Adam Lawrance: Bifurcation and the five common investor biases driving markets

You stand at a fork in the road. And your investment biases could be about to lead you down the wrong path, warns financial adviser Adam Lawrance.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

According to the traditional theories of finance, the efficiency of markets is underpinned by the assumption that humans act perfectly rationally.

Unfortunately, how investors should behave, and how investors actually behave tends to bifurcate. Or, to say things more simply, divide into two branches or forks.

For the latest investment news, sign up here for free Stockhead daily newsletters

Adam Lawrance, founder of the boutique independent financial advisory firm Lawrance Private Wealth, says this phenomenon has led to the emergence of behavioural finance, which attempts to explain how emotions, heuristics, and experiences impact our decision-making.

With the S&P 500 moving into bull territory last week and US traders betting against the macro economic headwinds, Lawrance spoke exclusively with Stockhead about five of the most common unconscious investor prejudices and what they can do to portfolio performance.

Overconfidence

“As humans, we tend to over-estimate our own abilities,” Lawrance said.

“A global survey by Visa found that 48 per cent of the 6000 respondents believed they could recognise a scam. Yet 73 per cent typically responded to terms and phrases used by scammers in messages and emails.

“In fact, respondents who described themselves as ‘very or extremely knowledgeable’ were more likely to respond to a scam than those who were ‘somewhat knowledgeable or less’.

MORE FROM STOCKHEAD: Why 60/40 portfolio is not dead | Go long on lithium, says T. Rowe Price | Investing in ‘Tiger Cub’ country

“Overconfidence can lead to investors disregarding new information or neglecting outside counsel. Investments may end up concentrated in a select few sectors or holdings the investor knows well, but the overall portfolio lacks diversification.

“Believing he (or she) is above average, the investor may try to time the market, something most professionals fail to achieve.

“At the end of 2022, 81.2 per cent of general Australian equity funds underperformed the S&P/ASX 200 over the previous five-year period.”

Familiarity

“Familiarity bias is the choice to remain within our comfort zone despite other viable options,” Lawrance said.

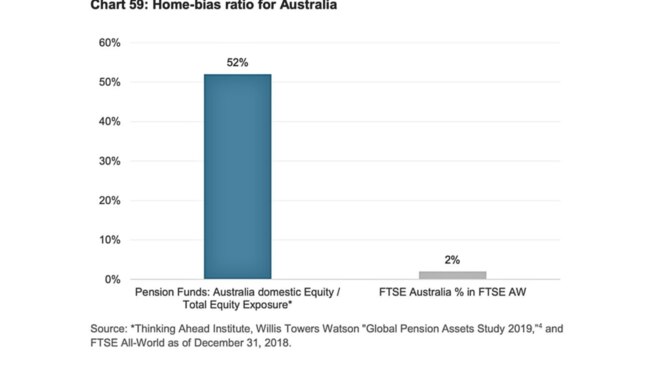

“This is prevalent in equity allocations, for which Australian investors are typically overweight the local market:

- Listed shares represented 29.3 per cent of self-managed super fund (SMSF) assets, compared to just 1.8 per cent for overseas equities.

- Among Australian investors, 58 per cent own Australian shares, compared to 15 per cent for international shares

- In a study by FTSE, Australian pension funds held 52 per cent of their equities allocation in domestic shares.

“This is despite Australia representing just 2 per cent of the FTSE All-World Index.” Intuitively, this makes sense, Lawrance said.

“We invest in companies and brands that are familiar to us such as Commonwealth Bank or Woolworths,” he said.

“Local investors also benefit from the dividend imputation system and franking credits.

Visit Stockhead, where ASX small caps are big deals

“However, it means investors forego the potential gains and portfolio diversification of investing across geographies.

“Overseas markets may rise and fall at different times to Australia, which can reduce portfolio volatility. It also provides exposure to different types of companies.

“This is important as the Australian equity market has a relatively large weighting towards materials and financials, with a relative underweight in technology.”

Investors should be mindful of currency, Lawrance warns, which it is an added variable when investing offshore.

Loss Aversion

“Nobel Laureate Daniel Kahneman found the pain from losses is twice as strong as (joy from) equivalent gains,” Lawrance said.

“He used the test of flipping a coin with his students to illustrate this point. If the coin landed on tails, the student lost $10. When asked how much compensation would be required to accept this gamble, students wanted $20 or more.”

“Kahneman said: ‘I’ve been doing the same thing with executives or very rich people, asking about tossing a coin and losing $10,000 if it’s tails. And they want $20,000 before they’ll take the gamble.’

“Loss aversion can subsequently lead to conservative portfolio allocations, with investors foregoing the potential for significant gains to avoid any probability of losses.

“Furthermore, an investor may hold on to loss-making investments in (a desire to avoid) realising losses, in the hope that these return to parity – known as disposition bias. “Conversely, when markets fall, an investor may opt to sell assets and miss any potential rebound in market prices.”

Following the herd

“Herd behaviour is the act of following or accepting the belief of the crowd rather than conducting independent analysis,” Lawrance said.

“When a large group of people are involved, it’s unlikely so many people could be wrong. Herding is often encouraged by quick and effortless gains.”

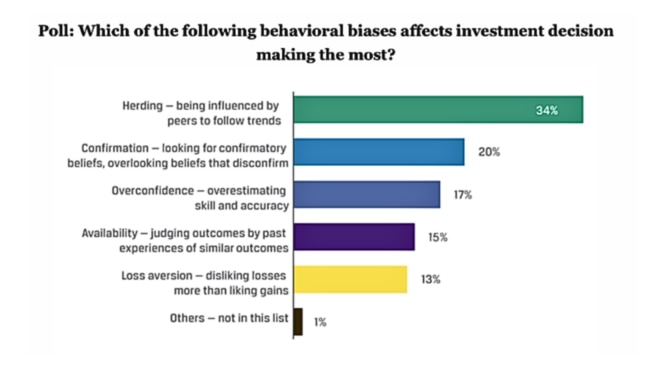

Herding behaviour was voted the No.1 investment bias among investment professionals in a poll by the CFA Institute, Lawrance said.

“It’s easy to fall into the trap of being influenced by peers or new trends, however, following the crowd can lead to poor investment returns,” he said.

“Potential gains may already be realised if there is already a large following.

“Asset bubbles and subsequently market crashes can occur, most recently evidenced by the fall in the value of cryptocurrencies. Moreover, there are trading costs of moving in and out of the next big thing.”

The Anchor

“Anchoring refers to when investors use arbitrary information, such as the first share price they see, as a benchmark for future decisions,” said Lawrance.

“To illustrate, it’s time to meet our fictional investor called Alfred Anchor …

“At the start of 2012, Alfred is considering purchasing CSL shares, which are trading for $32. “He decides to wait and see how the share price performs. One year later, the share price has risen to $53.

“Alfred thinks, ‘I couldn’t possibly buy CSL now, the share price is 65 per cent more expensive!’

“Alfred is anchoring to the first share price of CSL he saw. Instead, he should be determining the value of CSL shares.”

“Another year has passed, and now the CSL share price is $68 – more than double since Alfred first looked at the company.

“He sighs. ‘If only I bought CSL when I first looked at it.’

“Again, Alfred is anchoring to his initial reference price rather than CSL’s prospects and fundamentals. Had he resisted and decided to invest in 2014, he would have made four times his money – even after it had already doubled in the prior two years – with the CSL share price now above $300. ”

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

Originally published as Adam Lawrance: Bifurcation and the five common investor biases driving markets