Ratings agency S&P describes national broadband rollout as a retrograde mess

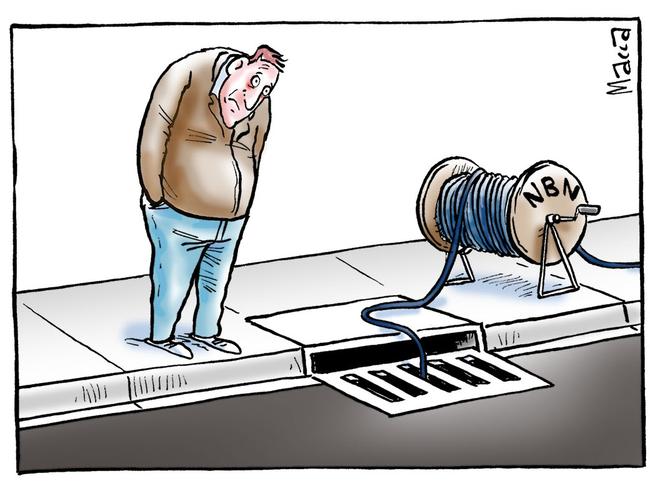

THE National Broadband Network is a “uniquely Australian” mess of outdated technology, political tampering and rollout miscalculations, according to Standard & Poor’s.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

THE National Broadband Network is a “uniquely Australian” mess of outdated technology, political tampering and rollout miscalculations, according to Standard & Poor’s.

And the federal government will almost certainly write down the value of the network as it abandons the theory it can “generate a commercial return on investment”, the ratings agency said.

NBN PROVIDERS MUST DELIVER WORKING CONNECTIONS IN THREE DAYS

TELSTRA FEELING THE PRESSURE OF NBN ROLLOUT

In a blistering critique, S&P said a convoluted pricing structure added to the mire, and consumers were afraid to sign up to the super-fast plans — the great selling point when NBN Co started rolling out the network — because they did “not view them as affordable”.

It said the high prices charged to the telcos operating on the network jeopardised the economics of the $30 billion taxpayer-funded project.

And the state of affairs was so poor the telcos were in an “arms race” to expand their mobile networks as a means of bypassing the NBN.

The report, from a team of S&P analysts led by Graeme Ferguson, said changes were necessary to entice Australians to sign up at the desired rate.

“We believe NBN Co’s forecast take-up rate will be hard to achieve without a step-change to its wholesale pricing model,” he said.

Telstra has previously criticised NBN Co’s pricing, arguing it was impossible to offer cheap plans because wholesale prices — the charges levied to telcos — were too high.

A writedown of the NBN “appears inevitable”, S&P said, meaning the value of the network would be cut below the tens of billions of taxpayer dollars ploughed into it.

Industry analysts have previously speculated such an occurrence.

Mr Ferguson said it was “getting harder for the government to stand behind the presupposition that NBN Co will generate a commercial return on investment”.

“Many of its problems are uniquely Australian: a retrograde technology mix, political involvement, rollout miscalculations, cross-subsidisation of unprofitable regions, as well as a convoluted pricing structure,” he said.

“It is a contrived market shaped by heavy government intervention, and it is consumers who are expected to underwrite NBN Co’s profitability via its favourable regulatory arrangements.”

Mr Ferguson said NBN Co’s “unusually complex pricing model is part of the problem”.

S&P cited a report published by US group Akamai that found Australia was ranked 50th out of 148 countries for average fixed broadband speeds.

While higher speed plans that would lift Australia’s ranking already exist, “their widespread availability is academic if subscribers do not view them as affordable,” the S&P report said.

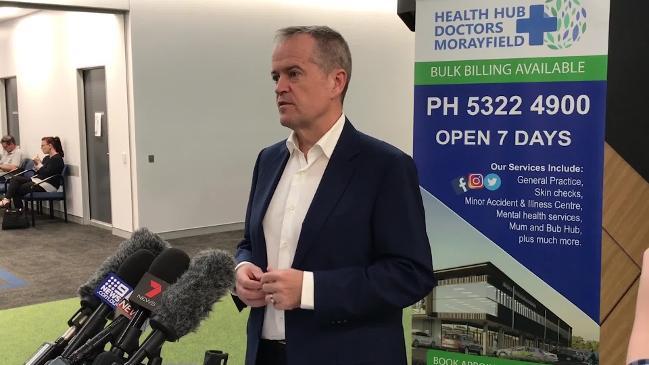

It comes as NBN Co chief Bill Morrow prepares to step down later this year after more than four years at the helm.

Mr Morrow has previously conceded the NBN may need government support to be sustainable.

The S&P report said Telstra, Optus and Vodafone had all invested in their mobile networks in the “infrastructure arms race”, and TPG is rolling out a mobile network.

“A prolonged infrastructure arms race threatens to stretch balance sheets and ultimately force industry consolidation,” it said.

Despite all this, the NBN was likely to help in “bridging the digital divide” between metropolitan and regional areas, the report said, “albeit at an enormous cost to taxpayers, subscribers and incumbent telecommunications providers”.