ICE Investors finds ‘sweet spot’ for small cap success

The “sweet spot” for ASX small cap investing is in high-quality companies with long-term competitive potential, says ICE Investors.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ICE Investors research has found the 'sweet spot' of small cap investing is within a high-performing subset

Actively managed small fund said it looks for companies with robust business franchises with potential to be future top 100 companies

Research shows small companies with strong business franchises consistently deliver superior returns compared to broader small-cap universe and overall share market

Investing in small cap companies can be risky, but also highly rewarding with the key for investors to pinpoint quality small caps with the potential to become tomorrow's top performers.

That's the view of ICE Investors managing director and portfolio manager Callum Burns who said not all small caps are created equal, with a wide performance gap among smaller companies.

ICE specialises in investing in predominately small cap, Australian-listed industrial companies.

Burns has been managing the fund since 2006.

The ICE Fund has outperformed the S&P/ASX Small Cap Industrial Index over one, three, 5, 10 and 15 years.

Burns said focusing on high-quality small companies with strong competitive advantages could yield significant long-term value for shareholders.

"The small-cap universe can be a significant challenge," he said.

"There are a lot of opportunities out there, but there are also many pitfalls.

"This is why a careful, methodical approach to stock selection is extremely important in small cap investing."

Burns said there were around 200 companies in the S&P/ASX Small Cap Index, and many more not even in the index, yet he noted many of these companies were not attractive investment propositions.

'Sweet spot' of small cap investing

Burns said research by the ICE Investors team had found that the “sweet spot” of small cap investing was within a high-performing subset.

"These are companies with robust business franchises that have the potential to be future top 100 companies," he said.

"However, extensive due diligence and research needs to be done to identify these companies."

Burns said a company with a robust business franchise was one that had an economic moat that made it difficult for competitors to take its revenues.

"These companies typically have assets that are difficult to replicate, such as licenses and brands, unique infrastructure, entrenched client bases or IP, and are well managed so the customers are sticky," he said.

"Companies with strong competitive advantages are more likely to succeed in the long run.

"They are also more likely to be quality companies that can weather future economic storms."

Three companies with a robust business franchise

Burns identified, for example, three stand-out companies with robust business franchises.

Burns said EQT, also known as Equity Trustees, had been established as an independent trustee and executor company more than 145 years ago and had become one of Australia’s largest specialist trustee companies.

"Equity Trustees is well known as a well established trustee company but what is not as well recognised is without the services they provide parts of the funds management industry would struggle to function," Burns said.

"There are competitors but very few of their capability and customers are very sticky.

"Add to that a very good management team makes a very attractive investment proposition."

"Chorus is New Zealand's NBN, the monopoly broadband provider, with the added advantage that its service is fibre to the home sans copper wires," Burns said.

"This business cannot be replaced and as a monopoly delivering a must have product the customers are very sticky."

Burns said PXA had a near monopoly position in Australia for digital conveyancing.

"This part of the business is close to one of the best businesses on the ASX," he noted.

"In addition PXA are attempting to deliver a similar position in the UK.

"This will take time and success is not totally assured but they have a unique capability which gives them an edge and the prize is large."

Underperformance presents opportunity

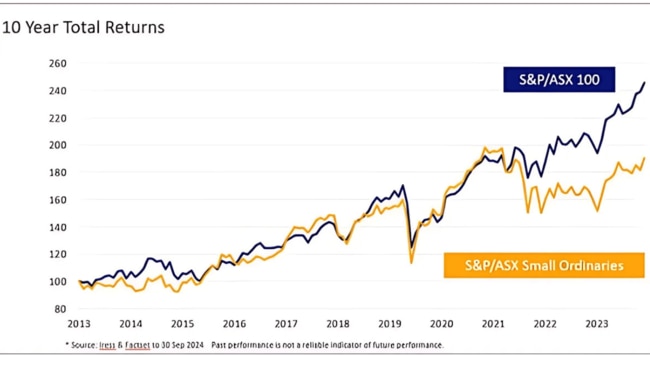

Despite the potential of small caps for long-term growth, Burns said the S&P/ASX Small Ordinaries Index had shown significant underperformance compared with the S&P/ASX 100 index since early 2022.

10 Year total returns

Burns said while the dislocation in performance remained in place, investing in small companies with strong business franchises caould yield dramatically different outcomes over time, as illustrated by ICE's research into the sector.

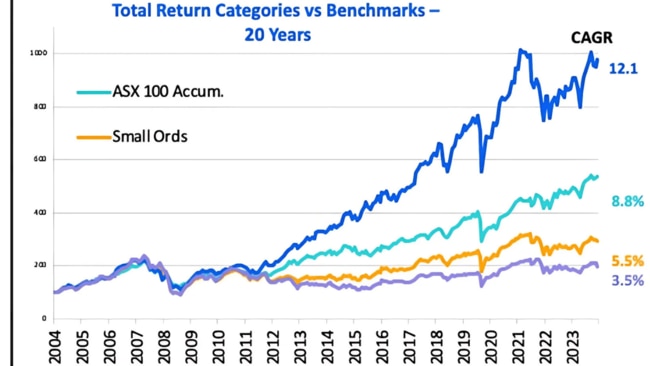

"This is demonstrated by looking at data over the last 20 years which shows that small companies with strong business franchises consistently deliver superior returns compared to the broader small-cap universe and the overall share market,” he said.

Burns said the above chart highlighted that small cap businesses with solid franchises, represented by the blue line, provided superior risk-adjusted returns due to their robust business models and consistent earnings growth.

In contrast, lower-quality small caps, represented by the purple line, generally exhibited weaker prospects and less durable growth.

“There are still many great small-cap companies out there waiting to be discovered," he said.

"However, investors need to be equipped with the right research and due diligence to differentiate between low-quality small caps, with little potential to outperform, from the next top 100 companies.

“Our investment approach at ICE Investors, helps us to differentiate and identify the next top 100 in the small caps space by finding strong business franchises with a solid competitive advantage and strong prospects to outperform in the long term."

Disclosure: The author held shares in Pexa at the time of writing this article. The views, information, or opinions expressed in this article are solely those of the interviewee and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Originally published as ICE Investors finds ‘sweet spot’ for small cap success