Fresh warning bell for Aussie economy

A fresh warning bell is ringing for the Aussie economy, with one analyst saying the country has entered a “flat patch”.

A fresh warning bell is ringing for the Aussie economy, with one analyst saying the country has entered a “flat patch”.

Australia’s biggest bank has delivered a sharp warning about the Reserve Bank’s shock decision to hold interest rates and what it means for Aussie households.

Australian savers are barely breaking even after inflation despite the Reserve Bank shocking markets and holding the cash rate.

Huge tariffs flagged by US President Donald Trump on copper and pharmaceuticals added to the ASX woes during Wednesday’s trading.

While mortgage holders will be cheering on lower rates, Australian savers will once again get smashed by the latest RBA announcement.

A major Australian employer has paused operations, leaving hundreds of workers in limbo, as President Trump’s tariffs wreak havoc.

Australia’s sharemarket dipped after setting a 50-day high, with growing unease over US spending plans sparking a cautious turn among global investors.

A new record high for Australia’s largest bank as well as strong gains in the energy and healthcare sector helped drive the share market to a three-month high.

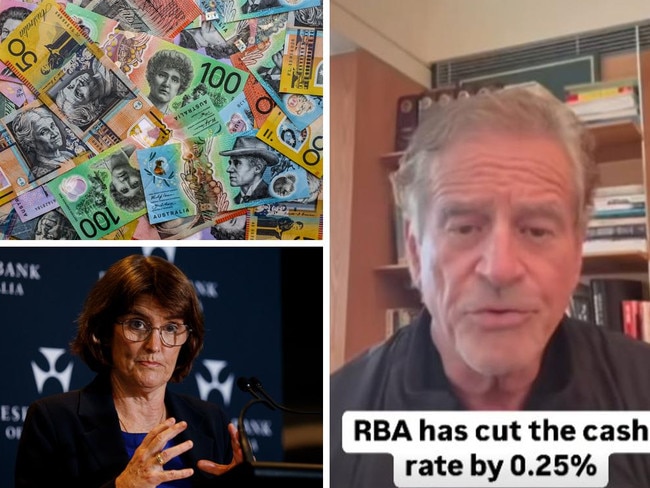

Aussie entrepreneur Mark Bouris has made a huge call on the future of rate cuts for the year, after the Reserve Bank cut the official cash rate by 25 basis points.

Aussie entrepreneur Mark Bouris has made a huge call on the future of rate cuts for the year, after the Reserve Bank cut the official cash rate by 25 basis points.

ANZ has warned Aussies to watch out for scammers using the RBA cash rate decision to rip off homeowners.

ASX investors have kept the ASX winning streak alive during Friday’s trading thanks to a surge in property and healthcare stocks.

A surge in the banking sector on the back of better than expected employment figures has helped drive the ASX200 higher during Thursday’s trading.

Australia’s share market closed higher for the sixth consecutive trading session, after seesawing throughout the day, on the back of a strong bump in energy and technology stocks.

Original URL: https://www.heraldsun.com.au/business/markets/australian-dollar/page/9