Short-changed or duped? Stage three tax cuts will trigger changes on financial advice

Financial advisers have been left all at sea as the unexpected changes to stage three tax cuts hit more than a million Australian salary earners.

High earners have been short-changed by the government tax cut changes, but financial advisers have been utterly duped.

As the wealth management sector digests the shock changes to a tax regime most believed were set in stone, financial plans that hinged on the original tax changes are now, by definition, wrong.

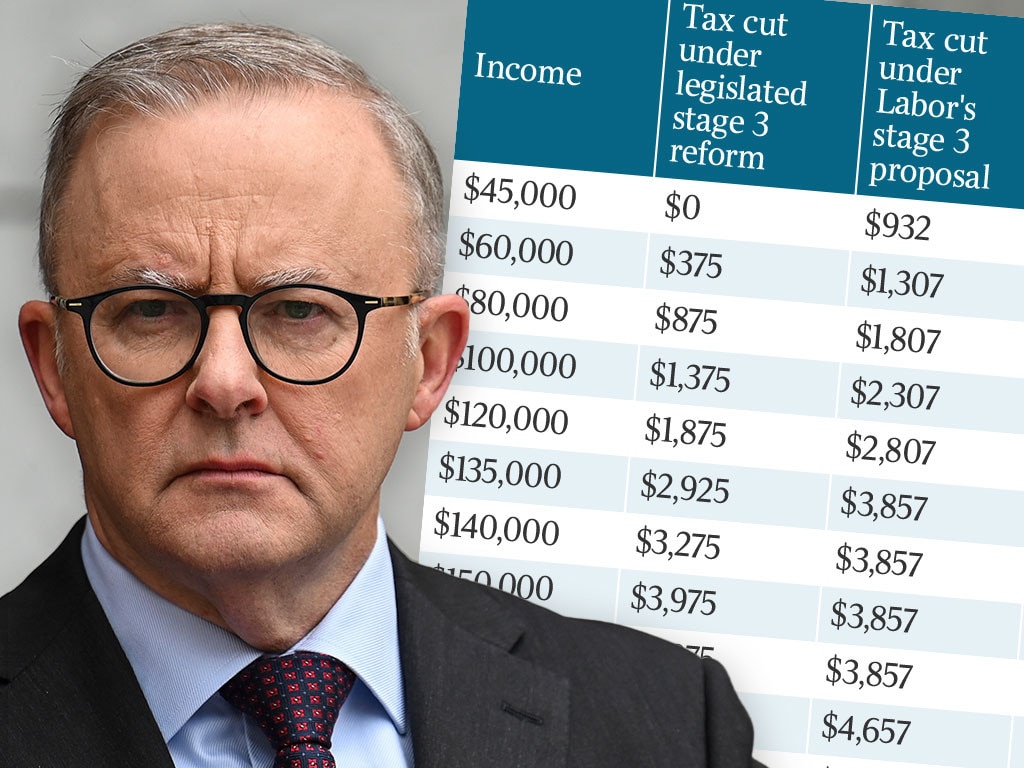

Wealth managers have focused mostly on two aspects of the anticipated changes. The top tax rate of 45 per cent will kick in at $190,000 not $200,000 as planned (it is currently $180,000), while the planned scrapping of the 37 per cent rate will not go ahead – it will instead kick in at $135,000 up from the current $120,000. The changes are due to begin on July 1.

More broadly, advisers suggest a key outcome of the changes will be to once again tilt the system against “salary earners”, especially the 1.2 million Australians who make more than $180,000, while leaving the wealth of older Australians – such as family homes and super savings – untouched.

‘There seems to be pushback on high earners. Earning $190,000 a year in Sydney or Melbourne is not a mind blowing salary when house prices are taken into consideration,” says James Gerrard from www.financialadviser.com.

At its sharpest, the Albanese changes literally halve the anticipated benefit of the original tax cuts to top earners making more than $200,000 a year.

Advisers also point out that our existing tax system already imposes high tax rates that cut in well below the point at which top tax rates start in the US or the UK, for example.

In the US, the top income tax rate of 37 per cent kicks in at $US609,000 ($925,000). In the UK the top tax band is the same as Australia at 45 per cent but it does not kick in until £125,000 ($241,000).

The $180,000 ‘top’ ATO threshold has not been changed since 2008 – and moving it to $190,000 is a very modest adjustment. It would have been raised to $200,000 under the original plan. What’s more, it would be around $250,000 if it had been adjusted for inflation in common with other key tax items such as the aged care pension or superannuation tax-free saving caps.

“We had taken this plan seriously, we had been factoring it into our planning,” Will Hamilton of Hamilton Wealth Management says.

It’s not the first time salary earners have been the meat in the sandwich for policy makers: This group was let down by previous governments, especially in the treatment of superannuation, where older Australians with super already accumulated get the benefit of tax concessions that enlarge through inflation indexing.

On July 1 last year, the amount you can have in tax-free super recently expanded from $1.7m to $1.9m. But salary earners in the super system got the short end of the stick when the pre-tax limit of $27,500 on contributions remained unchanged.

Apart from incorrectly assuming the government would deliver the cuts as promised, advisers had been outlining tax strategies such as prepaying interest on investment loans or income protection policies to optimise tax settings. Those calculations will now have to be adjusted.

Benefits for high earners will now be much reduced. It is estimated that someone on $200,000, who would have been $9075 better off under the original plan, will have that figure cut almost in half – the new number is $4934.

The Australian reported that 1.2 million Australians are already in the $180,000 plus tax bracket – this group will pay an extra $2640 to the ATO if the original plan is canned. Meanwhile, another 1.5 million salary earners are set to be pushed into the highest tax category over the next decade.

Advisers also suggest that financial planning will be almost impossible to do accurately around personal tax over the coming months as the government must get the changes through parliament, where there could be more adjustments made over the coming months.

More Coverage

Originally published as Short-changed or duped? Stage three tax cuts will trigger changes on financial advice