Aussie ‘Crypto King’ Fred Schebesta slams nanny state overregulation for killing innovation, calls for a Trump-style change

Australia is paralysed by overregulation that’s killed innovation and ‘Crypto King’ Fred Schebesta thinks the “nanny state” needs a Trump-style U-turn, and fast.

Markets

Don't miss out on the headlines from Markets. Followed categories will be added to My News.

Australia is suffering through a long and crushing innovation drought, and tech entrepreneur Fred Schebesta blames “violent” overregulation for turning the country into a nanny state.

And the ‘Crypto King’ thinks a Donald Trump-style war on red tape is what’s needed to turn the tide and help people “hope for prosperity” again.

Schebesta, who co-founded financial comparison website finder.com.au almost two decades ago and has made a fortune on cryptocurrency, points to his run-in with the financial watchdog as a perfect example of government oversight gone mad.

In 2022, the Australian Securities and Investments Commission sued him in the Federal Court over his Finder Earn product – a digital wallet that converted deposited Aussie dollars into cryptocurrency and offered up to six per cent interest in return.

Its lawsuit alleged the company was operating without a financial licence and exposing customers to the “risk of harm”. The case was thrown out.

“Going out and suing companies and people for cryptocurrency businesses, when there’s no law, is like suing the Wright brothers before they have a pilot’s licence,” Schebesta said. “It’s like the horse industry suing Henry Ford.”

The government immediately appealed. That was in April last year and Schebesta is still waiting for an outcome.

The Coalition has vowed to be a “friend” to crypto investors should it win the election, echoing the language of President Trump, who has ended the Biden Administration’s war against the sector in his first few months back in office.

“I think it’s refreshing,” Schebesta said of Trump’s approach.

“It gives hope for innovation and prosperity for the future. Those things were getting crowded out for a long time. In America, right now, you feel hope. You feel good about the future.

“Australia needs that. We are lost in the sea right now. We’re shipping minerals … what else? At least have some policy to potentially allow innovation. There’s no prosperity-driven growth mindset.”

From sceptical to ‘all-in’ on crypto

It was while in New York on a work trip in 2016 that Schebesta first became aware of the deafening buzz surrounding Bitcoin.

“I had a few people really pressing me on it and I thought, fine, I’ll go figure out what’s happening with this thing,” he recalled.

The fact cryptocurrency encapsulates finance, technology and marketing – three areas the entrepreneur loves, and on which he built finder.com.au – he was instantly intrigued.

“I studied it and found it a really interesting thing.

“It was a lot to take in. A deep hole of information. What is money? How does it get made? What is currency? What’s a mint? What backs up money and makes it valuable? What’s scarce and what holds value?

“And then, what are the challenges of digital money? What protects it and why can’t you just copy and paste it? What are the economics that surround it?”

The notion of decentralised finance is what really grabbed him, as well as the promise that crypto could blow open the world of banks, borrowing and lending and make it more transparent.

Schebesta has described Bitcoin as “the people’s money” in the past – and he believes it, telling news.com.au has “democratised” investment and risk.

Making a motza

Not long after doing his “due diligence” and deciding crypto was a worthy bet, Schebesta bought a pile of Bitcoin – he won’t divulge how much – at about $6000.

To put that in perspective, at the time of writing, Bitcoin was trading at a staggering AU$123,000.

Over the past nine-odd years, he has sold some and invested in other coins, taking a haircut on a few duds. These days, he prefers to buy and hold.

“I’ve been through three ups and downs. We’re in an up right now, so that’s good. I’ve seen it recover, and I’m like, wow. Wow. What a resilient thing.”

Schebesta wouldn’t reveal how much money he has invested in crypto – “I never feel comfortable talking numbers” – but pointed out his interests extend beyond trading.

“What I did was build a lot of businesses in crypto. Finder has a big crypto place. We built an over-the-counter desk and we sold that. Crypto to me has been multidimensional. There was some white space and we were able to go in and really fill that.”

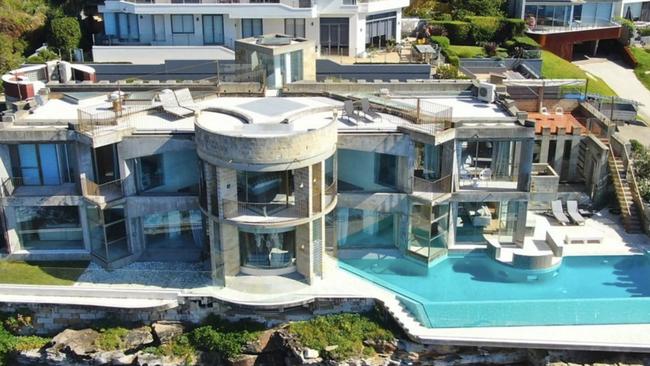

By the start of 2021, Schebesta had done so well that he bought himself a clifftop mansion in Coogee in Sydney’s eastern suburbs, christening it the ‘Crypto Castle’.

The stone and concrete monolith, designed by Renato D’Ettorre, was snapped up for a smidge under $17 million.

A prominent real estate figure told news.com.au it could now be worth about $25 million.

Finder.com.au, with its associated businesses, has a reported value of $650 million and Schebesta’s personal net worth is estimated to be upwards of $300 million.

A ‘violent’ backlash

The way governments, regulators and the financial sector establishment have treated cryptocurrency over the past decade didn’t necessarily take Schebesta by surprise.

But the attacks have been particularly “violent.

“People are protecting the way they do things. That’s the way it works and it’s how they make money. Everything else is wrong and so they want to shut it down.

“There’s a new financial system. That’s [sparked] a violent reaction. Some of the objections and arguments … it’s fascinating. They’re scared and fearful.

“When the stock market started out, it was the wild, wild west. All sorts of things went down. And yet, the government didn’t come out and sue everyone.”

Those who are concerned about cryptocurrency argue that it lacks regulation and a proper framework to protect consumers.

Schebesta said he’s inclined to agree.

“I gave testimony in the Australian Parliament about how we should regulate crypto,” he said.

“I’m the guy who spoke about how we can regulate. I’m not some rogue pirate trying to steal gold. I’m here to work with them, together. The response was to sue my organisation in Federal Court.”

Law enforcement agencies across the globe have also warned that cryptocurrencies, the trading of which is virtually anonymous and untraceable, facilitates all manner of major crime, from drug trafficking to child exploitation and modern slavery.

But Schebesta believes those kinds of nefarious uses are in the minority.

“There’s a small 0.1 per cent of bad actors. You can say that about most things. You can say it about cash. Some interesting transactions are made using cash.”

Australia being left behind

On the one hand, the Commonwealth has approached crypto with negativity and a big stick, while on the other, it’s failed to bring forth any legislation to regulate it.

Instead, agencies are trying to jam investors into the narrow confines of the Corporations Act, which was passed in 2001.

“Bitcoin was developed in 2009,” Schebesta pointed out.

As a result, Schebesta said many investors and entrepreneurs have left the country and taken their money elsewhere.

“These are all taxpaying and law-abiding people. People who create business and industries.”

The abrupt U-turn in policy in America will see the country become “the capital of crypto”, he believes.

“Now it’s the world’s most prosperous crypto place.

“They’ve absorbed an entire industry. Again. They did it with movies, they did it with the internet, they’re doing it with space. They keep adapting and don’t take a fearful approach. They’re productive.

“Here? There’s no movement. There’s an unusual feeling in Australia, like an island mindset, where we all point fingers at each other and it kind of spirals into this paranoid, over-regulated finger pointing.

“Let’s go and take a step forward. I feel very passionate about Australia and its identity. I think we can move forward. Even if it’s the wrong first step, at least we’ve done something.”

‘People are fed up’

While it started as a place to research credit card interest rates and fees, finder.com.au has become a comparison powerhouse.

In addition to plastic, the website crunches the numbers on everything from health and car insurance to mortgages, mobile phone plans and superannuation.

Its popularity means Schebesta has a pretty good read on the temperature of the country’s financial fitness.

“Australians are really hurting right now. I mean, small businesses are hurting because people aren’t spending as much or going out a lot. People are looking for cheaper ways to do things. Their mortgages are eating massively into their lives.

“I think it’s going to cause a change in political parties. I think it’ll be a major catalyst. People are fed up and really hurting.

“They’re annoyed and they want to see prosperity. People are longing for growth.”

That’s part of the reason he’s launching his own interview show, aiming to uncover how people can build wealth in today’s digital-first economy.

Equally, he believes ordinary Australians are sick of governments being too involved in their lives, with the ‘nanny state’ dictating just about everything.

“This is an overregulated country. You drive your car down the streets and there are so many signs you can’t drive. It’s beyond anything.

“Whoever makes signs in this country must be printing money.”

That fear-driven control has paralysed much of the country, he added, and puts Australia at risk of losing its once-innovative identity.

“What exactly is the fear? Maybe people will create some prosperity and pay some more tax?

“Right now, I’m pretty bearish about Australia. There’s no movement. I think we need to move forward. Have a go. Even if it’s the wrong step, at least we’ve done something.

“When Christopher Columbus set off and sailed west, he didn’t fall off the planet. The earth isn’t the centre of the solar system.

“We don’t use that many stone tablets. We don’t pay many people in salt. We don’t trade slaves that much. It’s an evolution. Let’s move on from faxes and landline telephones. Let’s take a step forward.

“I feel very passionate about Australia and its identity. Let’s move forward.”

Nothing is without risk

There’s no denying that cryptocurrencies are a volatile investment.

In early 2021, Bitcoin hit a then-high of about AU$78,000 but had fallen to AU$46,000 within a few months.

It rallied again, hitting a then-peak of about AU$87,000 in November, before tumbling sharply and collapsing to AU$24,000 within 12 months.

Then it took off once more, climbing for 18 months before sliding again, then rebounding sharply and quickly.

In late January, the price of a single Bitcoin was running at AU$165,000.

“You know when you see those photos of roller-coasters with everyone freaking out and there’s one guy just like, sitting there calm – that’s what it feels like in crypto,” Schebesta said.

In the early days, Schebesta might not have been one of the screamers on the ride – but he might’ve had a slightly nervous look on his face.

“I think I was trying to pick the market to some extent. Now, I don’t think that way – it’s about buying and holding. That takes a lot of discipline, considering it’s so volatile.”

He’s not on his phone all day checking price movements of the various cryptos he has money in.

But don’t mistake that for a high appetite for risk.

“I want to be very clear that I experience risk, just like everyone else, but the way I manage it is just to get more and more and more information. Other people might see it as risky, but I don’t because I’ve done so much due diligence.

“It’s like if someone knows a company well. Warren Buffett does it – he knows a company so well that even people inside it don’t know it as well.

“If you’re trying to do it short-term, the crypto market is like a casino. I’m not a big gambler. I’m not a big risk-taker.”

Schebesta believes the cryptocurrency system is “a better financial system than the one we have currently”.

“I think the [current] financial system is a patchwork of things. We did our best, as best as we possibly could. It will continue on. I see them as working together.

“The new [crypto] financial system will slowly get into more and more everyday things until it becomes tightly integrated. No-one will care if it’s blockchain or not. The underlying technology is by the by.”

Originally published as Aussie ‘Crypto King’ Fred Schebesta slams nanny state overregulation for killing innovation, calls for a Trump-style change