High Voltage: Battery metal bears out in force but ‘lithium demand is absolutely there’, says PLS boss

As lithium prices slump and a gloomy EV demand outlook emerges, many are bearish on battery metals. But two industry leaders beg to differ.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Stockhead’s High Voltage column wraps the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, manganese, magnesium, and vanadium.

As lithium prices slump and UBS issues a gloomy EV demand outlook, many are bearish on battery metals. But Pilbara Minerals’ boss isn’t buying it.

So then, what’s the general sentiment right now re the world of critical minerals that service the electric vehicle (EV market)?

It’s complicated, but battery metal bears are definitely out and about, leaving burnout and doughnut marks behind as they tear around, flipping the bird from souped-up petrol-guzzlers.

For the latest mining news, sign up here for free Stockhead daily newsletters

“Spot price” action for lithium is certainly slumping and has been for the best part of a year. There’s no getting around that fact right now. (Or is there? See Joe “Mr Lithium” Lowry’s tweet further below.)

As Fastmarkets reported a couple of days ago, “Chinese lithium carbonate prices are down amid bearish sentiment and thin demand, with hydroxide prices flat”.

Meanwhile, East Asian lithium prices are down on weak demand and consumer caution, and European and US lithium prices are following the Asian downtrend, the price reporting agency continued.

So that’s not great.

2023-11-01#Lithium Carbonate 99.5% Min China Spot

— Lithium Price Bot (@LithiumPriceBot) November 1, 2023

Price: $22,848.23

1 day: $-139.32 (-0.61%) 📉

YTD: -69.00%#Spodumene Concentrate (6%, CIF China)

Price: $2,100.00

1 day: $-10 (-0.47%) 📉

YTD: -63.95%

Sponsored by @SiennaResources$SIE$SNNAFhttps://t.co/yFr8De2ixo

The weakness in global lithium prices has reportedly erased $US22 billion of market capitalisation at Ganfeng Lithium and Tianqi Lithium, two of China’s biggest lithium producers.

“Their latest earnings reports suggest the rout may not be over,” reads an article by the South China Morning Post.

Then the multinational investment banking giant UBS had to come out this week and further rain on proceedings, issuing a research note that downgrades electric vehicle (EV) demand by between 5 per cent and 15 per cent through to 2030.

Basing that forecast on weaker-than-expected EV uptake in Europe and the US, UBS analyst Levi Spry said: “We have seen these signals for quite some time now with sequentially declining monthly sales, shrinking backlogs and growing discounts.”

Annnd … then there was a Reuters article on the last day of October titled “Lower prices, oversupply to weigh on lithium miners”.

MORE FROM STOCKHEAD: October’s top ASX miners, explorers | Quarterly exploration wrap | Perpetual enters Brazil’s ‘Lithium Valley’

“Albemarle Corp, the world’s largest producer of lithium, is expected to report lower quarterly profit as prices of the silvery-white metal came under pressure due to concerns of falling near-term demand and oversupply,” wrote Reuters, adding:

“Lithium miners have had a tough year as weak electric vehicle (EV) sales growth led to high stockpiles and sent prices of the metal tumbling down.”

Allow the bulls to horn in

Lithium expert Joe Lowry, who hosts The Global Lithium Podcast, however, reckons elements of that Reuters article were a “complete miss”, and references a more zoomed-out look at the lithium market’s price action:

“Yes, price is down but from the Chinese panic buying driven highs in 2022. Despite the drop, the China carbonate spot price is still more than 5 times the 2020 lows.”

Great example of a complete miss by @Reuters on what is really happening in the #lithium market. Yes, price is down but from the Chinese panic buying driven highs in 2022. Despite the drop, the China carbonate spot price is still >5X the 2020 lows. https://t.co/RIgtVMVZsv

— Joe Lowry (@globallithium) October 30, 2023

And before we look at what’s been turning heads on the ASX in this sector, words from Pilbara Minerals’ (ASX:PLS) CEO Dale Henderson, who was answering questions this week in a recent investor call, pricked up a few ears here and there. (And yes we know, if anyone’s going to be a lithium bull it’s him, but still …)

Henderson alleviated concerns when asked if PLS had trouble selling spodumene on the spot market (just one part of the company’s overall strategy) in the most recent quarter:

“The demand is absolutely there for product,” he said. “It hasn’t been a case of, ‘We can’t move product’, and certainly none of our customers are not wanting product.

“It’s just been more a case of moderating pricing and contending with the question of, ‘What is the right price for the market?’. That’s where the shift has been.”

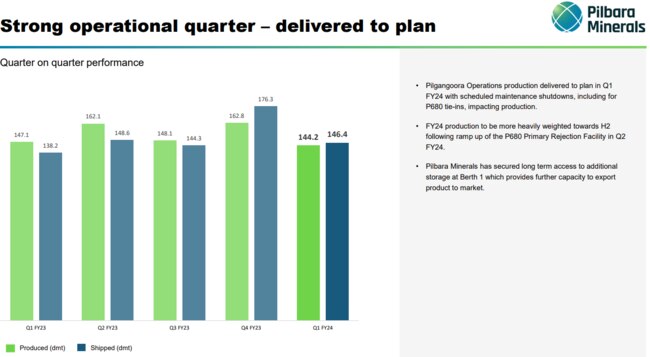

PLS has still been able to deliver a reasonably strong operational quarter again this time around …

… and the Aussie lithium gun maintains a solid cash position, too, with $3 billion. That’s down 9 per cent from the June quarter but the overall trend is still up when you consider the cash balance figure is roughly $1.6 billion higher than this time one year ago.

Oh, another thing. We noticed this neat graphic from Visual Capitalist, too, which suggests that by 2030, the way things are potentially going, demand for lithium will outstrip supply by 46 per cent.

Lithium is one of the world’s most critical natural resources and is central to our push toward sustainable energy âš¡ï¸

— Visual Capitalist (@VisualCap) October 27, 2023

Our sponsor @energyx asks: with over 350M EVs expected to be sold globally by 2030, can we meet tomorrow’s lithium demand?

Find out: https://t.co/u6IlifjAyUpic.twitter.com/TyAazAdSve

Visual Capitalist also notes further down its graphic, however, that direct lithium extraction (DLE) processes could help supply meet the lithium demand in coming years.

MinRes goes in for Wildcat

After the recent Liontown Albemarle/Rinehart tussle, and after SQM’s major move for Azure Minerals, the ASX lithium M&A scene is still frothy, still front and centre. Mineral Resources (ASX:MIN) has this week come in hot for stonking 2023 Pilbara lithium-hunting success story Wildcat Resources (ASX:WC8).

So all that ought to tell you something about how highly prized WA’s lithium land is perceived.

Visit Stockhead, where ASX small caps are big deals

The Chris Ellison-led mining giant has confirmed it’s now bought up almost a fifth of WC8, increasing its stake in the company to 19.85 per cent. WC8 is now up about 13 per cent as a result.

Per The Australian: “Mr Ellison is also speculated to be a shareholder in Azure Minerals under 5 per cent, and some had suspected he may have been looking to amass more shares in the takeover target of which Mrs Rinehart recently raided, with the billionaire gaining about 18 per cent.

“Wildcat’s market value has soared on the back of promising drilling results of its Tabba Tabba lithium project near Port Hedland in Western Australia.”

$MIN I'm a happy Mineral Resources shareholder with Mr Ellison placing blocking stakes in all the key WA lithium assets. Feel for shareholders of $WC8 $GL1 $DLI$ESS as MIN will squash future value growth in their Favour. pic.twitter.com/qJP2Ur4dxu

— Tony (@HookedOnLithium) October 31, 2023

Battery metals hot and not

THE WEEK’S BIGGEST GAINS

- WA1 Resources (ASX:WA1) +76 per cent

- Bulletin Resources (ASX:BNR) +67 per cent

- Heavy Rare Earths (ASX:HRE) +64 per cent

- Larvotto Resources (ASX:LRV) +60 per cent

- Azure Minerals (ASX:AZS) +49 per cent

THE WEEK’S BIGGEST FALLS

- Miramar Resources (ASX:M2R) -37 per cent

- Pan Asia Metals (ASX:PAM) -28 per cent

- Carnaby Resources (ASX:CNB) -25 per cent

- OD6 Metals (ASX:OD6) -23 per cent

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox.Click here

Originally published as High Voltage: Battery metal bears out in force but ‘lithium demand is absolutely there’, says PLS boss