Australian iron ore price up despite China’s move to scrap imports

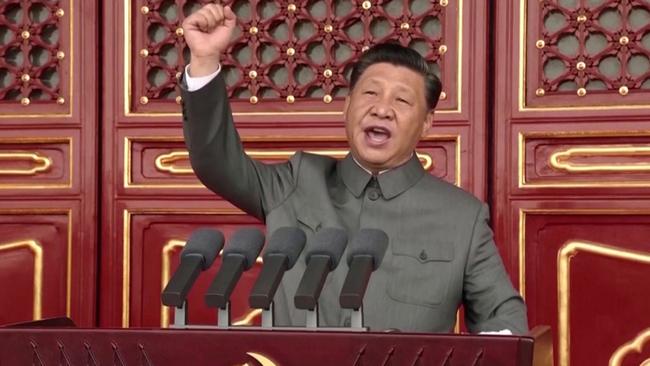

China’s brutal tactic against Canberra has backfired spectacularly, with Australia holding firm and continuing to reap the rewards.

Markets

Don't miss out on the headlines from Markets. Followed categories will be added to My News.

Australia’s iron ore prices continue to skyrocket as the nation cops ongoing threats from the communist nation.

At market close on Monday, iron ore was selling for a nearly record price of US$217.33 (289) a tonne, smashing through its $US200 a tonne mark.

Australia’s iron ore has been topping charts despite China vowing to bring down the cost of the popular export in May.

The economic powerhouse claimed Australia was “profiteering” off excessive iron ore prices, and threatened to wipe off $32 billion from our economy by buying less.

However, the move has backfired spectacularly for China.

RELATED: Aussie item China can’t get enough of

RELATED: China and Taliban forge ‘friendship’

Iron ore reached an all-time high of $US237 ($A312) a tonne on May 12 this year.

On Monday, the number wasn’t far behind, coming in at US$217.33 and causing mining companies to rise on the ASX 200 Index.

BHP Billiton lifted 3.2 per cent to $51.05, Rio Tinto was up 1.75 per cent to $127.6 and Fortescue Metals experienced a 3.3 per cent rise to $24.66.

Meanwhile, Mineral Resources Limited rose a whopping 4.2 per cent, reaching a record $59.77.

Australia’s biggest iron ore competitor, Brazil, has struggled to export due to disruptions caused by Covid, allowing Australia to reap the rewards.

A raw material used for steelmaking, iron ore topped $100 billion for Australia in the last financial year, but with the boom in price it is expected to push the total up by nearly 50 per cent for 2020-21 compared to the previous year, revealed a government report.

Mining and energy exports is expected to rake in $310 billion this year, according to estimates from the Department of Industry, Science, Energy and Resources.

This beats a $296 billion forecast made in March, a rise of five per cent.

The valuable steelmaking ingredient is by far Australia’s biggest export, and a whopping 60 per cent of it is bought by China for its mills.

Late in May, Chinese departments held meetings where they promised economic “pain” in Australia for “excessive speculation, price gouging and other violations” that they say helped lift iron ore prices.

The China Iron and Steel Association soon announced that the communist country would cut its steel capacity by 236 million tonnes by 2025, to create less demand for steal and therefore bring down prices.

“Among the most affected could be iron ore exports from Australia, which has benefited massively from the sky-high prices in its main export – emboldening officials in Canberra to continue on their relentless provocation against China,” Chinese media mouthpiece, The Global Times, said at the time.

“While China’s reliance on Australian iron ore will likely continue in the foreseeable future, despite its efforts to diversify sources, sharp drops in iron ore prices would mean heavy losses in export revenue for Australia, which is already seeing declining trade with China in areas such as wine and seafood.”

It warned this could translate into a loss of over $32 billion in extra revenue for Australia.

“If prices fell from about $200 per ton last week to about $60 per ton during the same time last year, losses in revenue could have been over $32 billion,” the paper stated.

However, as iron ore prices indicate, this is so far not the case.

“As long as demand globally remains strong (including China) and markets are tight, we think it is unlikely China’s authorities will be able to push prices down on a sustained basis,” the Bank of America said.

Originally published as Australian iron ore price up despite China’s move to scrap imports