‘I didn’t know’: Tax trend blindsiding Gen Z workers

A 21-year-old full-time worker has taken to social media to ask if her tax return is “normal”, exposing a shocking trend among Gen Z Aussies.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Taxes might be one of life’s only certainties, but that doesn’t mean Gen Zers know how to pay them or even how the system works.

Katie Lee Spresser, 21, lives in Melbourne, has finished university and now works full-time in sales and marketing, but she’s baffled by taxes.

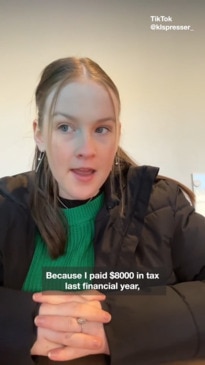

Ms Spresser posted on TikTok to ask everyone what they were getting back at tax time this year because she was confused by the small amount she’d been estimated to receive.

“I paid $8000 in tax in the last financial year, and my estimate says I’m only going to get $2500. I’ve never worked full-time before. Is that normal?” she asked.

The question hit a nerve with young people who commented to share they were also disappointed in their returns.

One complained she’d paid $16,000 in tax in the last financial year but still owed $5000, another shared she’d paid $12000 but still owed money back, and someone else said they paid $30,000 in tax but were only getting $81 back.

Gen Zers might have been disheartened by how much they were getting back from the tax office, but as someone pointed out, if you’re taxed correctly by your employer, you’re not “supposed to get a return”.

“I’m loving this comment section full of grown adults who have no idea how taxes work. $2.5k back is insane.”

“The fact that you’ve overpaid that much tax throughout the year is ridiculous. It’s not free money. It’s your money that you should have received, but instead, you overpaid to the government,” someone wrote.

Ms Spresser said she doesn’t understand tax well because she’s never been educated on it.

“I never really learnt about tax. I always knew it was something I had to pay and compulsory for anybody working to pay, but I never really knew how it worked,” she told news.com.au.

Beyond understanding she had to pay tax, she said she didn’t really understand where the money was “going” or “why people owed money to the government”.

“I didn’t realise you were supposed to owe nothing and receive nothing until I posted that video,” she said.

“I guess because I had always worked lots of casual jobs, where I was being taxed like crazy, I thought it was normal to get a heap of money back on your tax return each year.”

The young worker said she’s thankful that her lack of knowledge so far hasn’t led to any tax issues but she has been judged for not being more aware.

“I definitely got some funny looks when I told people I was 21 years old and didn’t actually know how a tax return worked,” she said.

People might be judgmental but ultimately young people aren’t being taught about tax in school and then are released into the workforce without any formal education around it.

“It is compulsory for everyone, so it definitely should be taught in schools. Growing up in Queensland, I never once learnt about how a tax return works or how much I should or shouldn’t be getting back each year,” she said.

“I haven’t once used Pythagoras’ theorem since high school, so I think the school curriculum should focus more on things that students are actually going to use outside of school.”

The 21-year-old also pointed out she’s not alone in her ignorance and she was “surprised” by how many of her fellow Gen Zers were just as unaware online.

In the end Ms Spresser went through an accountant this year to finalise her tax return because it was just too “hard” to do herself.

“Considering I only paid about $8000 in tax throughout the year, it was great to see I was getting about $2500 back. Even though I originally thought that wasn’t a lot, the people of TikTok definitely told me otherwise,” she said.

Sarah Megginson, a personal finance expert at comparison website Finder, said that young people shouldn’t be blamed for not understanding taxes because the system has let them down.

“I can’t say this often enough or loudly enough: Teaching kids everything they need to know about taxes should absolutely be taught more comprehensively in schools,” she told news.com.au.

“That context is everything and gives kids such a headstart when they start earning an income and paying taxes themselves. Teenagers are literally sitting in classrooms that are funded by taxpayer dollars, so it makes sense to start the conversation there.”

Ms Megginson deals with the kick-on impact of people needing to be taught about taxes in her work.

“So many adults are confused about taxes, what they owe and why their refund is or isn’t high, and it’s because we don’t know what we don’t know,” she said.

“If you don’t specifically study accounting, get taught by your parents, or have a personal interest in learning more about your finances and tax, you’re flying blind.”

Originally published as ‘I didn’t know’: Tax trend blindsiding Gen Z workers