Home loan rates: Why the big four banks are now unlikely to hike

GOT a home loan with a major bank? You may just have been spared a painful “out of cycle” rate hike, analysts say … and it’s all thanks to a surprise move by one of the big four.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

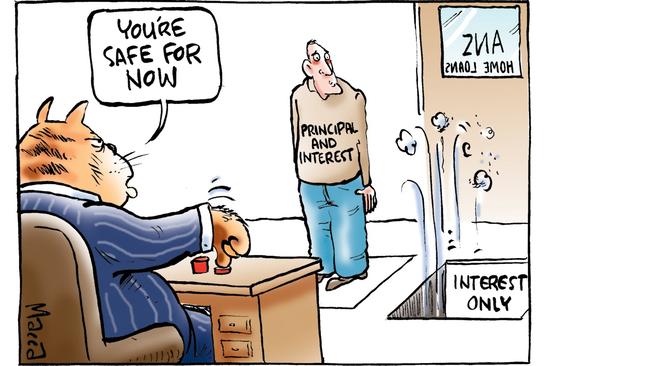

AUSTRALIA’S big banks are now less likely to hike interest rates on home loans despite rising funding costs, industry experts say.

Analysts say a move by ANZ yesterday to cut a discount variable home loan rate highlights a change in the dynamics of the mortgage market.

READ MORE: ANZ CUTS RATE IN SURPRISE MOVE

MORTGAGE STRESS AT RECORD HIGH, REPORT SHOWS

ANZ’s rate cut only applies to new customers, meaning its legions of existing mortgage customers receive no benefit.

But a team of analysts led by Jonathan Mott at investment bank UBS says it will now be much harder for ANZ to hike the rates that existing home loan customers pay.

“We believe it may be difficult for ANZ to justify offering deep discounts on front-book (new) mortgages, then subsequently reprice its back-book of existing loans as a result of higher funding costs,” Mr Mott said in a report for investors.

“We believe this would attract criticism from both customers and regulators as existing mortgagors would effectively be subsidising new customers.

“As a result we believe today’s announcement by ANZ makes back-book mortgage repricing by the major banks less likely.”

In the banking industry, the term “back book” refers to existing customers, while “mortgage repricing”, in this context, means rate hikes.

Mr Mott is broadly regarded as one of Australia’s leading banking analysts.

ANZ yesterday announced it was cutting the rate on its variable Simplicity Plus home loan — a no-frills mortgage product — by 0.34 percentage points to 3.65 per cent.

The lower rate is on offer for owner occupiers making principal and interest repayments, but only for new customers with a deposit of at least 20 per cent.

Mr Mott said that given the big banks were now less likely to lift rates without a cue from the RBA, this added to the profit and revenue pressure they would likely face over the next 12 to 18 months.

UBS had “a very cautious view” on bank shares as investments “at this stage of the cycle”, he said.

“Revenue pressures are intensifying”, Mr Mott said.

ANZ’s move to cut its no-frills loan rate for new customers comes after a succession of smaller banks hiked their variable home loan rates in recent months.

Analysts had broadly forecast that the big banks, ANZ, the Commonwealth Bank, National Australia Bank and Westpac, would soon follow — noting that funding costs have been rising.

They had speculated the banks were holding off due to the fierce scrutiny on the industry as a result of the financial services royal commission.