Macau investor takes a crucial stake as Star Entertainment teeters near collapse

A mystery Macau-based businessman is continuing to lift his stake in Star Entertainment Group, increasing speculation investors are preparing for a break-up of the casino operator.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A mysterious Macau-based businessman is continuing to lift his stake in troubled Star Entertainment Group, increasing speculation investors are preparing for a break-up of the casino operator or an opportunistic takeover.

Wang Xingchun now holds 6.52 per cent of Star after buying 28 million shares on Monday for just over 11 cents each. Mr Wang has spent more than $30m amassing more than 186.3 million shares since September 2024.

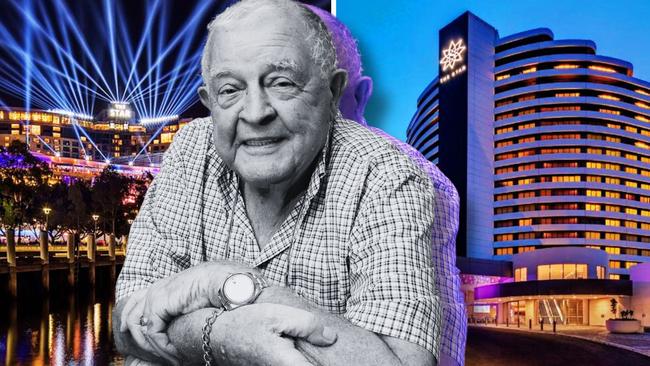

That makes him the second biggest shareholder in the company behind pub billionaire Bruce Mathieson, who holds under 10 per cent of Star. Far East Consortium International and Chow Tai Fook Enterprises, the Hong Kong-based partners in its Queen’s Wharf precinct, both have a 6.33 per cent stake. Star shares climbed 12 per cent to 14c on Tuesday morning.

Mr Mathieson told The Australian that he did not know who Mr Wang was, or why he was buying up a stake in the company.

Mr Mathieson said he also was not aware of any links between Mr Wang and Star’s Hong Kong consortium partners, but said if the Macau investor wished to increase his stake further he would require probity checks by Australian regulators.

“That can be difficult to get,” Mr Mathieson said. Mr Mathieson declined to comment on whether he would be interested in any assets of Star should it be broken up.

There has been speculation the Mathieson family would be interested in the company’s Gold Coast property. Bankers suggest Mr Wang’s voting stake could be exercised as a block with Star’s joint venture partners.

With Mr Wang, this represents 19.2 per cent, which is more than enough for a blocking stake or at least gives them a say in the event of an opportunistic take takeover of Star as it struggles with a serious cashflow crunch.

They could also call an extraordinary general meeting.

Several years ago, Chow Tai Fook eyed as much as 25 per cent stake in Star, although is thought to have gone cool over the deal.

The development comes as Star chief executive Steve McCann pleaded for more “time and support” to reset the company, saying “it’s complicated” but he is confident it can recover.

“For Star as a corporate entity to get through this, and for shareholders’ and creditors’ interests to be fully protected, and for our employees to have the job security they’re after, requires a meeting of minds of a significant range of stakeholders – it’s complicated,” Mr McCann said.

“So we need to have those stakeholders come together to deliver an outcome if we want to succeed.”

Mr McCann said “clearly we’re in difficult times at the moment and it’s very challenging for people to see beyond the immediate issues.”

“Suppliers, employees, a range of stakeholders are assessing the business on how the business is performing today, rather than the capability of the business in the longer term and we’re looking to reassure all of our stakeholders that we can navigate through this with the appropriate time and support,” he said.

Regulators and bankers are closely watch the ASX-listed gaming and hotel operation, with governments warning no more help would be extended to the teetering casino business.

Who is the mystery Macau investor in Star Entertainment?

Mr Wang, who gives his address as the luxury Windsor Arch high-rise project in the Asian casino enclave, bought his first lot of shares on September 24 for 25.7c each.

Star shares slumped more than 40 per cent last week after warning that it had burned through more than $100m of its dwindling cash reserves in just three months. The stock rose 13.6 per cent to close at 12c on Monday.

It has also emerged that Star’s attempt to raise almost $100m in asset sales to keep its doors open has taken a major blow.

The Australian understands that deals to offload the old Treasury Hotel building and adjacent underground car park in Brisbane’s CBD failed to get over the line just before Christmas.

Will a $79m cash crunch force Star to be broken up?

There is now increasing speculation investors are attempting to get a ringside seat to a possible break up of Star or opportunistic takeover.

The Corporations Act requires that the directors of a company must call a general meeting of shareholders on the request of shareholders with at least a 5 per cent stake.

One possible scenario in a break-up of the company would see Mr Mathieson pick up the Gold Coast property, with Blackstone, owner of rival Crown Resorts, taking Star Sydney.

Malaysian gaming giant Genting has been mooted as a possible buyer of Queen’s Wharf.

The company has already accessed half of a $200m financial lifeline put together late last year but there are growing doubts it can obtain the rest.

Mr Mathieson, whose family company owns 9.59 per cent of Star, said he would not be interested in putting any more money into the company until its financial future was clearer. He said the biggest issue remained a looming fine from Austrac for breaches of counter-terrorism and anti-money laundering laws, for which Star had provisioned $150m.

How did Star get to this dire point?

Star in 2024 announced it would sell assets in an attempt to raise much needed cash amid a worsening liquidity crisis that could force it into administration.

Star last September sold its interest in the Treasury Casino building to Griffith University for $67.5m.

The sale of the nearby Treasury hotel and carpark was expected to be completed in the second half of last year.

Both heritage-listed buildings were occupied by Star before its move to the new Queen’s Wharf precinct in August.

According to sources, an Australian company was in due diligence to buy the leasehold of the Treasury Hotel for about $45m but pulled out of the deal.

It is understood major pub group Oscars Group – which bought Luna Park in Sydney late in 2024 – pulled out of an earlier offer for the hotel. Oscars could not be reached for comment.

Sources said Brisbane-based syndicator Sentinel Property Group, which was in due diligence to buy the underground Queens Gardens Car Park between the hotel and old casino for $50m, also pulled out before Christmas.

“There were just too many problems with them (the buildings) and they wanted too much money,” they said.

Major issues exposed during the due diligence period were the age of the properties, shared infrastructure including electricals and services, the heritage listing and restrictive lease terms imposed by the state government.

Attempts to offload the buildings have faltered in the past. In 2021, ASX-listed Charter Hall announced it would pay $248m for both buildings and car park in a partial leaseback deal but pulled out two years later.

Star Entertainment chief executive Steve McCann has signalled that other assets that could be offloaded include the luxury Darling hotel properties on the Gold Coast and Sydney, as well as car parks and an event centre in Sydney.

Who else could buy Star?

Another possible bidder mentioned for properties in the troubled group include low-profile Brisbane hotelier Patrick Farrugia. Mr Farrugia on Monday declined to comment.

Mr Farrugia’s private company HDI-BB last year disclosed that in association with international partners it had approached Star with a turnaround strategy for its NSW and Queensland assets covering the casinos, hotels, entertainment, retail, and associated businesses.

Mr Mathieson last week said the troubled casino operator would either “go bankrupt or be bought” unless it could improve its finances in the coming months.

The company has already accessed half of a $200m financial lifeline announced in 2024, with growing doubts that it can obtain the second half.

Star said its available cash at the end of December had dropped 46 per cent to $79m – a reduction of $70m – from the previously reported position at September 30.

Morningstar analyst Angus Hewitt, in a note to investors, said at Star’s current cash burn the company would be lucky to make it to its interim results scheduled for February 28.

“Operating conditions are weak, with mandatory carded play and poor consumer sentiment,” he said.

“We now incorporate a 50 per cent probability that Star falls into administration, and equity holders are wiped out.”

— Additional reporting by Chris Herde

More Coverage

Originally published as Macau investor takes a crucial stake as Star Entertainment teeters near collapse