National Australia Bank increases rates for owner-occupiers, investors

Homeowners on an average mortgage will have to shell out hundreds more each year after National Australia Bank hiked its variable rate, out of step with the Reserve Bank.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Homeowners on an average mortgage will have to shell out an extra $264 a year after National Australia Bank this afternoon revealed it had hiked its variable home loan interest rate out of step with the Reserve Bank.

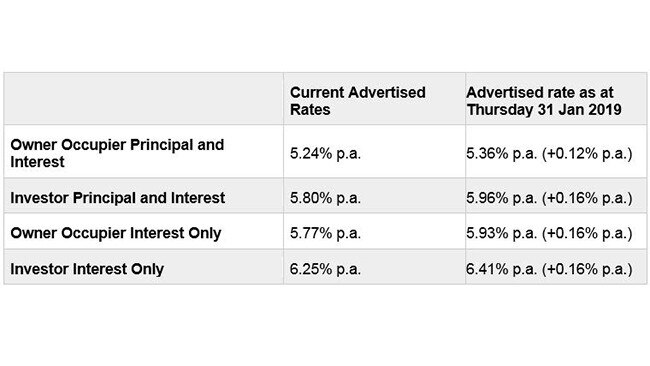

NAB has upped variable mortgage rates for owner-occupiers by 0.12 percentage points to 5.36 per cent a year.

It follows the rest of the big four hiking variable rates in October, blaming the rises on the cost of international funding.

MORE: NAB FEE-FOR-NO-SERVICE SCANDAL ‘ABSOLUTELY WRONG’

NAB HANDS OVER BOMBSHELL DOCUMENT TO ROYAL COMMISSION

CUSTOMERS AT NAB HIT BY BANKING OUTAGE

Based on a $300,000 home loan over a 30-year term, a NAB owner-occupier customer with a standard variable rate home loan will pay an additional $22 each month on their principal and interest repayments, or $264 each year.

NAB today also hiked variable rates for investors by 0.16 percentage points to 5.96 per cent.

The NAB changes kick in on January 31.

The bank’s chief customer officer for consumer banking Mike Baird said NAB had gone it alone for five months with cheaper rates than the other banks, but it had to move due to increased funding costs.

“Our decision to hold our standard variable rate since September last year, the only major Australian bank to do so, has led to around $70 million remaining in the households of more than 930,000 NAB customers,” Mr Baird said.

He said NAB had not increased its standard variable rate since March 2017.

“We have been deliberate in our approach to limit the impact on owner occupier borrowers by keeping their rates as low as possible to encourage both new and existing customers to pay down their loan sooner.”

The Reserve Bank has kept the official cash rate on hold at 1.5 per cent since August 2016.