Star Entertainment directors scramble to stave off collapse

Star Entertainment directors are locked in weekend meetings as they scramble to stitch together a lifesaving financing deal for the troubled casino operator.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Star Entertainment’s major shareholder has labelled the embattled casino operator a “mess” as its board and advisers work through the weekend to stitch together an eleventh-hour deal to stave off collapse.

It is understood one of the down-to-the-wire “proposals” being considered is for Star to sell its hotels in Sydney and the Gold Coast and operate as a pure casino company.

If none of the proposals stack up, administrators could be appointed to the company as soon as Monday, potentially throwing up to 9000 people out of work.

Star’s shares tumbled 15.4 per cent to 11c on Friday after it failed to deliver its half-year results, telling the market it was continuing “to explore possible liquidity solutions that might materially increase the group’s liquidity position.”

“[Star] anticipates that it will receive one or more liquidity proposals during the course of today,” Star told the ASX in a statement authorised by chair Anne Ward.

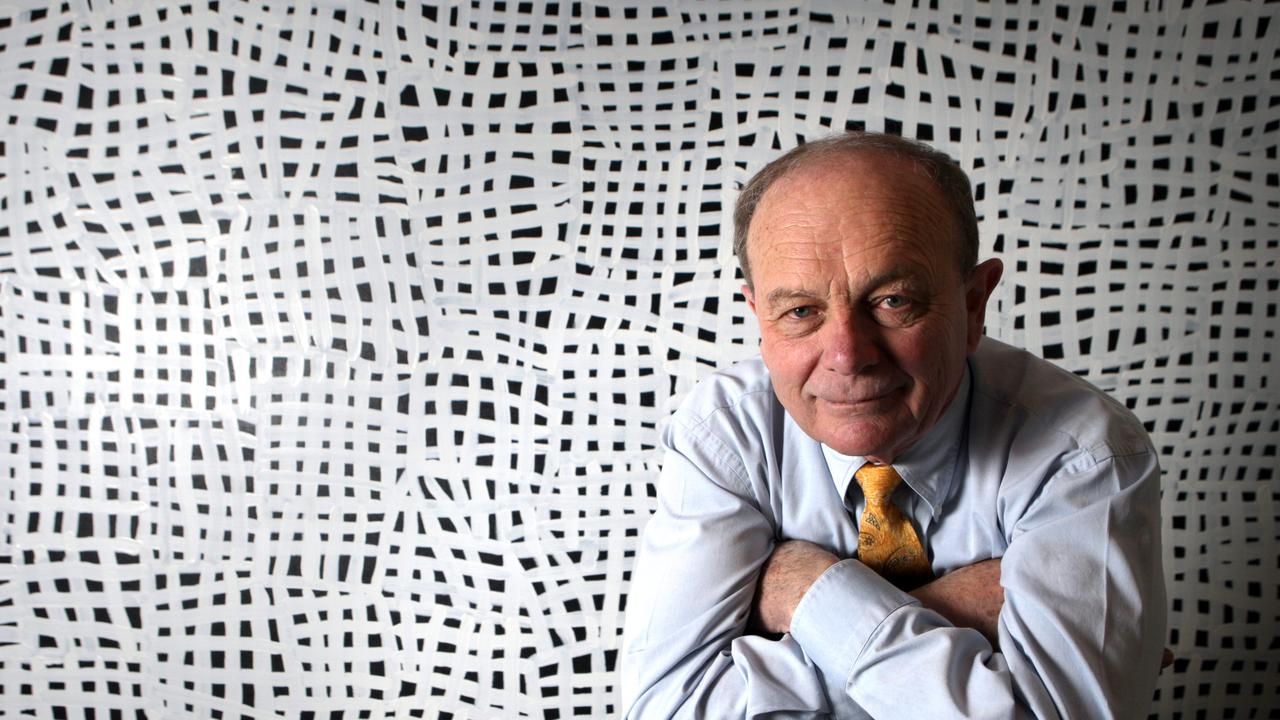

Pub billionaire Bruce Mathieson Sr, the largest single shareholder in Star with a 9.8 per cent stake, said he was not involved in any deal for the Gold Coast properties, despite having previously expressed an interest in them.

“It’s a mess. Even they [Star] don’t know what is going on,” Mr Mathieson said.

Star’s directors are locked in meetings to weigh up whether the casino operator can continue as a going concern and pay its liabilities as they fall due. “As noted in the company’s recent ASX announcements, there remains material uncertainty as to the group’s ability to continue as a going concern,” Ms Ward said.

Star is fast running out of cash and in February said it was considering a potential $650m financial lifeline from US-based Oaktree Capital. Star also revealed it had been approached about the sale of its half share in the debt-laden Queen’s Wharf precinct in Brisbane to its Hong Kong-based partners, Chow Tai Fook Enterprises and Far East Consortium.

The luxury Darling hotel properties on the Gold Coast and in Sydney are considered the jewels in the crown of Star and a sale would mean jettisoning some of the company’s most prized assets.

But Star chief executive Steve McCann and the board are desperate to raise funds to avoid administration.

Mr McCann made pleas to both the Queensland and NSW governments earlier this year for tax breaks, but the approaches fell on deaf ears.

The Queensland Government in particular is believed to have become increasingly frustrated with the slow progress at Star to improve its financial position.

The company’s shares, which have plunged 77 per cent over the past year, will be suspended from Monday, as required by ASX listing rules, following its failure to lodge its half-yearly results.

“Such a suspension would continue until the report is lodged and the ASX determines that the company’s shares should be reinstated to quotation,” Star said.

A source close to the company told The Australian that Star, which has been teetering on the brink of collapse since late last year, may soon not have enough cash to meet its short-term financial commitments, including interest payments and payroll.

Administration was flagged as a scenario earlier this year after Star warned of its deteriorating liquidity position.

A financial collapse of the company, which has casinos in Sydney, Brisbane and the Gold Coast, would be the biggest corporate collapse since Virgin Australia in 2020 and have serious ramifications for the tourism sector across Queensland and NSW.

Star has been in financial strife for the past year amid regulatory challenges, falling revenue and the loss of high roller gamers from Asia.

It delayed the release of its annual financial results in late August, resulting in a lengthy suspension from the ASX. That came as the NSW Independent Casino Commission (NICC) released the findings of the Bell II inquiry that tracked Star’s continuing regulatory failures.

Star has already flagged the sale of non-core assets, offloading the old Treasury casino building in Brisbane and an event centre in Sydney. But the sales have barely made a dent in the billions the company owes its financiers.

A sale of its luxury hotels however could raise enough funds to give Star a fighting chance to trade through its current difficulties. Star has been bleeding red ink for two years, reporting losses in 2024 of $1.69bn after a $2.44bn loss in the prior year. Cost overruns on Queen’s Wharf meant it would be required to invest a further $358m in the project

It reported it had $78m in available cash at the end of December after burning through more than $100m in just three months. The threatened financial implosion of Star comes as ASIC continues to prosecute its case in Federal Court against the company’s former executive team and board for breach of duties in relation to money-laundering controls and other activities at its casinos. The case is set to continue next week, with former chief executive Matt Bekier likely to give evidence in his defence.

Former Star casino chief Greg Hawkins and chief financial officer Harry Theodore have already reached a settlement with the corporate watchdog over their admitted breaches.

More Coverage

Originally published as Star Entertainment directors scramble to stave off collapse