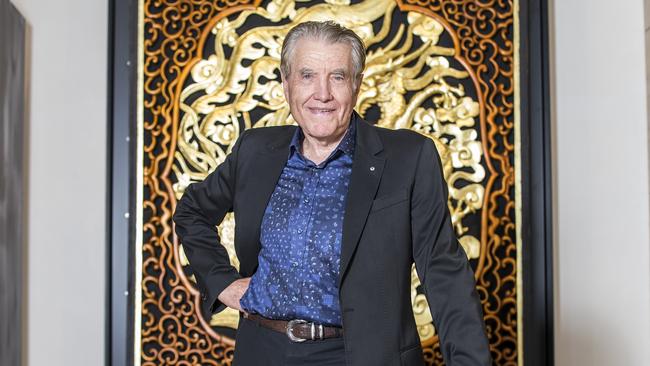

“Only 20 per cent will work” property magnate Max Beck warns on office to apartment push

Max Beck has seen it all in a six-decade, $10bn career. He says residential property is still the best asset class, but converting offices to units is not a panacea for the housing crisis.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Property doyen Max Beck has a blunt warning for the growing call for the conversion of out of fashion office towers to apartments to help solve the housing crisis: “It ain’t easy”.

Beck, who has seen it all in a six-decade career involving more than $10bn worth of property developments, says it will be extremely difficult to overhaul ageing or unused office space into residential dwellings at reasonable cost.

He cites a string of potential issues ranging from different sewerage and services that would need to be installed in the office towers for apartments, to the location of lifts, windows and lighting to floor plate sizes as costly impositions.

“It’s a great idea but there are some serious issues to actually do what you’d need to do to convert them,” Beck tells The Weekend Australian. “You might find 20 per cent of these buildings could work.”

A fitness fanatic who still cycles 200 kilometres every week around Victoria’s Mornington Peninsula or on the Gold Coast, Beck has built big commercial projects in Melbourne’s CBD, including the iconic 333 Collins Street project, apartments and housing developments, the $1bn mixed-use Essendon Fields with billionaire mate Lindsay Fox and more recently led the charge into the build-to-rent sector.

Now, with the pandemic having changed working patterns and white-collar workers seemingly reluctant to make long journeys to the office, that part of the property sector has been suffering.

At the same time rents have skyrocketed for housing amid a shortage of stock, leading to calls that Australia’s big cities rethink how they use their vacant office towers and for many to make way for residential apartments.

Blackstone global boss Jon Gray has been among the big names to call for big Australian cities to rethink the way they use their vacant office towers, and that they should make way for residential units given the structural shortage of housing.

But Beck, a member of The List – Australia’s Richest 250, says many of the vacant office blocks may need to be knocked down if they are to make way for badly-needed apartments.

“The floor ceiling height can be an issue in the office blocks and you can’t necessarily get light into the million of the buildings easily. Buildings that were built before flat plate construction became more widespread usually have big beams in them as well, which can be an issue for apartments,” Beck says.

“Basically, it just isn’t very easy. And so knocking them down may well be easier, which of course can be costly. So you might find that these office buildings get rented out pretty cheaply for a while, to at least get someone in there.”

Beck still believes that the residential sector is the right property asset class to be in, with his family’s private business taking over a 437 unit build-to-rent project in Melbourne’s Caulfield last year from failed builder Probuild and completing it on time and on budget with global giant Blackstone.

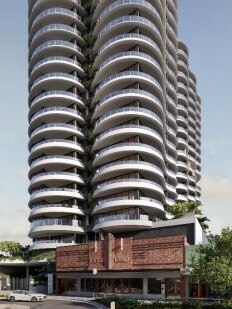

Beck Corporation also has a luxury apartment project planned at Coolangatta’s historic Jazzland Dance Palais building, where it wants to restore the brown brick building on site and build 132 units above and feature a pool, gym, theatre, private dining function rooms and children’s play area.

Beck says Coolangatta, which has had limited projects in recent years, should be on the cusp of a comeback.

“We’re trying to be ahead of the curve there. Prices all the way up to Main Beach on the Gold Coast have gone a bit mad in recent years and so I think Coolangatta will lift as people look for value. It is near the airport and I think it actually has the best beach on the Gold Coast.”

In Melbourne, the Caulfield project, led by Beck’s son Sam, was part of a joint venture with Blackstone that will roll out in stages and was initially clinched in a groundbreaking deal in 2019.

The Blackstone and Beck project has 437 apartments and a full-line supermarket as well as specialty retail stores.

Blackstone has now put their specialist building at Caulfield up for sale, an asset that could be worth $400m, while Beck’s company will itself work on future build-to-rent projects on the site.

“I’ve said that residential is still the place to be in property, and BTR is part of that,” Beck says.

“If someone said you’ve got $500m to spend on property, well you’ve got industrial now where the land holders have got stars in their eyes price wise and online (shopping) sales have kicked the s**t out of retail property.

“The biggest single issue with office is the travel times, so you probably need to look at satellite projects around the cities, like Box Hill in Melbourne so you can have locals not travelling far to work.”

The Beck and Fox families own the $1bn Essendon Fields complex adjoining the Essendon Airport in Melbourne’s north, and have had plans for a six-level office tower that has been stymied for now by a lack of demand. But if more companies, and their workers, shun the CBD, Beck says demand for space in the location in Melbourne’s north could return.

In the meantime, he will concentrate on the residential sector.

“You get back to the fundamental thing that people need, which is somewhere to live. And so that’s why I think the residential sector will continue to do well. We’ve got more people moving to Australia and they need somewhere to live. I think apartments will be more attractive and they are more affordable than land and house packages on the outskirts, which are really becoming costly.

“There’s just fundamental value in residential real estate. It might soften 10 to 15 per cent but it‘s always going to be worth something. There’s intrinsic value in property and Australians tend to understand that.

More Coverage

Originally published as “Only 20 per cent will work” property magnate Max Beck warns on office to apartment push