Closing Bell: ASX jumps 4.5pc on US tariff pause as EU prepares for trade war salvo

While the ASX is up 4.5pc and the tech sector 7pc as Trump pauses the majority of tariffs for 90 days, the EU’s own tariff measures released overnight could reignite tensions.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

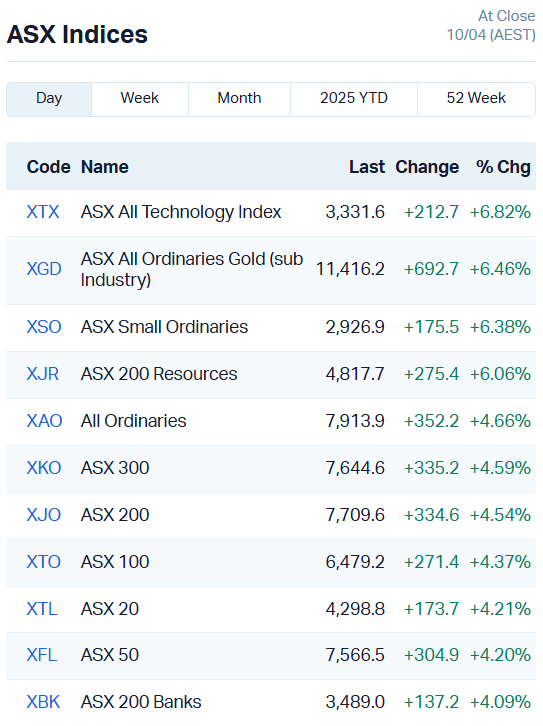

Back on the green end of the seesaw for today, the ASX is firmly in the positive, rising 4.5% after the Trump administration announced a pause on all but 10% of the most recent round of tariffs for all countries concerned except China, Canada and Mexico.

- ASX lifts 4.5pc, tech stocks 7pc as Trump pauses majority tariffs

- European Union responds to February's steel and aluminum tariffs from US with trade restrictions of its own

- EU tariffs of 25% to effect iron, copper, steel among US$45b in goods

US markets tore higher overnight on the tariff pause, encouraged by Trump comments earlier in the day that “This is a great time to buy” on Truth Social.

The uncanny timing of the comment, just four hours before the tariff pause was announced, has drawn accusations of inside trading, with Californian Democrat senator Adam Schiff calling for an investigation.

“I think what American businesspeople need is some certainty, some predictability,” he said. “They're getting anything but. Americans who have seen their retirement savings wiped out need to be made whole.”

EU fires back with its own tariffs

It’s unlikely that will happen anytime soon – the EU announced its own tariffs overnight, in a slightly belated response to those imposed on aluminium and steel exports by the US back in February.

In a staged response beginning April 15, the EU will introduce a 25% tariff on a swathe of US goods, many of which appear to be aimed specifically at Republican-dominant states.

Red state-grown soya beans were on the list, as well as coffee, copper, iron, motorcycles, steel, yachts and orange juice for a total of about US$45 billion in goods.

Directly after the vote had been made official, the European Commission stated that “The EU considers US tariffs unjustified and damaging, causing economic harm to both sides, as well as the global economy.

“These countermeasures can be suspended at any time, should the US agree to a fair and balanced negotiated outcome.”

If past action is anything to go by, the EU may soon find itself the subject of further tariffs, having just received a brief reprieve.

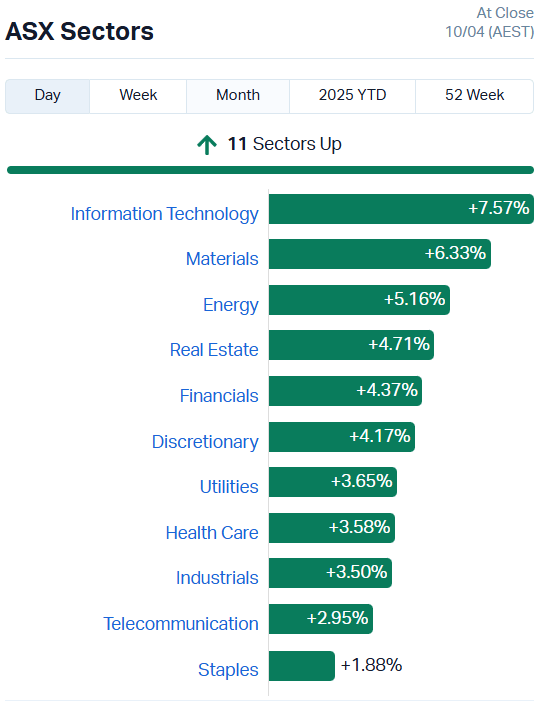

Back at home, the ASX is enjoying the stay of execution, with all 11 sectors firmly in the green.

Tech is still the standout today, up 7.28%, but resources and energy stocks are also taking advantage of our potentially brief moment in the sunshine, lifting 6.43% and 5.25% respectively.

At the big end of town, there was strong upward momentum for tech stocks. WiseTech (ASX:WTC) soared almost 8.44%, Xero (ASX:XRO) 6.50% and NextDC (ASX:NXT) 9.82%.

Big-cap miners recovered the majority of the damage taken yesterday, but the stocks are still well down for the month. Rio Tinto (ASX:RIO) is currently down 6.88% over the past 30 days of trading, BHP (ASX:BHP) 7.81% and Fortescue (ASX:FMG) 4.85%.

Overall, while the story has been a positive one today, the trend is still very much in the negative direction for the market as a whole.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| CT1 | Constellation Tech | 0.002 | 33% | 32,500 | $2,212,101 |

| MMR | Mec Resources | 0.004 | 33% | 280,000 | $5,549,298 |

| RMI | Resource Mining Corp | 0.004 | 33% | 1,181,000 | $1,996,217 |

| EYE | Nova EYE Medical Ltd | 0.115 | 32% | 2,012,914 | $24,714,939 |

| ARI | Arika Resources | 0.021 | 31% | 17,728,722 | $10,136,138 |

| GLL | Galilee Energy Ltd | 0.009 | 29% | 49,083 | $4,717,017 |

| SPA | Spacetalk Ltd | 0.180 | 29% | 44,827 | $8,928,691 |

| WOA | Wide Open Agricultur | 0.023 | 28% | 5,554,187 | $9,606,359 |

| IR1 | Irismetals | 0.195 | 26% | 660,931 | $26,498,704 |

| DKM | Duketon Mining | 0.100 | 25% | 14,188 | $9,792,926 |

| CHM | Chimeric Therapeutic | 0.005 | 25% | 175,000 | $6,480,599 |

| FRX | Flexiroam Limited | 0.005 | 25% | 267,500 | $6,069,594 |

| H2G | Greenhy2 Limited | 0.010 | 25% | 352,608 | $4,785,473 |

| IPT | Impact Minerals | 0.005 | 25% | 12,556,059 | $14,810,653 |

| LML | Lincoln Minerals | 0.005 | 25% | 142,500 | $8,225,038 |

| OLI | Oliver'S Real Food | 0.005 | 25% | 477,711 | $2,162,928 |

| RAS | Ragusa Minerals Ltd | 0.020 | 25% | 285,441 | $2,281,581 |

| TAR | Taruga Minerals | 0.010 | 25% | 796,479 | $5,648,214 |

| HFR | Highfield Res Ltd | 0.160 | 23% | 442,167 | $61,630,016 |

| GHM | Golden Horse Mineral | 0.318 | 22% | 1,549,485 | $29,679,947 |

| NRX | Noronex Limited | 0.017 | 21% | 2,167,261 | $7,799,660 |

| MM8 | Medallion Metals. | 0.255 | 21% | 1,774,451 | $100,539,741 |

| AEE | Aura Energy | 0.120 | 21% | 1,427,890 | $88,184,066 |

| LRV | Larvottoresources | 0.720 | 21% | 7,119,511 | $244,681,334 |

| EBR | EBR Systems | 1.595 | 21% | 1,314,430 | $492,223,148 |

Making a mark this afternoon…

Arika Resources (ASX:ARI) jumped more than 40% today after hitting multiple high-grade gold intersections in maiden drilling at the Pennyweight Point prospect, part of the Yundamindra gold joint venture project. With gold prices hovering close to all-time highs, ARI struck gold up to 35.76m at 2.14 g/t gold from 104.27 metres of depth, with intersections including 13.46m at 5.28 g/t gold from 150m and 14 metres at 15.48 g/t gold from 46m.

A new bill supporting lithium companies in the state of Arkansas, US, lifted Pantera Lithium (ASX:PFE) 28% higher, demonstrating strong government support for the exploration, extraction, processing and refining of the battery metal. Pantera is developing the Pantera lithium brine project, right next door to Exxon Mobil’s (NYSE:XOM) lithium brine project.

Golden Horse Minerals (ASX:GHM) has jumped more than 30% after unearthing broad gold intersections in drilling at the Central Zone, home to the Hopes Hill gold project. The company struck 43m at 4.5 g/t gold, within a broader intersection of 83m at 2.5 g/t gold from 103m depth.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FAU | First Au Ltd | 0.001 | -50% | 6,142,566 | $4,143,987 |

| RLC | Reedy Lagoon Corp. | 0.001 | -50% | 100,000 | $1,553,413 |

| ECT | Env Clean Tech Ltd. | 0.002 | -33% | 4,403,002 | $10,940,431 |

| SKN | Skin Elements Ltd | 0.002 | -33% | 436,190 | $3,225,642 |

| ZEU | Zeus Resources Ltd | 0.007 | -22% | 10,125,982 | $5,766,058 |

| UCM | Uscom Limited | 0.021 | -22% | 100,000 | $6,762,879 |

| MBK | Metal Bank Ltd | 0.011 | -21% | 20,000 | $6,964,426 |

| ALM | Alma Metals Ltd | 0.004 | -20% | 15,888 | $7,931,727 |

| OVT | Ovanti Limited | 0.004 | -20% | 15,065,395 | $13,507,739 |

| VFX | Visionflex Group Ltd | 0.002 | -20% | 399,999 | $8,419,651 |

| SVY | Stavely Minerals Ltd | 0.013 | -19% | 426,538 | $8,704,673 |

| SHP | South Harz Potash | 0.005 | -17% | 2,372,819 | $6,495,472 |

| EME | Energy Metals Ltd | 0.062 | -16% | 15,935 | $15,516,565 |

| MI6 | Minerals260Limited | 0.110 | -15% | 21,594,522 | $268,753,333 |

| PRM | Prominence Energy | 0.003 | -14% | 28,671 | $1,362,117 |

| CVR | Cavalierresources | 0.265 | -13% | 283,141 | $17,641,876 |

| BTN | Butn Limited | 0.100 | -13% | 1,078 | $32,124,626 |

| CF1 | Complii Fintech Ltd | 0.020 | -13% | 2,957,685 | $13,142,054 |

| GTE | Great Western Exp. | 0.020 | -13% | 377,598 | $13,058,432 |

| ARV | Artemis Resources | 0.007 | -13% | 1,146,761 | $20,228,234 |

| AVW | Avira Resources Ltd | 0.007 | -13% | 55,016 | $1,464,902 |

| GBZ | GBM Rsources Ltd | 0.007 | -13% | 595,808 | $9,368,560 |

| TMK | TMK Energy Limited | 0.004 | -13% | 10,642,318 | $37,454,660 |

| PEB | Pacific Edge | 0.105 | -13% | 57,500 | $97,429,917 |

IN CASE YOU MISSED IT

Zenith Energy (ASX:ZEN) is gearing up for a deep drilling campaign at the Red Mountain gold project after securing a $275,000 collaborative exploration initiative grant from the Queensland government, with the goal of unlocking the project’s gold potential, as well as associated copper and molybdenum mineralisation at depth.

Peregrine Gold (ASX:PGD) has secured $807,566 with the completion of a shortfall offer, part of a non-renounceable entitlement offer first offered October last year. The company will put the funding toward scaling PGD’s gold assets, which include the Newman and Mallina gold projects in Western Australia.

Targeting a bedrock gold source, Miramar Resources (ASX:M2R) has launched a drilling program at the Gidji joint venture project in Western Australia, with an eye to also extending the Marylebone, Blackfriars and Highway gold discoveries.

A long-standing dispute between Conrad Asia Energy (ASX:CRD) and Coro Energy Duyung has been resolved after the two parties signed a settlement agreement. CRD will obtain Coro Duyung’s 15% interest in the Duyung Production Sharing Contract, in return for cash consideration of US$300,000 and 500,000 new CRD shares, contingent on government approval. The company will issue afurther US$750,000 worth of CRD shares to Coro within the first 45 days of commercial production at the Duyung facility.

HyTerra Limited (ASX:HYT) has taken the first steps in executing a 12-month exploration program at the Nemaha project in the US, seeking to unlock the potential natural or white hydrogen within the area. The company has completed an aerial survey, with initial results providing important geological insights, and has mobilised a drilling rig to the Sue Duroche 3 well location, expected to arrive early next week.

At Stockhead, we tell it like it is. While Zenith Minerals, Peregrine Gold, Miramar Resources, Conrad Asia Energy, and Hyterra are Stockhead advertisers, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX jumps 4.5pc on US tariff pause as EU prepares for trade war salvo