Howzat! With Foxtel deal, DAZN on a quest to become Netflix of sport

The UK sports streaming operator has big plans for the way the world watches sport – and Foxtel is set to become a key part of this.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

In just over five years, little-known British sports streamer DAZN has moved from the sidelines with a grab bag of second-tier tennis and soccer matches to become one of the biggest players in global sports broadcasting.

And with a $3.4bn deal to acquire Foxtel, it has now planted itself as a major figure in Australia’s media landscape, controlling long-dated premium sport rights from AFL, NRL, cricket and motorsports.

Backed by London-based billionaire Len Blavatnik, DAZN has been compared to the ‘‘Netflix of Sport’’. By progressively snapping up the rights to global competitions now available in hundreds of countries it is on the way to becoming a one-stop shop of professional sport.

DAZN got its big break in 2018 when it signed a lucrative broadcasting deal with British promoter Matchroom for a middleweight boxing series based in the US.

It quickly started building up a portfolio of elite European leagues, with soccer now its most-watched sport. It has the global rights of matches from Spain’s LaLiga, Italy’s Serie A, Germany’s Bundesliga, as well as Japan’s J League and Europe’s Champions League. It also has a 10-year deal to broadcast the NFL football franchise outside the US.

And just weeks before the multibillion-dollar Foxtel buyout, DAZN made one of its largest rights plays in its short history.

It paid $US1bn to become the global partner to broadcast FIFA’s newly launched Club World Cup series. The competition will be broadcast free, supported by advertising, and is expected to have a global viewer reach into the billions. It will include names like Real Madrid, Manchester City and Paris Saint-Germain.

In locking up rights, DAZN has outmanoeuvred global tech giants including Amazon and Apple that have been coveting sport as a way to bolster their own streaming services.

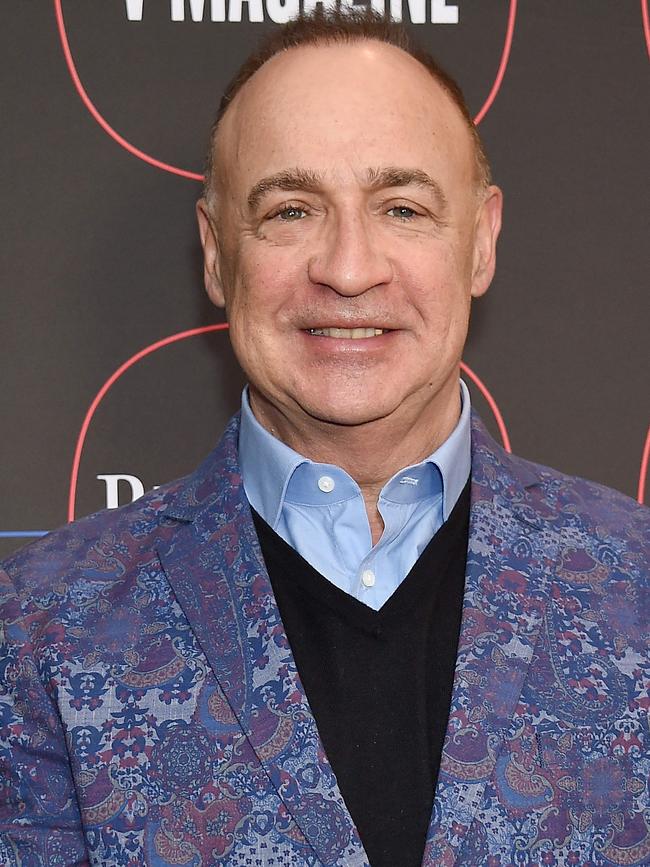

“We are building a global home of sport,” DAZN chief executive Shay Segev said in an interview.

“If you think about all the changes that happened in the last few years with the transformation of consumer behaviour to online and technology, especially in the media sector, there is an opportunity to provide a better experience and a global experience for sport fans.”

Segev said Foxtel made sense to DAZN because “Australia is one of the greatest market for sports”.

“We know how much Australian watch sport, more than any country around the world. Foxtel is a leader in the sport business in Australia. We felt that there is a very great alignment on the strategy as a sport led business.”

Segev sees the potential to take Australian sport, whether it’s AFL or NRL, to the global market to enhance the value for the clubs and competition. So too, Australians will be able to take their sports with them no matter where they live in the world.

DAZN has carved out a different viewer experience with chat boxes during events and a choice of commentators. It is also exploring gaming partnerships with some sports.

With the addition of entertainment streaming play BINGE and Foxtel’s drama and Hollywood library, it moves DAZN into a new market. However, Segev says entertainment has long been planned as a broader offering to keep consumers coming back, while appealing to viewers who aren’t following sport.

Blavatnik was born in Ukraine, then in the former Soviet Union, but lived in the US for more than 40 years, including studying for a master’s degree in computer engineering from Columbia University. He is now based in London, where he has been focused on building DAZN into a serious streaming rival.

While Blavatnik built his wealth in aluminium, oil and real estate, he made a splash in media in 2011 when he bought out US record label Warner Music Group from administration for $US3bn.

The buyout came when music streaming was in its infancy, and the value of back catalogues was about to take off. Blavatnik took Warner Music to a stockmarket listing four years ago, and it’s now valued at more than $US16bn.

He has invested heavily in the platform, spending billions funding rights deals and building out technology. He also brought Segev, the former boss of global gaming giant Entain, to drive growth and steer an eventual stockmarket listing. Foxtel is now a key part of this plan.

Foxtel first came onto DAZN’s radar earlier this year as the global streamer was eyeing off Optus Sport, with owner Singapore Telecommunications testing the market for its steaming service, which has the Australian rights to the Premier League and the FIFA World Cup.

This interest soon saw attention turn to Foxtel, given its larger subscriber base and long-dated sport rights across AFL and NRL, as well as its streaming entertainment business BINGE. That led to an initial conversation between Blavatnik and News Corp chief executive Robert Thomson.

As the global streaming market was heating up last decade with Netflix, Amazon and Disney entering the Australian market, both News and Telstra saw the need to radically change the Foxtel business model. Since its launch in the mid-1990s Foxtel was based around satellite broadcasting and a cable-based subscription service, but younger audiences were flocking to web-based streaming.

They invested heavily in exclusive drama and sports rights to deliver a more compelling offer, while launching streaming business to take the Foxtel offer to a wider audience.

This saw the launch of Kayo for sports content, and BINGE quickly followed. Today, both have about 1.6 million paying subscribers, rounding out Foxtel’s 4.7 million. Combined, this puts it on par with Amazon Prime in Australia.

Segev says “the transformation that Foxtel from a traditional pay-TV business to a digital business” was one of the standouts that made the business so compelling.

Foxtel chairman Siobhan McKenna led the transaction on behalf of 65 per cent owner News Corp. Foxtel’s junior partner Telstra was quick to give its support to a possible sale on the right terms.

Secret talks ran for months under the codename “Project Orange”, which was a nod to Foxtel’s long-established bright branding.

Excluding Foxtel, DAZN has more than 20 million global subscribers and combined the bigger group will have $US6bn in annual revenue.

News Corp mulled a possible stockmarket listing of Foxtel three years ago, in what would have been the biggest listed broadcaster on the Australian market. But News and Telstra opted instead to hold on to the business, given the rapidly changing media landscape.

The final sale price of $3.4bn enterprise value is much higher than investors had expected, reflecting the fundamental shift in Foxtel’s business towards a streaming and digital broadcaster, compared to a linear pay-TV operator with more limited growth options. As part of the sale News Corp and Telstra have taken a bet on the future growth of DAZN with 6 and 3 per cent stakes, respectively. News Corp will also have a board seat on DAZN. It is believed the two are also looking at potential tie-ups with New York-listed Fox Corp, which is led by Lachlan Murdoch and is behind Fox Sports in the US. Lachlan Murdoch is also chairman of News Corp, the owner of this masthead.

“Who says DAZN isn’t the sports streaming version of Netflix that can IPO in coming years – that’s an interesting time to come into a business that could be very large as an IPO in time,” said Angus Aitken, a director of Aitken Mount Capital Partners.

Foxtel CEO Patrick Delany, who will continue to run Foxtel under DAZN, said viewers were unlikely to notice any difference to their service but the move delivers scale to compete against the global streaming players and bring a better offer to Australia.

“I love the way DAZN is an innovator and wants to do a better job for consumers worldwide. That is exactly the way we think,” he said.

Originally published as Howzat! With Foxtel deal, DAZN on a quest to become Netflix of sport