Free money for Aussies as cost of living pressures soar

Inflation is squeezing but there’s an easy way to get money back for free – you just have to know where to look for it.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

As Australians head into another year set to be defined by inflation rising faster than household incomes, every dollar that can be saved or earned and added to household budgets is very much a welcome one.

Here are some easy ways for your household to keep more of your hard-earned money in your pocket.

Loyalty reward cards

Various rewards cards such as FlyBuys have been around for decades, but with the advent of personalised offers and the ability to get cash directly off the cost of your grocery shopping, various loyalty cards can be well worth the few extra seconds it takes to scan them at the checkout.

The base rate of direct cash off shopping is 2000 points ($2000) for $10 off, which really doesn’t sound like much. But by taking advantage of various additional reward points, they can begin to add up quickly.

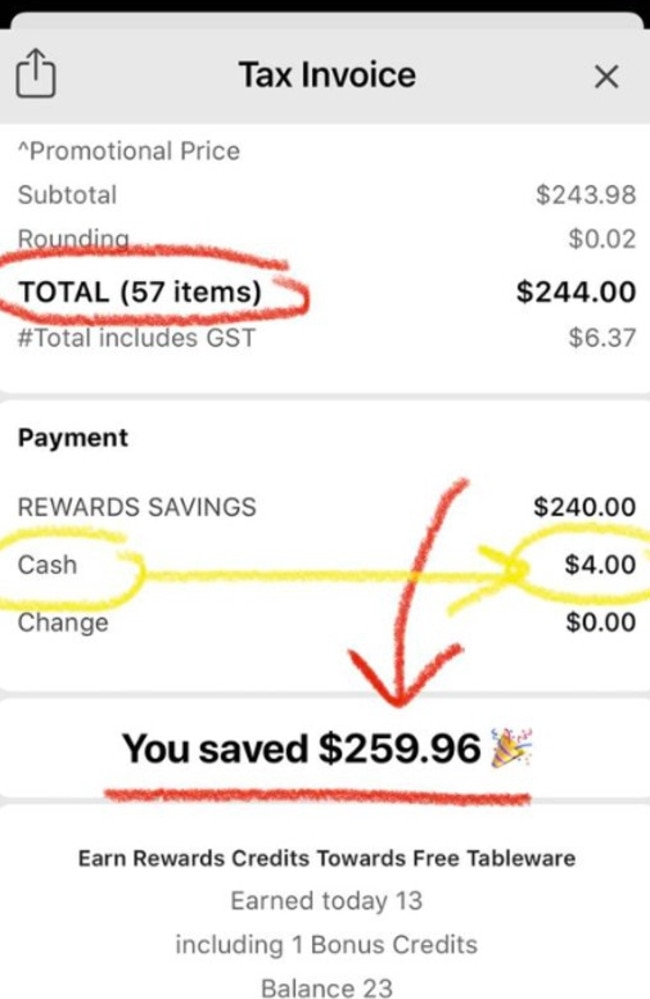

One shopper saved up their Everyday Rewards points to do their Christmas food shopping, saving $240 off their groceries.

High interest savings accounts and term deposits

For years, savers have paid the price for low interest rates, with most savings accounts providing near 0 per cent interest to account holders in recent years.

While standard savings accounts still don’t provide terribly attractive returns, there are currently high interest savings accounts with returns of up to 4.75 per cent per annum.

Many of these accounts do have requirements such as depositing a certain amount of money each month and/or making a certain number of transactions, but with accounts now providing some pretty strong returns, it may be worth doing the homework and seeing if a high interest savings account is right for you.

If you don’t mind locking cash away for a while or are looking to provide yourself with a solid fixed income, term deposits are also the most attractive they have been in years to savers. Depending on the institution and the duration, there are rates of up to 4.5 per cent on offer, generally on terms of up to five years.

According to data from comparison website Finder, the average Australian has $28,409 in savings. If put into the top yielding savings account and term deposit, the interest would provide an annual return of $1379 and $1278 respectively.

Cashback offers

Most of us are familiar with traditional cashback offers that you often see on things like appliances or random select items at the supermarket or pharmacy. But there are companies such as Cashrewards and Shopback that at any given time have cashback offers from a multitude of different retailers.

While the percentage amount you get back from any given transaction can vary widely depending on what retailer a purchase is made from and the offer available at the time, over time the rewards can be substantial.

For example, after purchasing a Lego set and some other items as Christmas presents for family from Amazon, I received 15 per cent cashback, which came to $19.

It’s not just goods where there are rewards on the table – you can also get cash back on services.

I recently spoke with a frequent traveller who took advantage of various cashback offers on a trip to Europe and the United States. By the time all the cashbacks from airfares, accommodation and various attractions were tallied up it came to over $400.

Coupons and sales

While most of us are familiar with a good old retail sale, in today’s fast-paced and digital world, there are often sales that offer deep discounts that sometimes last for as little as just a few hours. To keep track of all these various sale items and offers, there are a number of different social media pages, websites and forums.

Perhaps one of the most well-known is OzBargain, where users can post all manner of deals, whether it’s a lightning sale at Amazon where a product is up to 80 per cent off or a particularly attractive cashback offer at a major retailer such a Myer.

With thousands of users potentially looking at the site at any given time, some deals can be gone in a flash and retailers’ websites crashing under the increased traffic is not unheard of.

By being patient and waiting for items to come up on deep sale or with an attractive cashback offer, a savvy shopper can save themselves hundreds of dollars a year.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as Free money for Aussies as cost of living pressures soar