Lunch Wrap: ASX in a hole again as earnings roll in; Wesfarmers, Megaport lead winners

The ASX has dropped again with banks and miners hit. Aussie jobs stay strong at 4.1%, and Wesfarmers and Megaport have led earnings.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX down again, banks and miners taking a hit

Jobs market stays strong, Aussie employment rate at 4.1pc

Earnings updates: Wesfarmers, Megaport shine; ANZ and Fortescue stumble

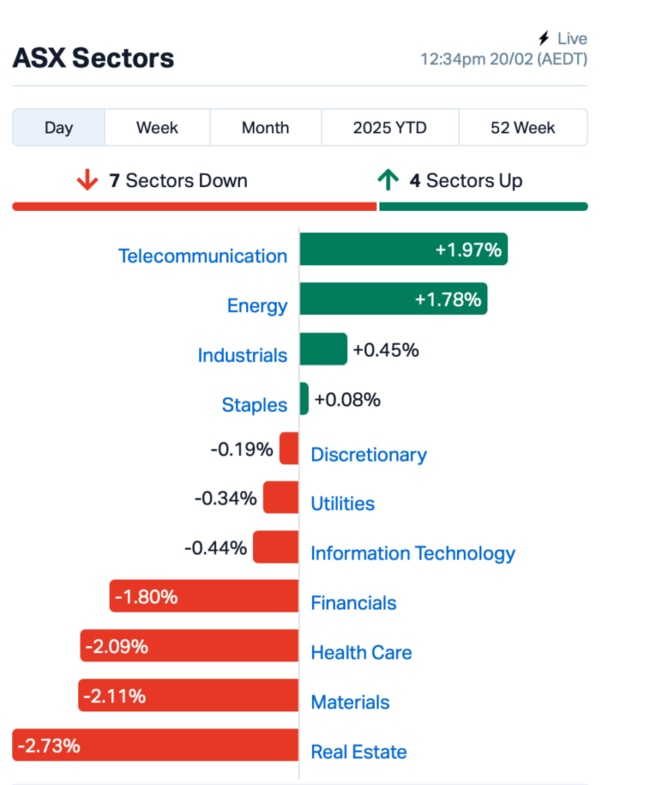

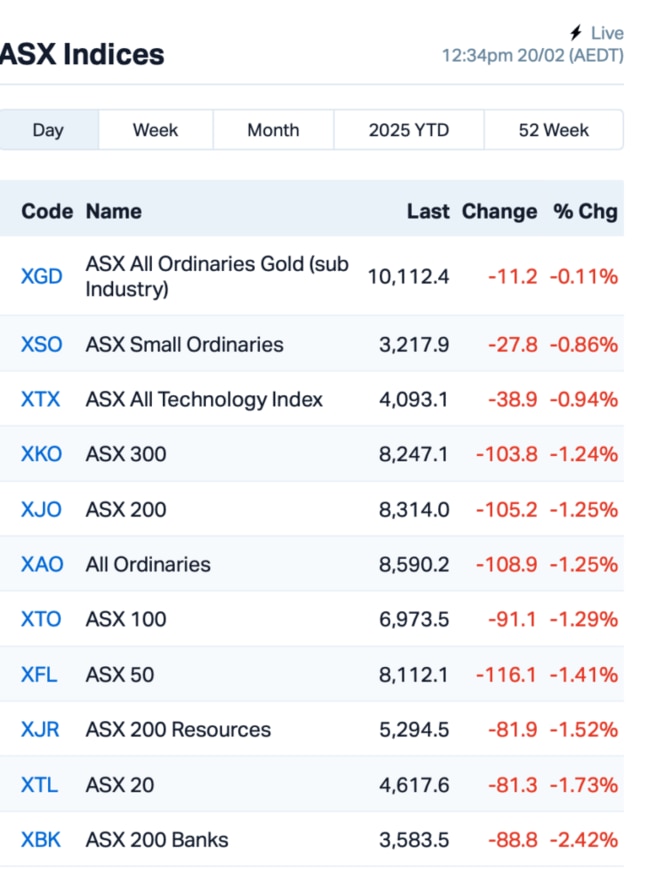

The ASX is slipping again on Thursday, picking up where it left off yesterday, with the S&P/ASX 200 down by 1.2% at lunch time.

Overnight, Wall Street had a quiet but solid session, with the S&P 500 hitting a new record high.

The US Fed's latest minutes showed policymakers are staying cautious, and plan to keep rates steady as inflation remains stubborn.

Back home, the jobs market showed some positive numbers, with Aussie employment rising by 44,000 in January, following an impressive 60,000 rise the month before.

But the unemployment rate ticked up to 4.1% from 4%, said the ABS, just slightly higher than expected, but still showing that the job market remains strong.

To the ASX, where the earnings season is in full swing.

It’s been a busy week with plenty of trading updates in the market, and today was no exception.

Large caps earnings updates

Australia and New Zealand Banking Group's (ASX:ANZ) impaired loans rise is adding fuel to the fire for the Aussie banks sell-off in the last few days. ANZ fell by over 3% this morning after the bank reported a slight dip in its overall profits, with revenue growth not as strong as expected. While deposits grew by 2% and loans increased by 4%, the bank’s risk-weighted assets and provisions for bad loans came in higher than anticipated.

Fortescue (ASX:FMG) also struggled this morning, down by 6% after reporting a massive 53% drop in net profit. Despite record shipments from the Pilbara, FMG saw revenue from hematite fall 21%, and its costs rose by 8%. Its interim dividend was slashed by more than half.

Rio Tinto's (ASX:RIO) earnings report showed a 15% increase in after-tax profits, reaching US$11.552 billion. However, its iron ore business saw prices fall 11%, leading to a slight dip in its overall earnings. Despite this, Rio still delivered a good full-year dividend, returning 60% of its 2024 profits to shareholders. Rio’s shares were down 2.5%.

Whitehaven Coal (ASX:WHC), meanwhile, had a strong half-year, with a 33% increase in net profit to $328 million. Revenue more than doubled to $3.4 billion, thanks to the strong performance of its newly acquired mines. The company also announced it would restart its buyback program and pay an interim dividend of 9¢ per share. Shares jumped almost 8%.

Lithium miner IGO (ASX:IGO) had a rough start to the year, posting a $782.1 million loss for the first half. This was mainly due to weak lithium prices and a major impairment charge related to its Kwinana lithium refinery. But the company is staying optimistic about the future and still expects production to pick up in 2025. Shares slipped 3%.

Pilbara Minerals (ASX:PLS), another lithium miner, reported a $69 million loss for the first half of the year. Despite a decline in revenue and EBITDA, the company remains hopeful that its cash flow metrics will improve in the second half after the completion of a plant expansion. Shares up 1.75%.

Read more here: Bumper results day sees RIO, FMG, PLS and more report

Capstone Copper Corp (ASX:CSC) saw its earnings more than double in the fourth quarter, thanks to increased copper production and higher copper prices. The company said it was optimistic about 2025, expecting a 30% increase in copper production. CSC's shares were still down by almost 2%.

Goodman Group (ASX:GMG) was one of the biggest large-cap losers on Thursday, falling by over 6% after it announced a $4 billion capital raise to boost its focus on data centres. It’s been 12 years since the company did a capital raise, and it seems investors weren’t thrilled about it.

Wesfarmers (ASX:WES) climbed 3% after it reported a 2.9% increase in profit, reaching $1.47 billion in the six months to December 31. The company was boosted by strong performance from its retail businesses like Bunnings and Kmart.

Tech company Megaport (ASX:MP1) skyrocketed 21% after it raised its revenue guidance for the year. Megaport has been growing strong across all regions, with revenue and gross profit both rising by 12%.

This is where things stood at around lunch time, AEDT:

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 20 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| CVR | Cavalierresources | 0.135 | 57% | 612,926 | $4,974,431 |

| ECT | Env Clean Tech Ltd. | 0.003 | 50% | 5,117,534 | $6,343,621 |

| PER | Percheron | 0.013 | 39% | 45,258,184 | $9,786,939 |

| WC1 | Westcobarmetals | 0.033 | 38% | 17,846,419 | $4,221,898 |

| PVW | PVW Res Ltd | 0.016 | 33% | 3,572,909 | $2,386,857 |

| RLL | Rapid Lithium Ltd | 0.004 | 33% | 2,836,887 | $3,097,334 |

| AVE | Avecho Biotech Ltd | 0.007 | 30% | 4,990,127 | $15,846,485 |

| 1TT | Thrive Tribe Tech | 0.003 | 25% | 422,497 | $4,063,446 |

| ERA | Energy Resources | 0.003 | 25% | 4,107,168 | $810,792,482 |

| WWI | West Wits Mining Ltd | 0.020 | 25% | 32,942,867 | $41,199,687 |

| HMY | Harmoney Corp Ltd | 0.685 | 25% | 325,080 | $56,080,281 |

| LCL | LCL Resources Ltd | 0.011 | 22% | 4,758,812 | $10,753,314 |

| MP1 | Megaport Limited | 11.580 | 21% | 3,488,337 | $1,530,699,487 |

| NSM | Northstaw | 0.030 | 20% | 1,601,160 | $6,816,913 |

| ADY | Admiralty Resources. | 0.006 | 20% | 303,442 | $13,147,397 |

| BNL | Blue Star Helium Ltd | 0.006 | 20% | 668,668 | $13,474,426 |

| RNX | Renegade Exploration | 0.006 | 20% | 142,000 | $6,420,017 |

| SKK | Stakk Limited | 0.006 | 20% | 11,991 | $10,375,398 |

| WSR | Westar Resources | 0.013 | 18% | 890,319 | $4,385,973 |

| TRS | The Reject Shop | 3.460 | 18% | 332,988 | $109,262,387 |

| PRS | Prospech Limited | 0.027 | 17% | 746,768 | $7,562,995 |

| MGU | Magnum Mining & Exp | 0.007 | 17% | 185,841 | $4,856,168 |

| SSR | SSR Mining Inc. | 16.310 | 16% | 33,453 | $49,491,954 |

| PUA | Peak Minerals Ltd | 0.011 | 16% | 12,505,728 | $24,245,048 |

| TRE | Toubani Res Ltd | 0.150 | 15% | 270,830 | $29,764,795 |

Cavalier Resources (ASX:CVR) has signed a non-binding deal for an US$11 million stream finance facility with Raptor to fund the Crawford Gold Project’s Stage 1 open pit development. The funds will also support drilling to upgrade more resources into ore reserves. The deal involves delivering up to 11,000 ounces of gold, but Cavalier won’t have to raise additional equity capital, so no dilution for shareholders. A 60-day due diligence period is now underway before moving to a binding agreement.

PVW Resources (ASX:PVW) has reported strong results from its drilling program at the Capão Bonito project in Brazil. Out of 32 holes drilled, 29 (94%) returned Total Rare Earth Oxide (TREO) concentrations above 500 ppm, with some hitting impressive grades up to 3,267 ppm. The mineralisation is shallow, making it easily accessible, and the project shows significant potential with mineralization still open.

Non-bank lender Harmoney Corp (ASX:HMY) reported a strong first half of FY25, with Cash NPAT hitting $2.3m, a 350% increase compared to 1H24. Statutory NPAT was $2.0m. The company said it’s on track to meet its Cash NPAT guidance of $5m for FY25, with a target of $10m+ for FY26.

LCL Resources (ASX:LCL) has announced its first-ever resource estimate for the Ono Gold Project in Papua New Guinea. The company’s Kusi skarn deposit has an Inferred Mineral Resource of 18.3 million tonnes at 1.42g/t gold, totalling 831,000 ounces of gold. There’s significant upside potential, LCL said, with impressive historical trench results showing high-grade gold, silver, lead, and zinc in nearby areas. LCL is planning further exploration to better understand the deeper mineralisation.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 20 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TX3 | Trinex Minerals Ltd | 0.001 | -50% | 337,778 | $3,757,305 |

| AOK | Australian Oil. | 0.002 | -33% | 1,100,000 | $3,005,349 |

| VML | Vital Metals Limited | 0.002 | -25% | 3,511,944 | $11,790,134 |

| RDX | Redox Limited | 3.410 | -21% | 1,023,115 | $2,263,100,955 |

| EGL | Environmental Group | 0.210 | -21% | 4,459,868 | $100,831,916 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 99,500 | $5,781,575 |

| CDT | Castle Minerals | 0.002 | -20% | 100,000 | $4,742,035 |

| CRR | Critical Resources | 0.004 | -20% | 100,480 | $12,321,106 |

| IXU | Ixup Limited | 0.008 | -20% | 1,013,346 | $20,319,859 |

| PNT | Panthermetalsltd | 0.014 | -18% | 2,612,783 | $4,218,903 |

| AMS | Atomos | 0.005 | -17% | 117,520 | $7,290,111 |

| G88 | Golden Mile Res Ltd | 0.010 | -17% | 811,536 | $6,328,174 |

| PLG | Pearlgullironlimited | 0.010 | -17% | 412,877 | $2,454,501 |

| TM1 | Terra Metals Limited | 0.027 | -16% | 38,041 | $13,044,322 |

| DAL | Dalaroometalsltd | 0.022 | -15% | 851,100 | $6,457,750 |

| ZNO | Zoono Group Ltd | 0.028 | -15% | 14,561 | $11,729,316 |

| NAG | Nagambie Resources | 0.017 | -15% | 3,075,214 | $16,066,047 |

| RWD | Reward Minerals Ltd | 0.052 | -15% | 192,243 | $16,239,394 |

| BCB | Bowen Coal Limited | 0.006 | -14% | 5,404,885 | $75,429,481 |

| BLU | Blue Energy Limited | 0.006 | -14% | 230,000 | $12,956,815 |

| DTZ | Dotz Nano Ltd | 0.068 | -14% | 23 | $44,739,852 |

| GBE | Globe Metals &Mining | 0.031 | -14% | 273,340 | $25,007,508 |

| SUL | Super Ret Rep Ltd | 13.950 | -14% | 1,391,006 | $3,656,131,035 |

| TRM | Truscott Mining Corp | 0.076 | -14% | 23,200 | $16,847,473 |

Healius (ASX:HLS), the country’s second-largest pathology group, posted a net loss of $12.8 million for the first half, after selling off its Lumus Imaging business. However, the company is optimistic about its turnaround plan, with underlying earnings and revenue both on the rise.

IN CASE YOU MISSED IT

Victory Metals (ASX:VTM) has boosted its cash position with a $751,909 tax credit for R&D activities in FY24, tied to exploration at its North Stanmore REE and critical minerals project in WA. The funds will go toward ongoing development at the project.

Bubalus Resources (ASX:BUS) has kicked off field programs at its recently optioned gold-antimony projects in Victoria's goldfields, highlighted by a major geochemical sampling program at the Crosbie North target. Previous rock chip sampling returned results of up to 12.1 g/t gold and 2.02% antimony.

Scorpion Minerals (ASX:SCN) has appointed experienced capital markets executive Peter Koller as a non-executive director. Bronwyn Barnes has resigned as non-executive chairman, with Michael Kitney succeeding her in the role.

At Stockhead, we tell it like it is. While Victory Metals, Bubalus Resources and Scorpion Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX in a hole again as earnings roll in; Wesfarmers, Megaport lead winners