‘Making things worse’: Fury over cigarette tax as inflation soars in Australia

Cigarettes are right near the top of the list of the fastest-rising prices in Australia – and it’s hurting all of us, even nonsmokers.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

Once again, inflation is out – and once again, cigarettes are right near the top of the list of the fastest-rising prices. It’s helping prop up inflation – and that affects all of us.

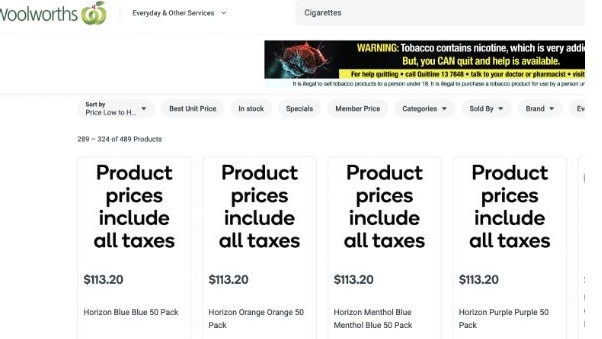

A pack of smokes costs $33.50 now, for the absolute cheapest 20-pack you can get at Woolworths or Coles. The most you can pay? $113.20, for a 50-pack.

The price keeps going up, and the reason is taxes. The tax per cigarette is now $1.366.

It went up at the start of September, even though it had already gone up at the start of March.

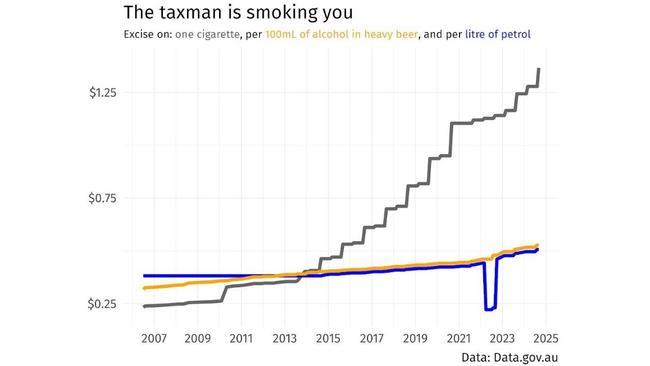

We call the tax on cigarettes “excise” and it is separate to GST, which is put on top.

Overall, excise on cigarettes is up around 10 per cent this year and up 67 per cent since 2019. There is excise on beer and petrol too.

As the next graph shows, the excise on a litre of petrol has gone up from about 40 cents to about 50 cents over nearly 20 years. In the same time, the excise on a cigarette has gone up from under 25 cents to over $1.35.

The tobacco excise will continue to rise next year. They increase it every year in line with wage inflation. Plus, there is a bonus 5 per cent increase scheduled for next year. So the excise could go up another 10 cents or so next year, adding another couple of dollars to the price of a 20-pack.

Revenue

Smokers are tipping a lot of cash into the federal budget – around $10.5 billion, according to the most recent estimates. It’s more than the $6.8 billion cost of treating smokers in hospital, and a lot more than the amount contributed by petrol excise.

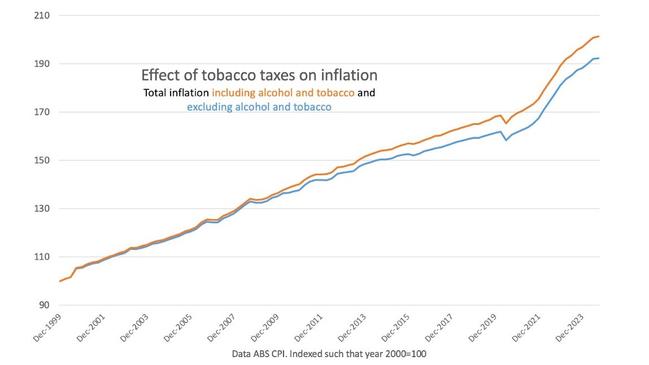

The other problem is that by taxing cigarettes more and more, we increase inflation.

I’ve made a chart to show just how high inflation for cigarettes is. The orange line shows how the actual level of prices has risen. The blue line indicates what would have happened if tobacco and alcohol were excluded. (The Australian Bureau of Statistics doesn’t provide data excluding just tobacco on its own, so we have to take out both alcohol and tobacco to see what it would look like without tobacco). The point is that in this time of rampant inflation, cranking up tobacco taxes is making things worse.

Obviously, you don’t actually face higher inflation yourself if you don’t buy cigarettes. Quitting smoking is like opting out of high inflation. But you might still be affected by the Reserve Bank of Australia putting interest rates up.

The RBA is trying to reduce overall consumer price inflation, and one of the reasons the price level is rising is tobacco.

Gangs and bombs

The idea is to get rid of smoking, and let’s be clear, I support that. I think smoking is stupid and bad. But when you put the tax up so high, it’s a bit like prohibition.

That was the era when America banned alcohol and organised crime sprang up to feed the nation’s taste for alcohol.

What we see now in Australia is that a pack of smoke is so expensive that normal people are willing to buy black market cigarettes. And organised crime is willing to supply.

When a pack costs $12 at the shops, there’s not much profit in undercutting the supermarket giants. But when a pack costs $50 at the shops, well.

Remember that tobacco and paper are very, very cheap to make, transport and sell. They store easily and don’t need to be refrigerated or kept food-safe. Anyone who has ever bought cigarettes in Asia knows the fair price of the actual product can be very low.

So if you can buy a pack of cigarettes for 30 cents wholesale out of Asia and sell it under the counter illegally in Australia for $20, the profits are huge.

Hence all the firebombing. All across Melbourne, tobacco stores are being burned down in the big tobacco wars. Organised crime is fighting for control of the market, and their weapon is fire. Over 100 tobacco shops have been burned in the last year.

It is in my view quite dumb to raise the price of cigarettes so high that you create a whole criminal industry. Because they rarely stop at one product – they spread out into adjacent products.

A tax on people who don’t deserve it

Rates of smoking have fallen as Australia attacks smoking on all fronts. But there is a hardcore group out there who haven’t quit. 12.2 per cent of men and 10 per cent of women still smoke, according to survey data.

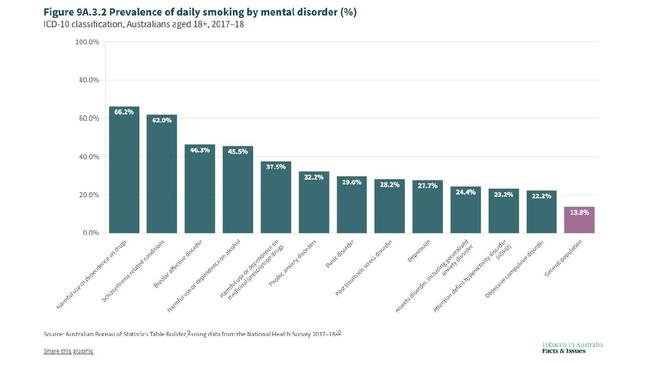

Smoking is addictive and some people can’t find a way to quit; smoking is also common among people with certain mental illnesses, as the next chart shows.

Over 60 per cent of people with schizophrenia smoke, and schizophrenia will affect an estimated one in 500 people in Australia in their lifetime. (Controlled scientific studies have shown smoking improves schizophrenia symptoms. One theory is they smoke because the nicotine makes them feel better). At some point, after everyone who can quit has quit, the tobacco tax becomes a tax on mental illness.

Dissuading smoking is good, but supercharging organised crime, taxing mental illness and putting a fire under inflation seems a lot less good.

Maybe it’s time to find ways other than taxes to dissuade people from smoking.

Jason Murphy is an economist | @jasemurphy.bsky.social. He is the author of the book Incentivology

Originally published as ‘Making things worse’: Fury over cigarette tax as inflation soars in Australia