Funding dispute between Ramsay Health Care and Bupa intensifies with ‘confusing’ post

Australia’s biggest private hospital group Ramsay Health Care is preparing patients for the fallout of a dispute with Bupa in comments the health insurer says are ‘confusing’.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australia’s biggest private hospital provider Ramsay Health Care is advising its customers to review their health insurance cover and warned of “additional out-of-pocket” costs after it said it failed to reach a new funding agreement with Bupa.

But Bupa says Ramsay is confusing patients, given funding negotiations remain ongoing, with senior staff from both organisations meeting in the past week.

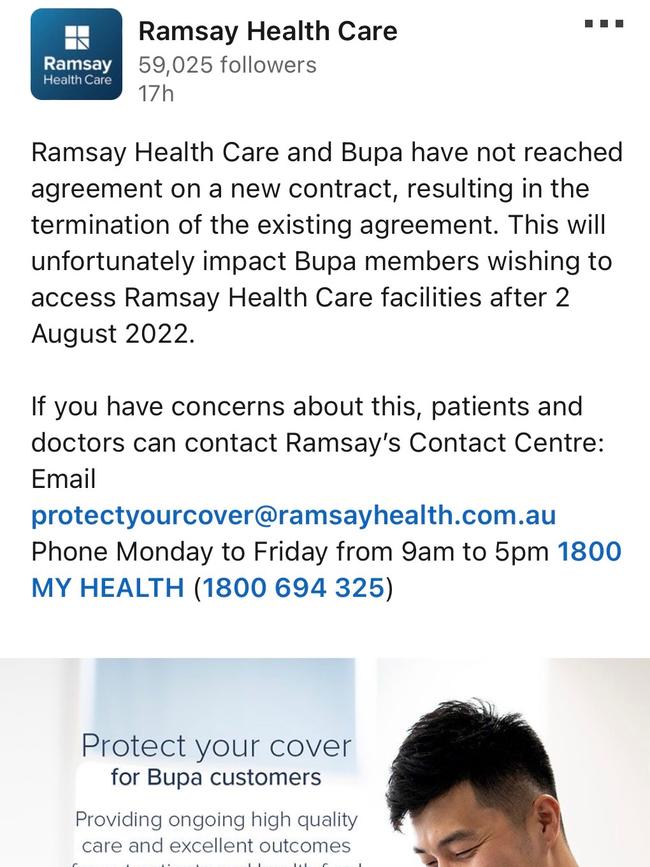

On Wednesday, Ramsay posted on LinkedIn that it had not been able to reach an agreement with Bupa and advised customers on their “options”.

These options were detailed on a website Ramsay has created during the funding dispute titled “protect your cover”. It includes a guide on how to switch health funds. This is despite a Ramsay spokeswoman confirming that negotiations were continuing.

Bupa health insurance managing director Chris Carroll said the comments were disappointing, particularly considering Bupa and Ramsay staff had been in talks over the past week.

“It’s disappointing that Ramsay is continuing to create confusion for patients as to the current state of the negotiations,” Mr Carroll said.

“We remain at the negotiating table with Ramsay and there have been discussions between senior members of both organisations over the past week.

“We’re determined to reach an agreement that balances the needs of their hospitals, maintains affordability for our members and supports the sustainability of the health system. We want to assure our members they remain covered at Ramsay hospitals over the coming months as negotiations continue.”

But on LinkedIn, Ramsay said given it had not reached a new agreement with Bupa its contract with the insurer will be terminated. “This will unfortunately impact Bupa members wishing to access Ramsay Health Care facilities after August 2, 2022.”

On its “protect your cover” website, Ramsay said it wanted Bupa insured patients to “be prepared for these changes before they impact their upcoming admission at a Ramsay Health Care hospital” and face an “additional out-of-pocket cost”.

“Like most hospitals and insurers, Bupa and Ramsay Health Care have a contractual agreement that normally includes an agreed annual indexation rate. This indexation, paid by the insurer, helps the hospital cover yearly increases in wage and supply costs,” the hospital group wrote.

“During the Covid-19 pandemic, private hospitals have taken enormous measures to protect patients and staff — such as increasing PPE equipment, cleaning protocols and infection prevention training for staff. Of course, each of these measures have involved significant costs and we continue to protect our patients and staff.

“Bupa’s offered rate of indexation is well below inflation and fails to cover these cost increases. Being unable to agree on a rate means Bupa patients at Ramsay hospitals will be required to cover the shortfall as an additional out-of-pocket cost. Ramsay has successfully collaborated with all other private health insurers, so this change will only impact Bupa patients.”

It added on its website that: “Reviewing your private health insurance can be overwhelming, so we have summarised below the important steps recommended by the ACCC and included some additional resources to make it easier.”

In an ASX announcement last month, Ramsay said if the contract expires Bupa-insured patients would have to pay an upfront cost upon admission – “being the difference between the statutory benefit Bupa is required to pay and Ramsay’s hospital costs”.

Following the release of the ASX announcement a bitter exchange erupted between Ramsay and Bupa. Ramsay said the health insurance sector recorded a $1.8bn profit last year, while Bupa said the hospital group was seeking to “increase the value of their business, which is currently subject to a private equity backed takeover offer”.

The Commonwealth Ombudsman is considering taking action, given it has guidelines against creating “adverse publicity” during funding disputes and contract terminations. Specifically, the guidelines ban “imputing motives to the other party” and “commenting on the financial position or ownership structure of the other party”.

Originally published as Funding dispute between Ramsay Health Care and Bupa intensifies with ‘confusing’ post