Closing Bell: This ASX looks ready to cut its own records after latest Wall Street highs

With US inflation seemingly off the boil, Wall Street enthusiasm bubbled over into Asia markets on Thursday with the local benchmark gaining almost 1%.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Local markets surged this morning after yet another record-breaking night for Wall Street and US megatech.

- ASX 200 punches it, record highs back in view

- 11 of 11 sectors higher, like a well-oiled machine

- Great day for small caps, goldies and Augustus Minerals

Around lunchtime the ASX200 was within a sliver of its all-time high of 7910.5 from early April 2024 .

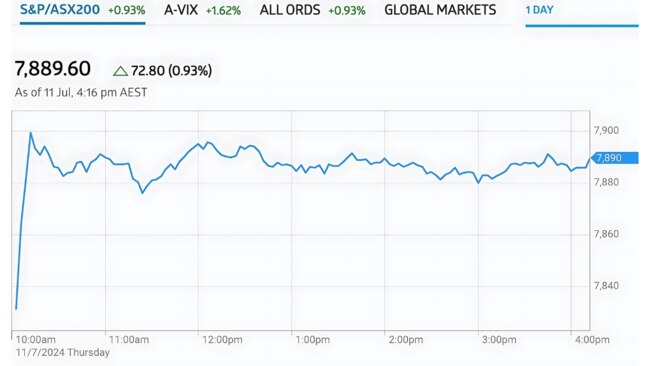

By the close on Thursday the S&P/ASX200 had gained 72.80 points or 0.89% to 7,889.60.

The benchmark stormed out the gates Thursday morning, with the action led by the IT sector and its small clique of homegrown tech majors.

The top-performing stocks in the best 200 index were Telix Pharmaceuticals (ASX:TLX) and Deep Yellow (ASX:DYL), up 9.95% and 8.61% respectively.

A quick look at the market sectors shows that it’s InfoTech out in front of a winning pack on Thursday, with investors piling into the sector’s big guns this morning, pushing the likes of Xero (ASX:XRO) up 3.3%, Life360 (ASX:360) up +2.2% and Macquarie Telecom Group (ASX:MAQ) up by +2.8%.

Pretty good, but the little end of the sector was busier: iSynergy Group (ASX:IS3) , Peppermint Innovation (ASX:PIL) and Novatti (ASX:NOV) all between 15% and 16% higher.

XPON Technologies (ASX:XPN) added 25% this arvo, so obvs something rather positive went down here...

So local markets surged 86 points (1.1%) to a three-month high of 7902.6 – within a sliver of its all-time high of 7910.5 from early April 2024.

The rally followed more of the same all-time highs out of Wall Street, with US Fed chair J.Powell babbling on a tight range about how the next rate cut's a matter of timing but that it also depends heavily on upcoming data... the unspoken elephant on Capitol Hill being tonight's all important US consumer prices (CPI) update.

In anticipation of looming cuts the US dollar fell while gold returned to its upward trajectory. That's been good for local exporters and some of our goldies.

Powell called the US economy "no longer overheated", which suggests at least he reckons the pieces are in place for some action, so fingers crossed for a gentler CPI (and PPI) drop.

At home, the benchmark built some broad-based gains on Thursday.

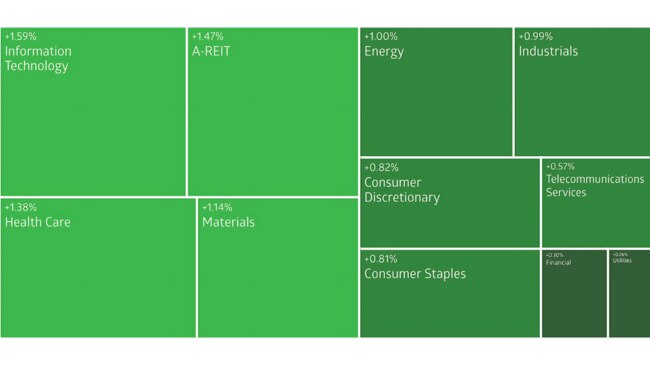

Here's the ASX Sectors looking positively spritely at around 3.30pm AEST.

It's not all that often one gets to see the 11 ASX sectors playing nicely with themselves and others. The standouts being the IT, Real Estate, Healthcare and Materials sectors.

IG Markets Tony Sycamore has whipped out the technical analysis on the local benchmark this arvo, and he says it's an index looking correct to the point of chastened.

"The up move is consistent with our view that the ASX200 has spent the past three months consolidating/correcting its gains from the late October 6751 low to the early April 7910.5 high.

"A break above the all-time high at 7910.5 is needed to confirm the correction is complete and that the uptrend has resumed, targeting 8,000 as the next stop."

I for one am looking forward to getting there.

This is what he means...

In New York it was more of the all-time highs for the S&P500 and the tech-heavy Nasdaq. Fed Chair Powell told the US Senate Banking Committee that last week's Goldiocksian jobs data suggests a labor market that's "cooled considerably".

US markets were more than satisfied to hear Powell say the Fed's weighing the fact high rates can actually wreck an economy and cause actual job losses vs reigniting more inflation by cutting too soon.

The big banks, led by the biggest of them all – the Commonwealth Bank (ASX:CBA) – continued to thumb its large proboscis at the short sellers when it hit another record high. This time JB HiFi (ASX:JBH) came along for the ride, clocking a record $66.38, buoyed by its own response to news its subsidiary The Good Guys allegedly haven't been playing so good with customers' rights, (Read about the ACCC's beef regarding this > here).

JB Hi-Fi told markets that the Good Guys takes compliance with the law "very seriously" and that did the trick.

In the Financial sector, this week the four big banks have all climbed an average somewhere near +2%.

The sector has had a great 2024 so far.

Yay also for gold, which has been encouraged by the clearer idea of a September rate cut. Gold spot prices moved past $2,375 on Thursday, rising a third straight session,

Gold is up about 15.5% this year.

A fair few of the smaller ASX gold prospects enjoyed Thursday in Sydney, too.

Way, way out somewhere in the Reynolds Range Project iTech Minerals (ASX:ITM) late last week reported (July 5) fast-tracked samples from a recent rock chip program revealed "outstanding "rock chips up to 182 g/t gold and gold associated with copper mineralisation at both the Scimitar and Reward Prospects.

At the moment, the highly prospective Reynolds Range project consists of x3 Exploration Licenses, currently being acquired by iTech Minerals (ASX:ITM), of which Prodigy Gold (ASX:PRX) holds 100% of two licences and 80% of another -20% of the third license is owned by Select Resources.

Managing Director Mike Schwarz reckons there's great potential for both high-grade low-sulphide gold style veins systems at the Sabre and Falchion Prospects, with the remaining copper, silver and base metal assays due in the coming weeks.

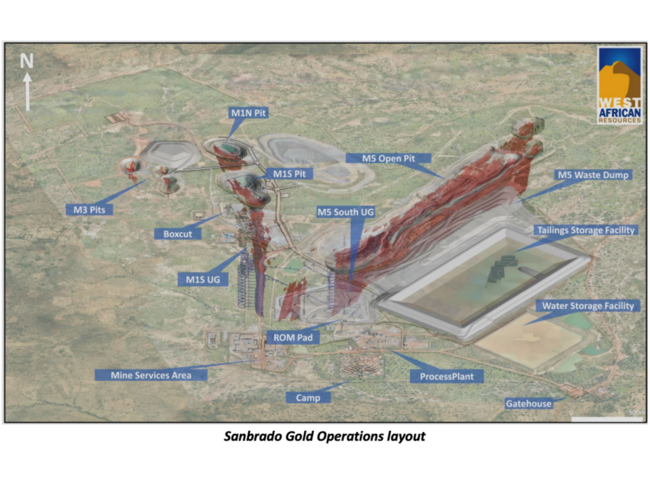

Meanwhile in other goldie news, the unhedged gold miner, West African Resources (ASX:WAF) just dropped a production update from its Sanbrado Gold Operations (Sanbrado) for the June quarter.

Sanbrado? Well, that's circa 90km east-southeast of the Burkina Faso. capital, Ouagadougou.

About here:

WAF has a 90% interest in Sanbrado, with the Burkina Faso Government holding the other 10%.

WAF poured first gold at the project in March 2020, some six months ahead of schedule and US$20m under budget.

So, the company says that with first half production of 107,644 ounces of gold, the mine is tracking well to achieve the upper end of the 2024 production guidance of 190,000 to 210,000 ounces of gold, with steady gold production expected over the second half of 2024.

WAF production update for Sanbrado (Q2 2024):

▪ Q2 gold production: 51,049 oz

▪ Q2 gold sales: 52,445 oz at an average price of US$2,314/oz

▪ H1 2024 gold production: 107,644 oz

▪ H1 2024 gold sales: 101,954 oz at an average price of US$2,199/oz

11 of the 11 ASX sectors were higher at the close. Information Technology is the best-performing sector, gaining 1.6% and just about 3% for the past five days.

ASX 200 by the sectors map on Thursday

Okay. Elsewhere... the brave ASX Small Ordinaries (XSO) index climbed about 1.4% while the ASX Emerging Companies (XEC) index finally made some hay, about 1% worth, but still hay.

The ASX (XPJ) A-REITs index gained 1.5% alongside the ASX Real estate sector (XEJ).

The XPJ is up about 23% YTD.

Over the last five days, the ASX200 (XJO) index has gained 1%% and is currently 1.2% off of its 52-week high.

Over the last five days, the index has gained 0.7%.

Not the ASX

I'm not much of a currency man myself, but probs worth noting that in Japan the wobbly old Yen has managed to steady at around USD$1.61.

That's at circa 38-year lows with uncertainty surrounding just how aggressive the usually sleepy Bank of Japan (BoJ) will time its looming attempt to normalise Japan's abnormal monetary settings.

The BOJ is expected to announce its bond purchase tapering plans at its upcoming policy meeting later this month after meeting with market participants this week to gauge how peeps might digest the likely pace for reducing the bank's ongoing bond buying ways.

Markets are also speculating that the central bank could raise interest rates again this month amid pressure from elevated boring costs abroad and a sharply weakening yen.

At home, the Aussie dollar's hada. great run, appreciating well past $0.670, clocking fresh 6 month highs (after last week's same scores).

Against the AUD, the greenback looks vulnerable since our late to the party RBA (Reserve Bank of Australia) is an almost certain late starter when the rates start getting cut.

Not only is our inflation stickier, but under previous Guv'nah P. Lowe the RBA began hiking interest rates much later than its global peers.

Overnight on Wall Street, equities enjoyed some stronger gains, while US Treasury yields rose modestly with the US Fed chair J. Powell telling congress the next rate cut's a matter of timing and that depends on upcoming data.

The US dollar fell and gold gained.

Oil futures rallied as US crude inventories fell. These are clearly hard things to measure.

Anyhooplah. As we were saying, in New York the records kept falling, a buoyant session ended overnight with the Dow Jones IA finally up strongly (1.1%), the S&P 500 higher by a little less than that and the spooky Nasdaq Composite adding a lazy bit more than the others – up 1.2% 'cos megatech,

That was the tech heavy's No, #27 record close in 2024.

Last night was actually the first time ever that the S&P 500 finished above the 5,600 point mark as well.

In US corporate goss, Apple added about 2% for a Tamar Valley crisp and fresh new high, lifting AAPL's audacious market cap to a $3.6 trillion... although with Nvidia climbing an even more casual 2.7%, that mega APPL market cap looks vulnerable.

Chip buddies Advanced Micro Devices and Micron Technology both jumped 4% higher.

Stocks in Asia have generally risen on Thursday, too.

ASX SMALL CAP LEADERS

Here are the best-performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AUG | Augustus Minerals | 0.093 | 144.7 | 28,605,837 | $3,244,060 |

| SHO | Sportshero Ltd | 0.005 | 66.7 | 1,833,796 | $1,853,499 |

| SVG | Savannah Goldfields | 0.036 | 56.5 | 818,055 | $6,464,953 |

| C7A | Clara Resources | 0.017 | 54.5 | 11,154,244 | $2,201,529 |

| AVE | Avecho Biotech Ltd | 0.003 | 50.0 | 594,397 | $6,338,594 |

| PRX | Prodigy Gold NL | 0.003 | 50.0 | 102,333 | $4,235,549 |

| RNE | Renu Energy Ltd | 0.006 | 50.0 | 336,281 | $2,904,536 |

| TD1 | Tali Digital Limited | 0.0015 | 50.0 | 109,537 | $3,295,156 |

| SM1 | Synlait Milk Ltd | 0.34 | 47.8 | 821,521 | $50,273,782 |

| LSA | Lachlan Star Ltd | 0.067 | 36.7 | 601,178 | $10,171,087 |

| ALY | Alchemy Resource Ltd | 0.008 | 33.3 | 642,927 | $7,068,458 |

| IBG | Ironbark Zinc Ltd | 0.004 | 33.3 | 9,878,338 | $5,077,718 |

| JAV | Javelin Minerals Ltd | 0.002 | 33.3 | 12,814,782 | $4,688,164 |

| RWD | Reward Minerals Ltd | 0.045 | 28.6 | 99,994 | $7,974,860 |

| ASN | Anson Resources Ltd | 0.16 | 28.0 | 10,207,947 | $161,316,026 |

| LIT | Lithium Australia | 0.023 | 27.8 | 12,036,055 | $22,001,250 |

| SLM | Solismineralsltd | 0.145 | 26.1 | 1,711,067 | $8,849,718 |

| ZLD | Zelira Therapeutics | 0.605 | 26.0 | 24,957 | $5,446,634 |

| NPM | Newpeak Metals | 0.017 | 25.9 | 1,917,006 | $2,037,569 |

| NUC | Nuchev Limited | 0.27 | 25.6 | 40,785 | $31,462,950 |

| XPN | Xpon Technologies | 0.015 | 25.0 | 1,667,766 | $4,349,298 |

| ADD | Adavale Resource Ltd | 0.005 | 25.0 | 3,580,088 | $4,261,061 |

| HLX | Helix Resources | 0.0025 | 25.0 | 687,668 | $6,528,387 |

| MRR | Minrex Resources Ltd | 0.01 | 25.0 | 4,053,926 | $8,678,940 |

| RLG | Roolife Group Ltd | 0.005 | 25.0 | 7,500 | $3,129,527 |

Up a sterling 60% is Augustus Minerals (ASX:AUG) which has received the following assays from new rock chip samples recently collected as part of an ongoing regional targeting program:

• 35% copper and 236 g/t silver from rock chip assays at Tiberius prospect.

• 32% copper, 3.26 g/t gold and 129 g/t silver from rock chips from the South Snowy prospect

• 10.1g/t gold from rock chips from the Justinian prospect

• 53.1 g/t silver and 5,000ppm molybdenum from rock chips from the Claudius prospect.

• 537ppm molybdenum and 47 g/t silver from rock chips from Minnie SE prospect, 1.4km SE of the existing Minnie Springs Mo-Cu porphyry drilling area.

AUG says mapping and field work is continuing around these prospects as well new targets identified from a combination of geology, geophysics and multi-spectral image analysis.

Clara Resources Australia (ASX:C7A) says that it's sold its holding in LSE-listed First Tin via an Institutional Book build at GBP £0.04, to raise net proceeds of circa A$4.3m (settling on 12 July).

Proceeds from this sale are to be applied towards the Ashford acquisition, discharging debt obligations and general working capital.

With the sale of the First Tin stake, tC7A says it will advance the purchase of the remaining 60% of the Company’s New South Wales based Ashford Coking Coal Project from Savannah Goldfields with that process expected to be finalised in the coming days.

Which brings us to Savannah Goldfields (ASX:SVG), where a new letter's been sent from Clara with a new transaction completion date set for Tuesday 16.

As per Savannah’s ASX Announcement of 2 July 2024, the consideration to be received by Savannah for the sale of its remaining shareholding interest in Renison Coal (and the timing of payment) now comprises of the following complex but lucrative deets:

- Upfront consideration of: $3,310,000 cash to be paid to Savannah at Completion, with completion now to occur by no later than 16 July 2024; and $750,000 cash received by Savannah on 31 May 2024. $200,000 cash for extension fees for extensions granted to the Completion Date with $100,000 received by Savannah on 11 June and a further $100,000 received by Savannah on 21 June 2024. 11.1 million Clara ordinary shares (which were issued to Savannah on 3 May 2024) which has taken Savannah’s shareholding interest in Clara to approximately 19.5%

- A retained royalty interest for Savannah to be paid $0.75 per tonne for every tonne of coal produced from the Ashford project. The current Indicated and Inferred Resource at Ashford is 14.8 million tonnes of in-situ coal.

SVG says the completion of the sale of its remaining share of Renison allows the company to bring forward realisation of value for the Ashford Project for its shareholders.

"It allows Savannah to remain focussed on and provides funding for progressing our gold mining and exploration projects in North Queensland and provides a ‘pure play’ gold investment profile for Savannah investors. Savannah shareholders will retain considerable exposure to the Ashford Coking Coal Projects’ future potential through the ~19.5% shareholding interest in Clara and the retained royalty interest on coal sold from the project."

Still in a hole to the banks today, Synlait Milk (ASX:SM1)... but where will we be tomorrow (or tonight?)

Its action at the AGM of the the Kiwi milky co, which says it's just got a major boost Thursday morning after big cuz Aussie milk giant A2 Milk said it will back a massive $130 million loan from major Chinese stakeholder in a key vote this arvo.

Synlait needs the money from its 39% shareholder – China's Bright Dairy – to repay its debt to banks by Monday. A2M is itself a key SM1 customer – and while China Bright can't vote cannot vote the news from A2M will be welcome.

A2 Milk (ASX:A2M) owns about one in every five of Synlait shares, but the hassle ahead is that everyone else – insto and retail punters – who control the balance of the company, also have to play ball.

If the resolution is a go-go at the meet, Synlait said it'll use every last penny and fully draw down the loan from China Bright.

Meanwhile, it's a big win for an Aussie lithium play on Thursday with Lithium Australia (ASX:LIT) achieving a maiden Operating Cash Profit for its recycling operations.

LIT says the moment is a "significant milestone" of delivering with the Q4 result was driven by the growth in its upstream ‘Fee for Service’ recycling model, increasing overall revenues and lowering dependence on downstream commodity sales.

"The strategic shift to large-format, lithium-ion battery (LIB) collections, combined with safety and operational improvements, underpins the company’s enhanced unit economics," LIT told the ASX, adding that the company is now focused on growing operating profit on a sustainable basis.

Upstream battery feedstock and revenues secured through new exclusive commercial agreements with customers including, LG Energy Solution, Volvo and Hyundai Glovis Lithium Australia CEO and MD, Simon Linge says the outcome was delivered during low commodity prices.

"(The operating profit), was driven by our growth in our fee for service model for battery recycling with all customers over the last year, which enables us to receive the majority of revenue upfront on improved terms. Our revised commercial model supports our ongoing joint development discussions with SungEel HiTech, which seek to scale up our operations in line with expected growth in LIB collection volumes.”

ASX SMALL CAP LAGGARDS

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MSG | Mcs Services Limited | 0.001 | -50.0 | 12,413,885 | $396,199 |

| OLH | Oldfields Holdings | 0.05 | -43.8 | 56,179 | $17,778,279 |

| CMD | Cassius Mining Ltd | 0.006 | -33.3 | 3,214,388 | $4,878,040 |

| 88E | 88 Energy Ltd | 0.002 | -33.3 | 7,617,878 | $86,678,016 |

| AXP | AXP Energy Ltd | 0.001 | -33.3 | 165,122 | $8,737,021 |

| LSR | Lodestar Minerals | 0.001 | -33.3 | 980,002 | $3,035,096 |

| MAY | Melbana Energy Ltd | 0.023 | -28.1 | 68,272,152 | $107,846,531 |

| KLI | Killiresources | 0.087 | -27.5 | 16,472,625 | $14,426,849 |

| APC | Aust Potash Ltd | 0.0015 | -25.0 | 2,034,441 | $8,040,379 |

| EXL | Elixinol Wellness | 0.003 | -25.0 | 943,671 | $5,284,729 |

| PKO | Peako Limited | 0.003 | -25.0 | 49,701 | $2,108,339 |

| JAY | Jayride Group | 0.007 | -22.2 | 205,744 | $2,126,782 |

| ALR | Altairminerals | 0.004 | -20.0 | 519,628 | $21,482,888 |

| BYH | Bryah Resources Ltd | 0.004 | -20.0 | 210,000 | $2,516,434 |

| LPD | Lepidico Ltd | 0.002 | -20.0 | 1,701,000 | $21,472,798 |

| IAM | Income Asset | 0.067 | -19.3 | 7,850 | $27,462,278 |

| JNO | Juno | 0.023 | -17.9 | 607,660 | $5,094,467 |

| PRM | Prominence Energy | 0.005 | -16.7 | 39,675 | $1,868,258 |

| TTI | Traffic Technologies | 0.005 | -16.7 | 120,000 | $5,837,311 |

| BIT | Biotron Limited | 0.033 | -15.4 | 6,152,454 | $35,188,745 |

| KGD | Kula Gold Limited | 0.011 | -15.4 | 1,156,250 | $8,036,755 |

| CMP | Compumedics Limited | 0.29 | -14.7 | 68,125 | $60,235,402 |

| FGH | Foresta Group | 0.006 | -14.3 | 5,475,161 | $16,487,653 |

| LML | Lincoln Minerals | 0.006 | -14.3 | 2,468,458 | $14,393,317 |

| TMK | TMK Energy Limited | 0.003 | -14.3 | 650,000 | $24,225,642 |

TRADING HALTS

Synlait Milk (ASX:SM1) – pending the outcome of the resolution put to shareholders at a special shareholders' meeting

Mineral Commodities (ASX:MRC) – pending an announcement regarding a developing maritime incident near the company’s Tormin Mineral Sands Project

Cygnus Gold (ASX:CY5) – pending the release of an announcement regarding a capital raising

ICYMI – PM EDITION

Adavale Resources (ASX:ADD) is planning to start a 3000m aircore drilling program at its recently expanded Marree Embayment uranium project in South Australia. This will target extensions of known mineralisation and roll fronts of oxidised and reduced sediments further downstream.

Phase 1 of Antipa Minerals’ (ASX:AZY) drilling at the 1.8Moz Minyari Dome gold-copper project in WA’s Paterson Province has identified new, near-surface gold zones along the northern edge of the GEO-01 discovery.

Arizona Lithium (ASX:AZL) has received the green light to start drilling at its Big Sandy lithium project from the US Bureau of Land Management. Drilling to test the exploration target of 271.1Mt-483.2Mt grading between 1000ppm and >2000ppm lithium is expected to begin in late July.

De Grey Mining (ASX:DEG) has completed a scoping study that outlines the potential of regional deposits to increase Hemi gold production to 700,000oz per annum. Capex for their development will be funded out of Hemi cashflow.

Equinox Resources (ASX:EQN) is set to begin drilling at the Mata da Corda rare earths project in Brazil after securing land access across the Patos de Minas and Lago Formosa prospects.

Haranga Resources (ASX:HAR) has completed regional termite mound sampling over its entire Saraya permit in Senegal with the low-cost process identifying numerous anomalous uranium targets that are currently being followed up on.

Itani Resources (ASX:ILT) has defined a 900m long high-grade silver-indium zone after drilling at Orient West, part of its Orient project in Queensland, returned assays of up to 334g/t silver equivalent.

Ora Banda Mining’s (ASX:OBM) board has approved the Final Investment Decision (FID) for its Sand King deposit, making it the company’s second underground mine at the Davyhurst gold project in WA.

Orthocell (ASX:OCC) has expanded its global footprint after receiving regulatory approval to sell its dental guided bone regeneration product Striate+ in Canada. This complements existing approvals for the product in their key markets including the US.

Prospect Resources (ASX:PSC) has started maiden drilling to define resources and test extensional opportunities at its recently acquired Mumbezhi copper project in Zambia.

Riversgold (ASX:RGL) reverse circulation drilling at its Northern Zone intrusive-hosted gold project just 26km from the Kalgoorlie Super Pit has returned gold intersections topping up at 18m grading 4.14g/t gold from 36m.

Renascor Resources (ASX:RNU) has secured a $5 million grant under the Australian Government’s International Partnerships in Critical Minerals Program for its planned Battery Anode Material graphite mine and manufacturing operation in South Australia.

Trinex Minerals’ (ASX:TX3) field work has discovered unexpected walk-up drill targets within a newly identified podumene-bearing pegmatite field at its Halo-Yuri project in Canada.

At Stockhead, we tell it like it is. While Adavale Resources, Antipa Minerals, Arizona Lithiu, De Grey Mining, Equinox Resources, Haranga Resources, Iltani Resources, Ora Banda Mining, Prospect Resources, Renascor Resources, Riversgold and Trinex Minerals are Stockhead advertisers, they did not sponsor this article.

Originally published as Closing Bell: This ASX looks ready to cut its own records after latest Wall Street highs