NSW woman reveals her ‘stressful’ robodebt battle – and how she took on Centrelink and won

Aussie single mother Rebecca Wright was in tears after being told she owed thousands of dollars. But she took on Centrelink – and won.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

When Centrelink contacted single mum Rebecca Wright over an $8000 debt, she was devastated – but also confused.

The alleged debts dated back to 2016 and 2017 when the NSW woman held part-time and casual jobs in hospitality and retail while receiving the Newstart allowance and the Family Tax Benefit.

As part of the conditions of her payment, Ms Wright needed to log the hours she had worked over a fortnight along with her earnings – which she did diligently, apart from one mistake regarding a one-off bonus that she didn’t report correctly.

So Ms Wright was convinced Centrelink was wrong and set about proving it.

She pored over past pay slips and cross-referenced a diary that she had always used to keep track of the hours she had worked and her earnings.

It was painstaking work carried out for “hours on end” over a two-week period, but in the end, it paid off.

It turned out Ms Wright was one of thousands of victims of Centrelink’s robodebt scheme scandal. After re-entering her work details online, her debt ended up being reduced from almost $8000 to about $1600 after discovering “around 75 per cent” of Centrelink’s claims “didn’t marry up”.

Ms Wright thought the debt was probably still too high, but she decided to “wear it” and move on with her life due to the stress and anxiety caused.

“It put me through such depression and anxiety – I was so upset because it came out of nowhere, and I had always been really particular with my reporting,” she told news.com.au.

“I’m a single mum and I was living with this debt over my head which I didn’t expect – it just put me in such a position of stress.

“I was crying and so stressed. I was panicking – I thought, ‘As a single mum, I can’t afford this’.”

She said the situation was so distressing she wouldn’t be surprised if it drove some people to self-harm, and it was compounded by “rude and unhelpful” Centrelink staff and the department’s “mind-boggling” and “confusing” reporting system.

Ms Wright recently posted about her experience in a private Facebook group dedicated to budgeting and saving and received a massive response from others with similar robodebt stories.

She said she wanted to raise awareness and encourage others to dispute debts.

“You report your income thinking you’re doing the right thing, and then get a smack in the face,” she said.

“It’s just sad. It’s a nightmare for some people. People need to fact check, ask questions and fight back.

“I’m just lucky I was able to figure it out, but other people don’t know what to do – they might not be aware or they might have disabilities which means they just wear it and start paying.”

Ms Wright has since repaid her reduced debt. Today, she works full-time as her daughter is older, and she no longer receives the Newstart payment.

But she said she was still cautious regarding Centrelink and urged others to be wary.

“Just don’t accept anything at face value,” she said.

WHAT IS ROBODEBT?

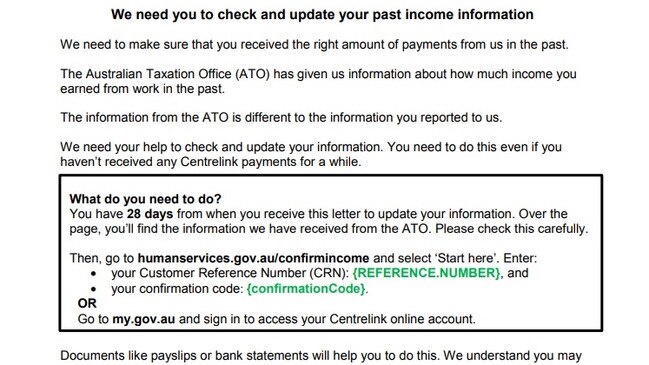

Robodebt is a term that refers to an automatic process that notifies Australians receiving benefits – such as the Parenting Payment, Newstart or Youth Allowance – that they owe the Government money after being overpaid.

But many of those debt notifications issued have been incorrect because they were calculated by a flawed formula that averaged a person’s income over several fortnights instead of using their actual earnings during a specific period.

Instead of relying on people’s actual hours and income – which many did self-report – annual data from the Australian Taxation Office was used as a proxy for recipients’ actual fortnightly earnings.

About 500,000 debt notices were generated by the system, and the Government collected around $660 million from people – although it is not known how many people were incorrectly charged.

CLASS ACTION

Earlier this month, law firm Gordon Legal announced it had launched a robodebt class action in the Federal Court on behalf of victims.

Gordon Legal managing partner James Naughton told news.com.au about 5500 people had registered their interest so far.

“When we think about the people affected, there is a commonality, and that is that at the time they were receiving benefits, they were financially vulnerable,” he said.

“We believe the money should be paid back to people it was taken from unjustly – the Commonwealth has an obligation when it makes a serious claim that people owe it money to prove that. It’s not good enough to just use an average.

“We also think where people have suffered distress, anxiety or stigma as a result of being labelled as owing a debt they should be compensated for the harm the system caused.”

Mr Naughton said many people with “patchy” or “intermittent” earnings – such as university students who worked different hours at different times of the year – had been significantly affected.

“It meant that when the income was averaged out, it looked like they worked more per fortnight,” he said.

“If you’re going to use a proxy instead of real results, these sorts of things will happen, and they have.”

If you have been affected and would like to register your interest in the class action, click here.

D EPARTMENT RESPONDS

The robodebt backlash has been so intense the Department of Human Services has confirmed it is “making changes” to the administration of the online income compliance program.

“The department will no longer raise a debt where the only information we are relying on is our own averaging of Australian Taxation Office income data,” it said in a statement.

“This is in line with our ongoing commitment to continually strengthen and improve our service delivery.

“We will work through all previous online compliance debts to determine those which did not use other information.

“As these cases are identified, the debts will be frozen while we look more closely at them. “People do not have to do anything for this to happen. We will write to people to advise we have stopped recovery activity if they are affected.

“Normal debt recovery activity will continue until and unless people are identified as being affected.”

The statement stressed “this kind of income averaging doesn’t occur in most compliance reviews and debt decisions” and “only applies to a relatively limited proportion of debts”, specifically “those arising from the online income compliance program where we have used only income averaging”.

People concerned about a debt notice can contact the department and ask for a reassessment of the decision or for new information.

For more information, contact the department on 1800 061 838 or visit the website.

Originally published as NSW woman reveals her ‘stressful’ robodebt battle – and how she took on Centrelink and won