Closing Bell: The benchmark strikes back as Telstra leads broad based gains

The local market has bounced back from Monday’s resources-led losses with a day of broad based gains, despite some light holiday trading volumes ahead of US inflation data.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Local markets jumped on Tuesday, erasing all of Monday's losses on some fairly trading-lite volumes.

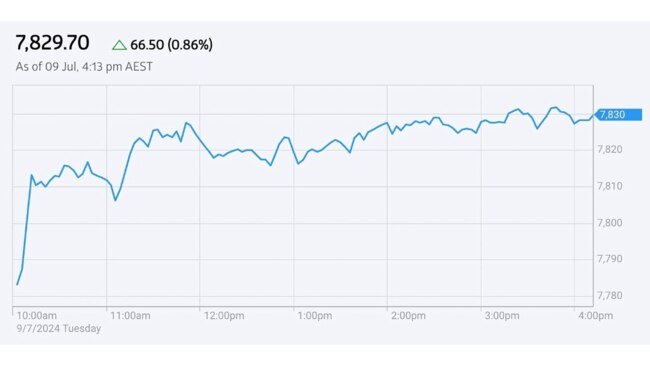

- ASX 200 rises strongly on Tuesday, closes up +0.86pc

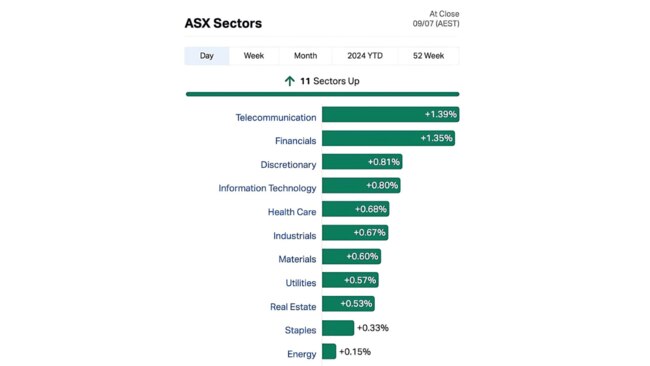

- All 11 sectors in the green, like Kermit on a golf course

- Top small cap was Killi Resources with a bumper +83.7pc surge

The S&P/ASX200 closed higher by 66.50 points or 0.86% to 7,829.70.

The benchmark enjoyed a day of fruitful trade with gains stretching across almost every sector, amid hopes of a dovish statement tonight from the US Fed Chair.

While the volumes were light, the gains were fairly emphatic as traders here and in the states attend CPI data and any other handy insights from Fed Chair Jerome Powell's senate testimony for signposts on the future interest rate trajectory.

That left the headline act on Tuesday in Sydney in the hands of former child star / market darling Telstra (ASX:TLS) , which added more than 3% for a near 6 month high after the telco slugged customers with price lifts from next month.

According to Tony Sycamore at IG markets, Telstra is close to testing its 200-day moving average, now at $3.79.

"Telstra’s rally followed a larger-than-expected increase in mobile phone pricing plans, thought to be around 4 -4.8%, which provides another reminder that hot services inflation is yet to be tamed. Further gains towards $4.00 appear likely as the Telco giant benefits from its pricing power operating within a cosy oligopoly framework."

It's TLS biggest single session gain since August 2023.

Also in the money on Tuesday - the big 4 banks, led by biggest bopper the Commonwealth Bank (ASX:CBA), although all 4 majors were more than 1% higher with 30 mins left in the day's trade.

Macquarie Group (ASX:MQG) bucked the trend, falling -0.96% to $202.41.

Winners were also in the bag for Consumer stocks, led by Wesfarmers (ASX:WES) .

The persistence of stubborn inflation, which heightens the risk of an additional RBA rate hike before year-end, has, as expected, weighed on Consumer Sentiment in July.

The biggest news: Toys R Us (ASX:TOY) survives.

The purveyor of Aussie toys with an American name today secured $2.49mn in funding by way of a Placement to new and existing institutional and sophisticated investor subscribe for approximately 35.57 million fully paid ordinary shares at an issue price of $0.07 per share.

TOY says it has reached an agreement with Mercer Street Global Opportunity Fund II LP (Mercer) to invest up to a further $1.5 million from the existing $4.2 million (facility limit) convertible securities facility, in two tranches. Yay. More toys.

Other random winners to go home with the cash were the metals recycler Sims Metal Management (ASX:SGM), Insignia Financial (ASX:IFL) and Judo Capital Holdings (ASX:JDO) , up 13.6% and 6.8% respectively.

Domino's Pizza Enterprises (ASX:DMP) and Liontown Resources (ASX:LTR) both up about 3%.

ASX200 by the sectors on Tuesday

Over the last five days, the benchmark index has gained 1.44% and is currently 1.02% off of its 52-week high.

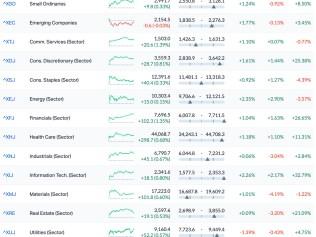

Meanwhile, the ASX Small Ordinaries (XSO) index climbed 0.33% while the ASX Emerging Companies (XEC) index ended pretty flat.

On the data front, Westpac’s Consumer Confidence survey fell by 1.1% in July to 82.7 points, remaining within the “deeply pessimistic” range.

The fall was larger than expected, with cost-of-living concerns more than offsetting the positive impact of the stage 3 tax cuts.

Meanwhile, NAB says Aussie business confidence surged last month just as business conditions continued to fall.

So if that's the business news then no wonder I'm confused about confidence.

NAB reports that business conditions fell 2 points to 4 index points.

So business conditions are at below average levels and still falling, reflecting the slowing in the economy through late 2023 and early 2024.

Not the ASX

After lunch in Hong Kong,

In Delhi, the Sensex clocked new record highs, jumping 240 points or 0.31% in morning trade on Tuesday.

The BSE Sensex tracked the latest Wall Street highs, while at home the RBI jobless read showed Indian employment rate rose to 6% in FY2024, the highest since 1982.

The Nifty 50 also added 0.1% by late aevo in Sydney to above 24,300.

In New York, the S&P 500 closed up 0.1% at a record 5,572.

The Nasdaq also set a new record close finishing the day 0.3% higher at 18,403.

The Dow Jones bucked the broader trend closing lower by 0.1%.

In corporate news Eli Lilly agreed to acquire Morphic for US$3.2bn opening up the lucrative if a little unpleasent multi-billion dollar inflammatory bowel disease (IBD) market.

Elsewhere, Nvidia added 2% pushing its valuation to US$3.15 trillion. Apple rallied 0.7 % to lift its market cap to US$3.49 trillion.

US Futures at 4pm on Tuesday in Sydney

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MOM | Moab Minerals Ltd | 0.006 | 100 | 10,422,820 | $2,135,889.18 |

| TKL | Traka Resources | 0.002 | 100 | 498,000 | $1,750,658.55 |

| KLI | Killiresources | 0.079 | 84 | 48,469,426 | $5,169,620.95 |

| CTN | Catalina Resources | 0.004 | 60 | 1,653,649 | $3,096,217.23 |

| LSR | Lodestar Minerals | 0.0015 | 50 | 1,000,000 | $2,023,397.35 |

| PVL | Powerhouse Ven Ltd | 0.052 | 37 | 3,467,866 | $4,588,240.69 |

| WEC | White Energy Company | 0.049 | 36 | 3,669 | $7,163,433.94 |

| HT8 | Harris Technology Gl | 0.016 | 33 | 1,686,950 | $3,589,625.77 |

| LYK | Lykosmetalslimited | 0.03 | 30 | 481,364 | $4,332,177.86 |

| CMD | Cassius Mining Ltd | 0.009 | 29 | 400,000 | $3,794,031.47 |

| SLM | Solismineralsltd | 0.11 | 28 | 1,289,365 | $6,618,050.02 |

| AHN | Athena Resources | 0.0025 | 25 | 203,926 | $2,140,935.12 |

| ATH | Alterity Therap Ltd | 0.005 | 25 | 125,000 | $20,980,461.27 |

| MCL | Mighty Craft Ltd | 0.005 | 25 | 1,377,243 | $1,475,637.08 |

| TTI | Traffic Technologies | 0.005 | 25 | 488,361 | $3,891,540.75 |

Killi Resources (ASX:KLI) was killin’ it on Tuesday morning, sailing high and tight on news of assays from surface rock chip sampling which returned high-grade gold and copper results at the Kaa target, within the 100% owned Mt Rawdon West Project in Queensland.

Killi is reporting one very high-grade sample which came back from the lab at 238g/t Au, 2.1% Cu & 513g/t Ag, which the company says it believes is representative of the surface outcrop of a mineralised structure.

Powerhouse Ventures (ASX:PVL) says it has formed a syndicate of investors to establish and co-sponsor a new natural capital platform in the Australian carbon market.

The company says the terms were structured and arranged by PVL which is leading an experienced consortium including a boutique natural capital investment and advisory firm as well as a globally experienced, Singapore-based commodities trading house. PVL says it's executed binding documentation for a $500,000 share subscription into the new company, currently called Australian Carbon Credit Investments, with these foundational acquisitions in Australia’s Carbon Project Economy (CPE).

Base and precious metals exploration company Lykos Metals (ASX:LYK) was up on news that the National Assembly of Republic of Srpska has voted to adopt an updated Law on Geological Exploration, which opens the door for the company to immediately seek the re-award of the Sockovac license, as well as size expansion from its previous 17km2 to 50km2 area.

And Solis Minerals (ASX:SLM) was rising on Tuesday after surface grab samples from the Cinto project came back from the lab sporting assays up to 7.14% Cu with mineralisation mapped over a 200m x 100m area in historical workings associated with significant alteration and structural deformation.

The company has signed an access agreement with local Carumbraya community at the Cinto project and initiated systematic mapping and sampling of outcropping copper mineralisation.

ASX SMALL CAP LAGGARDS

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CLZ | Classic Min Ltd | 0.001 | -50 | 25,178,133 | $1,616,730 |

| 1TT | Thrive Tribe Tech | 0.002 | -33 | 65,559,752 | $1,411,865 |

| EEL | Enrg Elements Ltd | 0.002 | -33 | 12,721,775 | $3,029,895 |

| LPD | Lepidico Ltd | 0.002 | -33 | 1,066,413 | $25,767,358 |

| PRX | Prodigy Gold NL | 0.002 | -33 | 20,000 | $6,353,323 |

| AAU | Antilles Gold Ltd | 0.003 | -25 | 71,356 | $3,986,140 |

| CUL | Cullen Resources | 0.006 | -25 | 183,639 | $4,561,386 |

| EXL | Elixinol Wellness | 0.003 | -25 | 3,563 | $5,284,729 |

| IBG | Ironbark Zinc Ltd | 0.003 | -25 | 170,000 | $6,770,290 |

| LNR | Lanthanein Resources | 0.003 | -25 | 5,613,805 | $9,774,545 |

| ODE | Odessa Minerals Ltd | 0.003 | -25 | 425,888 | $4,173,130 |

| ENV | Enova Mining Limited | 0.010 | -23 | 13,517,344 | $12,453,082 |

| AL3 | Aml3D | 0.145 | -22 | 21,997,203 | $69,763,321 |

| ALR | Altairminerals | 0.004 | -20 | 1,050,104 | $21,482,888 |

| AMD | Arrow Minerals | 0.002 | -20 | 24,207,267 | $26,348,413 |

| HLX | Helix Resources | 0.002 | -20 | 1,641,209 | $8,160,484 |

| SGC | Sacgasco Ltd | 0.004 | -20 | 9,899 | $4,483,201 |

| VMM | Viridismining | 0.875 | -17 | 1,700,823 | $67,437,675 |

| ASR | Asra Minerals Ltd | 0.005 | -17 | 10,446,501 | $12,216,476 |

| FBM | Future Battery | 0.032 | -16.0 | 997,050 | $25,166,485 |

TRADING HALTS

Quickstep Holdings (ASX:QHL) – pending a response by the Company in relation to an ASX query regarding recent share price and volume movements.

Agrimin (ASX:AMN) – pending a) a response by the Company in relation to an ASX query regarding recent share price and volume movements; and b) the release of an announcement to the market in relation to flotation test work results for the Mackay Potash Project.

Global Lithium Resources (ASX:GL1) – pending an announcement to the market regarding Board changes.

DigitalX (ASX:DCC) – pending release of an announcement in relation to the Federal Court of Australia’s decision on the Company’s summary judgement application relating to the matter between the Company and former Director, Mr Alex Karis.

Macarthur Minerals (ASX:MIO) ) – pending the release of the the release of capital raising announcement.

Perpetual Credit Income Trust (ASX:PCI) – pending an announcement in relation to a proposed capital raising to be undertaken by the Trust.

ICYMI – PM EDITION

Eagle Mountain’s (ASX:EM2) new seismic data has helped define large, copper porphyry-style targets at its Silver Mountain project in Arizona that appear to align with major porphyry deposits in the state.

Reverse circulation drilling at Future Battery Minerals’ (ASX:FBM) Kangaroo Hills lithium asset has extended the thick Big Red pegmatite by a further 200m after returning assays of up to 27m grading 1.04% Li2O from 118m.

Moab Minerals (ASX:MOM) has finalised an 81.85% acquisition of shares in Linx Resources, bringing its total ownership to 89.6% as it looks to capitalise on uranium’s strong market fundamentals. Linx owns 80% of the Manyoni and Octavo uranium projects in Tanzania.

Neurotech (ASX:NTI) has filed for orphan drug designation with the US Food and Drug Administration for its oral cannabinoid drug NTI164 in treating PANDAS/PANS, a rare paediatric disease.

Orthocell (ASX:OCC) has posted record quarterly revenue of $1.84m for the June 2024 quarter – up 14.4% on the previous quarter – due to a huge uptick in demand for its regenerative medicines. Its current sales growth trajectory is also expected to smash revenue records with FY2024 projected at $6.72m.

Spartan Resources (ASX:SPR) has unlocked more high-grade gold from its growing Dalgaranga gold project in WA ahead of an imminent resource update after drilling returned high-grade intersections of up to 10.14m at 11.26g/t gold and 9.07m at 17.81g/t gold.

Torque Metals (ASX:TOR) will pay Topdrill 50% of drill costs for its upcoming drill campaign at the Paris gold project in shares to a cap of $1m. The drilling is aimed at increasing the amount of shallow, high-quality gold ounces.

Toubani Resources (ASX:TRE) has welcomed the Mali Government’s adoption of the 2023 Mining Code, saying that it is a vital step towards reopening the country’s mining sector by returning it to regulatory stability.

At Stockhead, we tell it like it is. While Eagle Mountain, Future Battery Metals, Moan Minerals, Neurotech, Orthocell, Spartan Resources, Torque Metals and Toubani Resources are Stockhead advertisers, they did not sponsor this article.

Originally published as Closing Bell: The benchmark strikes back as Telstra leads broad based gains