IOOF share price hammered as watchdog moves to disqualify top brass

Investors have savaged wealth manager IOOF, stripping more than $900 million from its market value after the banking watchdog moved to disqualify its senior leadership team from running superannuation funds.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Investors have savaged wealth manager IOOF, stripping more than $900 million from its market value after the banking watchdog moved to disqualify its senior leadership team from running superannuation funds.

Shares in the group plunged almost 36 per cent on Friday on the bombshell revelation that the regulator had launched legal action against five of IOOF’s seniormost leaders: its chair, managing director and three other executives.

It stems from claims aired at the financial services royal commission that IOOF used superannuation fund members’ own money to compensate them after an investment bungle.

IOOF BOSS GOT IT WRONG, SAYS APRA

IOOF FIXED BLUNDER BY FUND PAYMENT CUTBACKS

The Australian Prudential and Regulation Authority has begun Federal Court proceedings seeking to have the five banned from being pension fund trustees.

It claims the chair and four executives failed to act in the best interests of fund members.

IOOF shares plummeted 35.8 per cent on Friday — wiping $902 million from the group’s market value — to end the session at $4.60.

That is down 57 per cent from the $10.72 they were fetching at the end of last year.

The wealth adviser put out a statement saying it was “disappointed” with APRA’s action.

“IOOF believes that these allegations are misconceived, and it and its executives intend to vigorously defend the proceedings,” the statement said.

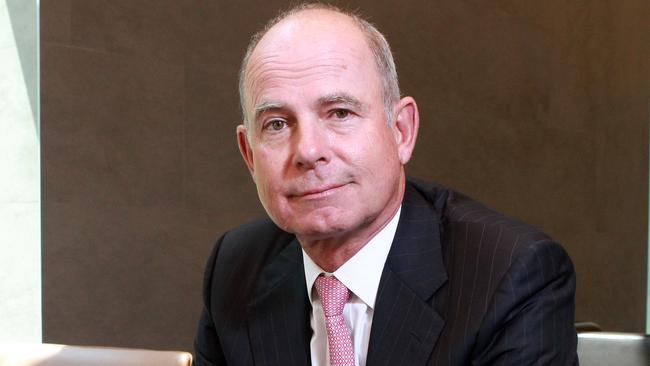

Facing disqualification proceedings are managing director Christopher Kelaher, chair George Venardos, chief financial officer David Coulter, general manager of legal, risk and compliance Paul Vine and general counsel Gary Riordan.

The banking regulator said that “if successful, the disqualification proceedings would prohibit the above individuals from being or acting as a responsible person of a trustee of a superannuation entity”.

It is also seeking to impose additional conditions on the company. IOOF has received a so-called show cause notice from the watchdog and must respond within 14 days.

Also on Friday, ANZ acknowledged the legal action clouded the planned sale of the bank’s superannuation business, OnePath, to IOOF for about $1 billion — a deal it struck in October last year.

In August, counsel assisting the financial services royal commission Michael Hodge, QC, explored the case of IOOF subsidiary Questor.

Mr Hodge revealed that, in 2009, a Questor-owned cash management fund accidentally paid $6.1 million too much into a super fund also overseen by Questor. The problem was detected in 2011.

To return the cash, Questor decided to reduce payments to the super fund over three years, but none of the 9000 super fund members were told.

A whistleblower then cast light on problems with the strategy of reducing distributions to the super fund. As a result, the IOOF board had to move to compensate some super fund members who were disadvantaged.

But the commission was told that, when super fund members were repaid by Questor, it came from the super fund’s reserves.

Mr Kelaher disagreed with the commission that he had used members’ money to pay them back.

The banking regulator on Friday highlighted that case as it took action, noting super fund members had been “compensated from their own reserve funds rather than the trustees’ own funds or third-party compensation”.

APRA deputy chair Helen Rowell said the financial services watchdog had sought to resolve its concerns with IOOF over several years and now felt it was necessary to take stronger action.

“APRA’s efforts to resolve its concerns with IOOF have been frustrated by a disappointing level of acceptance and responsiveness to the issues raised by APRA, which is not the behaviour we expect from an APRA-regulated entity,” she said.

“Furthermore, the individuals included in the proceedings have shown a lack of understanding of their personal and trustee obligations … and a lack of contrition in relation to the breaches.”