Headphones, airfares and takeaway: Consumer stocks light up ASX after Labor’s pre-election budget

Subsidies and tax cuts announced in the federal budget could support the outlook for consumer spending, with some analysts looking at the retail sector as a potential beneficiary.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Subsidies and tax cuts announced in the federal budget support the outlook for consumer spending, with the retail sector an early beneficiary.

However, while interest rates are still expected to come down, an ongoing rise in government spending is potentially making the Reserve Bank’s job of controlling inflation harder, slowing the pace of interest rate cuts that stand to support sharemarket valuations.

Households, taxpayers, pensioners, beer drinkers, patients, low income renters, home builders, first home buyers and local manufacturing are among the “winners” of the pre-election budget, according to AMP’s head of investment strategy and chief economist, Shane Oliver.

“The budget is positive for spending and hence retail shares, but this may be offset by higher than otherwise rates,” he said. “Some manufacturers may benefit from subsidies.

“Overall, it looks neutral for shares.”

Cost-of-living measures will keep headline inflation down, but the RBA will focus on underlying inflation and “here the ongoing rise in government spending is making its job harder,” he added.

In terms of retail stocks that could benefit from stronger consumer demand, electronics retailer JB Hi-Fi rose 2.5 per cent, Qantas soared 3 per cent, and KFC owner Collins Foods jumped 2.4 per cent on heavy volume. Retail-focused property trusts including Scentre Group, GPT Group and HomeCo Daily Needs REIT rose between 1.4 and 3.3 per cent led by Scentre.

Supermarkets operators also rose with Coles up 1.5 per cent and Woolworths gaining 1.7 per cent.

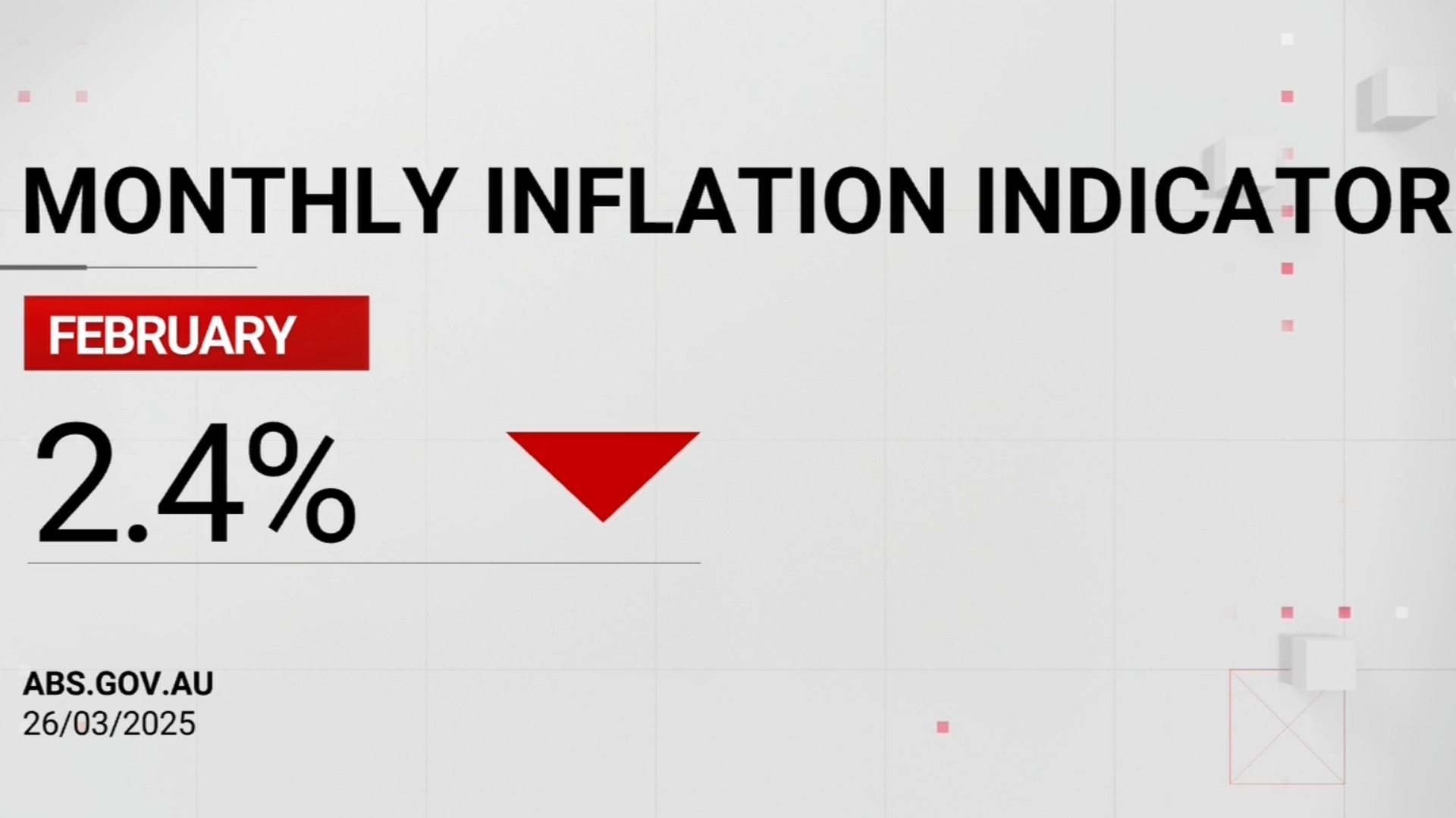

However, there was no rush to buy other stocks, although the market got a boost from lower than expected inflation data and a further rebound in the US market.

The benchmark S&P/ASX 200 jumped as much as 0.9 per cent to a two-week high of 8014.9 points at lunchtime, before closing up 0.7 per cent at 7999 points.

Budget spending initiatives included cost-of-living relief with a $1.8bn extension of electricity rebates for another six months at $150 per household and small business, and $689bn to lower PBS drug prices from $31.6 to $25; $7.9bn on Medicare to boost bulk billing, $1.8bn for public hospitals, $644m for new urgent care clinics and $793m for women’s health; $7.2bn more for infrastructure including the Bruce Highway upgrade; $1.2bn more for disaster relief and rebuilding after Cyclone Alfred; $1.5bn over five years in “decisions made but not yet announced” allowing for more election promises; and another freeze to deeming rates and a two-year freeze to beer indexation.

The budget also outlined $17.1bn in additional tax cuts over the next four years, cutting the 16 per cent tax rate to 14 per cent – but they’ll buy less than “a sandwich and milkshake” amounting to $5.15 a week from July next year and $10.3 a week from July 2027, according to AMP’s Dr Oliver.

A consequent shift from surplus to deficit and average 5.5 per cent year-on-year growth in federal spending to 2028-29 will boost demand in the economy.

“We don’t think it precludes more rate cuts, but it means interest rates will be higher than would otherwise have been the case,” Dr Oliver added. “Overall, it’s a pretty uninspiring budget.”

Wilsons Advisory head of investment strategy, David Cassidy, said the “spending spree” by the government has been masked by a significant revenue boom from soaring personal income tax payments and taxes on corporate profits due largely to resilient prices for iron ore, coal and gas.

“The enhanced revenue take of 25 per cent of GDP has kept the cash budget balance respectable at 2 per cent of GDP, however Australia’s revenue luck will likely run out at some point, risking a deterioration in the budget balance,” he said.

“Overall, the budget trends look more stimulatory for demand than previously and moderately inflationary despite the government’s claimed inflation reduction efforts.

“We don’t expect significant near-term implications for markets, but the structural implications of structurally stubborn spending across a broad front – including an increasing amount of spending ‘off balance sheet’ – are somewhat worrying.”

Similarly, Morgan Stanley saw “limited macro read-through”.

“The trend of strong government spending looks likely to continue from an underlying

standpoint – but private sector conditions are unlikely to be meaningfully influenced,” said Morgan Stanley equity strategist and economist, Chris Read.

“Tax cuts are longer-dated, and we do not expect near-term spending – energy rebate

extension, increased doctor bulk-billing – to move the dial on sentiment.”

“With the fiscal profile largely intact, the focus should be on potential impact to animal spirits rather than immediate catalysts for consumer spending or business activity.

“We think possible minority election outcomes and potentially a shallow easing path for the Reserve Bank have potential to curb confidence and delay any cyclical rebound in the earnings cycle. Stay relatively defensive.”

Citi retail and gaming analyst Adrian Lemme said the new measures in the budget should provide a $3.7bn boost to household disposable income in the 2026 financial year, but the new income tax cuts won’t take effect until FY27 with the full benefit not received by taxpayers until FY28.

“Overall fiscal policy will have a broadly neutral impact on households over FY26-FY28,” he said.

But households were “winners” to some extent as the budget gave “new small personal tax relief, extended electricity rebates, cheaper health care, medicines and childcare to all households,” said Citi chief economist Josh Williamson.

According to Macquarie Equities, the newly announced budget measures will “provide modest additional stimulus relative to the previous budget update in December” but they were “largely as expected and are not material enough to change our view on the economy.”

For the listed property sector, Macquarie analysts said a focus on improving affordability and increasing housing supply in the budget should help residential developers, with beneficiaries including Mirvac, Stockland, Lendlease and Qualitas.

They also pointed to personal income tax cuts, student debt relief, energy rebate extension, more bulk billing, lower medicine costs and child care subsidy reform, with the latter a plus for Arena REIT.

But while such “retail sector tailwinds” could support consumer discretionary property exposures like Scentre and Vicinity Centres, Macquarie sees “better value elsewhere”.

In fact, the broker observed “a little more support for industrial” property from a continued focus on priority road and rail infrastructure in the budget, with the $7.2bn to upgrade Queensland’s Bruce Highway and $1bn for the future rail corridors linking western Sydney and the Macarthur region.

“This supports the long-term outlook for Australian cities and connectivity to CBDs, benefiting industrial landlords and developers,” citing Dexus Industrial REIT, Centuria Industrial REIT, Goodman, Charter Hall, GPT and Mirvac.

More Coverage

Originally published as Headphones, airfares and takeaway: Consumer stocks light up ASX after Labor’s pre-election budget