Blowouts hit Santos Alaskan project

The increased costs were expected but the update is slightly above what the market had anticipated – frustrating some shareholders pushing for corporate growth.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Santos’s new oil development in Alaska will cost nearly 20 per cent more than previously estimated, though shareholder disappointment was tempered by confirmation that the development is on course for first production months ahead of schedule.

The increase of $US520m ($780m) tests the patience of Santos shareholders, though any dismay was checked by Santos announcing that its carbon capture and storage project is operating and injecting at full capacity – a lucrative new revenue stream for the company.

Santos is under intense pressure from shareholders to grow revenues and bolster its share price, and efforts were stressed when the company said it now expected a cost blowout of $US520m on the initial budget of $US2.6bn announced in 2022.

The increased costs had been expected amid global inflation, but Citigroup said it exceeded expectations of 15 per cent.

But tempering any underwhelmed shareholders, Santos said Pikka could start oil production up to six months earlier than originally planned, which the company said would adequately make up for increased costs.

Appealing to the shareholders, Santos said the project had a rate of return of 20 per cent, and would therefore unlock substantial value for the business.

But adding to the sense of shareholder frustration, Santos said quarterly sales dipped 3 per cent to $US1.27bn after production dipped 3 per cent from the previous three months.

The production shortfall came amid some planned outages, but the result weighed on shares despite the positivity of its carbon capture and storage project developed with Beach Energy running now on course to abate 1.7m tonnes of carbon dioxide.

Shares in Santos closed flat at $6.96.

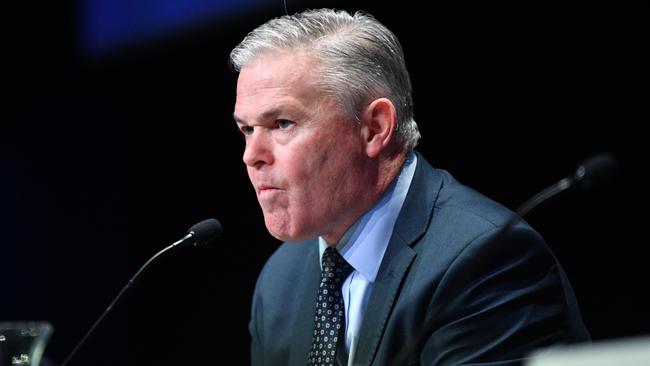

Despite the slightly lower quarterly result, chief executive Kevin Gallagher said the year had provided solid foundations for ongoing growth.

“Free cash flow from operations of almost $US1.5bn year to date creates a strong platform to provide solid returns to shareholders, backfill and sustain our existing business, and continue to grow our Santos Energy Solutions business,” he said.

Mr Gallagher’s confidence comes as Santos is poised to deliver a series of new developments, kicked off by the Moomba carbon capture and storage business.

The company’s $5.7bn Barossa development is 82 per cent complete, it said, and first LNG cargoes are due to begin in the third quarter of next year.

More Coverage

Originally published as Blowouts hit Santos Alaskan project