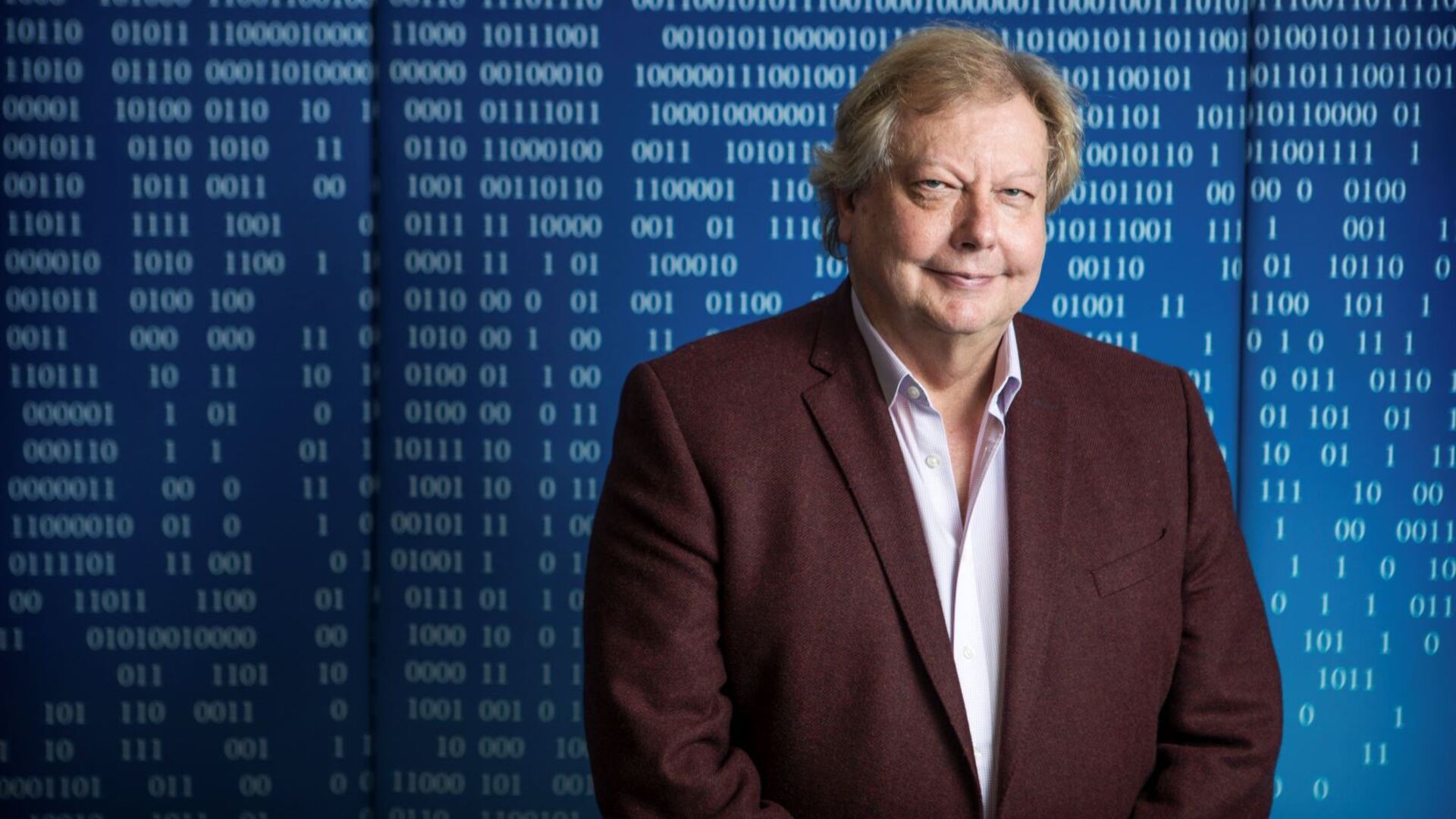

Former WiseTech chairman Andrew Harrison returns to the board of Richard White’s empire

WiseTech has appointed two board directors, including former chairman Andrew Harrison, who will assume the role of lead independent director.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A board shuffle at WiseTech elevating a former chairman as lead independent director shows that the company is struggling to put sufficient space between today’s leadership and its former lieutenants, a corporate governance expert has claimed.

On Monday, the logistics software giant announced that former chairman Andrew Harrison – who stepped down after near nine years as chair in April last year – had been appointed to the lead independent role, taking over from Mike Gregg, a 16-year WiseTech board veteran who was hired for the position just five weeks ago.

Mr Gregg holds 4.7 million shares, and is the founder of WiseTech’s backer, Shearwater Capital.

“What that tells me is that they’ve acknowledged they’ve got a problem with Mike Gregg and the solution is not to replace him with someone who’s almost identical in terms of their past relationship (with WiseTech),” Swinburne University of Technology’s Helen Bird told The Australian.

“Both of them had longstanding associations and they’ve now called Andrew Harrison the lead independent director as opposed to Mike Gregg, so clearly, in their own mind at least, it appears to suggest that Mike Gregg cannot be in that role given his past association.”

The appointments come less than one week after AustralianSuper – the company’s fourth-biggest shareholder and the second-largest outside investor in the company with a 2.79 per cent stake – sold its $580m stake, citing governance concerns.

Those concerns were raised after a board exodus on February 24, when four independent directors, including then chair Richard Dammery, abruptly resigned, and Richard White assumed control as executive chairman just days later.

Shares in WiseTech closed up 1.47 per cent on Monday at $81.23, representing a market value of $27.17bn. The company was contacted for comment.

On Monday, WiseTech told investors that it believed Mr Harrison would be able to help address governance concerns.

“Given Andrew’s prior tenure and role as chair of WiseTech and his skillset and depth of experience with the company, he will be able to make a substantial and immediate contribution to the continuity and governance of the company,” it said.

That is despite ASX listing rules that say a director who has been an officer within the last three years is not to be considered independent.

A WiseTech spokeswoman told The Australian in early March that it knew it was not compliant with ASX listing rules. She also said WiseTech was “satisfied that (Michael Gregg) meets the classification of an independent director”.

The Australian Shareholders Association said it was concerned as to how “independent” a former chair who led the board less than 12 months ago could be.

“The return of Wisetech’s former chair as lead independent director raises serious governance concerns. ASA supports genuine board renewal that brings in new perspectives and independent oversights - not a revolving door of directors,” ASA chief executive Rachel Waterhouse told The Australian.

“Investors may question whether this reflects meaningful change or the same leadership in a different guise.”

The company also appointed UPS vice-president Chris Charlton. He joins the WiseTech board after a 26-year career including roles in Singapore, Australia and New Zealand.

“The skills that Chris will bring to the board will enhance the board’s logistics and product knowledge, including product developments such as CargoWise Next, ComplianceWise, Container Transport Optimisation, and many other innovations and product initiatives,” the company said.

Ms Bird said that given two of WiseTech’s recent board hires were former directors, it was hard not to speculate as to whether Mr Charlton had a relationship with the company.

WiseTech was asked whether there was any previous relationship but is yet to formally respond.

Ms Bird said WiseTech was probably struggling to fill the empty seats left since non-executive directors Lisa Brock, Michael Malone, Fiona Pak-Poy and former chair Mr Dammery abruptly departed, citing “intractable differences in the board” and “differing views around the ongoing role of the founder and founding CEO, Richard White”.

WiseTech’s boardroom chaos has caught the attention of the Australian Securities & Investments Commission, with its chair Joe Longo confirming it was “very interested” in whether WiseTech had breached the Corporations Act with “extraordinary manoeuvres” at board level.

Earlier this month an independent review commissioned by WiseTech found Mr White had misled the WiseTech board over his personal relationship with an employee.

The review, which is continuing, prompted the board to conclude a “number of the matters are serious in nature, and that such conduct is not acceptable and must not be repeated”, WiseTech said in a statement.

The update also included preliminary findings regarding two further complaints WiseTech received in February this year regarding Mr White, an employee and a WiseTech supplier.

WiseTech’s second partial update was drawn from a review undertaken by Herbert Smith Freehills and Seyfarth Shaw.

The company has refused to release the full independent review, a decision that led to the mass exodus of four board directors earlier this year.

Mr White accepted the preliminary findings of the review and supported the adoption of a stricter code of conduct, the statement said.

“Mr White has indicated that while those matters were personal in nature, with the benefit of hindsight he would have more (fully) disclosed them to the board and handled the contracting process differently,” WiseTech said.

“Mr White understands the importance of his role in creating and influencing the culture of the business, and the seriousness of his actions.”

A spokeswoman for Mr White told The Australian that neither Mr White nor his lawyers Clayton Utz had received or seen a full copy of the Seyfarth Shaw report.

WiseTech said it was seeking two further directors to join its board.

More Coverage

Originally published as Former WiseTech chairman Andrew Harrison returns to the board of Richard White’s empire