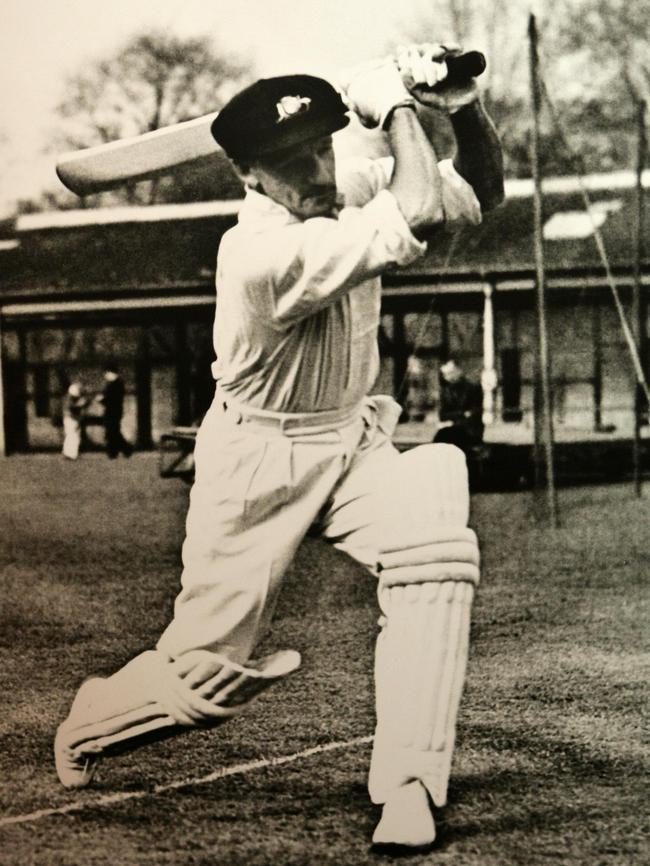

Scott Pape’s Don Bradman Strategy: How $200K can get you to 100 not out

THE normal retiring Aussie has about $200,000 in super. Is this enough? Scott Pape’s Don Bradman Strategy shows how you can still be at the crease aged 100, not out.

Every Step

Don't miss out on the headlines from Every Step. Followed categories will be added to My News.

“YOU need $1 million in retirement”, say most financial planners.

“Two million dollars might not even be enough”, wrote a financial planner in the newspaper recently.

Stop!

If you’re approaching your retirement these figures will likely scare the super out of you!

Alright, so here’s the truth: only around 1 per cent of Aussies have a million dollars (or more) in super.

True dinks.

The normal Aussie has around $200K in super when they retire.

But is it enough? Well, this is what I’m going to look at.

Even better, I’m going to share with you something I call the Donald Bradman Strategy, which will show you how to retire comfortably with much less than the magic million bucks.

I call it this because with this strategy, you can be like Don Bradman — still at the crease when you’re 100, not out!

HOW MUCH DOUGH DOES A COMFORTABLE RETIREMENT COST?

According to the Association of Superannuation Funds of Australia it costs:

■ $59,000 a year for couples.

■ $43,000 a year for singles.

What sort of lifestyle does that buy you?

Think Kath or Kim.

A near-new Toyota Corolla. A nice three-week holiday to the beach each year. A tipple (or two) each night. Dining out at decent restaurants. Regularly going to the movies (hello pensioner discount). Owning a poodle.

Now, here are my three rules for how you can achieve your own comfortable retirement.

RULE 1: YOU MUST HAVE THE BANKER OFF YOUR BACK

The Donald Bradman Strategy only works if you retire debt free … as in no mortgage.

The other day I was interviewed by a seniors magazine, and I was asked what advice I had for the increasing number of people who retire with debts.

Barefoot: “Easy. If you have debt, you can’t retire.”

Interviewer: “But that just doesn’t sound … fair.”

Barefoot: “I didn’t say it was.”

RULE 2: KNOW YOUR NUMBER

At a minimum, you need a paid-off home plus: Couples: $250,000 in super, singles: $170,000 in super.

This is your ‘retirement number’. To be clear, this is the number you need to nail before you even think about retiring — and that’s in addition to owning your own home outright.

At this point you might be thinking, “Does this plan of yours involve me holding up convenience stores with cricket bats? Because I can’t see how my $250,000 will afford us a $59,000 per year lifestyle”.

Don’t worry, I’ll get to it.

But for right now just remember you can’t retire until you’ve nailed your retirement number as a minimum (more money is better) — $250,000 in super for couples and $170,000 for singles.

This will earn you $12,500 (or $8500) a year. Hang on, what’s so special about these numbers?

This is the maximum dollar amount of assets (excluding your family home) that you can have and still get close to the maximum rate of Age Pension. The maximum rate is $34,382.40 per year for couples and $22,804.60 for singles. So it will get you 60 per cent of the way towards your comfortable ‘retirement number’ on its own.

Think of the pension as your safety net. It’s guaranteed by the Government, it’s indexed twice a year to keep up with inflation, and it will be paid until the day you die.

RULE 3: NEVER, EVER RETIRE

It is said that the two most dangerous years of your life are the year you’re born and the year you retire.

Well, it looks like you made it through the first one, so let’s talk about the second.

The golden rule of retirement is … keep working.

Once you reach pension age, you’ll not only be able to draw a tax-free pension from your super, but in addition a couple can earn up to $28,974 each without paying a cent of income tax (singles can earn $32,279 per year).

Even better, the Government has a ‘work bonus’ that allows pensioners to earn $6500 each without it affecting their pension payments. Okay, so now let’s take a look at the retirement scoreboard after you’ve applied all three rules.

1. You’ve paid off your home.

2. You’re getting the Age Pension of $34,382.40 (per couple) per year, indexed for life. And you’ve got $250,000 in super earning you $12,500 per year.

3. You and your partner each work just one day a week (and not every week) to bring in a combined $20,000 a year, completely tax free.

This will not only get you there — it’s almost $7,800 more than you need for a comfortable retirement!

And if you invest that into good quality shares, you’ll have enough money to eventually stop working part time, and you’ll never run out of money again.

In other words, as I’ve already said, you’ll be like ‘The Don’ — 100 and not out.

Ker-ching!

Blatant plug: I outline the Donald Bradman Strategy in much greater detail in my brand-new book, The Barefoot Investor: The Only Money Guide You’ll Ever Need, available in all good bookstores and online.

Tread Your Own Path!