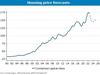

Predictions of a prolonged plunge in house prices may prove wrong as indications of a recovery grow

Australia’s multibillion-dollar housing market is at a turning point and there is evidence prices are recovering.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The perennial debate about the direction of home prices has taken a more positive tone since the start of the year as the early signs of a recovery in our biggest cities are now being locked in as buyers once again turn out in force.

Many were waiting for the best moment to return to house and apartment hunting after being locked out of the hot market during the pandemic, while others were spooked by predictions of deep falls which followed as interest rates appeared to be on an inexorable march higher.

A crucial pause by the Reserve Bank this month appears to have encouraged buyers back into the market with activity, particularly at the upper end of Sydney and Melbourne, signalling a recovery that shows signs of going national.

Melbourne buyers’ agent David Morrell said that the top end of the market had thrust aside thoughts of winter doldrums.

“A starting gun is fired and the race is on again,” he said. “Serious sellers are back. Serious buyers are meeting them. Serious money is abroad.”

While he specialises in luxury mansions, the moves at the top are reverberating across the market.

“It’s a wave that’s been dammed all year and now it’s breaking,” Mr Morell said.

It wasn’t meant to be this way, with predictions just last year of the deepest house price falls in 50 years as buyers were slugged with 10 consecutive interest rate increases and auction clearance rates plunged.

But a complex cocktail of forces, including relatively tight new housing stock and a lack of new supply amid the surge in immigration and a worsening rental crisis, has flipped the dynamics of the market.

PropTrack director of economic research Cameron Kusher had forecast at the start of the year that national property prices would fall 7 per cent to 10 per cent but now says the market would have to switch “significantly” for this to be realised.

He attributes rising prices to an ongoing lack of homes for sale and demand for properties holding up much better than expected. These conditions mean that buyers could not secure properties at hoped for large discounts and led to prices rising marginally this year.

Decisions made by the central bank and financial regulators will be just as critical in determining where the market goes next.

“The direction of property prices from here will likely be dependent on future interest rate movements, any changes to serviceability assessment rates from Australian Prudential Regulation Authority, and the amount of stock available for sale,” Mr Kusher said.

He expects more stock to hit the market and, if interest rates remain stable, an increase in buyer demand, supporting current housing market conditions.

Some economic forecasters are even more upbeat as the housing cycle has been shallower than expected.

ANZ economists Felicity Emmett and Adelaide Timbrell also cited demand spurred by higher than expected immigration. The pair also cited improved auction clearance rates, very strong population growth and the recent lift in prices as they upgraded their housing price forecast, with rises now expected next year.

The pair argue that low levels of housing stock and stronger-than-expected demand trumped the impact of higher mortgage rates in recent months, partly as banks were still competing for mortgage customers.

Westpac chief economist Bill Evans also came out and declared the housing market price slump won’t be as bad as initially feared.

But he cautioned the housing market will remain on edge in the near term with prices expected to hold flat this year with a sustained recovery only coming in 2024.

“Australia’s housing correction is largely over, several factors combining to produce a stabilisation,” Mr Evans and senior economist Matthew Hassan said.

Queensland developer Consolidated Properties Group chairman Don O’Rorke agrees that the worst may be over for home prices, partly because supply remains so tight because of material costs and labour shortages.

“The reason why there is no new supply being built, certainly with apartments, is because the costs involved in building a new apartment are so high,” he said.

“It takes a couple of years from the idea to completion. But where a lot of them are sticking is that when they get a price from a builder the numbers don’t work.”

Mr O’Rorke said interest rates could put a lid on prices coming back. “That would of course be tempered by the ability of people to pay their repayments because of increased interest rates,” he said.

“I think we are shifting that to a new norm – high inflation and interest rates – and unfortunately with all shifts sometimes it’s a bit uncomfortable for some people.”

Listed developers acknowledge that it’s tough for builders at the moment but believe that housing market is entering an upswing.

Mirvac chief executive Campbell Hanan remains bullish on the residential market despite his operation being hit by wet weather, which caused delays and hit earnings.

He also called out the challenges facing subcontractors and builders and labour shortages as making it harder to complete projects.

“We start this cycle with a really significant immigration story for Australia,” he said. “And then you have a supply outlook which is very muted.”

“There are constraints in construction. You’re seeing the collapse of second tier builders, you’re seeing subcontractors failing, so the whole supply chain going forward is constrained. “And that means the ability of our economy to deliver new products into this extraordinary demand is going to be challenged.”

Stockland chief executive Tarun Gupta told a National Housing Finance and Investment Corporation forum this week that the fundamentals of the housing market over the medium term are very solid.

“Net overseas migration and population growth naturally supports the sector,” he said. There could also be relief in sight from ever-higher costs, he said.

“We will see construction costs moderating and more capacity will build in the system.”

As head of the largest residential developer in the country, he believes that as builders adjust to lower volumes and leave Covid-related restrictions behind them, pricing will come back in line.

And governments are now committed to getting more homes built using incentives, including for the build to rent sector and for affordable housing.

The state of the overall economy will remain the key driver of housing.

“The financial fundamentals are strong because jobs are strong, population growth is strong and that gives us confidence in the medium term outlook,” Mr Gupta said.

Originally published as Predictions of a prolonged plunge in house prices may prove wrong as indications of a recovery grow