Closing Bell: ASX drops almost 1pc to end seven-day winning streak

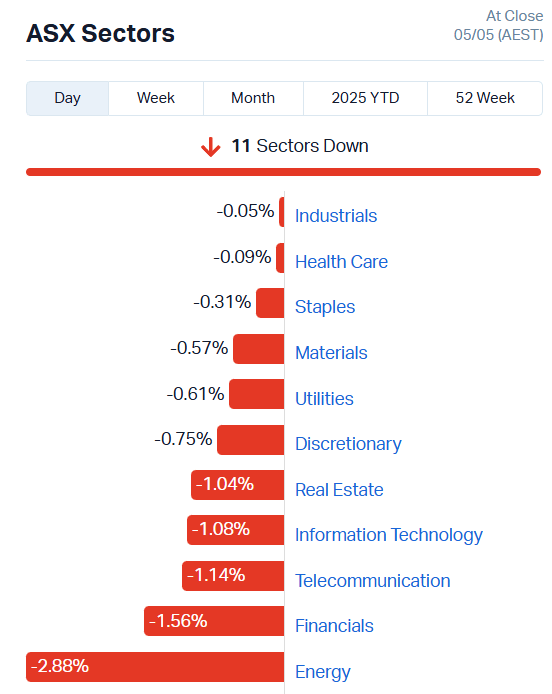

The ASX broke a more than week-long winning streak to fall across the board today, losing almost a full percentage point with particular weakness in the Energy and Financials sectors.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

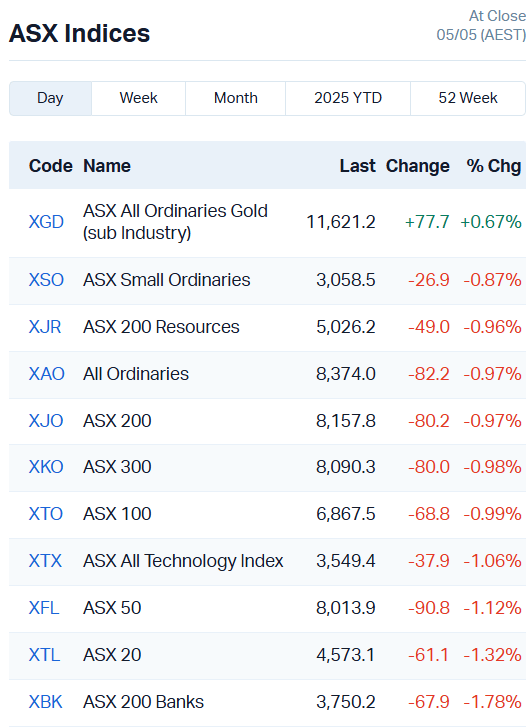

ASX falls almost 1pc on Monday after setting new 20-day high last week

Sectors in the red right across the board

Falling oil price weighs heavily on Energy sector, down more than 2.8pc

An eighth day of gains just wasn’t to be for the ASX, with the bourse stumbling to fall about a full percentage point today and all 11 sectors sinking into the red by close of play.

A downward trend in oil prices over the last few weeks applied pressure to the Energy sector, which fell almost 3%, down 2.88% at market end.

Still, the news wasn't all bad. For example, several small cap or uranium-focused stocks resisted the pull.

AXP Energy (ASX:AXP) and Pancontinental Energy (ASX:PCL) both gained 50%, while Elevate Uranium (ASX:EL8) lifted 14.82% and hydrogen compression company Provaris Energy (ASX:PV1) jumped 9.09%.

Of the larger stocks, only Ampol (ASX:ALD) managed to make any gains, up 0.84%. But Woodside Energy (ASX:WDS), Santos (ASX:STO) and Yancoal (ASX:YAL) all lost between 2.6% and 3.95%.

Meanwhile despite a fall in the gold price last week, the ASX All Ord Gold index stood out in a sea of gloom, lifting 0.67%.

Alongside Anax Metals (ASX:ANX), which we’ll expand on in a moment, several other gold stocks made sizeable gains today, pushing against the rip currents of the market.

Gold Road Resources (ASX:GOR) gained 9.43%, Sarama Resources (ASX:SRR) 21.43% and Koonenberry Gold (ASX:KNB) 18.42%.

The big caps didn’t entirely miss out, either. Northern Star (ASX:NST) gained 0.37% against a struggling resource sector, joined by Evolution Mining (ASX:EVN), up 2.14.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| XPN | Xpon Technologies | 0.021 | 250% | 70221284 | $2,174,649 |

| ANX | Anax Metals Ltd | 0.01 | 100% | 51352795 | $4,414,038 |

| AFA | ASF Group Limited | 0.006 | 50% | 94 | $3,169,590 |

| AXP | AXP Energy Ltd | 0.0015 | 50% | 270000 | $6,574,681 |

| PCL | Pancontinental Energ | 0.012 | 50% | 21351041 | $65,092,687 |

| RLL | Rapid Lithium Ltd | 0.003 | 50% | 5264969 | $2,489,889 |

| KPO | Kalina Power Limited | 0.007 | 40% | 2196679 | $14,471,099 |

| SPX | Spenda Limited | 0.007 | 40% | 32569213 | $23,076,077 |

| GTE | Great Western Exp. | 0.019 | 36% | 334054 | $7,948,611 |

| ADG | Adelong Gold Limited | 0.008 | 33% | 22104925 | $8,384,917 |

| AUK | Aumake Limited | 0.004 | 33% | 215727 | $9,070,076 |

| CT1 | Constellation Tech | 0.002 | 33% | 553114 | $2,212,101 |

| KGD | Kula Gold Limited | 0.009 | 29% | 474189 | $6,448,776 |

| EQX | Equatorial Res Ltd | 0.115 | 28% | 165052 | $11,830,082 |

| OD6 | Od6Metalsltd | 0.028 | 27% | 928833 | $3,503,406 |

| CTN | Catalina Resources | 0.0025 | 25% | 213317 | $3,327,519 |

| HLX | Helix Resources | 0.0025 | 25% | 2288887 | $6,728,387 |

| SPG | Spc Global Holdings | 0.39 | 24% | 32806 | $60,789,293 |

| VR8 | Vanadium Resources | 0.016 | 23% | 219603 | $7,335,794 |

| PUA | Peak Minerals Ltd | 0.011 | 22% | 3899791 | $25,265,892 |

| SMP | Smartpay Holdings | 0.925 | 22% | 533197 | $183,877,033 |

| SRR | Saramaresourcesltd | 0.034 | 21% | 143164 | $7,620,232 |

| DAL | Dalaroometalsltd | 0.03 | 20% | 1026086 | $6,223,798 |

| L1M | Lightning Minerals | 0.06 | 20% | 119871 | $5,166,416 |

| CCO | The Calmer Co Int | 0.003 | 20% | 737094 | $6,694,362 |

Making news…

Anax Metals (ASX:ANX) has just locked in a $3.3 million funding deal from a global player called Mineral Development Partners (MDP). MDP has agreed to tip in up to $103 million all up, backing Anax’s push to bring the Whim Creek copper project in WA back to life, and turn it into a major base metals hub for the Pilbara. Anax says the backing is needed to fire up Whim Creek and grow into a serious copper and base metals contender.

XPON Technologies (ASX:XPN) skyrocketed by 300% after snapping up Alpha Digital, a well-known Aussie digital marketing outfit and long-time partner of the business, in a deal set to wrap up in early May. The buyout is worth $1.72 million upfront, with a bit extra on the table if Alpha hits future earnings targets.

Alpha pulled in $4.6 million in revenue last year and comes with around a million bucks in cash. The plan now is to plug in XPON’s AI smarts to supercharge Alpha’s offering, and roll out more tools to big-name clients like Target, Kmart and QUT. XPON reckons this could be the first of many in a repeatable “acquire, AI-enable, cross-sell” strategy.

SmartPay (ASX:SMP) shares jumped after it entered exclusive talks with a mystery buyer offering $NZ1.20 a share. It had been weighing up offers from that bidder and Tyro, but went with the first after a sweetened proposal landed in late April. Tyro’s now out of the race, and Smartpay’s got until June 9 to lock in a deal.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TKL | Traka Resources | 0.001 | -50% | 231139 | $4,251,580 |

| 88E | 88 Energy Ltd | 0.001 | -33% | 4682292 | $43,400,718 |

| VML | Vital Metals Limited | 0.002 | -33% | 17428432 | $17,685,201 |

| BGE | Bridgesaaslimited | 0.016 | -30% | 144030 | $4,596,762 |

| AN1 | Anagenics Limited | 0.006 | -25% | 4400838 | $3,970,563 |

| AON | Apollo Minerals Ltd | 0.012 | -25% | 12814623 | $14,855,310 |

| VEN | Vintage Energy | 0.003 | -25% | 285611 | $7,155,687 |

| BLU | Blue Energy Limited | 0.007 | -22% | 689075 | $16,658,762 |

| LYK | Lykosmetalslimited | 0.014 | -22% | 113420 | $4,238,000 |

| DTR | Dateline Resources | 0.021 | -22% | 1.2E+08 | $74,670,353 |

| C1X | Cosmosexploration | 0.067 | -20% | 85870 | $8,691,195 |

| HCF | Hghighconviction | 0.036 | -20% | 283510 | $873,292 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 5116827 | $15,867,318 |

| CAV | Carnavale Resources | 0.004 | -20% | 444119 | $20,451,092 |

| RAS | Ragusa Minerals Ltd | 0.017 | -19% | 16281 | $2,994,575 |

| MQR | Marquee Resource Ltd | 0.009 | -18% | 50000 | $5,340,285 |

| PLY | Playside Studios | 0.135 | -18% | 2673921 | $67,521,652 |

| BRX | Belararoxlimited | 0.071 | -18% | 1188480 | $13,539,184 |

| NGS | NGS Ltd | 0.0225 | -17% | 380247 | $3,658,036 |

| EQS | Equitystorygroupltd | 0.025 | -17% | 420003 | $5,004,612 |

| HIQ | Hitiq Limited | 0.025 | -17% | 110034 | $11,026,874 |

| 1AD | Adalta Limited | 0.005 | -17% | 1235809 | $3,859,337 |

| 1AI | Algorae Pharma | 0.005 | -17% | 50357 | $10,124,368 |

| BPP | Babylon Pump & Power | 0.005 | -17% | 910000 | $14,997,294 |

| CHM | Chimeric Therapeutic | 0.005 | -17% | 1000001 | $10,904,117 |

IN CASE YOU MISSED IT

Decidr Ai Industries (ASX:DAI) has expanded its board in preparation for the next phase of commercial scaling and global expansion of its Agentic AI platform, selecting Gordon Starkey as chief revenue officer and Kael Hudson as head of partnerships. The two brings extensive sofrware-as-a-service and partner-led commercial strategy experience, with the appointments intended to “reinforce Decidr’s momentum following major wins across Australia and the US in healthcare, media, finance, education and energy”.

Arovella Therapeutics (ASX:ALA) is moving to obtain two new licenses for novel chimeric antigen receptors (CARs) targeting solid tumours, including neuroblastoma and hepatocellular carcinoma. Both CARS have been studied in clinical trials, reducing the need for preclinical testing.

A US$175,122 research rebate from the Canadian government has bolstered Recce Pharmaceuticals (ASX:RCE) funds, as the company works to develop a new class of synthetic anti-infectives to address the growing problem of antibiotic-resistant superbugs.

Trading Halts

ARC Funds (ASX: ARC) – potential cap raise

Aurum Resources (ASX:AUE) – cap raise

FOS Capital (ASX:FOS) – proposed acquisition

MyEco Group (ASX:MCO) – issue of convertible notes

NewPeak Metals (ASX:NPM) – update on the AusVan Battery Metals transaction

White Cliff Minerals (ASX:WCN) – material assays

Yari Minerals (ASX:YAR) – acquisition

At Stockhead, we tell it like it is. While DecidrAI, Arovella Therapeutics and Recce Pharmaceuticals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX drops almost 1pc to end seven-day winning streak