Astute’s Red Mountain turns it on with high grade US lithium assays

High-grade assays topping up at 4150ppm lithium from rock chip sampling have outlined the potential scale of Astute’s Red Mountain project.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

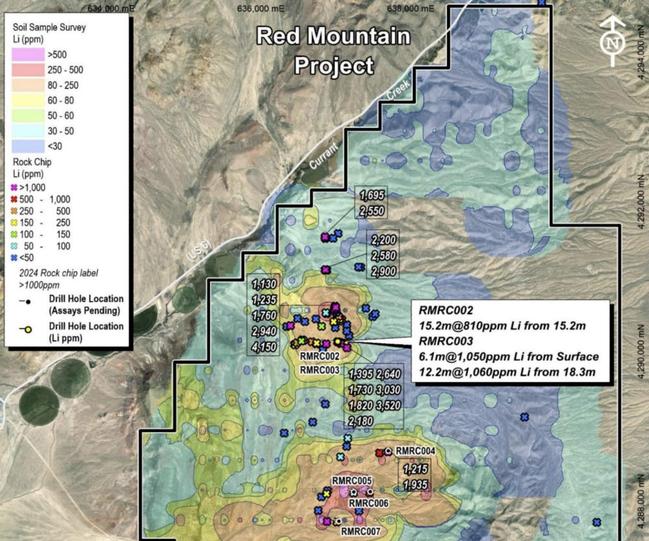

Astute Metals rock chip samples return high-grade assays of up to 4150ppm lithium over a 1.4km north-south trend north of hole RMRC002

Result extends the prospective lithium horizon at the Red Mountain project

Assays for remaining eight drill holes expected by the end of July

Special Report: High-grade assays topping up at 4150ppm lithium from rock chip sampling have outlined the potential scale of Astute Metals’ Red Mountain project in Nevada.

Shares in the company climbed 11.11% this morning on the news.

Astute Metals (ASX:ASE) staked the Red Mountain project in August 2023 to secure broad mapped tertiary lacustrine (lake) sedimentary rocks known locally as the Horse Camp Formation.

Equivalent rocks elsewhere in Nevada are known to host large lithium deposits such as Lithium America’s 16.1Mt LCE Thacker Pass project, American Battery Technology Corporation’s 15.8Mt LCE Tonopah Flats deposit and American Lithium’s 9.79Mt LCE TLC lithium project.

Such lithium clay projects are large in scale and projected to have low production costs in the lower half of the long-term lithium carbonate supply cost curve. They are also long-life assets with mine lives of up to 40 years.

Red Mountain appears cut from the same cloth with an 819-point soil sampling campaign carried out by the company returning grades of up to 1110 parts per million lithium and outlining a coherent +50ppm lithium anomaly over a strike length of 8km and width of up to 2.8km.

More recently, the first three holes in its inaugural drill program all returned high-grade lithium assays with a top result of 59.4m grading 1300ppm lithium from a down-hole depth of 73.2m in hole RMRC001.

These intersections span over 4.6km of strike, confirming that subsurface lithium mineralisation is present and providing a hint at its potential scale.

That Nevada is a world-class mining jurisdiction certainly doesn’t hurt when combined with US Government support and expected strong lithium demand.

Goldman Sachs, typically bearish on battery metals, forecast earlier this year that demand will increase from 1.17Mt lithium carbonate equivalent in 2024 to more than 2Mt LCE in 2027.

Rock chips reinforce scale potential

Rock chip sampling carried out by the company has now uncovered high-grade lithium claystone mineralisation in outcropping and sub-outcropping claystones at Red Mountain.

The north-south trend of high-grade samples extends the claystone mineralisation 1.4km north of hole RMRC002, which returned a 15.2m intersection grading 810ppm lithium from 15.2m.

They also suggest that the targeted high-grade lithium horizon persists further north than previously interpreted.

Adding further interest, 20 of the 81 samples retuned grades over 1000ppm lithium, a sign that high-grade clays are present across the project.

“Our exploration team continues to deliver exciting results, with these latest rock chip results returning exceptional lithium grades and further expanding the potential scale of the Red Mountain project,” chairman and former Pilbara Minerals (ASX:PLS) supremo Tony Leibowitz said.

“The latest results come from an area up to 1.4km north of the discovery we announced recently on 18 June and provide further evidence of the scale and potential of this project.

“We are eagerly awaiting the assays from eight drill holes along the initial 4.6km of strike tested by our recent drilling, with these new rock chip results further extending the prospective horizon to over 6km – adding a significant new area for drill testing later this year.

“The latest results suggest that Red Mountain could be a very large and significant lithium discovery, and we are looking forward to systematically unlocking its full potential.”

Next steps

ASE is currently awaiting assays from the remaining eight holes, which are expected to be returned in two batches this month.

Looking further ahead, the company is planning to carry out follow-up drilling in September-October 2024, preliminary metallurgical test work sometime later this year and define a maiden resource in 2025.

This article was developed in collaboration with Astute Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Astute’s Red Mountain turns it on with high grade US lithium assays