Closing Bell: Banks, Woodside weigh on ASX; but Jack Ma’s return sparks Chinese tech rally

Banks were down on Monday, while the Star soared, and Jack Ma’s return has fuelled a tech rally in China.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Banks drag as Bendigo, Westpac slump

Star Entertainment Group jumps on $650m refinancing

Jack Ma’s return sparks tech rally in China

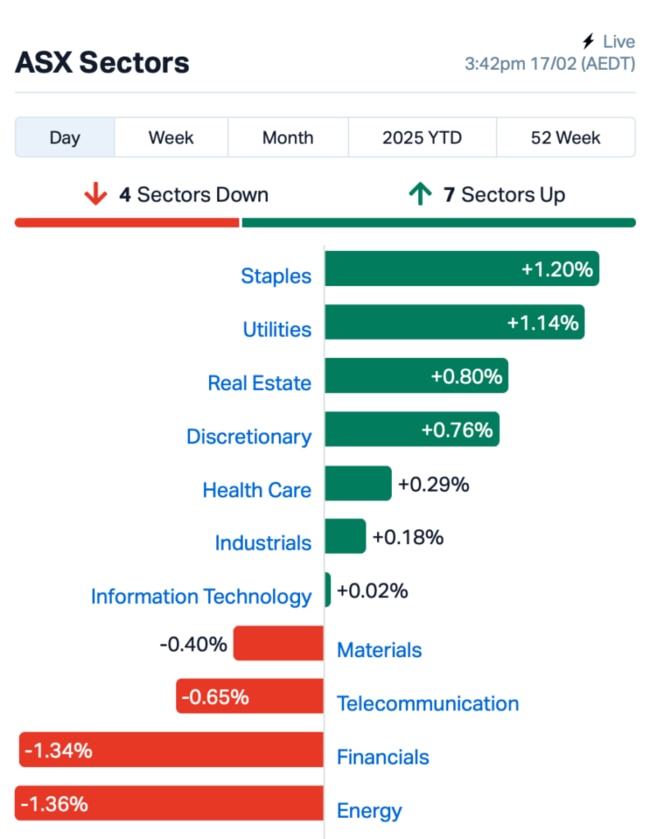

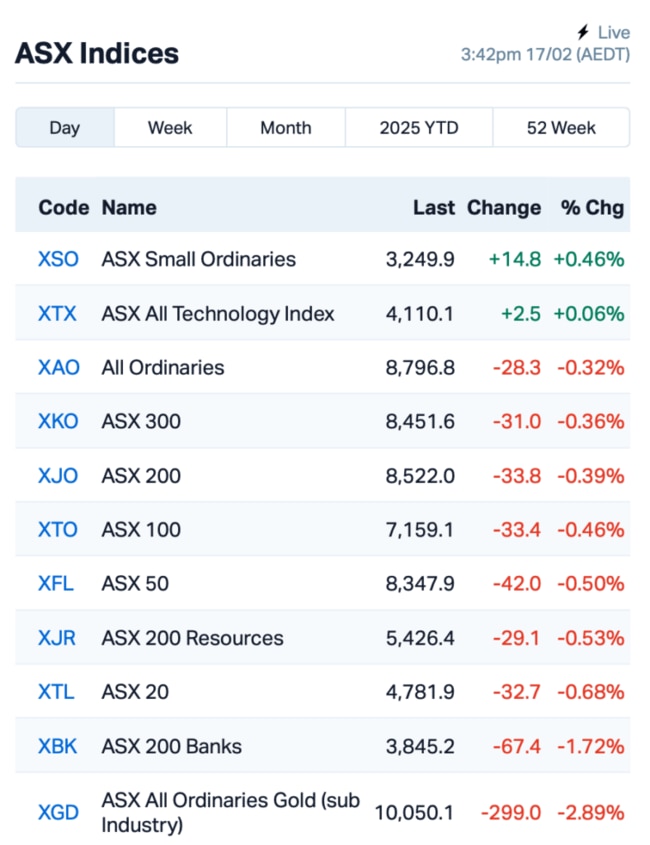

The ASX retreated by about 0.37% from Friday’s record high, with banks pulling the market down on Monday.

Bendigo and Adelaide Bank (ASX:BEN) was hit hardest, plummeting 16% after net profit for the first half of FY25 came in almost 10% lower compared to the previous six months.

But the main reason for the share price dip was the drop in BEN’s net interest margin (NIM), which shrank by six basis points to 1.88% due to rising deposit costs.

Westpac’s (ASX:WBC) shares also dropped 4% after a Q1 update showed weaker-than-expected results. Net interest income dropped 6%, while its NIM was slashed by 2 bp to 1.81%.

Insurers were also sold off today as election fears stirred up uncertainty, with Insurance Australia (ASX:IAG) falling by 3.5%.

Opposition leader Peter Dutton has been floating the idea of breaking up big insurance companies if the Coalition wins the election this May, claiming that insurers are ripping off Aussies with high premiums.

His plan is to bring more competition to the market, much like the government has threatened to do with supermarkets.

Over in the casino world, Star Entertainment Group (ASX:SGR) jumped 12.5% after it received a debt-refinancing proposal from Oaktree Capital Management, offering $650 million in debt facilities.

The proposal could help the struggling casino tackle its urgent liquidity issues, but it’s all still up in the air and depends on getting approvals from the government and regulators.

Meanwhile, Woodside Energy Group (ASX:WDS) shares slid almost 3%, weighing on the energy sector, despite the company reporting a solid resource base.

Woodside announced today that its proved reserves grew by 54.9 million barrels of oil equivalent (MMboe), and proved plus probable reserves increased by 46.2 MMboe, thanks to strong performance at its Sangomar project.

Elsewhere, gold posted its largest drop since December, weighing on gold stocks as investors questioned whether the recent rally had been overdone. The spot bullion price is currently trading at US$2,904/oz after slipping below US$2,900 earlier in the day.

This is where things stood leading up to today’s close:

Meanwhile in Asia, tech stocks in Hong Kong, China and South Korea rallied today as AI optimism spreads.

News has been circulating that Xi Jinping is set to chair a big symposium this week with top Chinese tech leaders including Alibaba's Jack Ma, who’s been out of the spotlight for a while.

Xi is expected to push for these tech giants to expand internationally amid the ongoing tech war with the US.

“The DeepSeek event has acted as a catalyst, boosting sentiment around Chinese equities. Despite recent performance, the market remains attractively valued," said Sandy Pei at Federated Hermes.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.002 | 100% | 8,252,577 | $4,109,881 |

| FAU | First Au Ltd | 0.003 | 50% | 28,144,425 | $4,143,987 |

| GGE | Grand Gulf Energy | 0.002 | 33% | 12,771,028 | $3,675,581 |

| PFT | Pure Foods Tas Ltd | 0.02 | 33% | 764,651 | $2,031,384 |

| DY6 | Dy6Metalsltd | 0.05 | 32% | 285,120 | $1,915,612 |

| NNL | Nordicresourcesltd | 0.067 | 31% | 383,934 | $7,516,576 |

| CDX | Cardiex Limited | 0.15 | 30% | 495,950 | $46,601,512 |

| AD8 | Audinate Group Ltd | 9.73 | 28% | 1,511,625 | $631,732,466 |

| GRV | Greenvale Energy Ltd | 0.055 | 28% | 1,910,091 | $20,935,553 |

| THR | Thor Energy PLC | 0.014 | 27% | 4,330,641 | $2,951,194 |

| CRR | Critical Resources | 0.005 | 25% | 838,624 | $9,727,853 |

| ICE | Icetana Limited | 0.02 | 25% | 50,832 | $4,234,055 |

| CHN | Chalice Mining Ltd | 1.4775 | 23% | 15,496,054 | $466,832,146 |

| E79 | E79Goldmineslimited | 0.05 | 22% | 11,320,931 | $4,188,668 |

| AMS | Atomos | 0.006 | 20% | 17,124,265 | $6,075,092 |

| CCO | The Calmer Co Int | 0.006 | 20% | 507,410 | $12,709,459 |

| GMN | Gold Mountain Ltd | 0.003 | 20% | 100,000 | $11,448,058 |

| TYX | Tyranna Res Ltd | 0.006 | 20% | 3,559,972 | $16,439,627 |

| NMR | Native Mineral Res | 0.08 | 19% | 2,724,431 | $39,407,834 |

| NUZ | Neurizon Therapeutic | 0.155 | 19% | 1,327,503 | $63,999,750 |

| A2M | The A2 Milk Company | 7.08 | 19% | 11,552,467 | $4,307,913,752 |

| FMR | FMR Resources Ltd | 0.19 | 19% | 179,038 | $3,386,452 |

| SRI | Sipa Resources Ltd | 0.013 | 18% | 1,751,358 | $4,580,382 |

| 1AE | Auroraenergymetals | 0.053 | 18% | 110,995 | $8,057,868 |

| BOC | Bougainville Copper | 0.415 | 17% | 127,223 | $142,377,188 |

Eden Innovations (ASX:EDE) has scored a second order from Holcim Ecuador worth about $353,266 for EdenCrete Pz7, set for use across multiple concrete plants. This comes after an initial order back in May 2024, bringing the total from Holcim Ecuador to around $473,666. Holcim, a global cement giant, has been trialling EdenCrete Pz7 in places like the US, UK, Canada, and Ecuador, with ongoing trials in Canada and the UK showing promise.

Audio tech company Audinate’s (ASX:AD8) 1H25 results came in above market expectations, with moderate growth expected in 2H25. Key highlights include a gross profit of US$16 million (down 29% from 1H24), but a strong gross margin of 82%, thanks to a shift toward higher-margin software. Despite a dip in EBITDA and cash flow, the company said it remains in a solid financial position with $111 million in cash.

Thor Energy has wrapped up the acquisition of 80.2% of Go Exploration, an Aussie company focused on natural hydrogen and helium. Go Exploration holds one of the few hydrogen and helium exploration licences in South Australia, near some big discoveries. This move fits with Thor's strategy to push into clean energy, and the company’s now well-positioned to take advantage of the growing hydrogen and helium market.

Chalice Mining (ASX:CHN) said it has made a major breakthrough at Gonneville, producing saleable copper and nickel concentrates without the need for expensive hydrometallurgical processes. This simplifies operations, cuts costs, and reduces risks. The project’s margins are expected to improve significantly with new optimisations, and the Pre-Feasibility Study (PFS) is set for mid-2025.

IperionX (ASX:IPX), a US-based metals producer which specialises in advanced titanium and rare earth materials, has just scored a $74.1 million deal with the US Department of Defence. This partnership is part of a two-phase, two-year project to enhance the US’s industrial base by strengthening the domestic supply of titanium. IperionX said the cash will fund a two-year project to ramp up US titanium production, boosting both national security and economic strength.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FBR | FBR Ltd | 0.024 | -35% | 107,666,228 | $187,214,774 |

| ASR | Asra Minerals Ltd | 0.002 | -33% | 515 | $6,937,890 |

| MOM | Moab Minerals Ltd | 0.0015 | -25% | 92,504 | $3,133,999 |

| MRQ | MRG Metals Limited | 0.003 | -25% | 714,245 | $10,906,075 |

| RDN | Raiden Resources Ltd | 0.006 | -25% | 18,651,429 | $27,607,132 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 164,569 | $9,673,198 |

| WR1 | Winsome Resources | 0.325 | -24% | 3,301,696 | $94,301,411 |

| OVT | Ovanti Limited | 0.0115 | -23% | 176,041,764 | $34,973,218 |

| FRS | Forrestaniaresources | 0.02 | -23% | 5,044,095 | $6,343,050 |

| WEC | White Energy Company | 0.028 | -22% | 3,100 | $7,163,434 |

| YOW | Yowie Group | 0.014 | -22% | 90,230 | $4,128,622 |

| MSG | Mcs Services Limited | 0.004 | -20% | 220,000 | $990,498 |

| PRM | Prominence Energy | 0.004 | -20% | 519,300 | $1,945,882 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 7,687,500 | $7,105,156 |

| ALR | Altairminerals | 0.0025 | -17% | 711,442 | $12,890,233 |

| BNL | Blue Star Helium Ltd | 0.005 | -17% | 438,179 | $16,169,312 |

| CDT | Castle Minerals | 0.0025 | -17% | 18,279,881 | $5,690,442 |

| ERA | Energy Resources | 0.0025 | -17% | 2,589,378 | $1,216,188,722 |

| LML | Lincoln Minerals | 0.005 | -17% | 767,498 | $12,337,557 |

| ROG | Red Sky Energy. | 0.005 | -17% | 40,972 | $32,533,363 |

| BEN | Bendigo and Adelaide | 11.28 | -16% | 5,913,655 | $7,622,211,993 |

| WSR | Westar Resources | 0.011 | -15% | 844,548 | $5,183,423 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 8,975,024 | $22,185,079 |

| HLX | Helix Resources | 0.003 | -14% | 111,045 | $11,774,678 |

| MGU | Magnum Mining & Exp | 0.006 | -14% | 959,924 | $5,665,530 |

IN CASE YOU MISSED IT

Through testing, Green Critical Minerals' (ASX:GCM) VHD graphite has shown breakthrough thermal diffusivity, outperforming aluminium, graphite, and copper, making it a superior material for high-performance cooling applications. The company is now designing heat sinks for AI data centres, aiming for commercialisation by 2025.

Trigg Minerals (ASX:TMG)has received NSW government approval for the licence transfer of its high-grade Wild Cattle Creek antimony deposit, allowing it to move forward with access and exploration applications. It comes as the company’s been busy expanding its antimony portfolio, strengthening its cash position, and enhancing its leadership team in recent months.

Recce Pharmaceuticals (ASX:RCE) has delivered strong phase II clinical trial results for its RECCE 327 topical gel, achieving a 93% primary efficacy endpoint in treating acute bacterial skin and skin structure infections, including diabetic foot infections. The results set the stage for the company’s registrational phase 3 trial in Indonesia.

Rock chip sampling at Perpetual Resources’ (ASX:PEC) Itinga project in Brazil’s Jequitinhonha Valley has returned high-grade tin, tantalum, niobium, and titanium, with multiple assays exceeding detection limits. Perpetual believes the results underscore the opportunity to advance additional commodities alongside the company's lithium projects.

Northern Territory gold explorer Prodigy Gold (ASX:PRX) has outlined to the market today its plans for the 2025 field season. Notably, the company will drill at its Hyperion deposit to test the down-dip extension of previously reported mineralisation – which measured at 10m at 15.9g/t gold from 177m.

Other catalysts for the company include surface sampling near Hyperion, metallurgical samples on 2024 drill samples from Hyperion and assessing a potential near-term mining opportunity at the historical Old Pirate mine.

White Cliff Minerals (ASX:WCN) is locked and loaded to drill at its Rae copper project in Nunavut after tapping Northspan Explorations to undertake the work. Northspan holds under its belt more than 40 years of experience drilling in Northern Canada, including at projects near Rae. The maiden campaign at Rae will burrow roughly 4000m at the Hulk Sedimentary target and Danvers project area.

The market has a new kind of hunger for gold projects in Western Australia’s Pilbara region, and Raiden Resources (ASX:RDN) is hot on the tail of chasing a discovery. The company completed 79 aircore drill holes in November at its Arrow gold project – spanning more than 3000m.

Raiden shared with the market that today several gold in soil trends correlate with elevated gold anomalism from November’s drilling. Follow up work is now being planned by the company’s JV partner, Mallina Co.

Legacy Minerals’ (ASX:LGM) sights are set on an untested copper-gold anomaly at its Glenlogan project in New South Wales following geophysical testing by earn-in partner, S2 Resources (ASX:S2R). LGM management believes the anomaly points towards a potential mineralised porphyry intrusion, which will be the focus of future work.

At Stockhead, we tell it like it is. While Green Critical Minerals, Trigg Minerals, Recce Pharmaceuticals, Perpetual Resources, Prodigy Gold, White Cliff Minerals, Raiden Resources and Legacy Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Banks, Woodside weigh on ASX; but Jack Ma’s return sparks Chinese tech rally