Aussie property: The beast is back and what that means for prices in 2024

The Australian property market is back to being a monster. And PropTrack reckons price increases will go on, with three states leading the charge in 2024.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Now we’re half way through December one can safely say – without claims of rampant exaggeration or fulsomely ranging hyperbole – that the Australian property market is back to being a beast.

For the latest real estate news, sign up here for free Stockhead daily newsletters

And it’s going to continue being beastly next year, according to the latest calculations from property data firm PropTrack.

Recovery amid rising rates

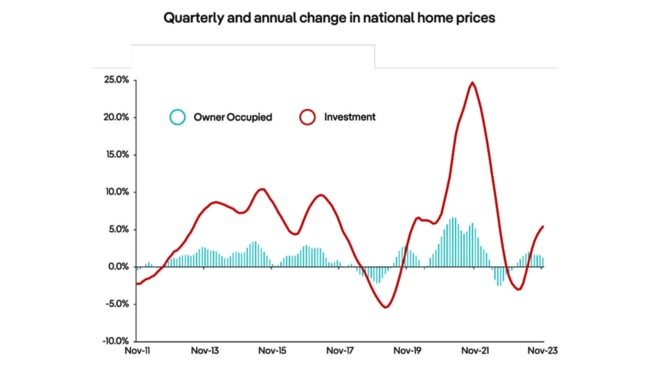

Australian residential has regathered all the strength it lost post-pandemic, and has quickly reverted back to its preferred state of urgent expansion, with sales well up on last year, auction rates highly annoying and capital city prices back at all-time highs.

Australia’s property market proved resilient in 2023, said Cameron Kusher, PropTrack’s director of economic research.

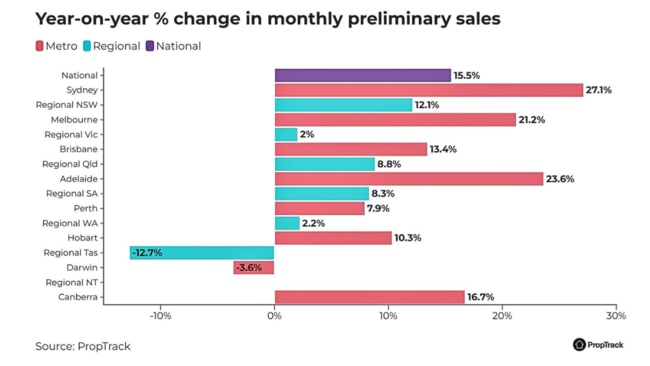

Residential sales volumes have surged some 15.5 per cent on the same time a year earlier, and all this despite the Reserve Bank’s culling of Australian borrowing capacity via 13 staccato rate rises in just 18 months.

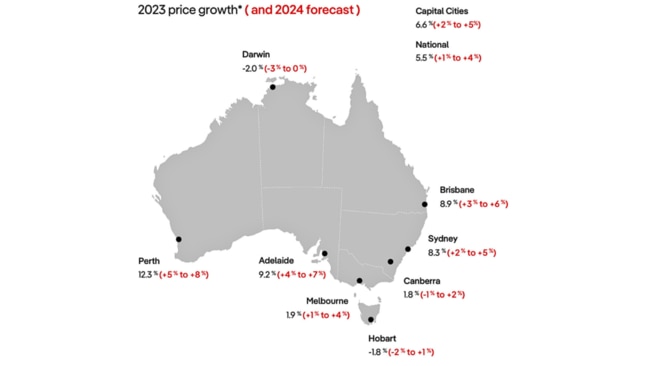

“Home prices have increased 5.5 per cent so far this year to a record high, despite deteriorating housing affordability and interest rate rises significantly reducing borrowing capacities,” Kusher said.

And he expected the rebound in home prices to continue in 2024, with national prices tipped to increase between 1 per cent and 4 per cent.

Everything is up

Aussie real estate, end 2023: the tale of the tape …

- In November 2023, home prices had risen 5.5 per cent year-to-date, to sit at a record high

- This followed 11 straight months of price growth

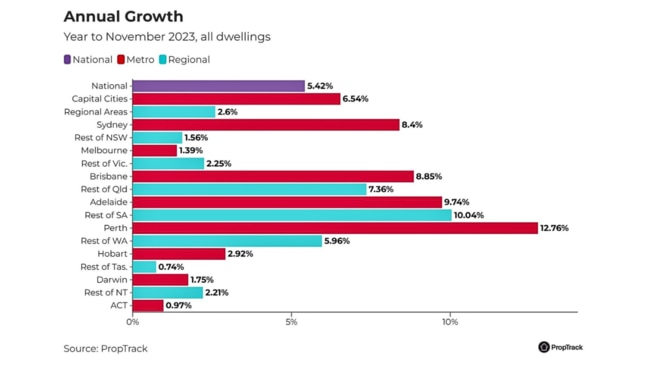

- Capital cities drove home price growth in 2023, rising 6.6 per cent over the same period, compared to a 2.8 per cent increase in regional areas

MORE FROM STOCKHEAD: Gold the gift at Stawell | Lendlease, Goodman ‘pick of real estate stocks’ | Morningstar’s outlook for 2024

- Nationally, the total stock of properties for sale is historically low, sitting -23.9 per cent below its November decade average.

- Buyers have been competing for a relatively low volume of stock. As a result, the number of inquiries per listing on realestate.com.au increased 20.5 per cent year-on-year.

- Over the year, house prices have risen at a moderately faster pace than unit prices, with lifts of 5.6 per cent and 5 per cent, respectively.

The score for 2024

Kusher said Aussie capital city house prices were rising faster (6.9 per cent) than units (5.3 per cent). The trend was reversed in regional markets, with stronger unit price growth (4.2 per cent) than houses (2.5 per cent).

Prices in Sydney (+2 per cent to +5 per cent), and Melbourne (+1 per cent to +4 per cent) were set to rise, though at a slower pace than they have in 2023.

Perth (+5 per cent to +8 per cent), Adelaide (+4 per cent to +7 per cent), and Brisbane (+3 per cent to +6 per cent) were likely to lead home price growth across the country after consistently recording strong gains in 2023.

Kusher added that over the next 12 months, the smaller capital cities may see slight declines or moderate gains, including Canberra (-1 per cent to +2 per cent), Hobart (-2 per cent to +1 per cent), and Darwin (-3 per cent to 0 per cent).

Auctions on the rise

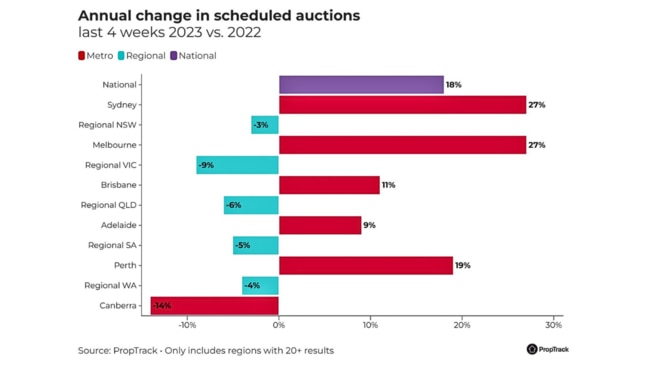

Auction rates over the past four weeks are up some 18 per cent on the same period before Christmas last year, although in Sydney and Melbourne – the auction capitals of the nation – scheduled auctions are up a staggering 27 per cent.

Hobart is the only city with fewer auctions than last year, as it takes longer to recover than others. However, Hobart has fewer auctions in comparison to other forms of sale than the other cities, so this has not affected sales volumes.

Despite scheduled auctions being down compared to last year, sales in the regional areas are up everywhere … except regional Tasmania.

Visit Stockhead, where ASX small caps are big deals

Higher scheduled auctions indicate that agents think a higher price can be obtained by going to auction because demand is so high, according to PropTrack.

“The lower scheduled auctions in regional areas may show that agents don’t think the market is strong enough yet,” Kusher said.

Taxes and interest rates

Kusher said stage three tax cuts, due to kick off in July, would benefit higher income earners, and in turn, could lead to increased demand for higher priced housing.

“Interest rates are now at a 12-year high, and while they remained steady in December, there is a possibility of future increases, which could have an impact on buyer and seller sentiment,” he said.

“Reflecting on 2023, a number of factors drove the home price rebound.

“The volume of stock available for sale remained at persistently low levels while buyer demand also increased significantly, fuelled by a housing shortage and strong population growth. It’s likely these trends will continue into 2024.”

Capital growth

Capital city markets have led 2023’s price upturn, while regional areas have seen slower growth.

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

Originally published as Aussie property: The beast is back and what that means for prices in 2024