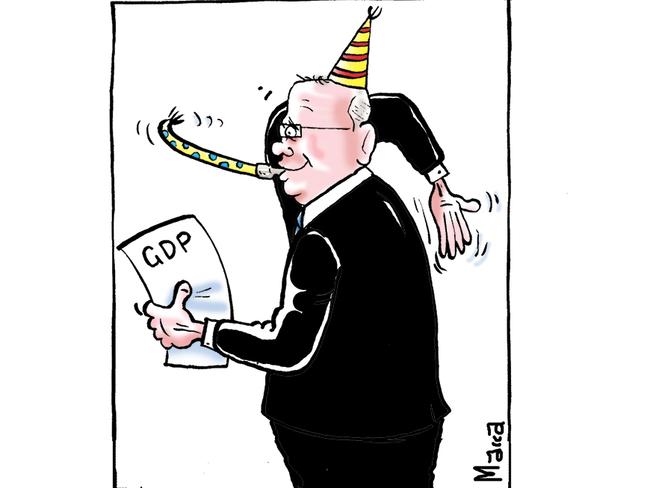

GDP spikes while the rate of savings plummets

AUSTRALIA’S economy has entered its 28th year of expansion after posting its best growth spurt in almost six years.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

AUSTRALIA’S economy has entered its 28th year of expansion after posting its best growth spurt in almost six years as households stop saving and spend up.

Gross domestic product — the value of all goods and services produced in the nation — climbed by a better-than-expected 0.9 per cent during the three months to June, taking the annual growth rate to 3.4 per cent.

AUSTRALIAN ECONOMY OUTSTRIPS EXPECTATIONS

GOVERNMENT PLANS TO SPEED UP RETURN TO SURPLUS

The result, up from an annual rate of 3.1 per cent at the end of March, was delivered as the proportion of household income saved hit its lowest level in more than a decade, with the nation splashing out on food, entertainment and furniture.

Home building activity and government spending in health also picked up and the mining sector marked a return to investment.

The latest numbers from the Australian Bureau of Statistics, released yesterday, show the economy is growing at its fastest rate since September 2012, when Australia was reaping the benefits of a mining investment boom that had only just started to show the first signs of cracking.

The economy has grown for 108 quarters — 27 years — the longest stretch of growth in modern history.

It entered its 28th year of growth on July 1.

“There are good reasons to expect the expansion to continue for some time to come,” CommSec chief economist Craig James said.

The latest growth rates came in well head of what economists were expecting.

Mining investment jumped by 5.1 per cent in the quarter — the first rise since early last year, but despite the pick-up, mining investment was down 9.7 per cent in the year to June.

UBS economist George Tharenou said GDP had “surprisingly boomed”, but was likely to slow as banks tightened their lending to the housing market.

The unexpected boost had largely been delivered by consumers “unsustainably” spending virtually all their income rather than saving, he said.

“Growth was boosted by solid consumption that was reliant on an incredible and unsustainable drop in the household saving ratio,” Mr Tharenou said.

“Looking ahead, we expect macroprudential tightening to cause falling house prices and a fading household wealth effect, seeing consumption — and hence GDP — moderate.

“With inflation pressure still low, we still expect the RBA to keep rates on hold until 2020.”

AMP Capital chief economist Shane Oliver said an annual growth rate of 3.4 per cent was “impressive versus other major countries” but it was helped by strong population growth.

The nation’s per capita GDP growth was running at 1.8 per cent compared with 2.2 per cent being generated in the US, Dr Oliver said.

Federal Treasurer Josh Frydenberg said households were benefiting from strong employment growth with more than 330,000 jobs created in the past financial year — the largest jobs growth in more than a decade.