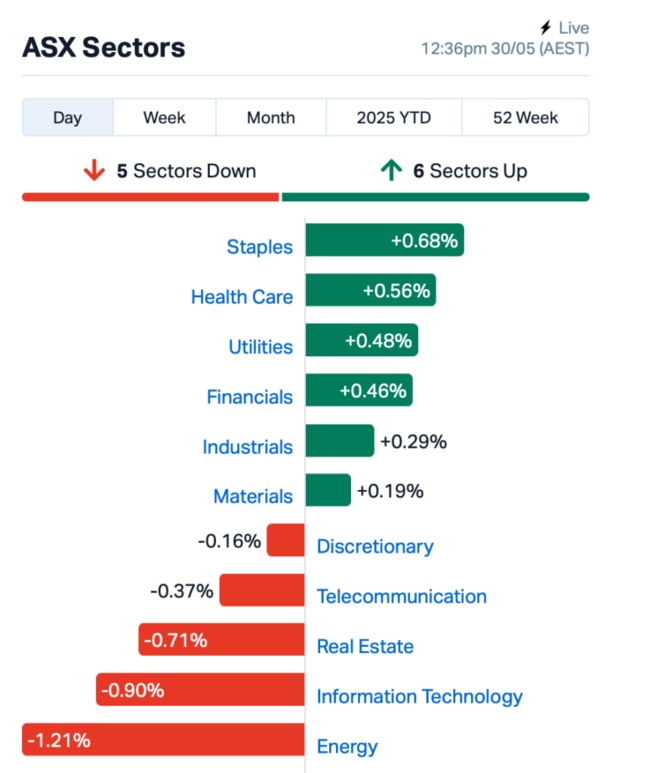

To the ASX, 5 of 11 sectors were flashing red this morning. Energy stocks led the losers as oil prices slipped.

Gold stocks however rallied as bullion found new sparkle, driven by tariff uncertainty and fresh US jobless data.

In large caps news, Paladin Energy (ASX:PDN) is under fire again, with a second class action on the way over how it handled production guidance at its Langer Heinrich uranium mine in Namibia.

The Banton Group is gearing up to file this time. The first class action was filed by Slater and Gordon on April 16, essentially on similar claims.

Viva Energy (ASX:VEA) got the green light from Victoria to move ahead with its Geelong LNG terminal. But despite the tick of approval, Viva shares dipped 2%.

And still in large caps, mining services firm NRW Holdings (ASX:NWH) climbed 1% after its subsidiary Primero scored a $157 million deal to build infrastructure at Rio Tinto (ASX:RIO)’s Hope Downs mine in the Pilbara.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 30 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| PRM | Prominence Energy | 0.004 | 100% | 9,000 | $778,353 |

| ERL | Empire Resources | 0.005 | 67% | 319,668 | $4,451,740 |

| CR9 | Corellares | 0.003 | 50% | 412,320 | $2,011,213 |

| ASP | Aspermont Limited | 0.007 | 40% | 1,209,102 | $12,365,938 |

| TAS | Tasman Resources Ltd | 0.025 | 39% | 455,510 | $3,314,567 |

| CZN | Corazon Ltd | 0.002 | 33% | 700,000 | $1,776,858 |

| GMN | Gold Mountain Ltd | 0.002 | 33% | 296,327 | $8,429,639 |

| SHP | South Harz Potash | 0.004 | 33% | 404,999 | $3,308,186 |

| LOC | Locatetechnologies | 0.090 | 29% | 352,514 | $14,083,568 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 198,136 | $6,296,765 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 599,251 | $3,479,814 |

| ECT | Env Clean Tech Ltd. | 0.003 | 25% | 159,004 | $8,013,537 |

| OVT | Ovanti Limited | 0.003 | 25% | 507,500 | $5,587,030 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 1,000,000 | $6,350,111 |

| RGL | Riversgold | 0.005 | 25% | 189,093 | $6,734,850 |

| TEM | Tempest Minerals | 0.005 | 25% | 421,040 | $2,938,119 |

| VML | Vital Metals Limited | 0.003 | 25% | 494,000 | $11,790,134 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 1,155,003 | $18,739,112 |

| WBE | Whitebark Energy | 0.005 | 25% | 100,000 | $2,749,334 |

| NHE | Nobleheliumlimited | 0.011 | 22% | 557,421 | $5,395,725 |

| OLL | Openlearning | 0.018 | 20% | 145,461 | $7,240,120 |

| AZL | Arizona Lithium Ltd | 0.006 | 20% | 3,857,357 | $26,351,572 |

| PIL | Peppermint Inv Ltd | 0.003 | 20% | 200,000 | $5,690,224 |

| LKY | Locksleyresources | 0.079 | 20% | 28,480,896 | $9,680,000 |

| CC5 | Clever Culture | 0.019 | 19% | 5,784,516 | $28,252,645 |

Mining media company Aspermont (ASX:ASP) has clocked up its 35th straight quarter of subscription growth, with subs now making up 75% of total revenue. Recurring subscription revenue hit $11.2 million, up 4% year-on-year, while overall group revenue dipped 6% to $6.7 million. EBITDA was negative, but the company is still debt-free and sitting on $700k in cash.

Tempest Minerals (ASX:TEM) has tightened up sampling at its Sanity gold target in WA’s Yalgoo project, and the results are looking promising. By increasing the sample density, it’s sharpened the definition of a strong and continuous gold anomaly, pointing to the potential for a large-scale mineralised system. TEM says Sanity sits in a juicy bit of ground, backed by rock chips grading as high as 7g/t gold.

Healthco Healthcare and Wellness REIT (ASX:HCW) surged after striking a lifeline deal with troubled hospital operator Healthscope and its receivers, agreeing to partially defer rent payments across several properties. That deal helped settle nerves about HealthCo’s income stream and brought a bit of clarity to an otherwise messy situation. Investors clearly liked the look of the stabilised cash flow, and piled in fast.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 30 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BLZ | Blaze Minerals Ltd | 0.002 | -33% | 142,857 | $4,700,843 |

| AOA | Ausmon Resorces | 0.002 | -25% | 357,633 | $2,622,427 |

| BMO | Bastion Minerals | 0.002 | -25% | 500,000 | $1,807,255 |

| RAN | Range International | 0.002 | -25% | 3,198,946 | $1,878,581 |

| MGA | Metalsgrovemining | 0.061 | -25% | 50,000 | $8,539,020 |

| WNX | Wellnex Life Ltd | 0.300 | -22% | 47,583 | $26,092,038 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 1,597,010 | $15,867,318 |

| EVR | Ev Resources Ltd | 0.004 | -20% | 519,000 | $9,929,183 |

| PLC | Premier1 Lithium Ltd | 0.009 | -18% | 1,932,215 | $4,048,666 |

| REZ | Resourc & En Grp Ltd | 0.015 | -17% | 492,052 | $12,089,504 |

| DAF | Discovery Alaska Ltd | 0.010 | -17% | 25,000 | $2,810,816 |

| KPO | Kalina Power Limited | 0.005 | -17% | 2,468,473 | $17,597,818 |

| OEL | Otto Energy Limited | 0.005 | -17% | 888,386 | $28,770,059 |

| TEG | Triangle Energy Ltd | 0.003 | -17% | 500,999 | $6,267,702 |

| CML | Connected Minerals | 0.130 | -16% | 10,139 | $6,410,523 |

| ADG | Adelong Gold Limited | 0.006 | -14% | 59,334,827 | $9,782,403 |

| OM1 | Omnia Metals Group | 0.012 | -14% | 820,682 | $3,039,284 |

| QXR | Qx Resources Limited | 0.003 | -14% | 700,000 | $4,586,151 |

| SRJ | SRJ Technologies | 0.013 | -13% | 15,005 | $9,083,671 |

| 1CG | One Click Group Ltd | 0.007 | -13% | 398,955 | $9,423,039 |

| AX8 | Accelerate Resources | 0.007 | -13% | 235,331 | $6,377,510 |

| HFY | Hubify Ltd | 0.007 | -13% | 43,849 | $4,089,090 |

| CRD | Conradasiaenergyltd | 0.620 | -12% | 158,139 | $132,939,151 |

| DBO | Diabloresources | 0.015 | -12% | 58,660 | $2,296,970 |

IN CASE YOU MISSED IT

Stockhead’s Tylah Tully looks at White Cliff Minerals’ (ASX:WCN) exploration at Danvers, where continuous, high-grade copper and silver mineralisation at surface has been confirmed.

Tylah also breaks down the latest from West Coast Silver (ASX:WCE),which has started drilling to test extensions of known high-grade mineralisation at its Elizabeth Hill project in Western Australia.

At Stockhead, we tell it like it is. While White Cliff Minerals and West Coast Silver are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX walks tightrope; lawsuit number two looms for Paladin