2023 IPO stonks: Seven stocks seeing best returns since their ASX debuts this year

Life isn’t easy for ASX newcomers, with just seven of the 29 stocks to list this year muscling up. Here’s a look at those that lifted shareholders’ spirits.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

This year, 29 stocks have so far listed on the ASX.

There’s still a month left and nine companies waiting in the wings to burst onto the scene before the new year – but that’s another story.

Today we’re taking a look at which players have made gains since listing, because even though, as Stockhead’s Eddy Sunarto recently noted investing in an IPO can be an excellent way to potentially maximise your chances of lucrative returns, of the class of 2023, only seven IPOs are actually trading above their listing price.

For the latest investment news, sign up here for free Stockhead daily newsletters

Who made the gains?

JAMES BAY MINERALS (ASX:JBY)

Listed: September 12

Up 85 per cent

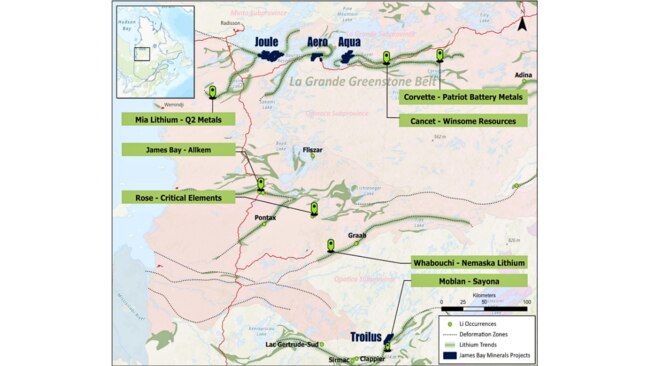

James Bay Minerals has performed strongly since IPO thanks to a dominant, spod-rich, but underexplored landholding in Canada’s James Bay region.

It has enjoyed a steady stream of early stage exploration success across the Joule, Aero and Aqua properties in the La Grande sub-province, along trend from Patriot Battery Metals’ (ASX:PMT) 109.2Mt Corvette deposit.

Aqua is also right next door to Fin Resources (ASX:FIN) Cancet West project, where FIN recently identified “abundant spodumene crystals within a broad pegmatite outcrop” less than 250m from the tenement boundary.

Recent helicopter surveys of Aqua have now identified five large outcropping pegmatite dykes, interpreted to be a continuation of FIN’s spodumene-rich pegmatites.

At Aero, JBY has discovered the 560m-long Warhawk pegmatite, and subsequently the Gauntlet pegmatite – both sampled to contain high grades of lithium.

Maiden drilling is planned in H1 2024.

GOLD HYDROGEN (ASX:GHY)

Listed: January 13

Up 66 per cent

Gold Hydrogen is already seeing early success at the Ramsay project in South Australia’s Gawler Craton.

Its first well, Ramsay-1, was drilled to a depth of 1005m on time and on budget.

Importantly, it encountered significant concentrations of natural hydrogen and helium, confirming historical measurements and demonstrating that an active system is present in the Ramsay project area.

Testing and laboratory results measured air-corrected hydrogen at 73.3 per cent at 240m below ground level, consistent with the 76 per cent air-corrected concentration of hydrogen reported in the Ramsay Oil Bore 1 in 1931.

Helium was also detected with an air-corrected content of 3.6 per cent at a depth of 892m, which represents a significant value-add given the high value of helium.

The company is currently preparing to drill the Ramsay-2 well in mid-November to further appraise the best estimate prospective resource of 1.3Mt of hydrogen.

MORE FROM STOCKHEAD: Weebit Nano wins semiconductor race | Sodium-ion batteries challenge for lithium | Firebrick stars as antivirals go viral

CHARIOT CORPORATION (ASX:CC9)

Listed: October 30

Up 53.33 per cent

Chariot Corporation is in third place, controlling one of the largest lithium exploration landholdings in the US.

It has launched the first drilling to be undertaken at Black Mountain where 60cm long spodumene crystals (6-7 per cent lithium) were first observed in 1997.

CC9 managing director Shanthar Pathmanathan recently told Stockhead’s Reuben Adams the company’s Black Mountain project in Wyoming “looks like Liontown Resources’ (ASX:LTR) Kathleen Valley before it was drilled”.

In early November, the company announced plans to diamond drill the project, ahead of a Phase 1 4900m campaign targeting outcropping spodumene-bearing LCT pegmatite dykes within a 1km long by 50-150m wide zone.

Initial results are due in January.

GREAT DIVIDE MINING (ASX:GDM)

Listed: October 18

Up 32.5 per cent

Since listing, this Queensland gold, antimony and critical metals explorer reported a maiden inferred mineral resource estimate (MRE) at the Yellow Jack project of 1.84Mt at 0.86g/t gold (Au) for 51,100oz contained gold.

The project’s shallow, open resource is close to existing heap leach and carbon-in-pulp process plants, enabling project development with limited capital expenditure.

The company expects to achieve a maiden resource in the near term.

PIONEER LITHIUM (ASX:PLN)

Listed: September 28

Up 30 per cent

PLN’s main game is the Root Lake project in Canada, down the road from Benham and right next door to Green Technology Metals’ (ASX:GT1) 14.6Mt Root Bay deposit.

The company has already found three pegmatites — a host rock for lithium mineralisation — along the Extended Morrison trend in the northwest part of the project, which is also directly along strike from GT1’s Morrison-McCombe pegmatite system.

A drill program is being planned, which will feed into an exploration target and maiden resource in the first half of 2024.

PLN also owns the LaGrande project in Quebec, which is surrounded by large lithium deposits such as Patriot Battery Metals’ (ASX:PMT) district-scale 109.2Mt at 1.42 per cent Li2O Corvette project and Winsome Resources’ (ASX:WR1) Cancet discovery.

Visit Stockhead, where ASX small caps are big deals

The explorer is undertaking geological recon programs off historical data across three claim areas to determine future fieldwork that will look to identify lithium dispersion and associated pathfinder minerals.

Plus, earlier this month the company picked up the Benham project in Ontario and wasted no time kicking off exploration, with fieldwork under way and rock chip samples expected to narrow down future drill targets.

GREAT DIRT RESOURCES (ASX:GR8)

Listed: November 10

Up 22.5 per cent

GR8 is set to tap manganese potential at its historical Doherty and Basin projects in NSW.

The company’s 168sq km exploration licence has produced both battery (74.3 per cent) and metallurgical grade (46 per cent) manganese oxide for two decades from 1940 to 1960.

The demand for manganese is expected to grow as it is steadily split between the more traditional steel industry, and the emerging battery sector, a trend market analysts see growing ninefold by 2030.

An aerial magnetic and radiometric survey have begun over the Doherty project to develop targets for future exploration.

TOLU MINERALS (ASX:TOK)

Listed: November 10

Up 4 per cent

The Papua New Guinea-focused Tolu is set to explore potential of the high-grade Tolukuma gold mine.

Recent trench and rock sampling at the Taula vein has returned 1m at 26.7g/t gold and 98.5g/t silver within a broader mineralised zone of 2m at 13.7g/t gold and 52.3g/t silver.

The results also extended the gold and silver mineralisation of the Taula vein system from a 750m strike length to over a 1300m strike length, demonstrating the potential to develop numerous near mine gold targets.

The plan going forwards is to establish a maiden resource centred on and immediately around the Tolukuma gold mine, but potentially looking to include the broader Tolukuma structure.

This content first appeared on stockhead.com.au

At Stockhead we tell it like it is. While Chariot Corporation, James Bay Minerals and Pioneer Lithium are Stockhead advertisers, they did not sponsor this article.

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

Originally published as 2023 IPO stonks: Seven stocks seeing best returns since their ASX debuts this year