Myer secures 18-month extension to $340m lending facility

Myer has secured an 18-month extension to a key lending facility and lenders have agreed to not apply the usual covenant testing to its accounts for the past financial year.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Myer has won critical breathing space from its lenders after the coronavirus pandemic “severely impacted” trade at the department store chain.

The retailer has secured an 18-month extension to a key lending facility, worth $340m, until August 2022.

Lenders have also agreed they will not apply the usual covenant testing to Myer’s accounts for the financial year just completed. Covenant tests are effectively stress tests used by lenders to assess whether their customers are in breach of loan terms.

During the first wave of the coronavirus pandemic in March, as Myer temporarily closed all its stores, there was speculation the retailer was at risk of breaching its covenants.

Myer’s loan facility — effectively a pool of funds it can borrow from as needed — was previously capped at $360m and scheduled to expire next February.

Under the terms of its revised agreement, it is now $340m and will fall to $310m next year, then to $250m in 2022.

Myer said those lower levels partly reflected its success in reducing debt over the past two years.

In a statement lodged with the Australian Securities Exchange late Thursday, Myer chief financial officer Nigel Chadwick said the extension “was testament to the work that we have undertaken” in that period.

“It is particularly pleasing to have secured this extension to our (lending) facilities during such an unprecedented time of economic and social disruption in retail,” Mr Chadwick said.

The revised lending deal comes at critical juncture for the department store chain and the broader retail sector as the pandemic continues to take a heavy toll.

In its statement, Myer said trading during the second half of the financial year had been “severely impacted” by the pandemic.

While it continued to trade online, the retailer closed all 60 of its stores nationally on March 29. It progressively reopened them from May 8 and most reopened on May 27.

“As well as store closures for the majority of that two-month period, sales were further impacted by significant reductions in foot traffic, in particular in CBD locations, and more recently the metropolitan Melbourne region,” the group said.

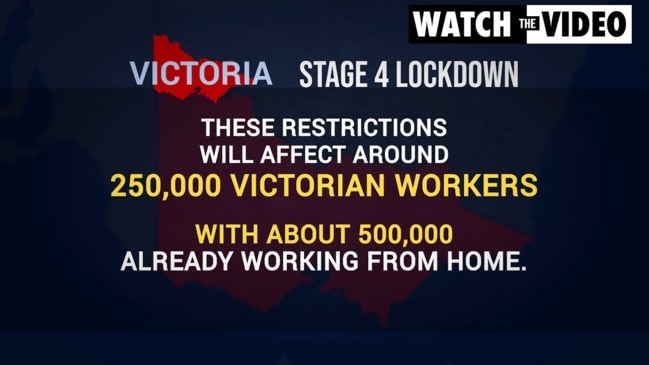

Myer has again closed all its Melbourne stores, in line with the state government’s stage-four restrictions.

Separately on Tuesday, Scentre — the owner of all Westfield shopping centres in Australia — warned the value of its properties was likely to have fallen 10 per cent in the six months to June.

“This is principally due to the estimated impact of the COVID-19 pandemic,” it said in a statement lodged with the ASX. Many tenants temporarily closed during the period and sought rent relief.

Shopping centre owners are expected to take further hits to property values this half as tenants look to cut back on spaces or pay less rent.

Analysts at investment bank UBS said structural headwinds in retail were already factored into the share prices of shopping centre companies, but substantial risks remained.

“With minimal long-term leasing deals being executed, short-term cash flows will remain under pressure and a second wave adds to the increased uncertainty,” they said in a research report for investors.

Scentre shares fell 2.3 per cent, or 4.5c, on Thursday to $1.92.

Shares in Myer, which announced its agreement with lenders after the market closed, had fallen 0.5c, or 2.6 per cent, to 19c.

with THE AUSTRALIAN