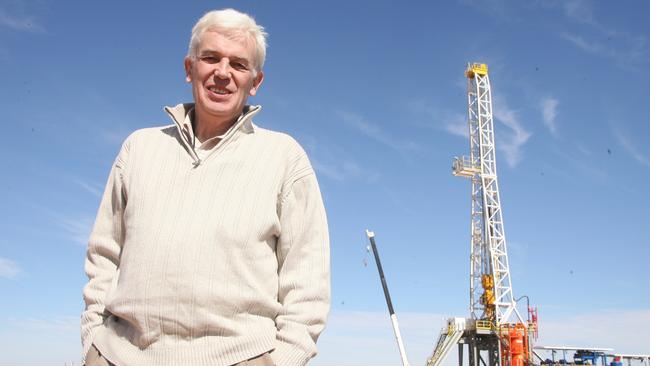

Former Beach Energy boss Matt Kay re-emerges with new geothermal energy play

It’s been a long time between drinks for geothermal energy interests on the ASX, but former Beach Energy boss Matt Kay is back with a plan to re-energise the sector.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Geothermal energy will make a return to the ASX with former Beach Energy managing director Matt Kay leading a backdoor-listing of a suite of assets.

The re-entry of a geothermal-focused listed company marks almost a decade since the previous serious aspirants such as Geodynamics and Petratherm called time on ambitious projects, mainly based in South Australia and in particular the Cooper Basin, which promised long-term, green and seemingly almost limitless sources of energy - if the engineering challenges could be overcome.

It turned out that was much harder than was hoped.

For this new tilt, Mr Kay, and business partners including former Core Lithium managing director Stephen Biggins, have folded two entities into the listed shell of Cradle Resources.

Those companies, Volt Geothermal and Within Energy, hold geothermal assets in Queensland and South Australia, the ASX was told earlier this month, and Cradle aims to raise $6m in new capital to start proving them up.

Geothermal was much in favour in during the back end of the 2000s, with Geodynamics and Petratherm in 2009 being awarded $153m of a total of $253m in Renewable Energy Demonstration Program (REDP) grants put up by the federal government at the time. Not all of this money was drawn down however due to a failure to reach project milestones.

Geodynamics led the charge from a public relations perspective on geothermal energy, and on paper, the idea was simple and elegant.

Geothermal energy is, by all accounts, an enormous resource, which if it could be tapped, would be a large contributor to net zero goals - not that this phrase had been conceived at the time.

The energy source is widely used throughout the world, but generally in places where there is naturally-occurring subterranean hot water which can be tapped and used as the delivery mechanism to bring heat to the surface.

Most of the Australian geothermal aspirants, such as Geodynamics, were instead looking at “engineered geothermal”, which involved drilling deep into hot granites up to 4km below the surface, then fracturing the rock between wells to create a loop, and cycling water through that loop.

And there was plenty of interest from investors and other energy companies.

Origin Energy took a 30 per cent stake in Geodynamics’ SA project in 2007 in a deal worth an initial $105m, and said at the time it expected to spend another $45m or so over the following two to three years at the project.

Geodynamics was at the time drilling the third of its “Habanero” wells, named after the famously hot chilli variety, but had already encountered problems in its second well.

The company lost a drill bit at a depth of more than 4km, and attempts to salvage the well, near Innamincka, were eventually abandoned.

Geodynamics had been aiming to have a 50MW generator up and running by 2011 and eventually 500MW by 2016, which would have cost billions in investor capital and would have also necessitated a large investment in rigs capable of drilling to those depths.

Grant King, the then Origin managing director who was on-site for the announcement of the company’s investment, said they had high hopes.

“We believe that geothermal energy will play an increasing role in securing the world’s future needs for clean energy,’’ Mr King said.

“Geodynamics’ tenements are among the most prospective geothermal areas in Australia and include some of the hottest rocks in the world.’’

Had the project been successful, there were various uses the power could have been put to. While the project was remote, it was relatively close to the Moomba gas processing plant, and there was also an idea floated at the time that data centres could be sited in remote parts of Australia, where they would be both secure and close to much-needed energy sources.

Geodynamics’ efforts eventually petered out however, with the company achieving only a 1MW demonstration plant, and providing fair warning to others that drilling at such depths came with plenty of risk.

Its Habanero base, including a 1MW pilot plant, was eventually sold to Beach Energy for just $1.5m.

Beach had also taken a punt on geothermal, with a joint venture with the listed entity Petratherm looking to supply energy from a 30MW plant to the Beverley uranium mine in SA’s Flinders Ranges.

Petratherm had won a promise of $13m in grant funding from the Emerging Renewables Program (ERP) Grant awarded by the Australian Renewable Energy Agency (ARENA), but in 2014 abandoned its “Paralana Geothermal Project” after efforts to raise investor funds to back it failed.

Petratherm is now focused on rare earths exploration.

The interest in geothermal energy from an investor perspective was effectively spent by about 2014, and ARENA itself says on its website that while Australia has considerable geothermal potential, it is not currently financially viable here because of the challenges around finding resources, producing high rates of fluid flow, and “overcoming the significant upfront capital costs associated with enhanced geothermal system technologies and the cost of transmitting electricity from remote locations’’.

The Cradle Resources announcement does not have a lot of detail about the projects it has acquired, however says they have “significant discovered resources in South Australia’’ and large prospective resources.

The company will be looking to employ “binary cycle” technology, which can use lower temperature reservoir water between 80C and 180C “via a heat exchanger process to operate a turbine in a closed loop’’.

“The ... projects are positively differentiated by proven technological improvements resulting in potential developments at lower temperatures and lower depths, along with their location closer to existing infrastructure,’’ the company told the ASX.

“Initial work will focus on preliminary survey and resource assessments based on offset well data, exploration location definition and exploration drilling.

“Subject to exploration success, the focus will shift to resource estimates, field development and production drilling.

“It is expected that the future development plans will focus on multiple 10MWh facilities with scalability and regional diversification to manage risks.

“The ‘cookie cutter’ approach to these projects will manage financing risks by staggering capital requirements. For reference, a 10MWh development can power approximately

7000 homes.’’

Cradle says a 10MWh plant would cost about $50m, but only about 50 per cent of that cost would be prior to a final investment decision, meaning the project was not overly capital intensive in the high-risk early stages.

Cradle has raised $850,000 through the issue of 42.5 million new shares at 2c apiece, and will in September issue a prospectus and notice of meeting to raise another $6m and approve the backdoor listing.

The company also intends to change its name to better reflect its new focus.

Mr Kay, who will be managing director of the company, shocked the market when he quit Beach abruptly in late 2021, however the Beach board insisted it was an amicable parting.

More Coverage

Originally published as Former Beach Energy boss Matt Kay re-emerges with new geothermal energy play