Rest Super insurance bungle hits thousands of members

Thousands of Rest Super members wrongly slugged insurance premiums have been told they need to get in contact if they don’t want to keep paying the fees turned on by ‘accident’ months ago.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Thousands of Rest Super members slugged insurance premiums in error since mid-2024 will keep paying the added fees unless they opt out, after it ‘switched on’ their cover by accident more than seven months ago.

Around 2500 of the super fund’s members who had either opted not to have insurance cover with the fund or previously had their insurance cancelled have been paying premiums in error since June.

In what is becoming a common complaint in the industry, the blunder is understood to have been made by Rest’s administration provider, MUFG, formerly known as Link Market Services, which has been at the centre of scandals and member service failures that have come to light in recent months. The worst of these have been the excessive delays in funds paying out thousands of death and disability claims.

Rest is understood to have become aware of the insurance payments error in December but members weren’t notified for another month.

Instead of cancelling and refunding the payments, Rest has put the onus back on members to ‘opt out’, telling those affected they have 35 days to contact the fund if they want to halt the premiums and get their money back.

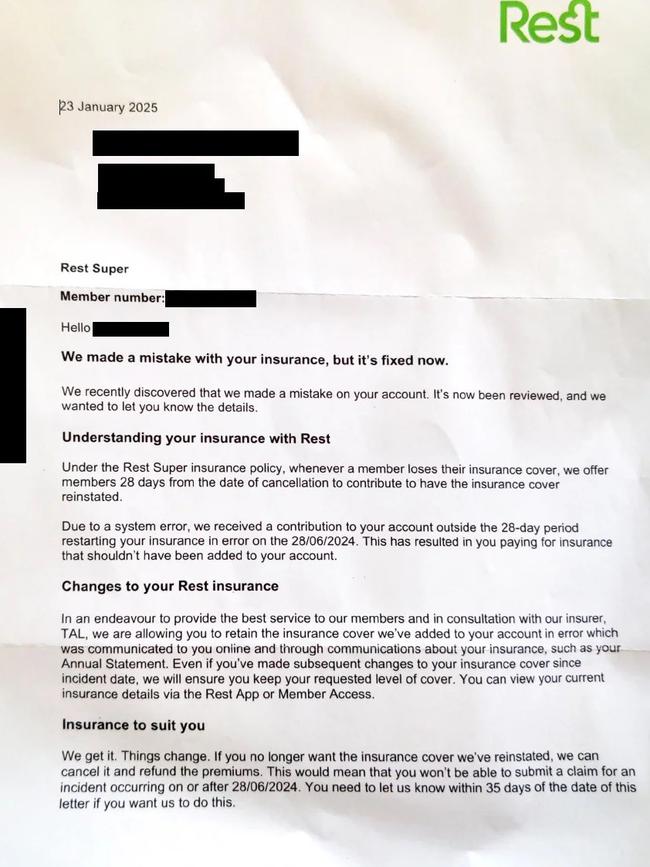

“We made a mistake with your insurance, but it’s fixed now,” Rest said in the letter sent to members last month, a copy of which was posted on Reddit.

“Under the Rest Super insurance policy, whenever a member loses their insurance cover, we offer members 28 days from the date of cancellation to contribute to have the insurance cover reinstated.

“Due to a system error, we received a contribution to your account outside the 28-day period restarting your insurance in error on the 28/06/2024. This has resulted in you paying for insurance that shouldn’t have been added to your account,” the letter, dated January 23, said.

“In an endeavour to provide the best service to our members and in consultation with our insurer, TAL, we are allowing you to retain the insurance cover we’ve added to your account in error.

“If you no longer want the insurance cover we’ve reinstated, we can cancel it and refund the premiums. You need to let us know within 35 days of the date of this letter if you want us to do this,” the fund wrote.

A Rest spokesperson told The Australian that a small number of uninsured Rest members incorrectly had insurance coverage added to their accounts last year as a result of a system error.

“Once identified, the error was addressed quickly and the impact was limited to less than 2500 members,” the spokesperson said. “Rest wrote to the impacted members to inform them of this mistake, and advised them how to cancel the insurance and have any premiums refunded.

“Rest’s approach is to honour any insurance coverage provided in error for a number of reasons, including in case any claims arise.”

Wrongly charging insurance premiums is the latest blunder to hit the under-pressure sector that is facing unprecedented scrutiny from regulators.

Construction industry fund Cbus is already being sued by the corporate cop for its death and disability payment failures, but ASIC is now turning its attention to the fund’s peers, including the biggest in the market, the $360bn AustralianSuper, for similarly taking too long to pay out death claims.

AustralianSuper in November sought to get ahead of the regulator’s clutches, vowing to pay millions of dollars in compensation to deceased members’ beneficiaries for the delays in processing claims.

ASIC, meanwhile, is part way through a deep dive of super funds’ handling of death benefit claims, with its report due in the coming months.

In the wake of the scandals that have dogged the sector for months, the federal government in January said it would introduce mandatory and enforceable service standards for all large APRA‑regulated superannuation funds.

Originally published as Rest Super insurance bungle hits thousands of members