Closing Bell: ASX agriculture stocks find silver lining in tariff trade war

While the ASX lifted 0.3pc in midday trading, the gains weren’t to last. Strength in bank and agriculture stocks staved off losses and the market ended just about flat.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

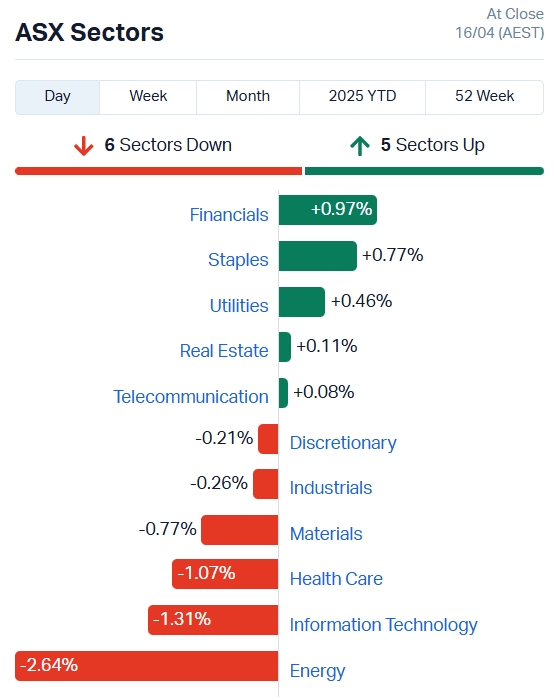

ASX climbs 0.3pc before falling flat to end at -0.04pc

Financial and consumer staples sectors outperform to limit losses

Energy plummets more than 2.5pc as oil outlook darkens

Between looming pharmaceuticals and semiconductor tariffs and plummeting oil outlooks, the ASX has been struggling against the tide today.

While the Aussie bourse put up a valiant fight, lifting as much as 0.3% intraday, strength in the financial and consumer staples sectors wasn’t up to the task of holding up the flagging energy sector. The ASX fell just 0.04%, ending trading in just about the same place it started.

Oil demand falls sharply

Both the International Energy Agency and OPEC have signalled demand for oil is falling sharply in 2025 and 2026 as the trade war dampens global economic activity.

Ironically, the Trump administration is calling for more oil and gas exploration within US shores but the US energy sector itself is winding back production as crude inventories rise.

"The deteriorating outlook for the global economy amid the sudden sharp escalation in trade tensions in early April has prompted a downgrade to our forecast for oil demand growth this year," the IEA’s monthly report read.

"Growth is expected to slow further in 2026, to 690,000 bpd, as lower oil prices only partly offset the weaker economic environment."

ASX energy stocks are faltering as a result.

Whitehaven Coal (ASX:WHC) has fallen 7.37% today alone, Paladin Energy (ASX:PDN) 4.59% and New Hope Corporation (ASX:NHC) 2.72%.

The bigger stocks are also struggling – Santos (ASX:STO) is down 2.14%, Ampol (ASX:ALD) 3.05% and Yancoal Australia (ASX:YAL) 2.05%.

Aussie financials hold strong

Amidst the gloom, there are usually some silver linings.

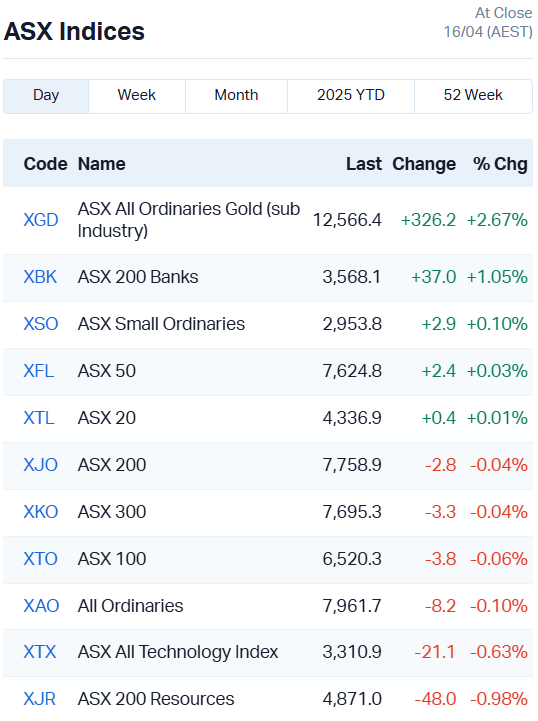

ASX bank and financial stocks ended up 0.97% higher today. Of the big caps, Westpac (ASX:WBC) gained 1.27%, QBE Insurance (ASX:QBE) banked 1.96%, NAB (ASX:NAB) nabbed 0.92% and ANZ (ASX:ANZ) climbed 0.98%.

The ASX 200 Banks Index is up 1.05% overall.

Further down the pecking order, Bank of Queensland (ASX:BOQ) jumped 4.92% while Zip Co (ASX:ZIP) soared 18.24%.

Zip’s success comes on the back of a Q3 FY25 results update which revealed some very promising cash and revenue numbers. The digital financial services company achieved a 219% increase on cash EBTDA versus the same quarter last year, bringing in $46m.

The stock’s total income also increased 26.5% on the same period to $279.9m, boosted by a 27.3% increase in transactions.

“We delivered the largest ever quarterly cash earnings in Zip’s history of $46.0m, underpinned by material operating leverage,” CEO and managing director Cynthia Scott said.

Financials aren’t the only stocks making progress today, though, with consumer staples also up 0.71%.

Much of that strength came from supermarket duopoly Woolworths (ASX:WOW) and Coles (ASX:COL), up 1.04% and 1.01% respectively, but that isn’t the end of the story.

Australian farmers find new markets amid trade war chaos

The Trump administration’s tariffs – while incredibly disruptive – may have opened some new opportunities for Australian farmers, particularly beef exporters.

Ostensibly as part of trade war retaliations, China has declined to renew export registrations for US beef exporters this year, effectively leaving them unable to sell into the Chinese market.

"The majority of US beef production is now ineligible for China," the US Meat Export Federation said.

"This impasse definitely hit our March beef shipments harder and the severe impact will continue until China lives up to its commitments under the Phase One Economic and Trade Agreement."

Australia is one of the largest beef exporters in the world, and it looks like we’re stepping into the gap.

Australian exports of grain-fed beef to China have surged almost 40% since the beginning of the year, shipping almost 22,000 tonnes in February and March alone.

" sales to China have fallen to zero … and not only is the market now closed based on the March 16 production date, but the combined retaliation tariffs by China now take the tariff on US beef to 116%, a level that will quickly halt trade,” Global meat analyst Brett Stuart said.

The export void has boosted agricultural stocks at home.

Australian Agricultural Company (ASX:AAC) is up 5.49% today, Wide Open Agriculture (ASX:WOA) 4.76% and Australian Diary Nutritionals (ASX:AHF) 2.17%.

Now, onto today’s ASX winners…

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EQS | Equitystorygroupltd | 0.032 | 78% | 158623 | $2,984,767 |

| T3D | 333D Limited | 0.008 | 60% | 111186 | $880,917 |

| WMG | Western Mines | 0.17 | 55% | 967090 | $9,938,868 |

| PAB | Patrys Limited | 0.003 | 50% | 2793151 | $4,114,895 |

| NSB | Neuroscientific | 0.052 | 49% | 9800082 | $5,061,170 |

| NWM | Norwest Minerals | 0.013 | 44% | 3704002 | $4,366,076 |

| REE | Rarex Limited | 0.036 | 44% | 24046566 | $20,021,146 |

| PGY | Pilot Energy Ltd | 0.007 | 40% | 54862035 | $8,293,300 |

| SLZ | Sultan Resources Ltd | 0.008 | 33% | 4121489 | $1,388,819 |

| AXI | Axiom Properties | 0.039 | 30% | 2000 | $12,981,410 |

| WIN | WIN Metals | 0.018 | 29% | 6527681 | $7,700,813 |

| C1X | Cosmosexploration | 0.091 | 26% | 653288 | $7,449,595 |

| ASP | Aspermont Limited | 0.005 | 25% | 500000 | $9,880,046 |

| CCO | The Calmer Co Int | 0.005 | 25% | 20690034 | $10,215,485 |

| FAU | First Au Ltd | 0.0025 | 25% | 165039 | $4,143,987 |

| LCY | Legacy Iron Ore | 0.01 | 25% | 170011 | $78,096,341 |

| LNR | Lanthanein Resources | 0.0025 | 25% | 507973 | $4,887,272 |

| RAN | Range International | 0.0025 | 25% | 70000 | $1,878,581 |

| RDN | Raiden Resources Ltd | 0.005 | 25% | 6793929 | $13,803,566 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 764233 | $18,739,112 |

| MEI | Meteoric Resources | 0.11 | 24% | 37486560 | $207,980,788 |

| TG6 | Tgmetalslimited | 0.12 | 22% | 422597 | $7,302,392 |

| DRE | Dreadnought Resources Ltd | 0.0145 | 21% | 13345454 | $56,038,000 |

| SHN | Sunshine Metals Ltd | 0.009 | 20% | 15827097 | $14,882,336 |

Making news…

Equity Story Group (ASX:EQS) surged on inking an acquisition agreement with leading financial advisory firm Baker Young. Baker Young has some $700m funds under management, with $180m in managed discretionary accounts and audited FY24 revenue of $4.5m.

“This opportunity expands our wealth advisory platform, strengthens our corporate advisory reach, and delivers national scale,” EQS CEO Shane White said.

NeuroScientific Biopharmaceuticals (ASX:NSB) skyrocketed after sealing a deal to acquire StemSmart, a patented stem cell tech from Isopogen WA, giving it full rights to produce next-gen cell therapies using mesenchymal stromal cells (MSCs).

Early trial results in Crohn’s patients are looking promising, showing the treatment is safe, effective, and potentially life-changing. To fund the move, NSB has raised $3.5 million and lined up fresh board talent, including industry veterans and a new chief scientific adviser.

Pilot Energy (ASX:PGY) has pulled in $5 million through a heavily oversubscribed placement at 1 cent a share, double its last trading price. The fresh cash will go toward wrapping up the recently announced Korean deal. The deal is a proposed investment by a Korean consortium into Pilot’s Mid-West Clean Energy Project, aiming to develop a large-scale clean hydrogen and ammonia operation in WA.

Norwest Minerals (ASX:NWM) has just secured a key mining lease for its 100%-owned Bulgera gold project, a historic site with a 217,600-ounce gold resource.

The project sits just 50km from Catalyst Metals’ 1.8Mtpa gold plant, making it ripe for a potential restart. With the gold price surge breathing new life into Bulgera’s economics, Norwest will be holding off on any capital raise for now while it reworks its models.

WIN Metals (ASX:WIN) has updated its Butchers Creek gold resource, now sitting at 5.23Mt at 1.91g/t Au for 321,000oz of gold, with a big boost to the indicated resource, up 86% to 258,000oz.

This increase sets the stage for development studies, as WIN eyes low-cost open-pit mining in the current high gold price environment. WIN’s also planning more drilling in 2025, targeting high-priority areas like Golden Crown, which recently returned 6m at 10.85g/t Au.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Name | Price | % Change | Volume | Market Cap | |

|---|---|---|---|---|---|

| TMS | Tennant Minerals Ltd | 0.005 | -38% | 22307327 | $7,647,123 |

| NES | Nelson Resources. | 0.002 | -33% | 9605 | $6,515,783 |

| RLL | Rapid Lithium Ltd | 0.002 | -33% | 500000 | $3,734,834 |

| SKN | Skin Elements Ltd | 0.002 | -33% | 234414 | $3,225,642 |

| AJL | AJ Lucas Group | 0.005 | -29% | 4214251 | $9,630,107 |

| MEL | Metgasco Ltd | 0.003 | -25% | 1002000 | $5,830,347 |

| NTM | Nt Minerals Limited | 0.0015 | -25% | 6634997 | $2,421,806 |

| PIL | Peppermint Inv Ltd | 0.003 | -25% | 87784 | $8,950,558 |

| TMK | TMK Energy Limited | 0.003 | -25% | 28848294 | $37,454,660 |

| GLE | GLG Corp Ltd | 0.13 | -24% | 6000 | $12,597,000 |

| GR8 | Great Dirt Resources | 0.1 | -23% | 100000 | $3,815,664 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 610509 | $15,846,485 |

| HLX | Helix Resources | 0.002 | -20% | 1163333 | $8,410,484 |

| LYK | Lykosmetalslimited | 0.016 | -20% | 375315 | $4,708,889 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 1239626 | $7,480,156 |

| SPQ | Superior Resources | 0.004 | -20% | 10326765 | $11,854,914 |

| GNM | Great Northern | 0.014 | -18% | 133334 | $2,628,694 |

| EM2 | Eagle Mountain | 0.005 | -17% | 150000 | $6,810,224 |

| SHP | South Harz Potash | 0.005 | -17% | 23608 | $6,495,472 |

| WBE | Whitebark Energy | 0.005 | -17% | 1900 | $2,399,441 |

| ASE | Astute Metals NL | 0.021 | -16% | 60003 | $15,453,506 |

| ORD | Ordell Minerals Ltd | 0.585 | -15% | 554973 | $24,831,492 |

| SHV | Select Harvests | 4.6 | -15% | 1476396 | $768,802,327 |

| NTI | Neurotech Intl | 0.029 | -15% | 264568 | $35,687,145 |

IN CASE YOU MISSED IT

With an eye to growing the mineral reserves at the Minyari Dome gold project, Antipa Minerals (ASX:AZY) has kicked off a 35,000-metre drilling program incorporating air core, reverse circulation and diamond core drilling. The drill bit will test the Parklands target, Minyari Dome deposit and GEO-01 south prospect over the three-month program, designed to increase the existing 2.3-million-ounce gold resource.

At the Kasiya natural rutile and graphite project in Malawi, Sovereign Metals (ASX:SVM) has initiated several geotechnical drilling programs. The results will inform infrastructure layout and engineering design for the project’s definitive feasibility study, scheduled to be released in Q4 2025.

QMines (ASX:QML) is set to acquire the Mount Mackenzie project nearby the flagship Mount Chalmers asset in Queensland. The project hosts a resource of 129,000 ounces of gold and 862,000 ounces of silver, which could improve the mine life of the Mount Chalmers copper project.

Trading Halts

Aldoro Resources (ASX:ARN) – exploration results

Orpheus Minerals (ASX:ORP) – a material acquisition and cap raise

Proteomics International Laboratories (ASX:PIQ) – cap raise

Somerset Minerals (ASX:SMM) – cap raise

Stealth Global (ASX:SGI) – cap raise

Strickland Metals (ASX:STK) – cap raise

Sunrise Energy Metals (ASX:SRL) – yep, you guessed it, a cap raise

At Stockhead, we tell it like it is. While Antipa Minerals, Sovereign Metals, Norwest Minerals and QMines are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX agriculture stocks find silver lining in tariff trade war