Closing Bell: Tech stocks rally, AZ9 leads small caps with 70pc gain, but Paladin plummets

The ASX closed higher on gains in tech stocks, with Fortescue rising while Paladin Energy plummeted following acquisition warning.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX closes slightly higher on the heels of slow-mo tech gains

Fortescue rises on higher iron ore prices

Paladin energy plummets after acquisition warning

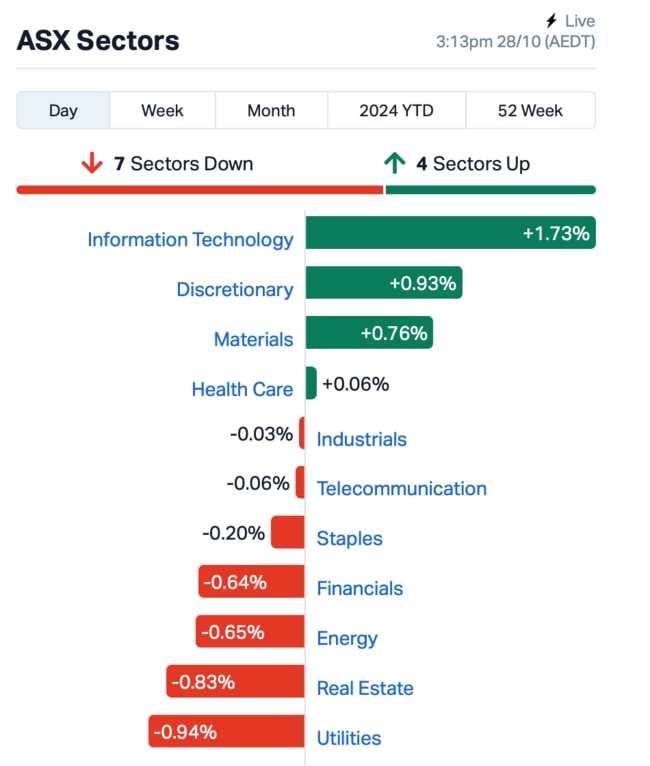

Aussie shares slid to a muted close of +0.12% on Monday after opening in positive territory, then dipping as the day wore on. Tech stocks led, offsetting falls in energy and utilities.

Large cap miners were mostly up as Fortescue (ASX:FMG) jumped 2.5% after iron ore prices in China opened 3% higher.

Mineral Resources (ASX:MIN) ’s shares, which were under pressure throughout last week, bounced back 1.5% after investors showed support for the board’s probe into founder and CEO, Chris Ellison. The company is now preparing to reveal findings from its investigation into alleged tax evasion linked to Ellison.

The other troubled stock last week, WiseTech Global (ASX:WTC) also bounced back 1.5% after a rough week marked by its CEO's resignation.

In financials, Big banks took a hit, with Australia and New Zealand Banking Group (ASX:ANZ) down 1% after announcing a $196 million accounting charge tied to its Suncorp buy. But buy now, pay later (BNPL) company Zip Co (ASX:ZIP) surged almost 5%.

The biggest large cap laggard today was Paladin Energy (ASX:PDN) , which plunged 15% after warning that its $1.5 billion buyout of Fission Uranium might not clear Canadian regulators anytime soon.

Meanwhile, online furniture and homewares retailer, Temple & Webster (ASX:TPW), has reported a slowdown in sales momentum this half, but it's holding firm on its margin guidance for the full financial year. Shares were down 2.5%.

Elsewhere...

The yen dropped today after Japan's ruling coalition lost its parliamentary majority, raising concerns about how this political uncertainty might affect Bank of Japan's interest rate policies.

The currency fell by about 1%, but it helped boost the Topix index by 2%.

Japan's ongoing low interest rates compared to the US have been a major factor in the yen's decline, but experts believe it's unlikely the BoJ will change its rate policy anytime soon.

Meanwhile, Chinese shares dipped after industrial profits data for September fell sharply, highlighting the struggle the economy is facing.

In the oil market, crude prices fell after Iran reported that its oil industry was unaffected by recent Israeli strikes on military targets.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AZ9 | Asian Battery Metals | 0.080 | 70% | 69,036,875 | $14,204,104 |

| LIS | Lisenergylimited | 0.190 | 58% | 3,880,835 | $76,824,028 |

| DTR | Dateline Resources | 0.005 | 50% | 12,845,245 | $7,548,781 |

| VR1 | Vection Technologies | 0.020 | 43% | 25,529,738 | $18,572,246 |

| PPG | Pro-Pac Packaging | 0.034 | 36% | 1,387,038 | $4,542,193 |

| ERL | Empire Resources | 0.004 | 33% | 380,037 | $4,451,740 |

| LNU | Linius Tech Limited | 0.002 | 33% | 100,000 | $8,797,861 |

| PKO | Peako Limited | 0.004 | 33% | 125,000 | $2,635,425 |

| RNE | Renu Energy Ltd | 0.002 | 33% | 629,120 | $1,332,868 |

| PPK | PPK Group Limited | 0.500 | 30% | 397,315 | $34,962,812 |

| CCZ | Castillo Copper Ltd | 0.009 | 29% | 1,368,420 | $9,096,537 |

| AVE | Avecho Biotech Ltd | 0.003 | 25% | 580,280 | $6,338,594 |

| PUA | Peak Minerals Ltd | 0.005 | 25% | 5,124,910 | $9,988,441 |

| RLG | Roolife Group Ltd | 0.005 | 25% | 10,641,734 | $4,707,985 |

| TMK | TMK Energy Limited | 0.003 | 25% | 1,114,917 | $15,183,224 |

| TTI | Traffic Technologies | 0.005 | 25% | 1,867,996 | $4,475,272 |

| AUQ | Alara Resources Ltd | 0.042 | 24% | 501,405 | $24,414,976 |

| IBX | Imagion Biosys Ltd | 0.060 | 22% | 634,898 | $2,008,662 |

| FRX | Flexiroam Limited | 0.011 | 22% | 597,820 | $7,070,794 |

| UCM | Uscom Limited | 0.022 | 22% | 85,659 | $4,508,586 |

| SPD | Southernpalladium | 0.665 | 21% | 431,123 | $49,362,500 |

| JBY | James Bay Minerals | 0.720 | 20% | 634,142 | $20,065,500 |

| CZN | Corazon Ltd | 0.006 | 20% | 4,690,552 | $3,339,528 |

Asian Battery Metals (ASX:AZ9) has annunnced the remaining assay data from the Phase 1 diamond drilling program at the 100% Oval Cu-Ni-PGE prospect, located in the Gobi-Altai region of Mongolia, including a highlight sulphide intercept in hole OVD021 of 8.8m @ 6.08% Cu, 3.19% Ni, 1.63g/t E31, 0.11% Co (CuEq2 12.57%) from 107.2m. The find is located within 800m of strike which remains open at depth and in the SE, NW, NE and SW directions.

Li-S Energy (ASX:LIS) was rising on news that it has substantially improved the performance of its lithium sulphur battery technology. The company says that it has been able to manufacture full size 10Ah semi-solid-state cells delivering an energy density of 498Wh/kg on first discharge, and an industry leading 456Wh/kg after formation cycling, with the cells continuing to cycle in ongoing testing.

RooLife Group (ASX:RLG) was up after announing that the global expansion of its RLG marketplace has delivered $270,000 in new sales achieved in October to date. The recent expansion included three new online stores launched this month in Australia, China and Hong Kong, with the new Indian RLG Marketplace on schedule for launch in November.

Imagion Biosystems (ASX:IBX) delivered a quarterly this morning that has investors pretty excited, mainly focussed on a licensing agreement with Aussie company Biosensis to produce and sell Imagion’s PrecisionMRX nanoparticles, specifically for the biomedical research markets.

The company also revealed that it has managed to attract significant investment, and expects to successfully complete a $3 million capital raise in early December, through a two-tranche share placement that it has previously announced received firm commitments.

Next Science (ASX:NXS) was up on news of the publication of a study which found the company’s XPERIENCE product to be efficacious in preventing periprosthetic joint infection (PJI) in patients undergoing primary total knee (TKA) and hip (THA) arthroplasties, aka joint replacements.

According to the study, the overall rate of Surgical Site Infection (SSI) of the 471-patient cohort was zero percent (0/471) compared to a 0.5% infection rate among the control group (4/824) who were treated with a povidone-iodine (Betadine) solution soak in a standardised protocol.

Prodigy Gold (ASX:PRX) has been trending higher for the past couple of weeks now following high-grade drill hits at the Hyperion gold deposit, part of the Tanami North project in the NT. A stand-out strike of 10m at 15.9g/t gold has created a buzz among investors ahead of a planned resource upgrade and further drilling planned for the 2025 field season.

This comes as bullion, considered a hedge against geopolitical and economic uncertainties, reaches a new record of ~$4000/oz on the back of US election uncertainties and conflict in the Middle East.

Hyperion is in the highly prospective but under-explored area situated between the 1.1Moz Groundrush gold deposit and the 94,000oz Crusade gold deposit, both of which form part of the neighbouring Northern Star Resources (ASX:NST)/Tanami Gold NL (ASX:TAM) Central Tanami project. PRX’s exploration team is awaiting results for the Tregony North, Brokenwood and Pandora drilling that was completed subsequent to drilling at Hyperion.

Empire Resources (ASX:ERL) has completed an aircore drilling program at the Yuinmery Copper-Gold Project, totaling 31 holes and 1,488 meters. The drilling targeted four areas, focusing on three copper-gold sites and one gold-only site, aiming to confirm and extend previously identified mineralisation. Samples have been sent to a certified lab in Perth, with assay results expected in about four weeks. The Yuinmery project is located 470 km northeast of Perth, within the Archaean Youanmi greenstone belt, which hosts significant copper-gold deposits.

Castillo Copper (ASX:CCZ) has secured the necessary steps to acquire 85% of the Harts Range Project, located 120km northeast of Alice Springs. Historical samples indicate promising grades of niobium, uranium, and heavy rare earth elements. Following a recent field trip, CCZ plans exploration at the Cusp Prospect, including surface sampling and geophysical surveys.

Additionally, CCZ has expanded its exploration area by 25% with the Harts Range East Project application. The company is also advancing its NWQ Copper Project strategy and planning to divest its BHA West and Mkushi projects.

James Bay Minerals (ASX:JBY) has wrapped up its 2024 summer field program which targeted high priority areas of the La Grande lithium projects, identified from previous aerial surveys and desktop studies. The company said data generated from this program has enhanced the team’s understanding of the key geological features and will be used to guide upcoming field work.

Overall, a total of 193 samples were taken across the project, including rock chips and channel samples at key LCT pegmatite, rare earths and uranium targets which were generated from LiDAR, high-resolution photography, aeromagnetic and spectro magnetic surveys.

Alara Resources (ASX:AUQ) has improved copper output at its Wash-Hi Majaza plant in Oman, with the sixth shipment ready for dispatch. In the latest two-week cycle, it produced 186 tons of copper and 5 kg of gold, up from 124 tons in the previous four-week cycle.

Improvements in production came from optimizing processes and using higher-grade ore. The shipment is set to leave Sohar Port for China on October 29. While focusing on the copper-gold mine, AUQ is also exploring other projects in Oman.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VPR | Volt Group | 0.001 | -50% | 348,794 | $21,432,416 |

| BYH | Bryah Resources Ltd | 0.003 | -40% | 955,636 | $2,516,434 |

| EQN | Equinoxresources | 0.135 | -36% | 2,000,102 | $26,008,501 |

| ADD | Adavale Resource Ltd | 0.002 | -33% | 19,740 | $3,671,296 |

| BP8 | Bph Global Ltd | 0.002 | -33% | 10,531 | $1,189,924 |

| EEL | Enrg Elements Ltd | 0.002 | -33% | 1,417,000 | $3,135,048 |

| FAU | First Au Ltd | 0.001 | -33% | 266,667 | $2,717,990 |

| AMD | Arrow Minerals | 0.002 | -25% | 9,254,315 | $26,047,256 |

| BNL | Blue Star Helium Ltd | 0.003 | -25% | 506,955 | $9,724,426 |

| ENT | Enterprise Metals | 0.003 | -25% | 650,000 | $4,713,269 |

| IEC | Intra Energy Corp | 0.002 | -25% | 3,911,041 | $3,381,563 |

| LNR | Lanthanein Resources | 0.003 | -25% | 284,071 | $9,774,545 |

| MHC | Manhattan Corp Ltd | 0.002 | -25% | 1,150,000 | $8,995,940 |

| PAB | Patrys Limited | 0.003 | -25% | 450,000 | $8,229,789 |

| RIE | Riedel Resources Ltd | 0.002 | -25% | 994,482 | $4,447,671 |

| SKN | Skin Elements Ltd | 0.003 | -25% | 714,000 | $2,357,944 |

| SLZ | Sultan Resources Ltd | 0.009 | -25% | 714,118 | $2,371,038 |

| NNL | Nordicnickellimited | 0.095 | -24% | 3,225 | $18,244,439 |

| EWC | Energy World Corpor. | 0.020 | -23% | 1,348,916 | $80,051,952 |

| OSL | Oncosil Medical | 0.010 | -23% | 36,236,330 | $49,193,042 |

| 88E | 88 Energy Ltd | 0.002 | -20% | 1,581,355 | $72,334,530 |

IN CASE YOU MISSED IT

Codeifai (ASX:CDE) ConnectQR subscriber base has grown to near 1000 since the commercial launch in April. This represents a recent month-on-month growth of around 60% with 31% of the new subscribers coming through the recent Canva integration.

CuFe (ASX:CUF) has formed a strategic alliance with Emmerson Minerals and Tennant Mineralsto jointly pursue copper, gold and critical metals development opportunities in the Tennant Creek Region of the Northern Territory.

Trigg Minerals’ (ASX:TMG) drilling has uncovered a new epithermal system at the SW Limey prospect within its Old Glenroy gold project. Vectoring of the alteration intensity between two holes suggests that system intensifies to the northeast.

Asra Minerals (ASX:ASR) has revealed that it is a successful applicant for Round 30 of the Exploration Incentive Scheme (EIS) Co-Funded Drilling Program, and has been offered up to $150,000 to go towards exploration at its 100% owned Yttria Rare Earth Element (REE) project located in Leonora, Western Australia. The EIS is a state government sponsored program designed to foster exploration throughout the state, for the long-term sustainability of the State’s resources sector and the demand for critical minerals on the transition to a net-zero energy system.

Golden Mile Resources (ASX:G88) has announced it has received commitments to raise $480,250 (before costs) from institutional and sophisticated investors, through the issue of 48,025,000 new, fully paid ordinary shares at an issue price of $0.010, subject to shareholder approval. Funds raised will be used to fund additional exploration works including geochemistry, detailed geological mapping, geophysics and drilling at the company’s Pearl copper project, located in Arizona and for general working capital purposes.

Legacy Minerals (ASX:LGM) has delivered a drilling update from its Glenlogan Project, as completed by earn-in partner S2 Resources.

The company says that the main magnetic anomaly targeted is an alkaline gabbroic diorite, intruded by later quartz diorite porphyry (QDP) dykes that increase in abundance downhole, with the final 300 metres of the hole containing increasing QDP dykes, hydrothermal alteration and disseminated pyrite and increasingly anomalous levels of copper, gold and other chalcophile/pathfinder elements.

Per the earn-in agreement, S2 Resources can spend $6 million over 5 years to earn a 70% interest in EL9614 in two stages:

- Stage 1 – $2 million over 2 years to earn a 51% interest; and

- Stage 2 – $4 million over 3 years to earn a further 19% interest.

Norwest Minerals (ASX:NWM) has announced the completion of mapping and rock chip sampling at its Marymia East project, where it straddles the E52/2394 and E52/2395 tenement boundary.

The company says that a number of the multi-element assay results for the 115 rock chips collected return anomalous copper & zinc values, allowing Norwest to plan aircore drilling to test for base metal mineralisation (copper and zinc) at two sites in the southern portion of the BGB. The drill testing includes 21 holes totalling 1,050 metres across two drill lines at 50m hole spacing, and is due to begin in early 2025, following Heritage Study work.

QX Resources (ASX:QXR) has received firm commitments to raise $1,000,000 (before costs) through a two-tranche share placement to new and existing sophisticated and professional investors, through the issue of 200 million shares at $0.005 per share, a 16% discount to to the company’s last closing price of $0.006 and a 16% discount to the 15-day VWAP. Funds raised will be sed towards progressing the Company’s Queensland gold projects, Western Australian iron ore and hard rock lithium projects, for working capital purposes, and to identify and assess new complimentary project opportunities.

Raiden Resources (ASX:RDN) is getting ready to fire up the drills, after approvals were granted for exploration work on the Mt Sholl Cu-Ni-PGE project ]in the Pilbara, Western Australia.

The planned drilling, consisting of a minimum of 3,000 metres of Reverse Circulation drilling, is designed to test new targets defined by First Quantum Minerals, as well as direct extensions of the mineral resource previously defined by Raiden. The program will be managed and financed by First Quantum Minerals under the MOU in place relating to the Mt Sholl project.

Riversgold (ASX:RGL) has completed a site visit at the Saint John high-grade copper, gold, antimony, and silver project, located in New Brunswick, Canada, immediately to the west of the city of Saint John and only 50km east of the US border.

Geologists took 64 rock chip samples to validate previous sampling sites with reported grades up to 17.6% copper, 70.4 g/t gold, 10.8% antimony, and 1,500 g/t silver, as well as expand sampling into new areas not previously sampled.

TRADING HALTS

Siren Gold (ASX:SNG) – pending a shareholder meeting to vote on a resolution to approve the proposed sale of the Company’s shares in Reefton Resources to Rua Gold.

Panther Metals (ASX:PNT) – pending the release of an announcement to the market regarding exploration results.

OD6 Metals (ASX:OD6) – pending an announcement regarding a material acquisition.

RocketDNA (ASX:RKT) – pending an announcement regarding a capital raising.

Otto Energy (ASX:OEL) – pending an announcement regarding the drilling and casing results of the F5-ST Bypass Well at SM 71.

Gold Hydrogen (ASX:GHY) – pending the release of an announcement regarding material exploration results from its South Australian Ramsay project.

Good Drinks Australia (ASX:GDA) – pending the release of an announcement by the company in respect to its application to be removed from the official list of the ASX.

Black Dragon Gold (ASX:BDG) – pending an announcement concerning a capital raising.

Thor Energy (ASX:THR) – pending release of an announcement by the Company in relation to the potential acquisition.

Aurumin (ASX:AUN) – pending an announcement in relation to commercial discussions with respect to a potential joint venture relating to the Sandstone Project.

Tryptamine Therapeutics (ASX:TYP) – pending an announcement in relation to a capital raising.

St George Mining (ASX:SGQ) – pending an announcement in relation to the funding of the Araxa project.

Bowen Coking Coal (ASX:BCB) – pending an announcement concerning the outcome of a shortfall bookbuild involved in its capital raising, recognising the capital raising is critical to the company’s continued financial viability.

Aurora Labs (ASX:A3D) – pending an announcement regarding a proposed capital raising.

At Stockhead, we tell it like it is. While Asra Minerals, Codeifai, CuFe, Golden Mile Resources, Legacy Minerals, Norwest Minerals, Raiden Resources, Riversgold and Trigg Minerals are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Tech stocks rally, AZ9 leads small caps with 70pc gain, but Paladin plummets