Melbourne man loses $700k, others lose $500k, $200k and $160k to ‘sophisticated’ scam

The Melbourne dad got a “sinking feeling” in his stomach when he realised he’d given his $700,000 fortune to “clever” scammers.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

A group of “sophisticated” and “well-resourced” fraudsters are conning highly-educated and financially savvy Australians out of their life savings by posing as investment arms from some of the country’s biggest banks.

Four victims – that news.com.au knows of – cumulatively lost $1.56 million, with most now facing financial ruin.

The scammers used legitimate business numbers confirmed by ASIC, employed receptionists to man phone lines, created complex website portals and paid back dividends to maintain the charade.

One man, Melbourne-based Andy*, was conned into handing over $700,000 in March in the belief he was buying government bonds with an ANZ entity called Capel Court.

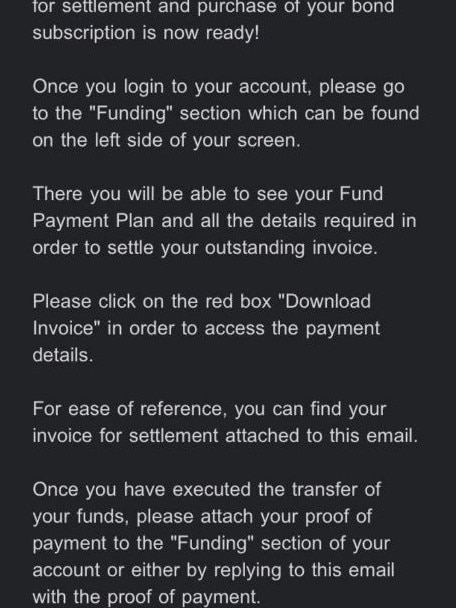

Also that month, Robert*, an accountant, gave away $160,000 to the same investment group.

Another victim, Gold Coast former team manager Bardhold Blecken, transferred $200,000 into a Barclays Bank term deposit that turned out to be fake. Mr Blecken has no savings left; he and his wife must now subsist on the age pension.

And last month, news.com.au reported on NSW schoolteacher Jody Bridges and husband Corey who put $500,000 they had made from a property sale into a so-called Capel Court bond scheme. Their funds – and the website – have since disappeared.

“They will do it again if they’re not behind bars, these guys are clever,” accountant Robert, in his late 40s, warned.

Want a streaming service dedicated to news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Andy, Jody and Robert all fell for the Capel Court fake bond website despite doing their due diligence in what is a scam that they claim anyone could fall for.

For Andy, he and his wife had recently sold their property and they had $700,000 in their pocket. They were looking to put the money somewhere safe until they decided to re-enter the real estate market.

And so the mum and dad – who have adult children – came across Capel Court, a website that offered government bonds with slightly higher return rates than others they’d seen.

“I inquired, then I got a phone call from [someone called] Oliver James, he had a British accent,” Andy recalled.

This man with a British accent is a recurring presence among all victims, using multiple aliases including David Jones, William Hughes, Ben Davis, Jacob Price and of course Oliver James.

After researching the company, Andy looked up Capel Court’s Australian financial services licence and its Australian Company Number (ACN).

“They all checked out,” he said.

The problem is there really is a Capel Court bonds company that ANZ owns – but this wasn’t it. The scammers had stolen the company’s credentials.

After several weeks, he decided to invest his money, selecting the Commonwealth Bank Bond and the Sweden Treasury Bill bond.

He even got his niece, who works in the financial services, to check everything. The International Securities Identification Numbers (ISINs) he was given for the bonds were correct as those bonds really do exist.

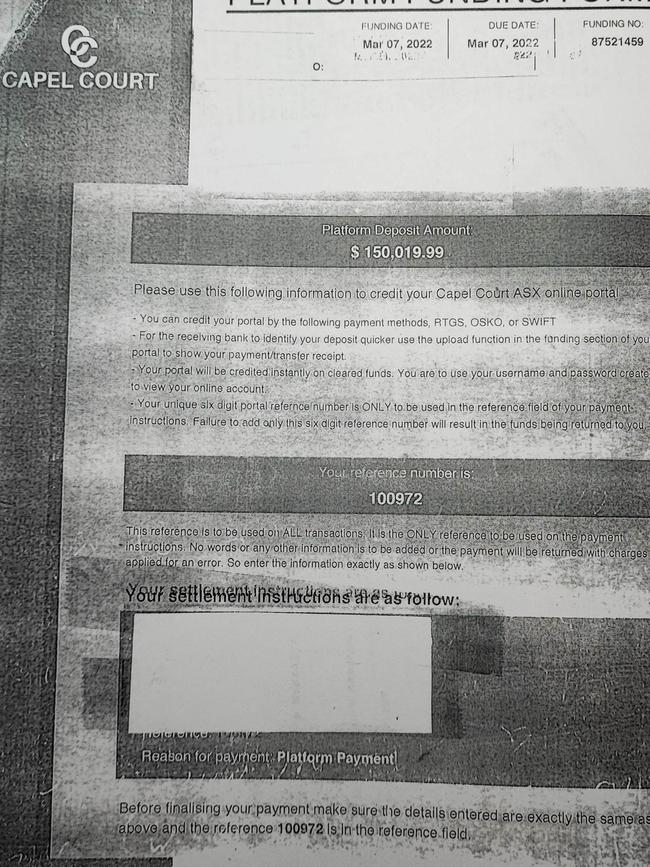

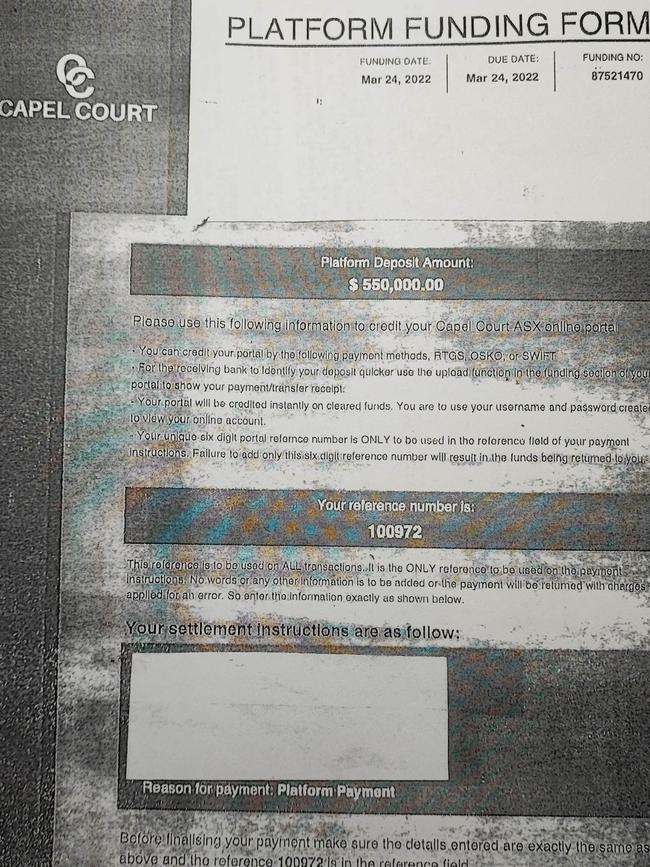

On March 6, he transferred $150,000 to buy the Commonwealth Bank Bond and then nearly three weeks later, shelled out another $550,000 to buy the Sweden Treasury Bill.

Have a similar story? Get in touch | alex.turner-cohen | @AlexTurnerCohen

Everything appeared to go smoothly, with the funds appearing in Andy’s account on the website portal and the scammers keeping in touch after his transfer.

In fact, he was so certain of the investment’s legitimacy that he recommended Capel Court to his sister-in-law who poured $200,000 into the scheme.

However, her bank warned her it might be a scam and she was luckily able to recover all her funds.

“Even then [after his sister-in-law’s warning] I was very convinced that it was a genuine investment,” he said.

Only when his dividends weren’t forthcoming on April 18 did he think something was amiss.

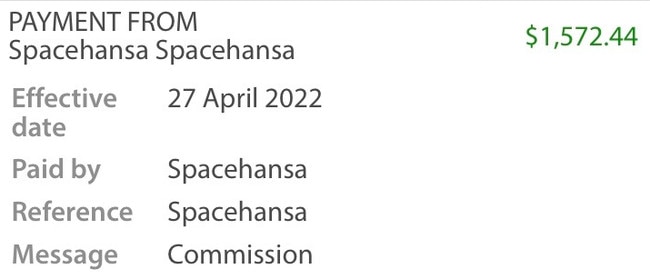

“Eventually they managed to send me the dividends of $1500 to make me think it was real,” he said.

But looking at the transfer, he knew it was illegitimate. Instead of appearing on his bank statement as coming from Capel Court, they had been funnelled through a company called Spacehansa.

By April 22 he’d reported the scammers to his bank and on April 29, he lodged a police report. It was over by then.

“The bank said ‘there’s no money to be recovered’, my heart literally sank,” he added.

These scammers even ripped off Robert, an accountant, to the tune of $160,000.

“I’ve got a finance background, I’m an accountant, that’s why this is a bit embarrassing,” he said.

With a term deposit of theirs maturing, Robert and his wife, in their late 40s, were looking to invest their money for 18 months until they could put it towards purchasing a property.

“I wanted something low risk, I wasn’t looking for super returns or ridiculous profits,” he said.

In February, he found Capel Court, an entity he’d heard of before.

“I was asking fairly technical questions, they knew the answers, I suspect they spent quality time in a financial institution,” he said.

The scammers confidently answered all his questions including how to hedge interest rate risks, how he could pull out his bond early and what the penalty would be.

“It wasn’t just a shallow conversation, that’s what lulled me into that sense of security,” Robert added. “It was really well thought out…It was quite a set up.”

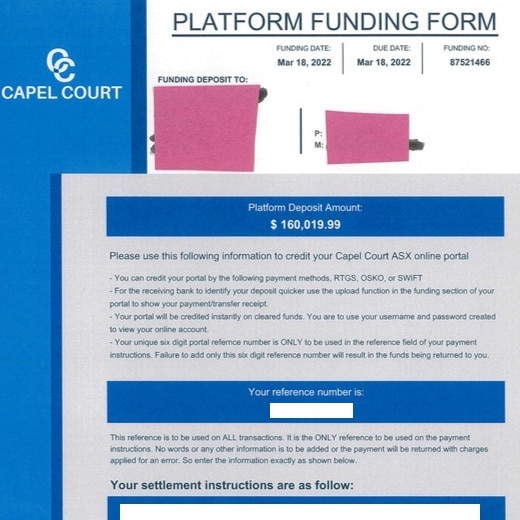

He was “conscious” that he was only communicating with one person – a British man called David Jones – on their mobile number so he called the office number and it went through to reception. He also got a call from a Sydney-based landline which “reaffirmed confidence” because he knew they had an office there.

On March 18, he transferred $160,000 in one transaction.

“The deposit went in, the online portal all got updated to reflect my bond, everything was still working fine two weeks later,” Robert said.

Afterwards, the scammers stayed in touch and even informed him they wouldn’t be working on a public holiday.

“They would not be answering calls, it would be a complete office shut down, it gave me some confidence,” he said.

“At that point I logged onto the portal and it was still there.”

However, after news.com.au’s article last month, the website vanished.

“I saw it [the article] and that’s when I panicked,” he said. “It makes me sick to my stomach.

“These are Australian people, educated in Australia, using the Australian financial services system to rip off Australians.”

Courtney and Martin almost invested their life savings into Capel Court when a gut feeling warned them something was off.

A registered nurse from Western Australia, Courtney had squirrelled away $50,000 and thought Capel Court would be a good way to invest after finding the website in mid-April.

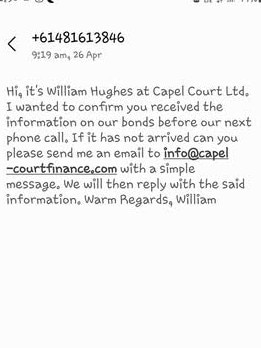

The man she dealt with had a British accent and went by the name William Hughes.

After several weeks of back and forth and due diligence, she was about to transfer her money over when her mother said, just as a precaution, to pass the information onto her financial planner.

Here, the financial planner looked up the name William Hughes in a database for Australians trading with financial services licences and it came up empty.

“I was about two days out from transferring over $50,000 which was my current life savings,” she told news.com.au.

While Courtney hadn’t handed them any money, she was now concerned as she had given the scammers 100 points of ID.

“I was so terrified and trying to protect my identity,” she said. “I didn’t want him to know I knew it was a scam [as] that gave me more time to block any loan requests.”

It was the same for Queenslander, Martin.

“My wife and I were contacted by the same organisation and went partially down the track of setting up an account,” he told news.com.au. “Our concern at the moment is identity theft.”

A British man called Jacob Price took them through all the steps to invest with Capel Court but in the back of Martin’s mind, alarm bells were ringing.

They were looking to buy $25,000 worth of bonds when all other banks had set $50,000 as the minimum amount to invest.

To top that off, Martin was in the middle of filling in the online form when the website crashed.

Despite that, William rang him acting like the form had gone through, making him suspect it was a scam.

“We got to the point where I’m not sure who ghosted who,” he said.

Anyone concerned about their ID security should contact IDCare, a free Australian service that can track and reduce identity theft related crimes.

Same scammers pose as Barclays Bank

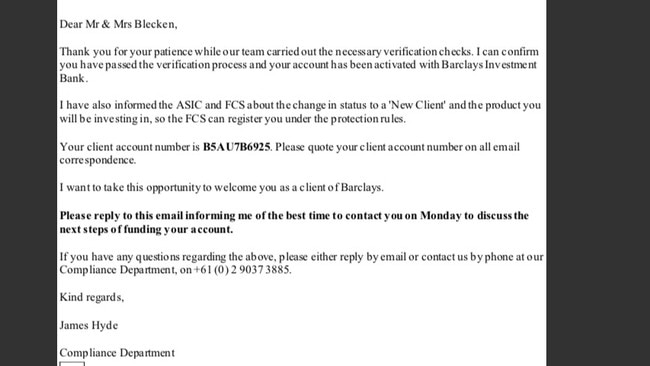

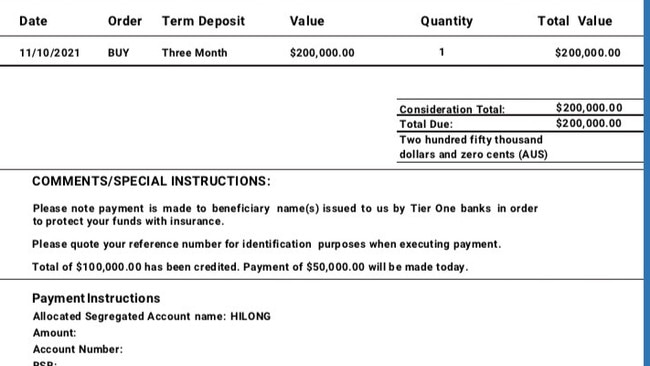

The scammers aren’t just masquerading as Capel Court; half a year earlier, retiree Bardhold Blecken and wife Antje lost $200,000 believing they were investing in a Barclays Bank term deposit.

In September last year, the Gold Coast couple, in their 70s, were contacted by a British Capel Court employe called Ben Davis.

When news.com.au compared mobile numbers, it was 0481 613 846 – the same one used by William Hughes in the Capel Court scheme.

Mr Blecken, who is paralysed on the left side of his body because of a stroke, said they had sold a townhouse and had $200,000 leftover.

“I had a term deposit account at Suncorp, they promised me 0.5 per cent interest, but when it matured they only gave 0.45 per cent. That made me really angry. I thought I’d look for a better opportunity,” he told news.com.au.

It was here he found that Barclays Bank was offering between 1 and 4 per cent per year in a term deposit.

A month later, in October 2021, he transferred $200,000 in four instalments of $50,000.

After the first two transactions, the bank suspended his account believing the activity was suspicious but he assured them it was his doing and they unblocked the account.

But a week later, the receiving bank, ANZ, told Suncorp they believed the account was fraudulent.

“By then it was too late, the money was transferred. [It was] too late to recover,” Mr Blecken said. “They wrote me a letter saying there was no possibility of getting it back.

“Emotionally it was a bit hard, we both get the age pension now.”

Last month, news.com.au spoke to Jody and Corey Bridges, a NSW teacher and landscaper conned out of $500,000 by the same scamming syndicate.

“This could happen to anybody,” the distraught mum-of-three told news.com.au at the time. “Pretty sure I’m almost f***ing bankrupt.”

She also dealt with a British scammer going by the name of William Hughes.

“When I found out it was a scam it was gut wrenching,” Ms Bridges said. “I would never ever forgive myself … the guilt I have to live with.

“I could never work enough to ever repay that.”

When she finally realised they were scammers, she called them back and they turned nasty, swearing at her and threatening her family, telling her the name of her oldest child and saying they knew where she lived.

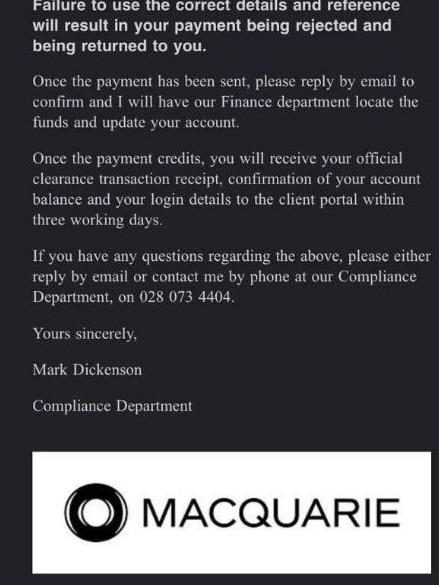

Last month, news.com.au reported on Melbourne widow Jacomi Du Preez, who lost $760,000 from the life insurance payout of her husband in an elaborate Macquarie Bank term deposit website that turned out to be fake.

Luckily, Ms Du Preez realised it was a scam within a day and was able to recover all her money.

It’s likely she was targeted by the same group as she dealt with a “slick” man with a British accent called Mark Dickinson.

Her funds had been channelled through instant payment systems and cryptocurrency exchanges, the same platforms that the Capel Court syndicate used to move money.

These particular scammers are fans of rapid payment platforms like Cuscal, Money Tech/Monoova and also cryptocurrency platforms including Binance, TechMarket AU/ED Australia and ElBaite.

They have also used bank accounts through the Commonwealth Bank, ANZ, Citibank and NAB to channel money. It’s understood many of these accounts are under investigation.

How to spot investment scams

Investment scams have “exploded” in the last two years against the backdrop of Covid-19, according to a cyber security expert.

Low interest rates have made Aussies look elsewhere to put their money and scammers are all too happy to oblige.

So far in 2022, Australians have collectively lost $157 million in investment scams, according to the ACCC’s Scam Watch.

“We have a horrible habit of victim shaming. Yet this is the scammer’s job. They pay their bills by scamming,” Nick Savvides, Chief Technology Officer for APAC at Forcepoint, told news.com.au.

“They know what buttons to press, what emotional hooks to press, what technical things to use, they have refined it to an art form.”

He said the Capel Court scam was so “sophisticated” and “well-resourced” that it was likely they had a group of at least 20 people working together to steal large sums of money from Australian victims. The money has likely ended up overseas.

There are ways to spot investment scams, he said, which includes calling numbers independently, checking everything with a financial planner and insisting on a face-to-face meeting.

“Never go to a website that they [the scammers] control,” Mr Savvides explained. “Find the website of the organisation independently, search for a website on Google, don’t follow any links on emails they sent you, don't trust phone numbers they give you, look them up on the bank or financial institution’s main website.”

Investment companies have to lodge a Prospectus on the ASIC website outlining how they can ensure financial security for potential investors, which means the Prospectus the scammers give you won’t match with the real thing.

“If the scammer is providing a Prospectus search for it on ASIC Offer Notice Board,” Mr Savvides explained. “They’ll give you a very detailed Prospectus, they’ll make it look really good, check everything matches an existing offer.”

ASIC also lists companies you shouldn’t deal with as well as naming and shaming fake regulators or exchanges.

“If you’ve been asked to transfer to different destination accounts, that’s a sign that mule accounts have been shut down,” he continued. “An investment bank will only ever ask you to put money into a single receiving account.”

He also said to insist on coming into the office at least once to check it out.

“There are scammers who will meet you face-to-face, but the chances of being caught are much more likely. If they’re always giving you an excuse [not to meet] become very, very suspicious.”

What to do if you have been scammed

“Do not confront the scammer, it will only work against you, they’ve got nothing to lose,” Mr Savvides continued.

Instead, he encouraged someone who thinks they have fallen for a scam to report to the Australian Cyber Security Centre (ACSC) and their bank.

“Act quickly, that will maximise your chances of reducing any further losses, and maybe even getting some of your money back,” Mr Savvides said.

“My top tip – even if you are slightly suspicious, do not ignore that feeling. It doesn’t matter how down the path you’ve gone, the faster you react the better it will be for you.”

Police investigation

Police confirmed to news.com.au they had received reports about this particular group of scammers.

NSW Police wouldn’t comment as investigations are ongoing while Queensland Police said they were not involved in any joint investigation with other state departments.

A spokesperson for Victoria Police said they were “working through a number of individually reported cases relating to an investment scam.

“The process is ongoing however we understand the cases have various links to other states and will work with our law enforcement partners where applicable.”

A person in Melbourne might have some connection to the fraudsters and Queensland Police told one victim they believe it is a Sydney-based group of scammers.

Banks respond

In a statement, ANZ said: “We are aware of this latest bond scam, which is a particularly sophisticated operation that has unfortunately defrauded some people of their money.

“ANZ is assisting NSW Police with its ongoing investigations into the matter and we are working through any useful information that may help.”

A Suncorp spokesperson said: “We know financial loss and scams are deeply distressing for people and we do everything we can to protect customers. Due to privacy obligations, we are limited with what we can share.

“However, in this instance, we detected suspicious activity on this account and locked it until we had spoken to the customer who confirmed authorisation of the transactions.”

On their website, Barclays Bank said it was aware of scammers using fake marketing materials posing as them.

“Barclays would like to remind the Australian public that it does not offer term deposits to retail customers, or any other retail banking or personal investment products, in Australia and has no connection to this term deposit offering,” they said.

*Names withheld over privacy concerns

alex.turner-cohen@news.com.au

Originally published as Melbourne man loses $700k, others lose $500k, $200k and $160k to ‘sophisticated’ scam