Closing Bell: ASX powers up 0.36pc as tech and energy stocks bring the juice

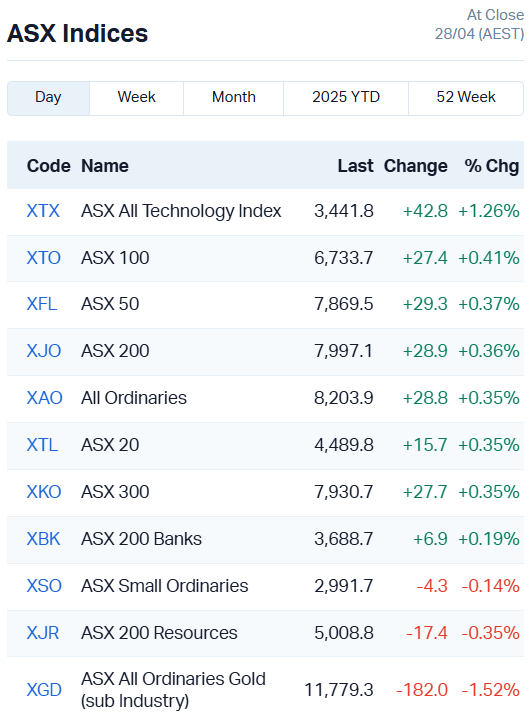

The Nasdaq’s Friday rally coupled with firming oil prices have driven tech and energy stocks higher, boosting the ASX 0.36pc.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

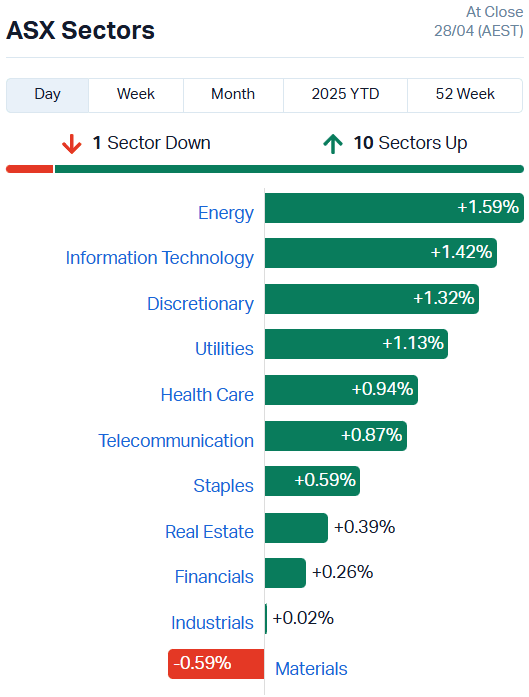

Energy and Tech sectors up about 1.5pc each

Technology index boosted 1.26pc

Materials the only laggard, down 0.59pc

While a late run of bears has taken some of the wind out of the ASX’s sails, the Aussie market is firmly in the green today, up 0.36% on the back of strong upward movements in energy and tech stocks.

After more than a week of losses, the price of oil posted a 0.5% recovery on Friday, lifting to US$66.87 per barrel of Brent crude.

While still down 1.6% for the week, the uptick offers some optimism for energy stocks, which have been some of the hardest hit in the fallout from the US-China trade war.

Big cap tech and energy movers

At the big end of town, Woodside Energy (ASX:WDS) climbed 1.55%, Santos (ASX:STO) 2.21%, Yancoal (ASX:YAL) 1.33% and Ampol (ASX:ALD) 0.89%.

Notable among mid cap movers were Paladin Energy (ASX:PDN), up 1.26%, and Karoon Energy (ASX:KAR) which posted a 1.62% gain.

The US Nasdaq – a particularly tech-heavy index – led the way up for Aussie tech stocks last week, lifting 1.3% and almost doubling the performance of the larger US S&P500.

On Aussie shores, Xero (ASX:XRO) is the standout today, gaining 2.18%. The cloud-based accounting company’s shares are sitting at about $159.9 each as of writing.

Goldman Sachs estimates that number could grow to something more like $201 per share, if Xero can expand its current subscriber base of 4 million into their estimated market of 100 million potential customers.

Technology One (ASX:TNE) is also up 2.92%, NextDC (ASX:NXT) 3.06% and Life360 (ASX:360) 1.02%.

Materials is the only sector on a bear tilt today, down 0.59% on falls in base metal and gold prices.

Looking at our indices, the banks have made some inroads, lifting the Banks index 0.17%, but the spotlight is on tech today – the All Technology soared 1.10%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap | |

|---|---|---|---|---|---|---|

| ADD | Adavale Resource Ltd | 0.0015 | 50% | 3058746 | $2,287,279 | |

| TON | Triton Min Ltd | 0.007 | 40% | 10000 | $7,841,944 | R |

| MMR | Mec Resources | 0.004 | 33% | 3755022 | $5,549,298 | |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 336599 | $7,254,899 | |

| AZL | Arizona Lithium Ltd | 0.0065 | 30% | 13037804 | $22,809,073 | |

| MBK | Metal Bank Ltd | 0.013 | 30% | 283926 | $4,974,590 | |

| INF | Infinity Lithium | 0.025 | 25% | 3311773 | $9,451,842 | R |

| EAT | Entertainment | 0.005 | 25% | 155815 | $5,235,144 | R |

| MTB | Mount Burgess Mining | 0.005 | 25% | 399400 | $1,406,811 | R |

| OSL | Oncosil Medical | 0.005 | 25% | 250000 | $18,426,321 | R |

| JLL | Jindalee Lithium Ltd | 0.32 | 23% | 279884 | $19,133,881 | R |

| TMB | Tambourahmetals | 0.032 | 23% | 25133877 | $3,057,341 | |

| PUA | Peak Minerals Ltd | 0.011 | 22% | 7339538 | $25,265,892 | |

| SMN | Structural Monitor. | 0.4 | 21% | 189539 | $50,920,666 | |

| SPN | Sparc Tech Ltd | 0.205 | 21% | 92591 | $16,298,401 | R |

| 1AI | Algorae Pharma | 0.006 | 20% | 2052422 | $8,436,974 | |

| AJL | AJ Lucas Group | 0.006 | 20% | 106673 | $6,878,648 | |

| AQX | Alice Queen Ltd | 0.006 | 20% | 2835727 | $5,734,450 | R |

| FIN | FIN Resources Ltd | 0.006 | 20% | 1600000 | $3,474,442 | |

| KLI | Killiresources | 0.048 | 20% | 238959 | $5,608,950 | |

| RDS | Redstone Resources | 0.006 | 20% | 3830655 | $4,626,892 | |

| SKN | Skin Elements Ltd | 0.003 | 20% | 505252 | $2,688,035 | |

| KNG | Kingsland Minerals | 0.125 | 19% | 47853 | $7,618,896 | |

| SP3 | Specturltd | 0.013 | 18% | 186000 | $3,389,651 | R |

| RAS | Ragusa Minerals Ltd | 0.02 | 18% | 206516 | $2,424,179 |

Making news…

Triton Minerals’ (ASX:TON) reinstatement on the bourse was welcomed warmly by investors, who drove the small cap stock up 40% after the company released its annual report for the 2024 year.

While still embroiled in a legal battle over unmet payments for the sale of its Mozambique graphite assets, Triton is keen to begin exploration at the Aucu copper-gold project in central west Mozambique.

Infinity Lithium (ASX:INF) is divesting its non-core Victorian projects in a $3.4m option agreement with Dart Mining NL, with the goal of focusing all of its resources on the flagship San Jose lithium project in Spain. INF intends to develop a fully integrated mine-to-market lithium chemical operation in the Extremadura region.

Interim metallurgical test work results from Mount Burgess Mining’s (ASX:MTB) Kihabe-Nxuu project in Botswana have boosted the stock 25% today. The company’s tests showed recoveries of up to 96% zinc, 79.4% lead, 91.1% vanadium, 59.3% gallium and 77.2% germanium.

Finally, Sparc Technologies’ (ASX:SPN) first inspection of its Ecosparc enhanced anti-corrosion coating on steel infrastructure has yielded positive results, with no signs of degradation or failure observed during the initial trial phase.

The company says this is the most critical period for identifying performance issues, and the results support commercial and specification discussions with major potential offtake partners.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HCF | H&G High Conviction | 0.35 | -54% | 140771 | $14,748,923 |

| CGO | CPT Global Limited | 0.049 | -35% | 13593 | $3,142,302 |

| AIV | Activex Limited | 0.006 | -33% | 600001 | $1,939,523 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 1505000 | $9,862,021 |

| HCD | Hydrocarbon Dynamics | 0.002 | -33% | 101006 | $3,234,328 |

| BRX | Belararox Limited | 0.091 | -33% | 4052737 | $21,130,518 |

| PEB | Pacific Edge | 0.075 | -32% | 120649 | $89,310,757 |

| PPY | Papyrus Australia | 0.009 | -31% | 653775 | $7,418,863 |

| ARV | Artemis Resources | 0.007 | -30% | 31005169 | $25,285,293 |

| 1TT | Thrive Tribe Tech | 0.0015 | -25% | 32179232 | $4,063,446 |

| EEL | Enrg Elements Ltd | 0.0015 | -25% | 1149000 | $6,507,557 |

| CMB | Cambium Bio Limited | 0.225 | -22% | 7065 | $5,301,973 |

| PLG | Pearl Gull Iron Limited | 0.007 | -22% | 11943 | $1,840,876 |

| PLN | Pioneer Lithium | 0.105 | -22% | 17995 | $5,745,827 |

| EXL | Elixinol Wellness | 0.022 | -21% | 1205311 | $6,182,964 |

| WYX | Western Yilgarn NL | 0.027 | -21% | 64564 | $4,677,077 |

| EVR | Ev Resources Ltd | 0.004 | -20% | 1194203 | $9,929,183 |

| OVT | Ovanti Limited | 0.004 | -20% | 1886063 | $13,507,739 |

| YAR | Yari Minerals Ltd | 0.004 | -20% | 1617 | $2,411,789 |

| HPC | Hydration Pharma | 0.009 | -18% | 608707 | $4,216,310 |

| HFR | Highfield Res Ltd | 0.115 | -18% | 311893 | $66,370,786 |

| LMS | Litchfield Minerals | 0.115 | -18% | 81032 | $4,066,448 |

| SRJ | SRJ Technologies | 0.019 | -17% | 2714084 | $13,928,296 |

| 1AD | Adalta Limited | 0.005 | -17% | 400000 | $3,859,337 |

| ANX | Anax Metals Ltd | 0.005 | -17% | 1023670 | $5,296,845 |

IN CASE YOU MISSED IT

Miramar Resources (ASX:M2R) is preparing to delve deeper into the Glandore gold project in Western Australia, following up on historical results of up to 1m at 161 g/t gold with plans for a seismic survey and multi-element analysis of end of hole samples. The company will advance its geophysical and metallurgical efforts as it waits on the grant of Glandore’s pending mining licence application.

Caprice Resources (ASX:CRS) has kicked-off a 5,000-metre Phase 3 drilling program at the Island gold project, targeted several high-grade, structurally controlled gold targets and following up on results of 28m at 6.4 g/t gold from 114m and 22m at 2.3 g/t gold from 168m of depth.

Entering into a binding head of agreement with Red Hill Minerals (ASX:RHI), Brightstar Resources (ASX:BTR) will receive a cash payment of $4 million in return for a 2% gross revenue royalty once BTR completes 80,000m of drilling at the Sandstone gold project.

Two fully developed stope blocks containing 2,075 tonnes at 17.8 g/t gold has been identified by Vertex Minerals (ASX:VTX) at its Reward Mine. The company says the stopes are suitable for airleg mining, and were not included in the production forecast detailed in VTX’s 2024 PFS.

Adding more than 30 years’ experience in executive decision making and financial markets experience to the board, Petratherm (ASX:PTR) has tapped Rob Sennitt to become executive director of the board, effective May 1. Sennitt joins the team as PTR moves to develop its titanium-rich HMS Mickanippie project to commercialisation.

Trading Halts

Norwest Minerals (ASX:NWM) - cap raise

Vection Technologies (ASX:VR1) - cap raise

Tolu Minerals (ASX:TOK) - cap raise

HitIQ (ASX:HIQ) - cap raise

Perpetual Resources (ASX:PEC) - cap raise

Toubani Resources (ASX:TRE) - cap raise

iSynergy Group (ASX:IS3) - cap raise

Askari Metals (ASX:AS2) - cap raise

Nexus Minerals (ASX:NXM) - cap raise

betr Entertainment (ASX: BBT) - cap raise

At Stockhead, we tell it like it is. While Miramar Resources, Caprice Resources, Brightstar Rsources, Vertex Minerals and Petratherm are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX powers up 0.36pc as tech and energy stocks bring the juice